Compared to last week’s dramatic data surprises, this week’s offerings are decidedly of the slim-pickings variety. But boring, the days ahead will not be. While we’re still of the thinking that President Donald Trump won’t fire Jerome Powell, the Federal Reserve chair’s fate could be written between the lines of any data series that undershoots expectations.

Following Friday’s weaker-than-expected July employment report, Trump wasted no time posting on social media that “Powell should be put out to pasture” for not easing already. That same day, Trump wrote that “IF HE CONTINUES TO REFUSE, THE BOARD SHOULD ASSUME CONTROL, AND DO WHAT EVERYONE KNOWS HAS TO BE DONE!”

Trump reveled in the news that Fed Governor Adriana Kugler is resigning early. He undoubtedly will replace her with a third loyalist on the Fed's Board of Governors very soon. All this will intensify attention on Fed officials’ speaking engagements this week, including that of Governor Lisa Cook (Wed).

Overseas, financial markets widely expect the Bank of England to cut rates by 25bps for a fifth time (Thu). Over in Mumbai, the Reserve Bank of India is seen standing pat (Wed). China releases trade figures (Thu), providing an update on tariff pain in Asia’s biggest economy.

Here’s a brief look at US releases this week:

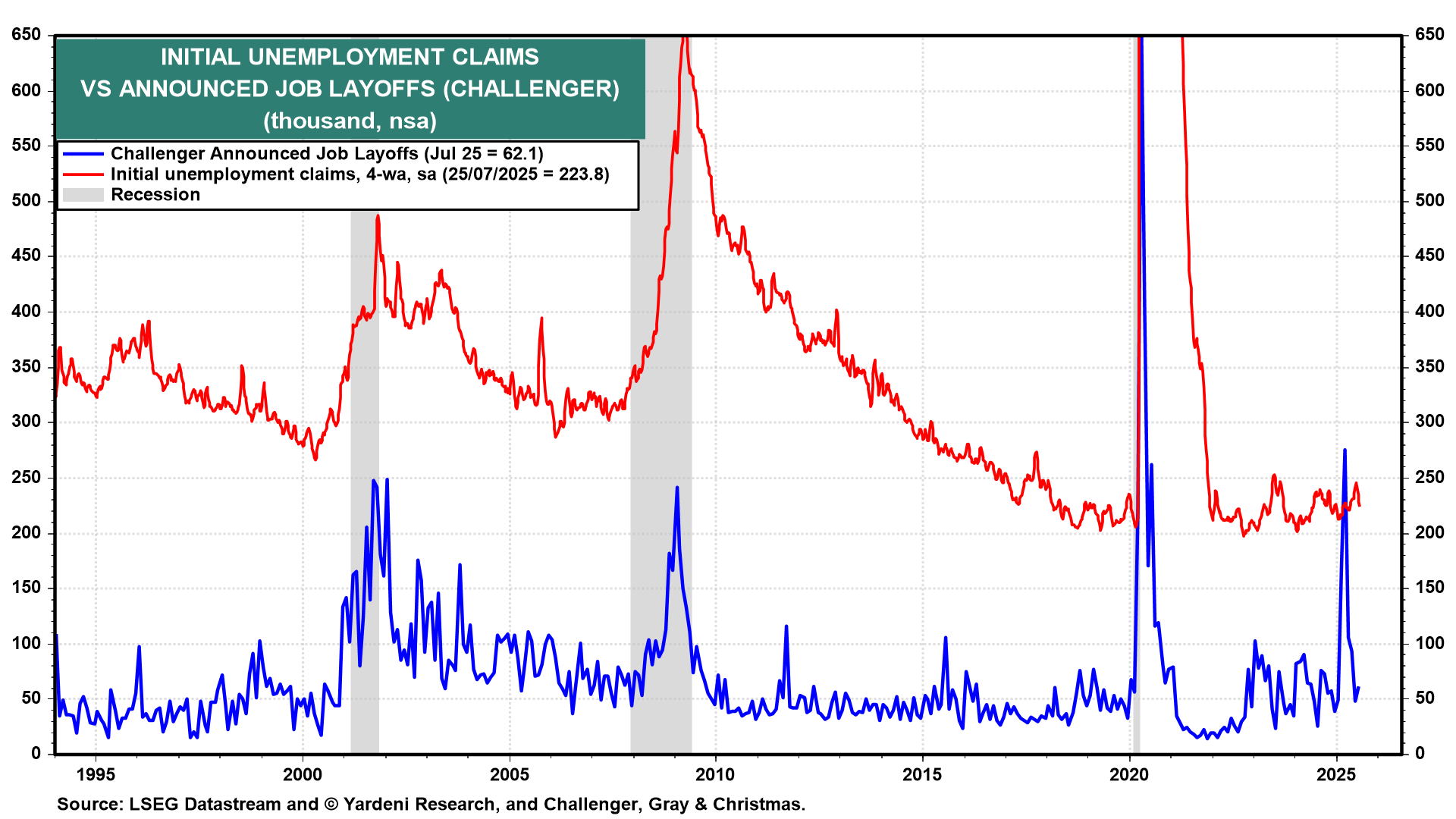

(1) Jobless claims. While Trump’s Tariffs Turmoil (TTT) might have depressed hiring in recent months, layoffs remain subdued. Weekly unemployment claims are expected to stay around 225,000 (Thu) after monthly Challenger, Gray & Christmas figures showed that layoffs remained low during July (chart).

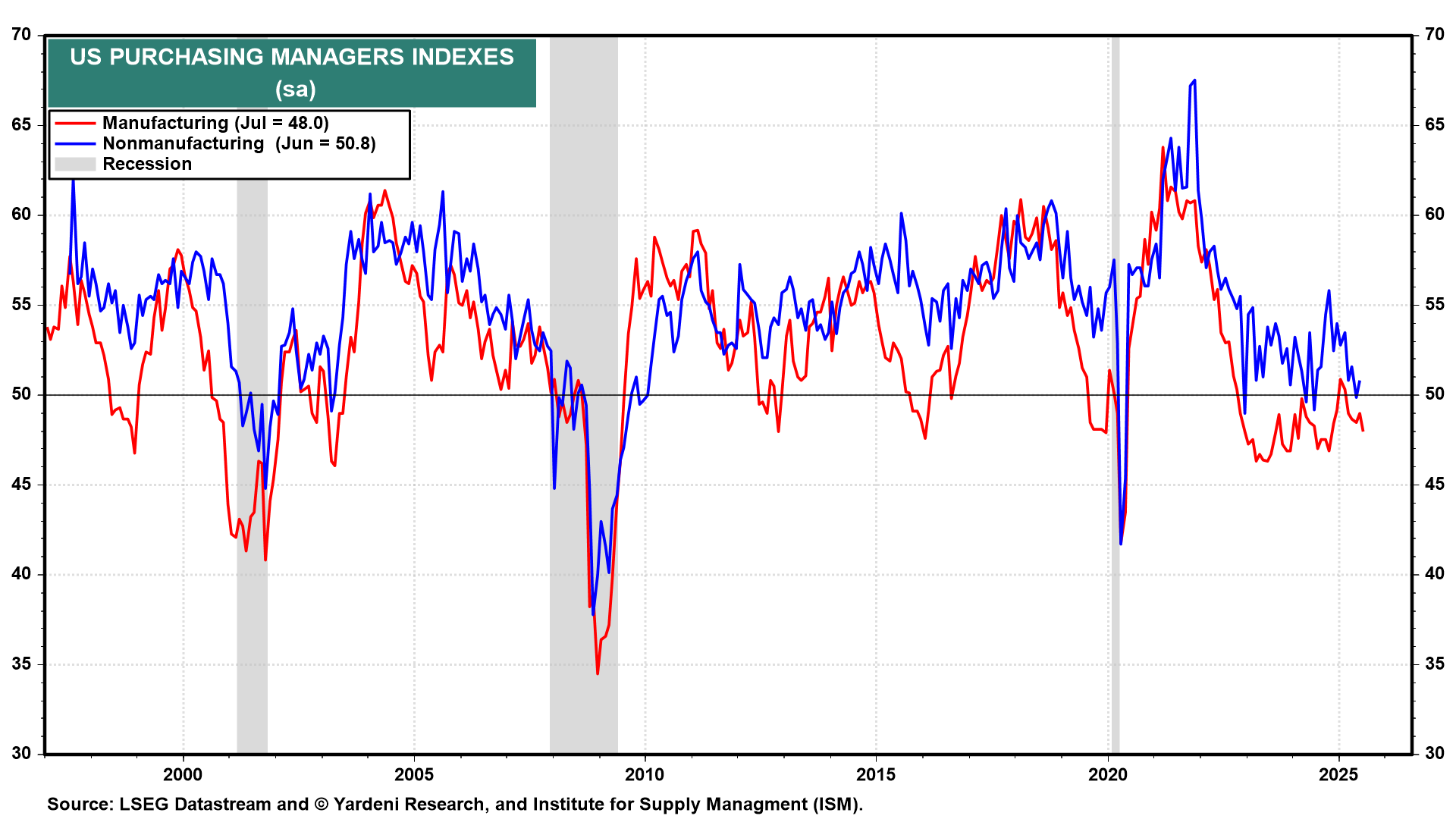

(2) PMI data. July's NM-PMI may garner more attention than usual (Tue). Last week, we learned that the tariffs helped put factory activity back into contraction. The M-PMI dropped to 48.0 in July. In June, the NM-PMI stayed in the expansion zone at 50.8. The series’ ability to avoid falling into contraction, as we expect, could be a real pick-me-up for the stock market.

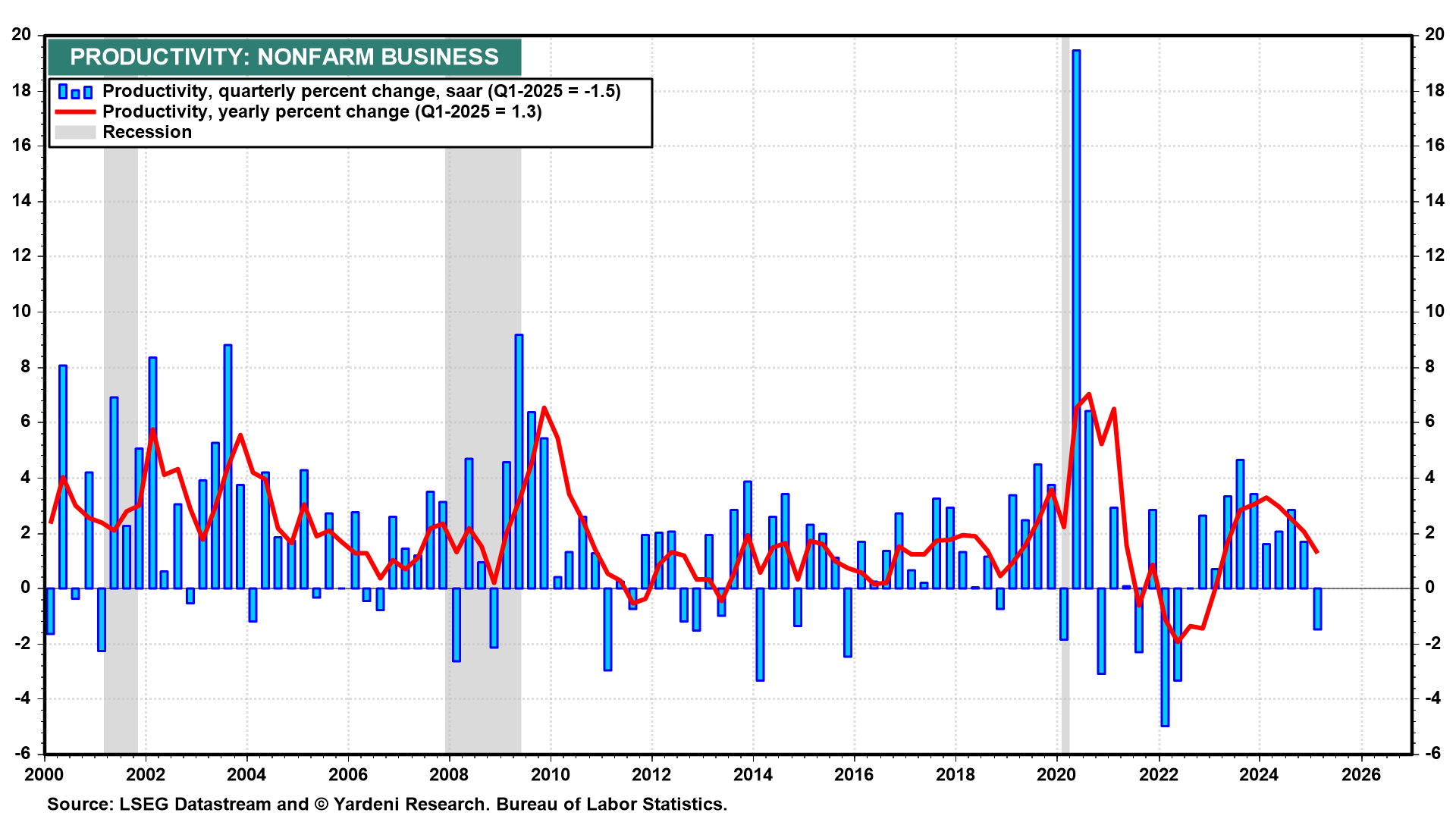

(3) Productivity & costs. One happy implication of the significant downward revisions in May and June payrolls is that Q2’s productivity (Thu) should show a significant gain (chart). That’s especially true since real GDP rose solidly during the quarter by 3.0% (saar).

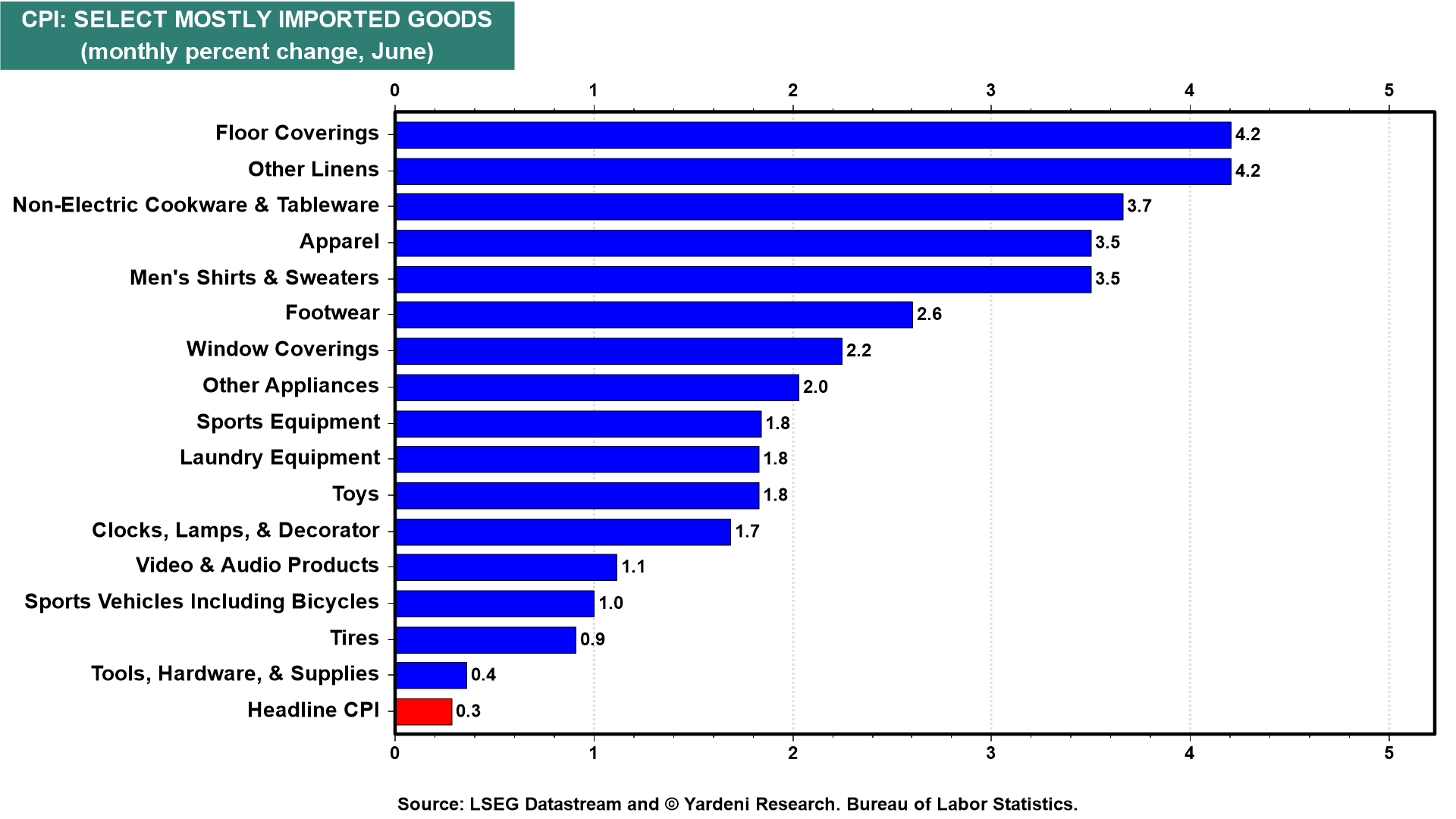

(4) Inflation expectations. As the great inflation debate of 2025 rages on, the New York Fed expectations survey has been offering some comforting readings. In June, it showed that respondents expected inflation to be 3% over the next 12 months. That’s roughly the same level as in January, before TTT arrived. The July reading (Thu) might move a bit higher, signaling that tariffs are having some inflationary impact; they certainly are on imported goods (chart).