With the odds of a December Fed rate cut starting the week at 86% (according to CME FedWatch), the Fed and investors alike probably wish more hard economic data were hitting the tape.

Ten days ahead of the most anticipated Federal Open Market Committee (FOMC) meeting this year, the hawks and doves are doing a bang-up job making their cases for either waiting until late January to lower the federal funds rate again or announcing another rate cut on December 10.

The doves have the momentum. After slashing the federal funds rate by 150bps since September 2024, twice in 2025 so far, Powell & Co. seems likely to lower borrowing costs by another 25bps. Yet with inflation running around 3% y/y, it's hard to see the Fed adding even more liquidity at the January 27-28 FOMC meeting.

In the absence of many shutdown-delayed data series, the personal consumption expenditures deflator (PCED) for September (Fri) may fill in some analytical blanks. So may earnings reports from retailers, including Dollar Tree (Wed) and Kroger (Thu). The same goes for any early clues about spending tallies for Black Friday and Cyber Monday.

Here are some releases with the potential to push the odds of Fed action in December either back toward 50% or closer to 100%:

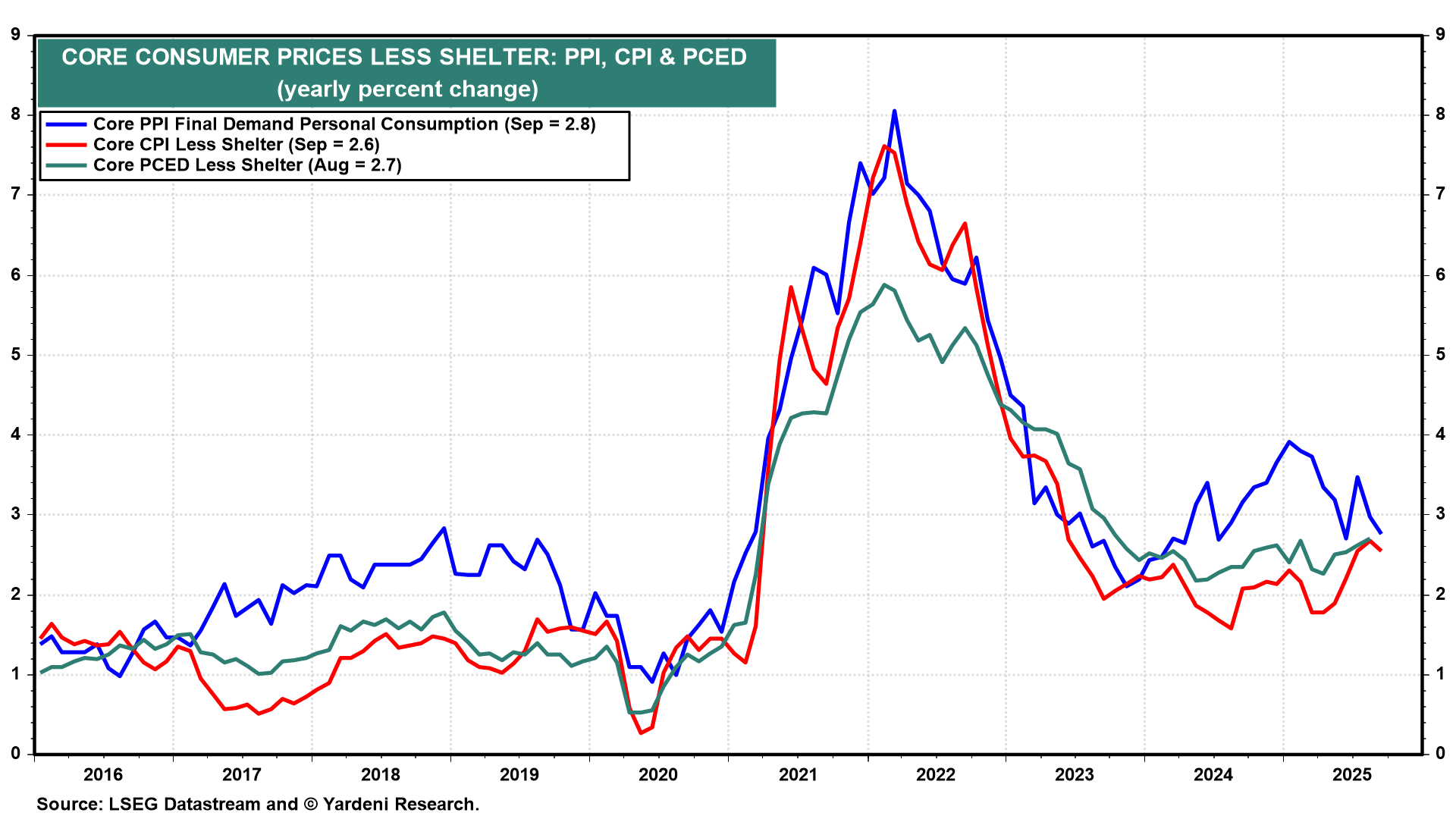

(1) Inflation indicators. The Fed would surely prefer November stats, but September data on consumption and PCED inflation (Fri) will have to do. The last time Washington released the series, for August, the core PCED rose 2.9% y/y. Core PPI and CPI inflation rates for September suggest that PCED inflation may have moderated slightly. That month's data on import and export prices (Wed) could also offer clues on the state of inflation at the end of Q3.

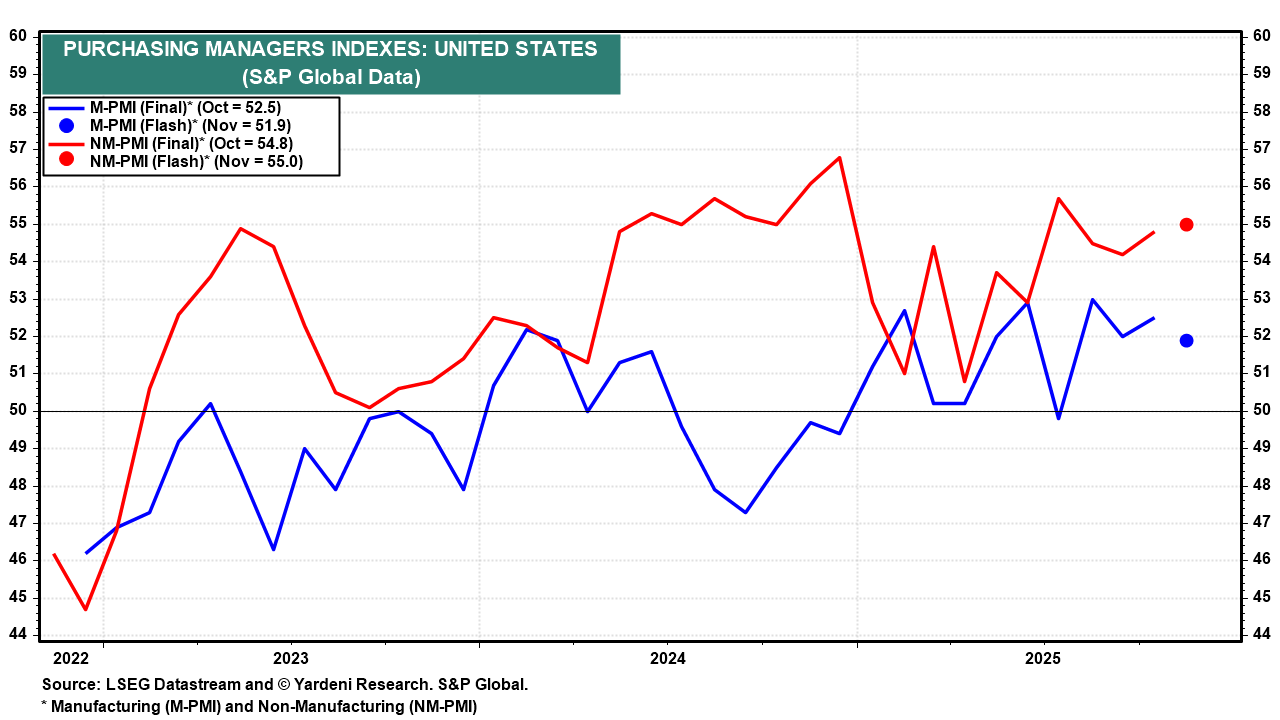

(2) PMI surveys. The ISM manufacturing PMI starts the week off (Mon). Last month, it declined to 48.7 amid tariff gloom. The non-manufacturing survey (Wed) edged up to 52.4 in October. The S&P Global flash estimates suggest that both might have edged up in November (chart).

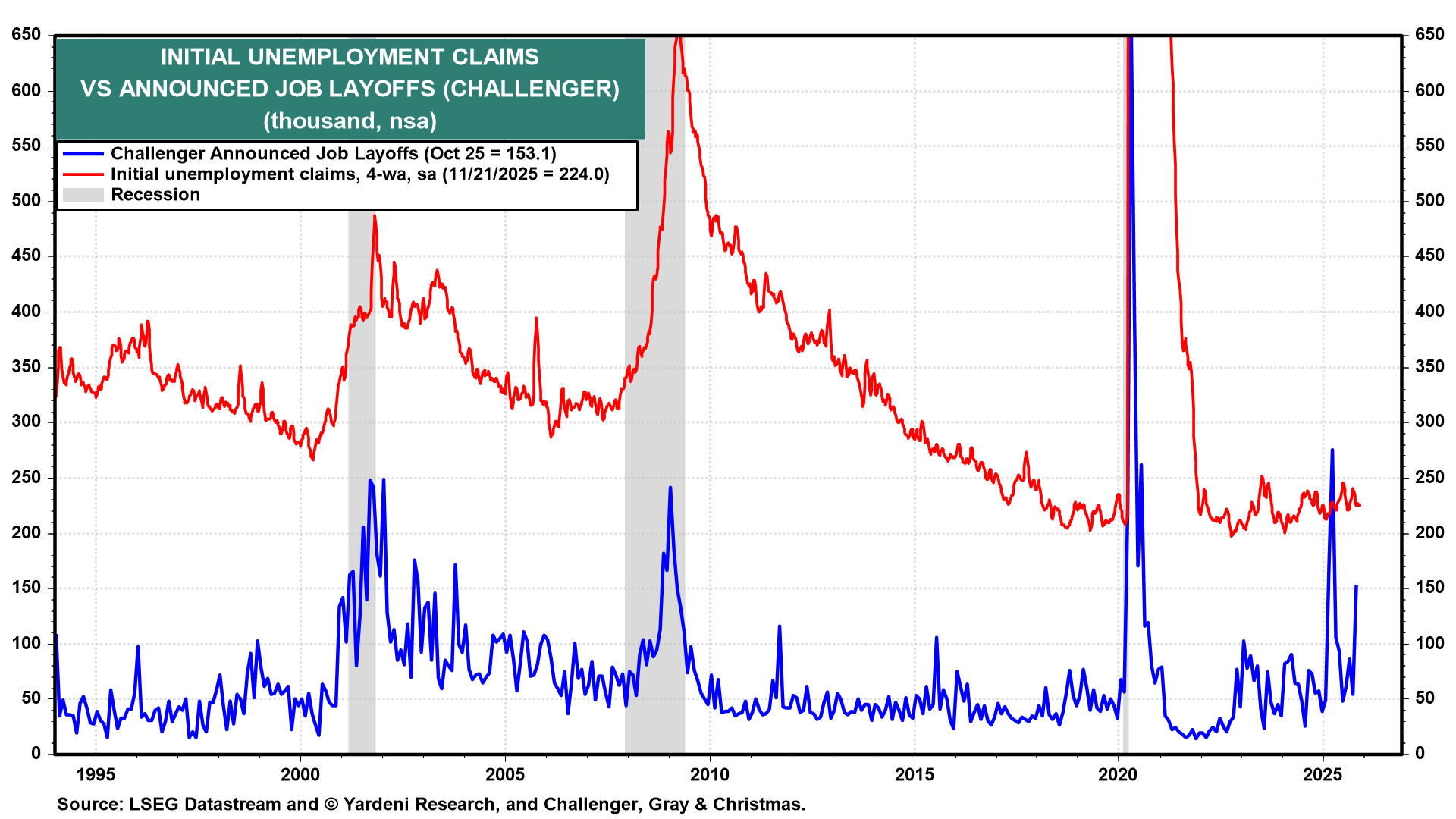

(3) Employment dynamics. Ahead of the November employment report on December 16, weekly unemployment insurance applications (Thu) are gaining greater importance. Last week’s drop to 216,000 was a reminder that the labor market might be more robust than many fear. ADP's employment report for November (Wed) will garner considerable attention after the previous month's better-than-expected 42,000 increase. So will the latest Challenger report for November (Thu), following a jump in layoffs in October (chart).

(4) Mortgage demand. Given the volatility in US 10-year yields in recent months and shaky consumer confidence, data from the Mortgage Bankers Association is having a moment (Wed). In the week ended November 21, applications jumped 7.6% to the highest level since early 2023. A repeat performance in the November 28 week could remind Fed officials that the US economy might be closing out the year on a solid footing.