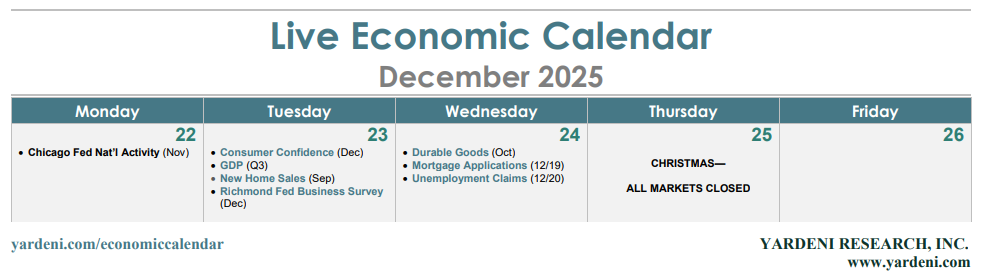

This looks to be a mercifully quiet holiday week that nonetheless offers a smattering of key data releases. Chief among them will be Q3's GDP and December's Consumer Confidence Index survey.

Clearly, the economic fog caused by the government shutdown is following the markets into the new year. Though recent employment data have been illuminating—showing that the labor market may be a bit more robust than many expected—their quality is questionable. The same can be said of other recently released key data series.

Last week's CPI release for November is another foggy one. While nice to have, the lower-than-expected 2.7% y/y increase raised fresh questions about the reliability of post-shutdown data.

Investors are also uncertain about the year-end stock rally in this shortened Christmas week. Any signs of holiday cheer could go a long way on Wall Street as investors scrutinize massive corporate spending on AI and shifting perceptions about when—and whether—Powell & Co. might ease again in early 2026.

Here's a look at some data reports that might influence the Fed's views on how the US is exiting a uniquely chaotic year:

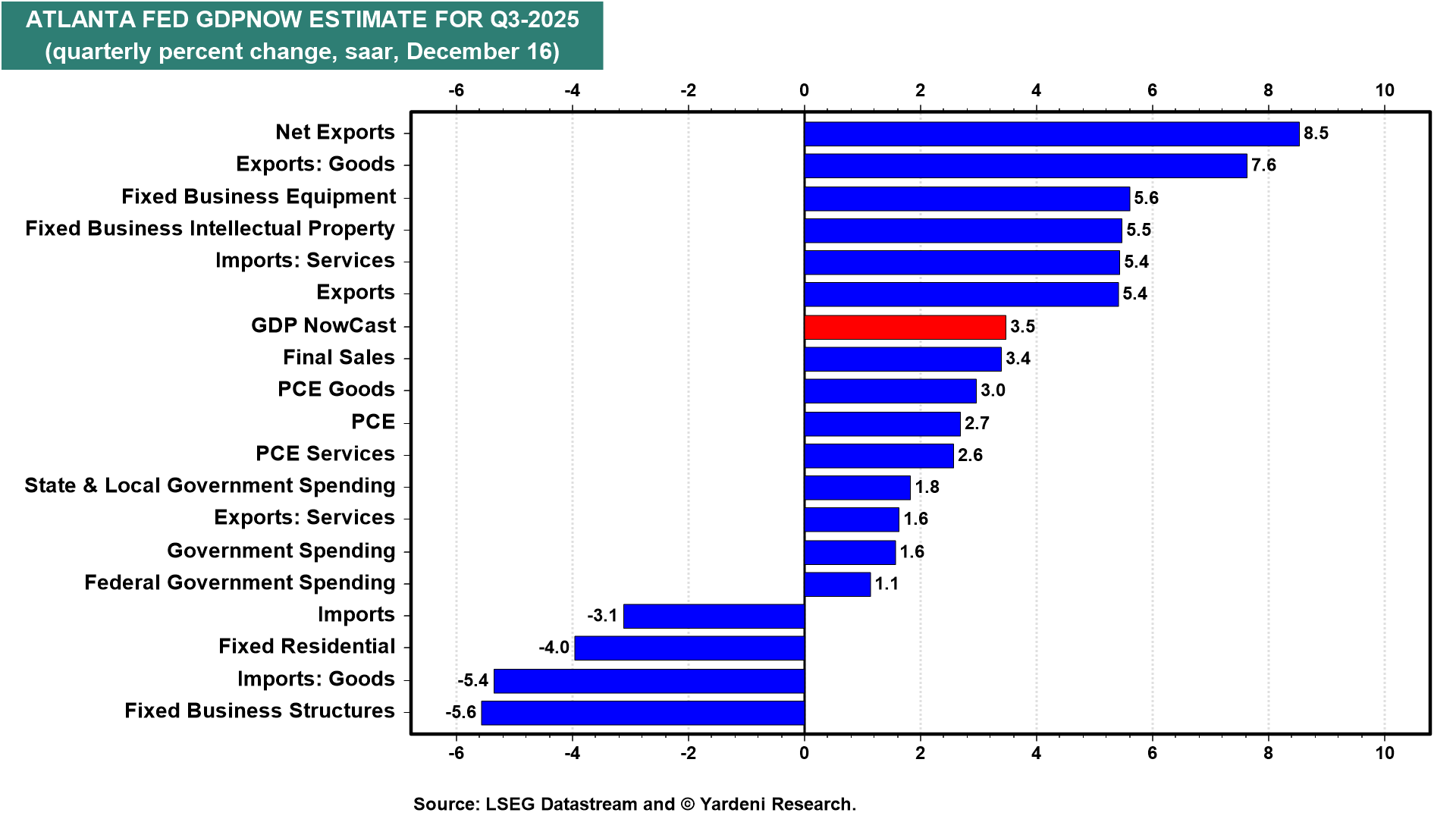

(1) GDP update. Real GDP rose 3.8% (saar) during Q2. We expect a reasonably robust 3.5% Q3 GDP report (Tue) to confirm that economic growth remains robust. This would be consistent with the Atlanta Fed’s GDPNow estimate (chart).

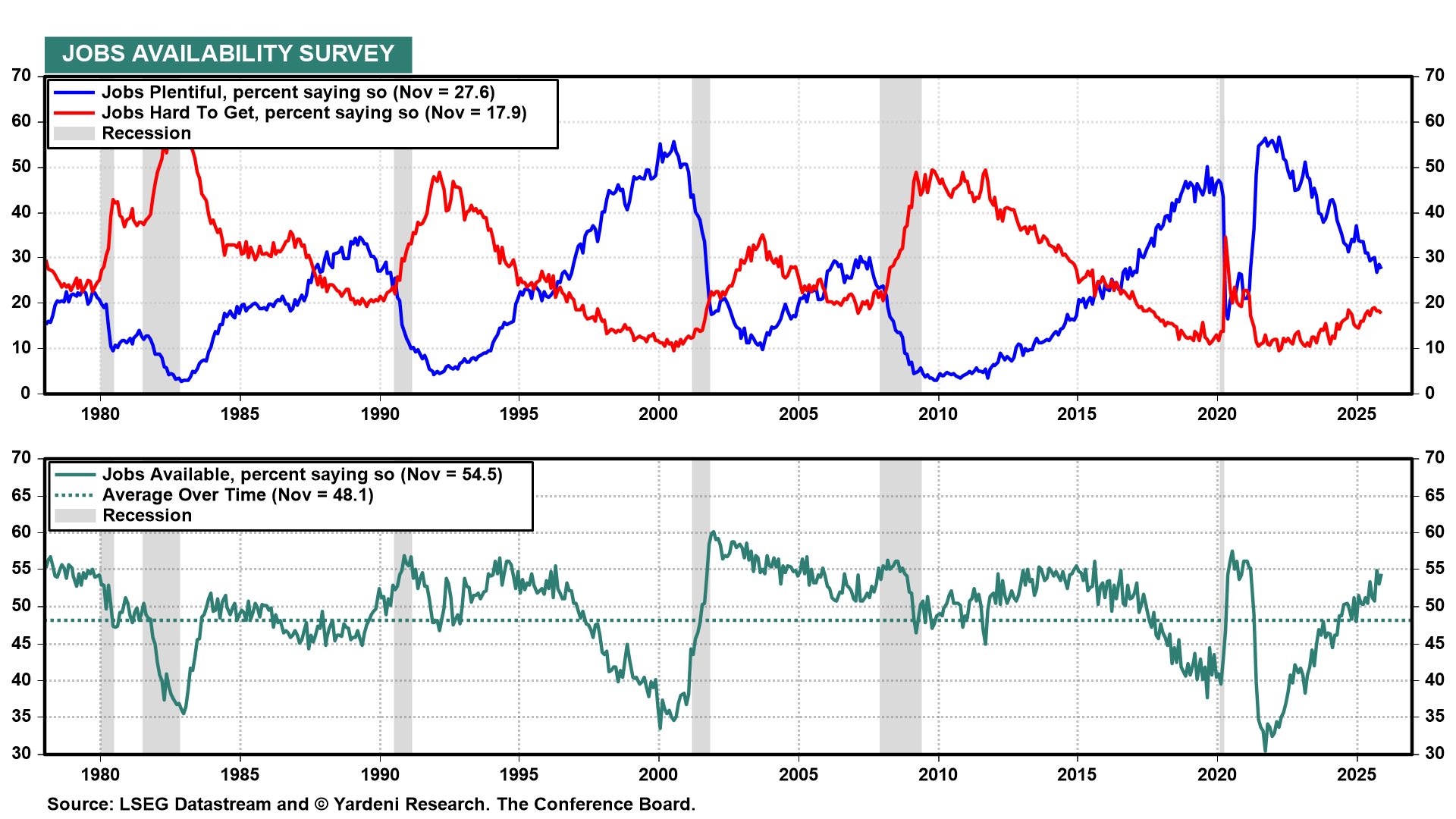

(2) Consumer confidence. With government data still trickling in—and at times offering mixed signals—private surveys are filling the void as rarely before. The Conference Board's Consumer Confidence Index survey (Tue) is a case in point. It provides the earliest monthly lead on the labor market. We expect it to confirm that job market conditions remain mixed (chart).

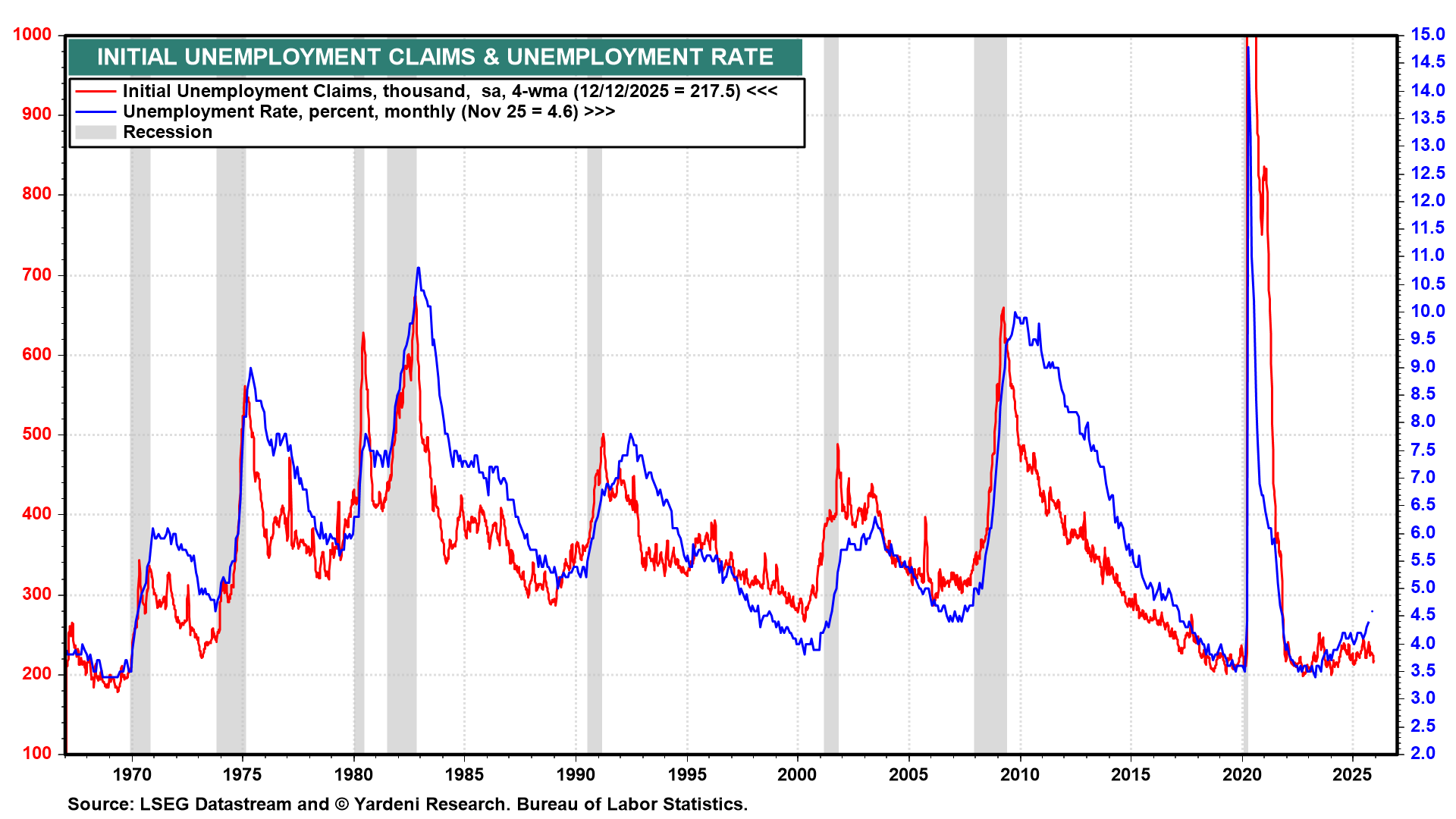

(3) Jobless claims. Amid the statistical fog, the level of weekly claims for unemployment insurance (Wed) remains something of a beacon for perplexed investors. The latest reading (following last week’s 224,000 level) should show, once again, that layoffs remain low, suggesting that a slight decline could follow November's 4.6% jobless rate in December (chart).

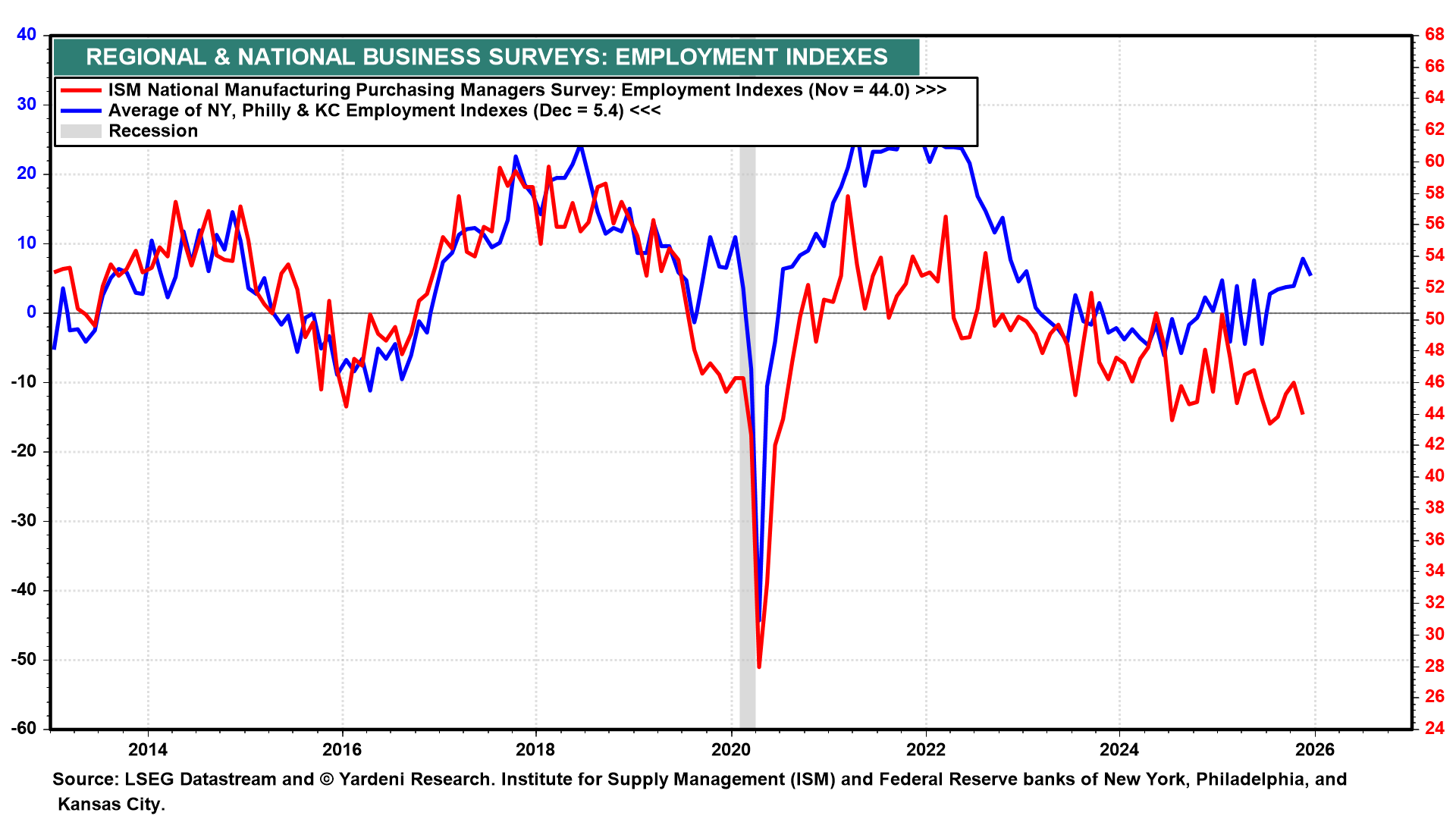

(4) Regional Fed surveys. The week opens with the Chicago Fed’s National Activity Index (Mon) for November. That's followed a day later by the Richmond Fed's business survey (Tue) for December. Though the regional Fed bank surveys have faced their own challenges as government data have gone quiet, this week's Richmond update may confirm the solid December employment reports from the NY, Philly, and Kansas City Feds (chart).