Now that Fed Chair Jerome Powell is talking the talk of easing, markets are on the lookout for whether upcoming data are walking the walk.

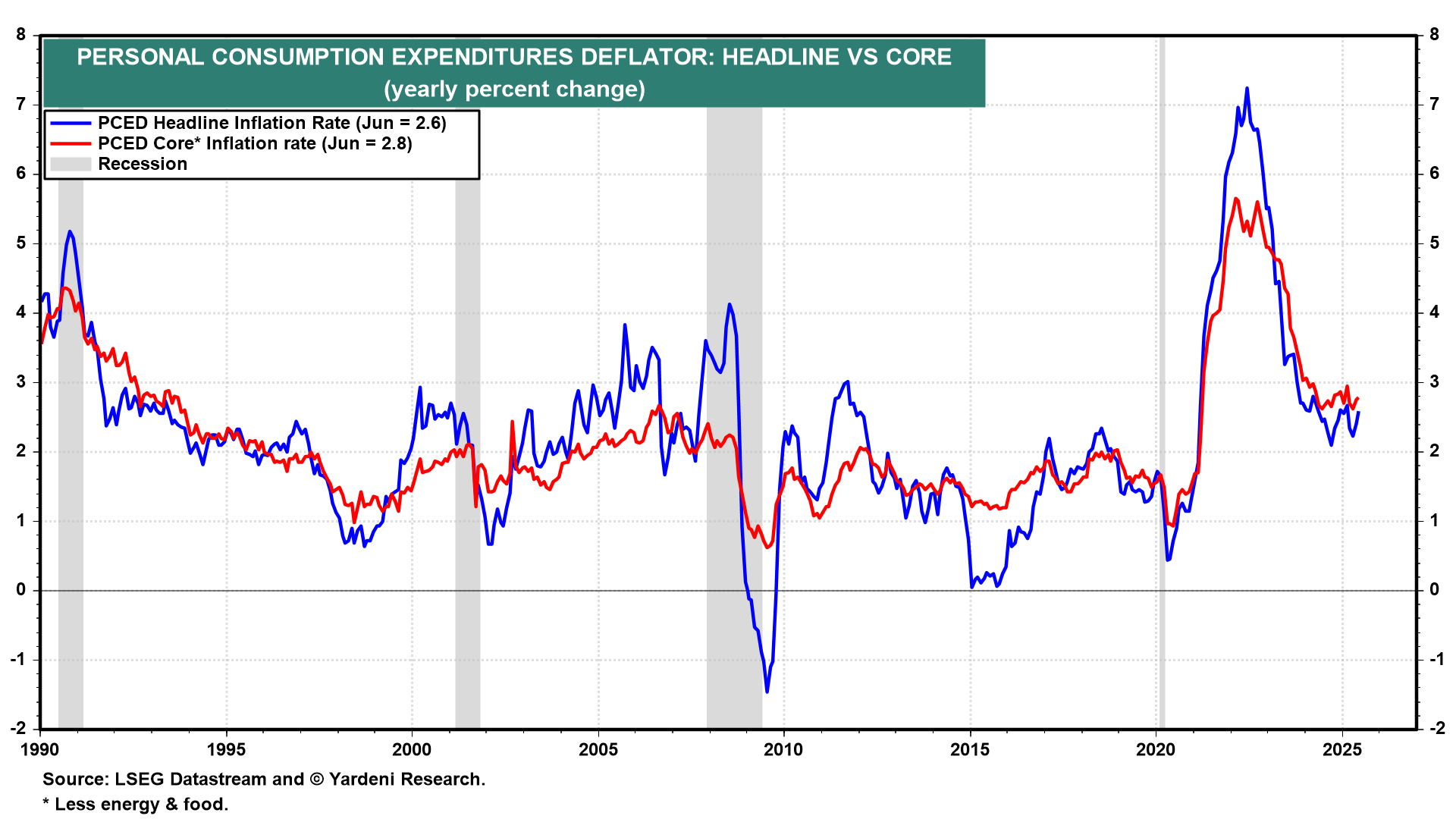

A Fed rate cut next month isn't a done deal, no matter what Powell hinted at last Friday at Jackson Hole. A lot can happen in a few weeks. Before the Federal Open Market Committee (FOMC) meets September 16-17, policymakers will see a fresh batch of employment and inflation data. This could put a stronger-than-usual spotlight on July's PCED inflation rate (Fri) and any other data that might alter Fed views on either end of its dual mandate of full employment and price stability.

In this context, Fed Governor Christopher Waller's economic outlook speech this week (Thu) will garner considerable attention. Waller, of course, is one of the two governors who dissented in favor of an easing move at the July 29-30 FOMC meeting. Markets will also scrutinize comments by regional Fed bank presidents, including New York's John Williams (Mon). Though neither Lorie Logan of Dallas (Mon) nor Tom Barkin of Richmond (Tue) is currently a voting FOMC member, comments by both could make headlines.

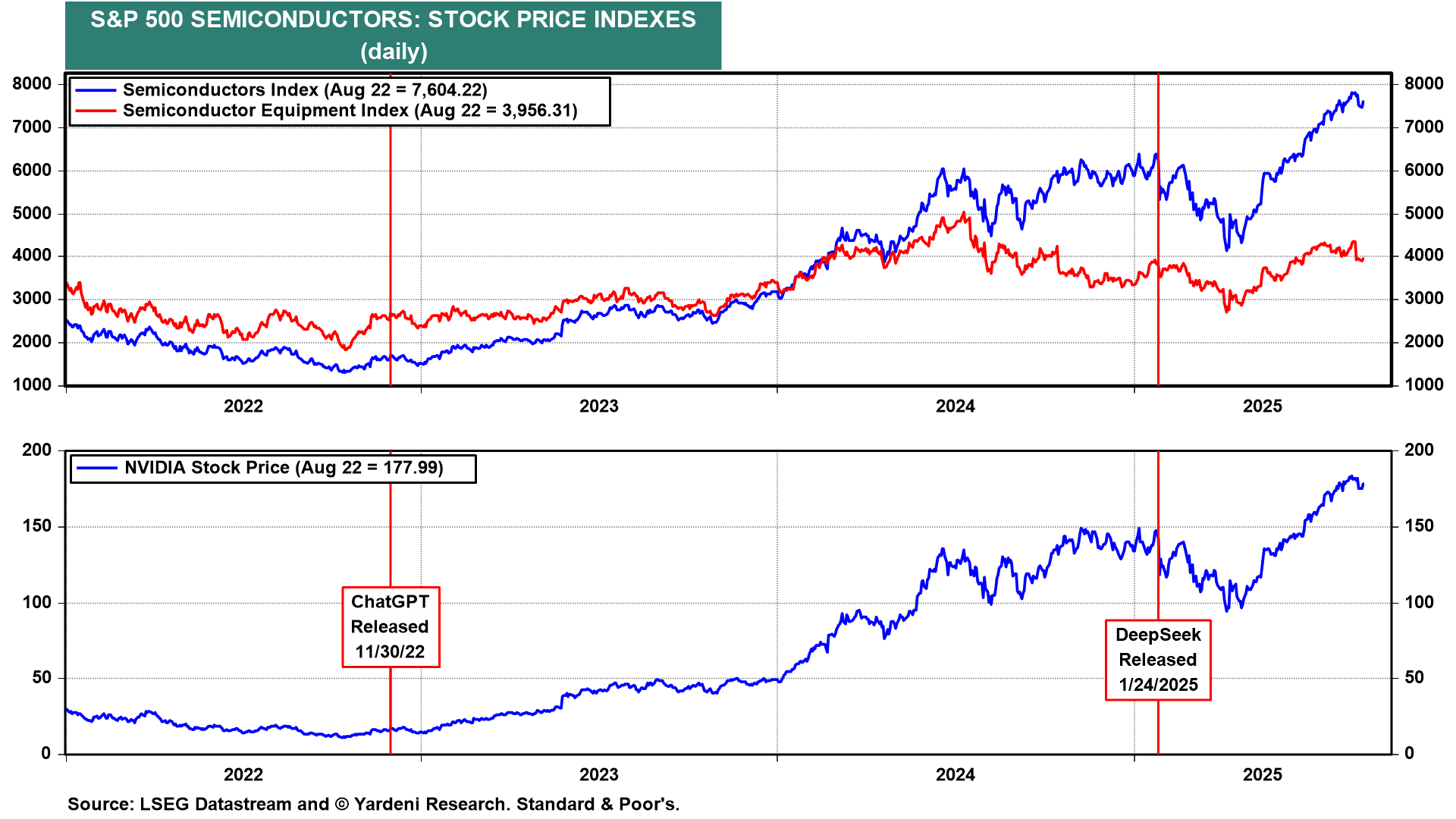

Nvidia's earnings report (Wed) may also prove to be one of the week's top events (chart). Following the market's powerful post-Powell speech rally on Friday, news on how the globe's most valuable company is navigating tariffs imposed by the US, headwinds from China's trade curbs, and the rapids of the AI boom should be very interesting.

Here's a look at economic reports most likely to change the odds of a Fed rate cut on September 17:

(1) PCED inflation rate. Last Friday, Powell highlighted the importance of the core PCED inflation rate (Fri), which he estimated is increasing at a roughly 2.9% y/y rate. That's a touch higher than the 2.8% rate in June (chart). The Cleveland Fed's Inflation Nowcasting model suggests a 3.0% PCED inflation rate is likely.

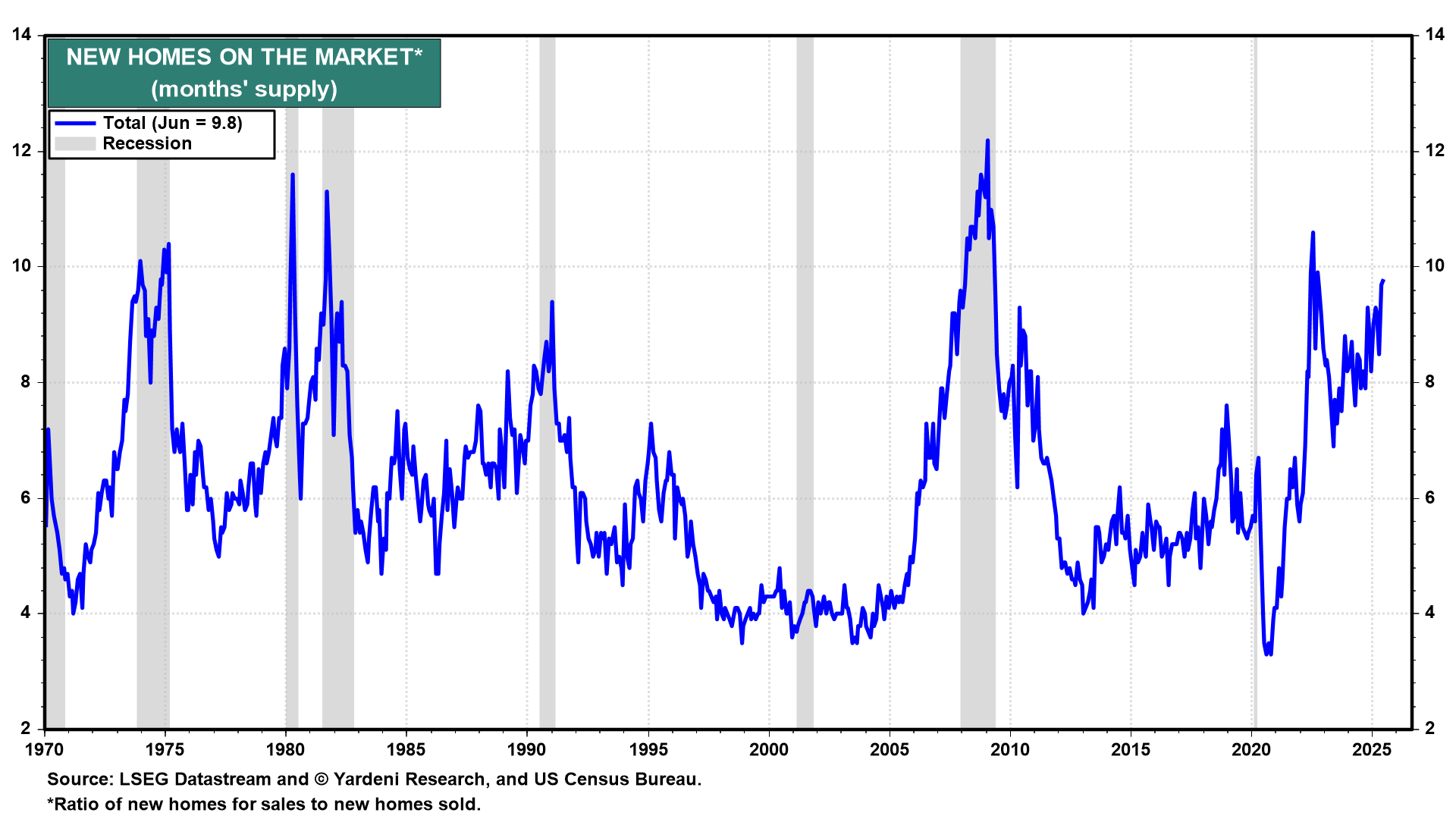

(2) New home sales. July new home sales (Mon) probably remained weak, given that there was a 9.8 months' supply of new homes on the market in June (chart).

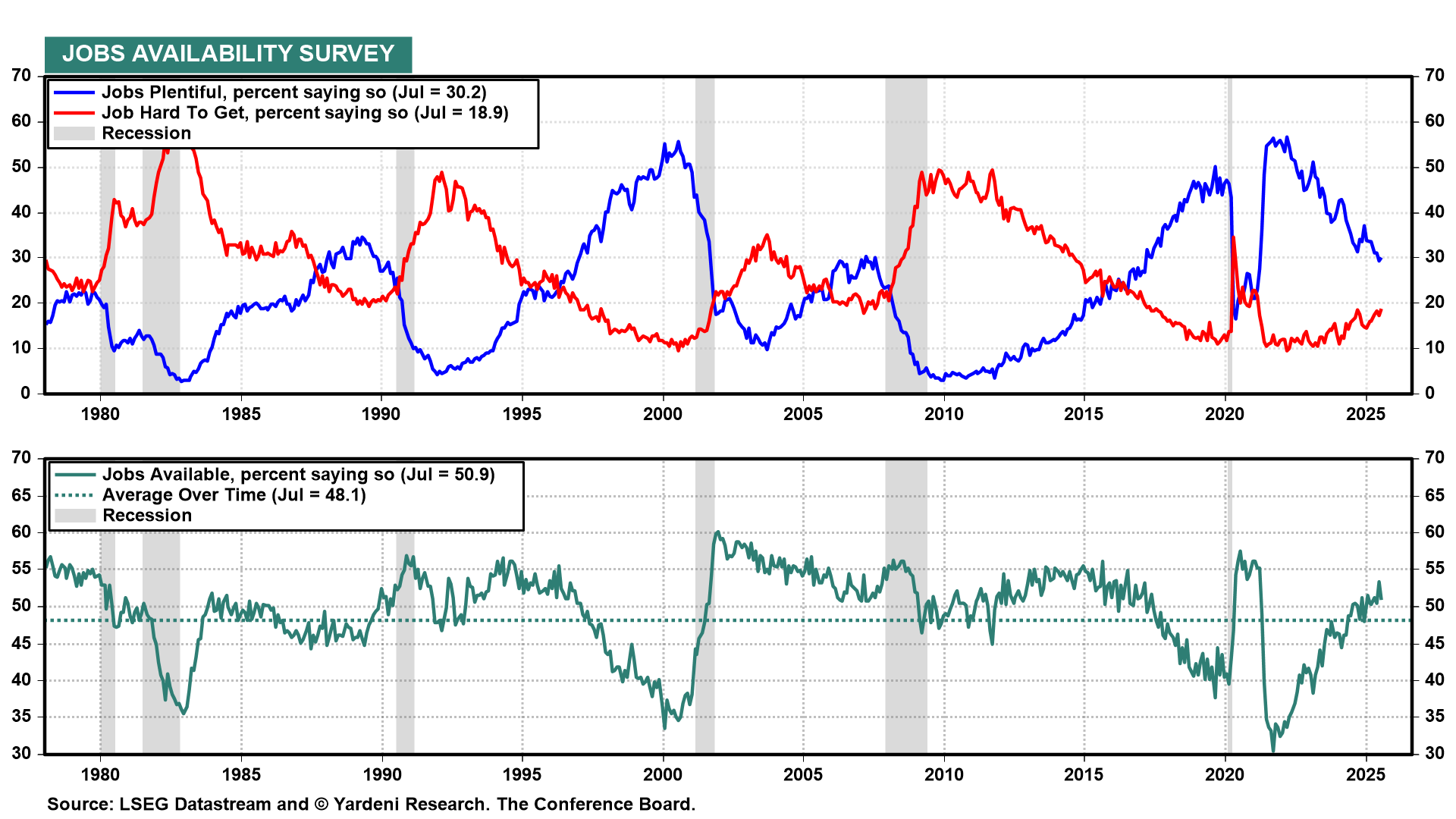

(3) Consumer and business surveys. The Conference Board's Consumer Confidence Index report (Tue) will provide one of the first insights into August's labor market. We will be focusing on the job availability series (chart). We expect that the "jobs plentiful" series, which is highly correlated with JOLTS job openings, will indicate that job vacancies remain relatively high.

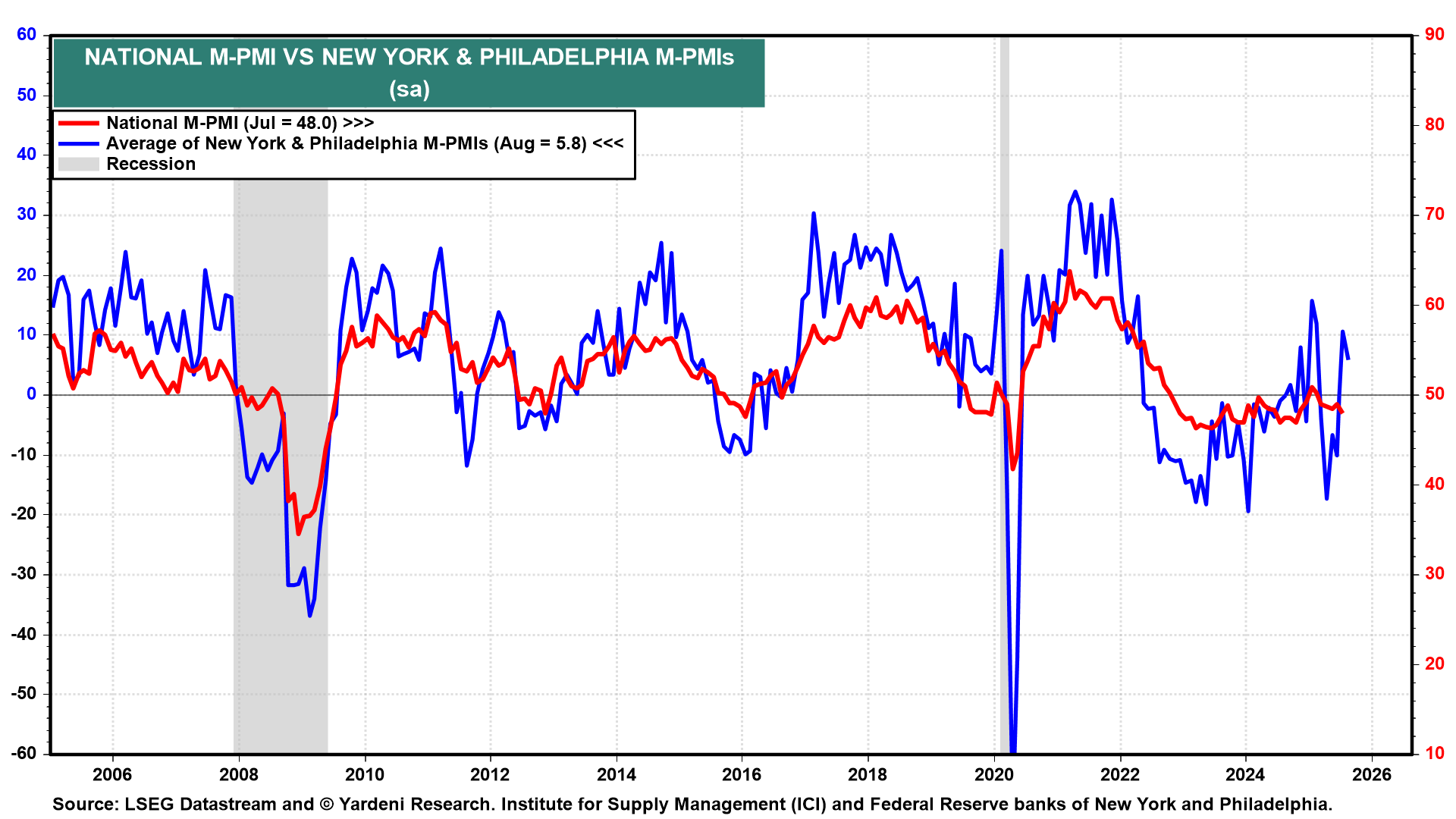

August's regional business surveys from the Dallas Fed (Mon), Richmond Fed (Tue), and Kansas City Fed (Thu) are likely to confirm those from the New York Fed and Philadelphia Fed showing a pickup in business activity (chart).

(4) Jobless claims. The latest weekly initial unemployment insurance claims (Thu) should continue to signal that layoffs remain low. However, continuing claims might edge higher again, signaling that the duration of unemployment is increasing. This reflects an increasing skills mismatch between unemployed workers and job openings, in our opinion.