This is a week loaded with economic data releases that have the potential to shed light on the health of the US economy and change minds at the Federal Reserve—none more so, perhaps, than inflation. While the CPI and PPI are always of interest, the July releases come in the aftermath of jobs data that increased the prospect of interest rate cuts.

In this context, retail sales data for July will also receive increased scrutiny as the financial markets seek clues about how tariffs are affecting consumers. In addition, corporate earnings from Cisco, Applied Materials, Deere, and other household names might offer hints of what’s coming next in 2025—especially in tech and industrials.

If only things were that simple. Along with scouring data, market participants are likely to find themselves parsing President Donald Trump’s real-time, unfiltered social media reactions to the latest tabulation efforts by the Bureau of Labor Statistics (BLS) or trying to gauge how the figures from the Commerce Department’s Bureau of Economic Analysis jibe with Trump’s gut economic feelings.

Trump, of course, has a busy week ahead with various tariff deal negotiations, settling on a new BLS head, and filling a Fed vacancy before jetting to Alaska for a high-stakes summit with Russian President Vladimir Putin. Along with Ukraine’s future, the two men could move oil markets with any agreements on sanctions against Moscow.

Further East, China has a busy week of its own. Beijing’s latest credit numbers could answer questions about whether efforts to revive economic growth are gaining traction. July activity data on employment, fixed-asset investment, industrial production, and retail sales will shed light on the damage tariffs are doing to Asia’s biggest economy.

Here’s a brief look at US data that could turn heads most—from Wall Street to the Oval Office:

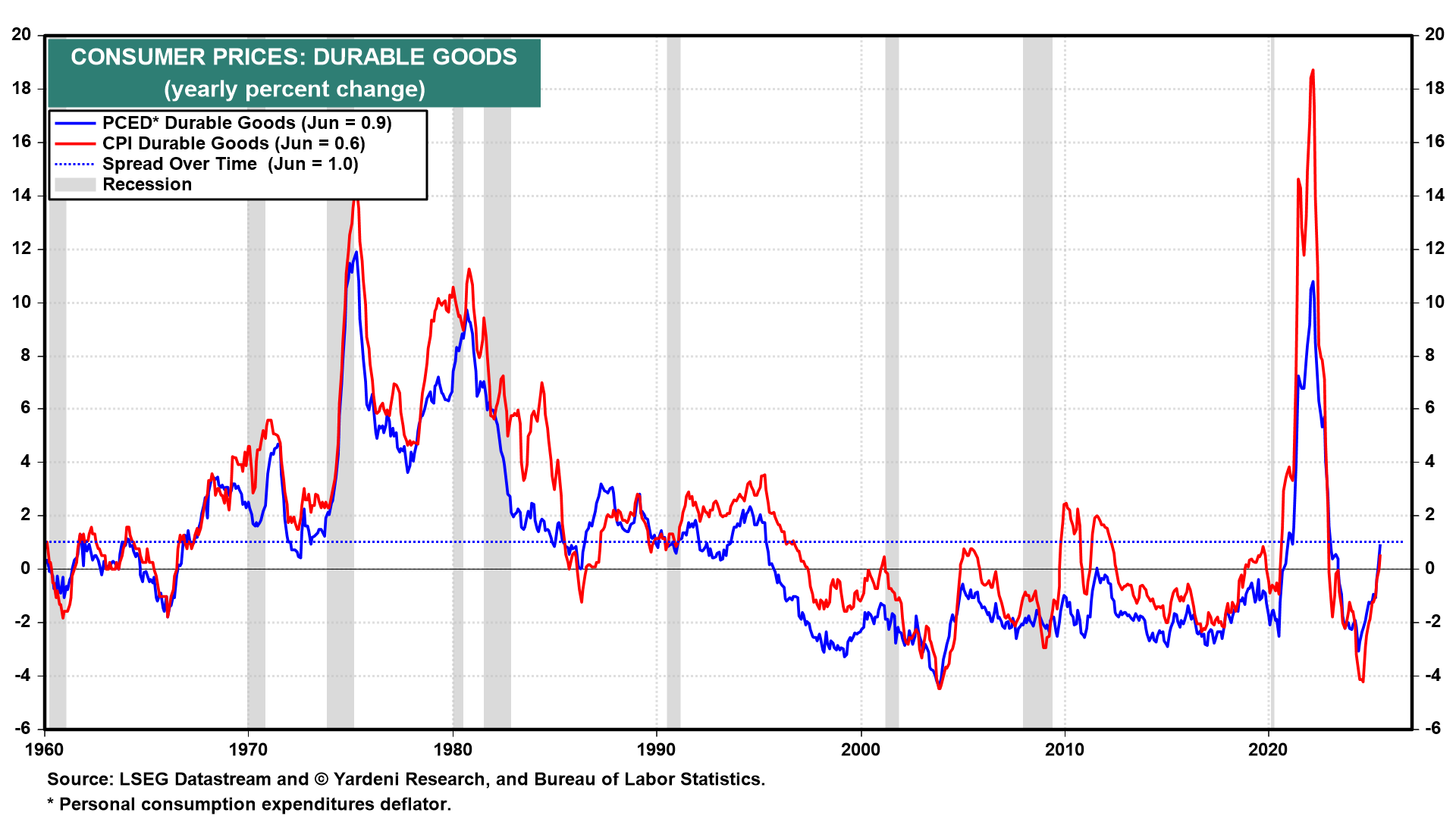

(1) CPI. The odds are low that we’ll see downside surprises in July CPI inflation data (Tue). There’s little doubt that tariff effects are boosting durable goods inflation, as they did in June. But the risk of a big upward surprise is tempered by signs that rents and used car prices are cooling. The Cleveland Fed’s Inflation Nowcasting model has the CPI rising 3.04% in July and 3.02% in August. Those would be considered too hot to justify Fed easing.

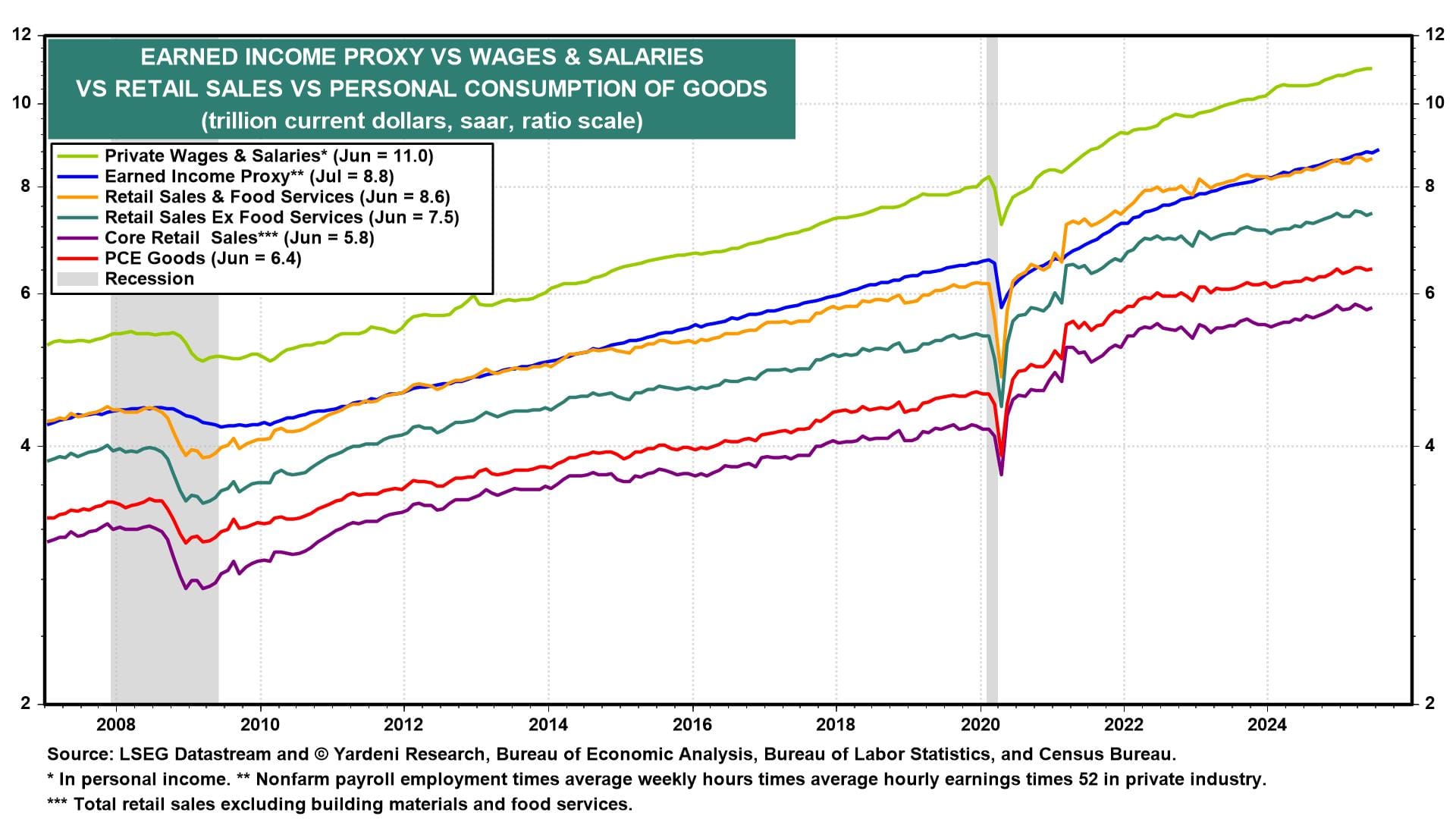

(2) Retail sales. July likely saw steady, if uninspiring, consumer spending (Fri) but perhaps not the sharp slowdown some might expect following the below-forecast July employment report. That's because our Earned Income Proxy for wages and salaries in personal income rose to a new high in July (chart).

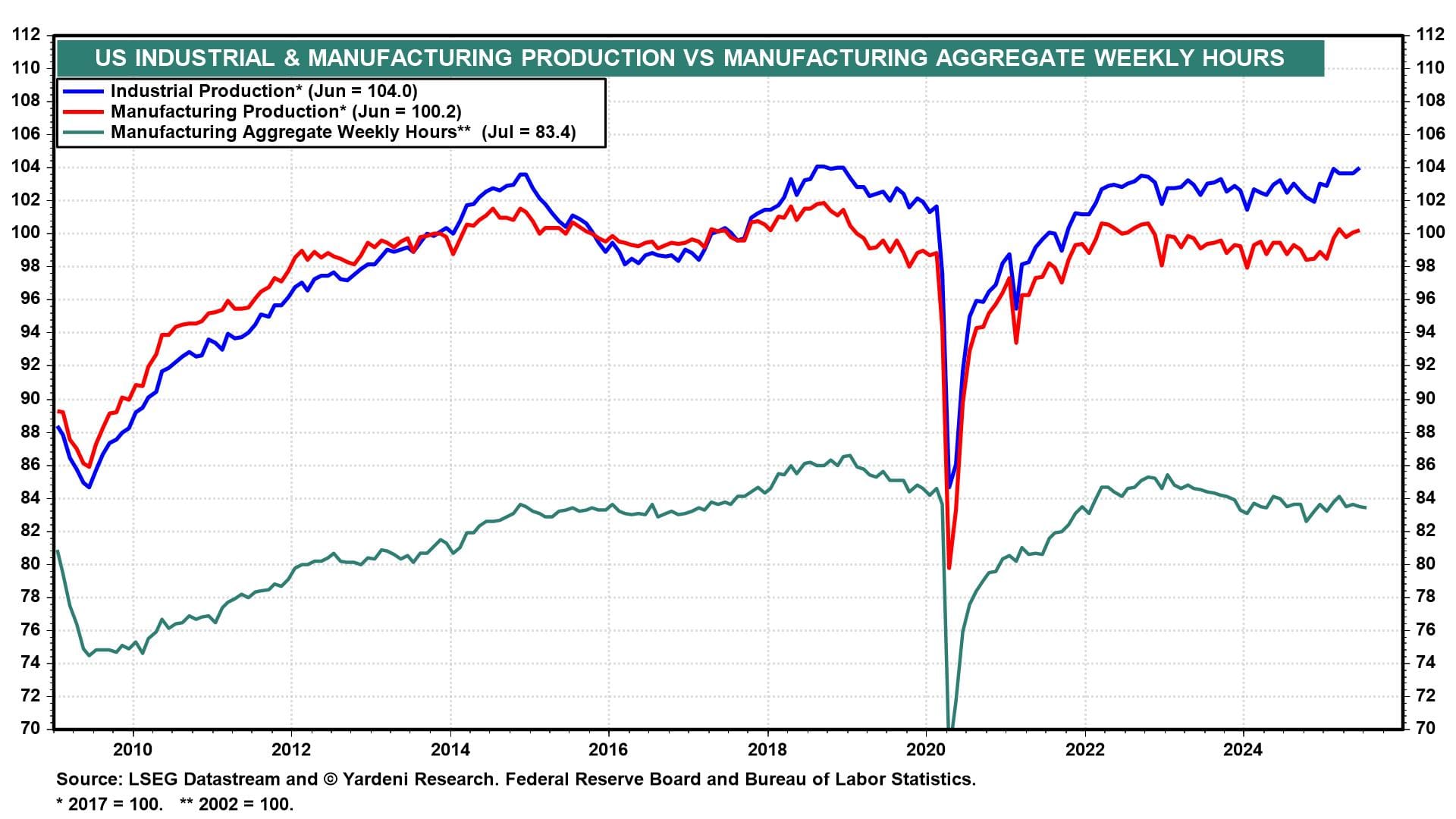

(3) Industrial production. July's industrial production (Fri) could be weak given the modest decline in manufacturing aggregate weekly hours during the month (chart). That was no stellar performance certainly, but it was not soft enough to spur recession talk or have Fed officials plotting urgent rate cuts.