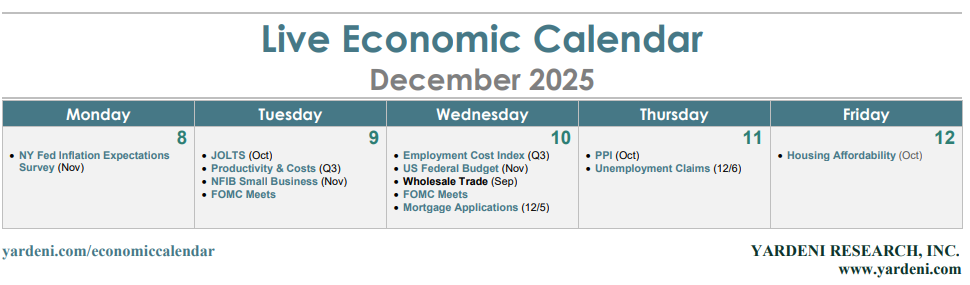

Obviously, this week is all about the Fed's big interest-rate decision (Wed); the policymakers are expected almost universally to cut rates 25bps for a third time this year.

The immediate focus will be on the composition of the FOMC's vote and the insights from Fed Chair Jerome Powell's press conference: how many dissenters, if any; Fed officials' take on the balance of risks between weakening employment gains and inflation stuck around 3.0% y/y; any surprising forward guidance clues; and any notable observations in the FOMC statement. Most important might be the latest quarterly Summary of Economic Projections.

Outside the US, the week ahead is rich with opportunities to assess the severity of headwinds emanating from Trump's trade war. They include central bank decisions in Canada, Australia, and Switzerland. China and Taiwan will release export data, while the bond and currency markets will be keeping an eye out for any change in the odds that the Bank of Japan might go ahead with a tightening move on December 19.

Upcoming reports of particular interest include:

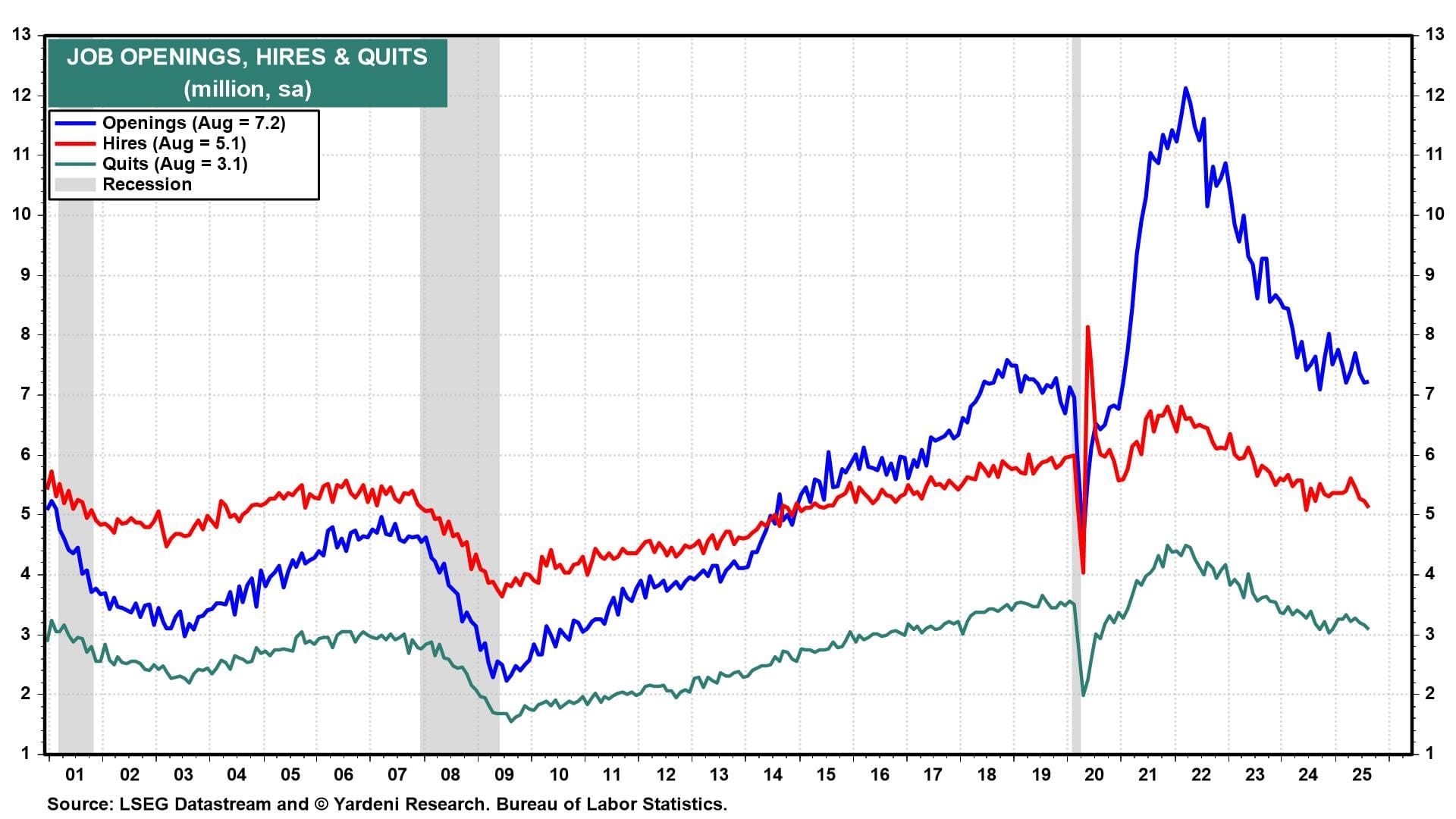

(1) JOLTS. As the data fog begins to lift, the October Job Openings and Labor Turnover Survey (Tue) will offer the markets a look at the latest labor market trends—especially hires, quits, and layoffs (chart). Though somewhat dated, any intel on how the economy opened Q4 will do. Initial claims (Thu) should also confirm that layoffs remain low.

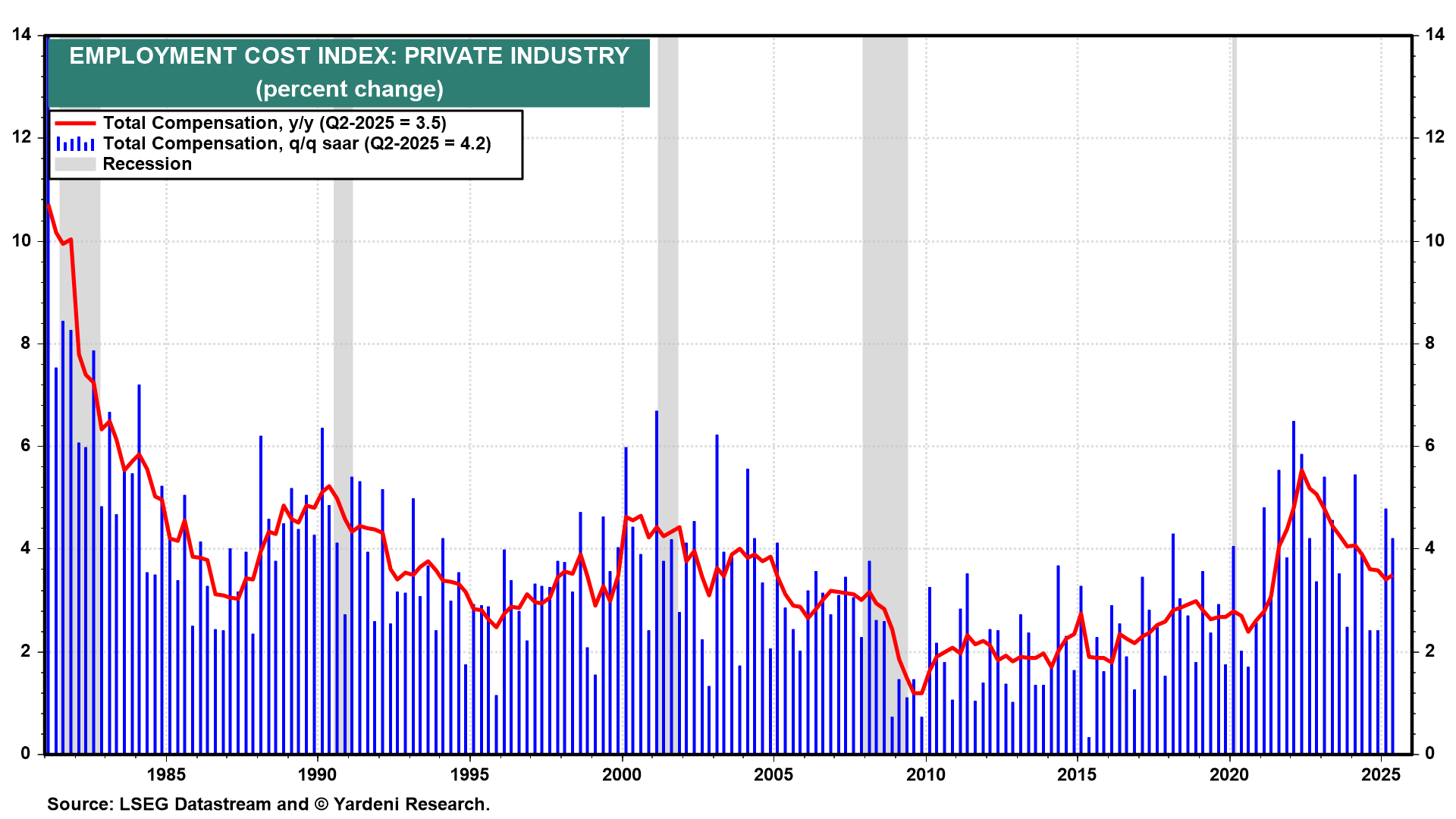

(2) Employment costs. Hitting the tape on Fed decision day, the Employment Cost Index (Wed) for Q3 could provide timely clues on wage dynamics. In Q1 and Q2, compensation rose by about 3.5% y/y (chart). Q3 might serve as a reminder from a wage perspective that US growth isn't as weak as many fear. Data on Q3 productivity and costs (Tue) should be robust as well.

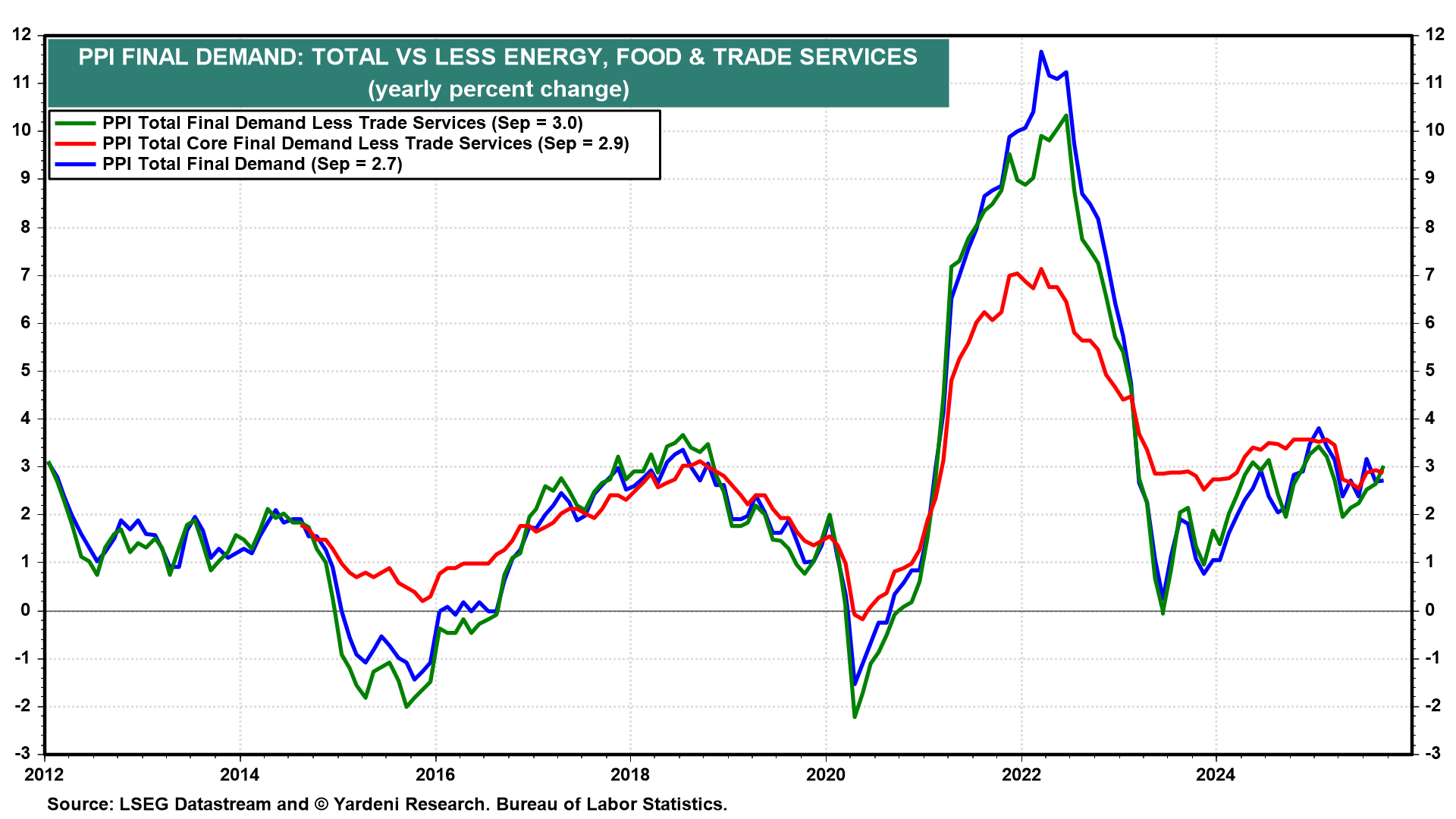

(3) PPI. October's belated PPI (Thu) might show that inflation remains stuck just south of 3.0% y/y (chart).

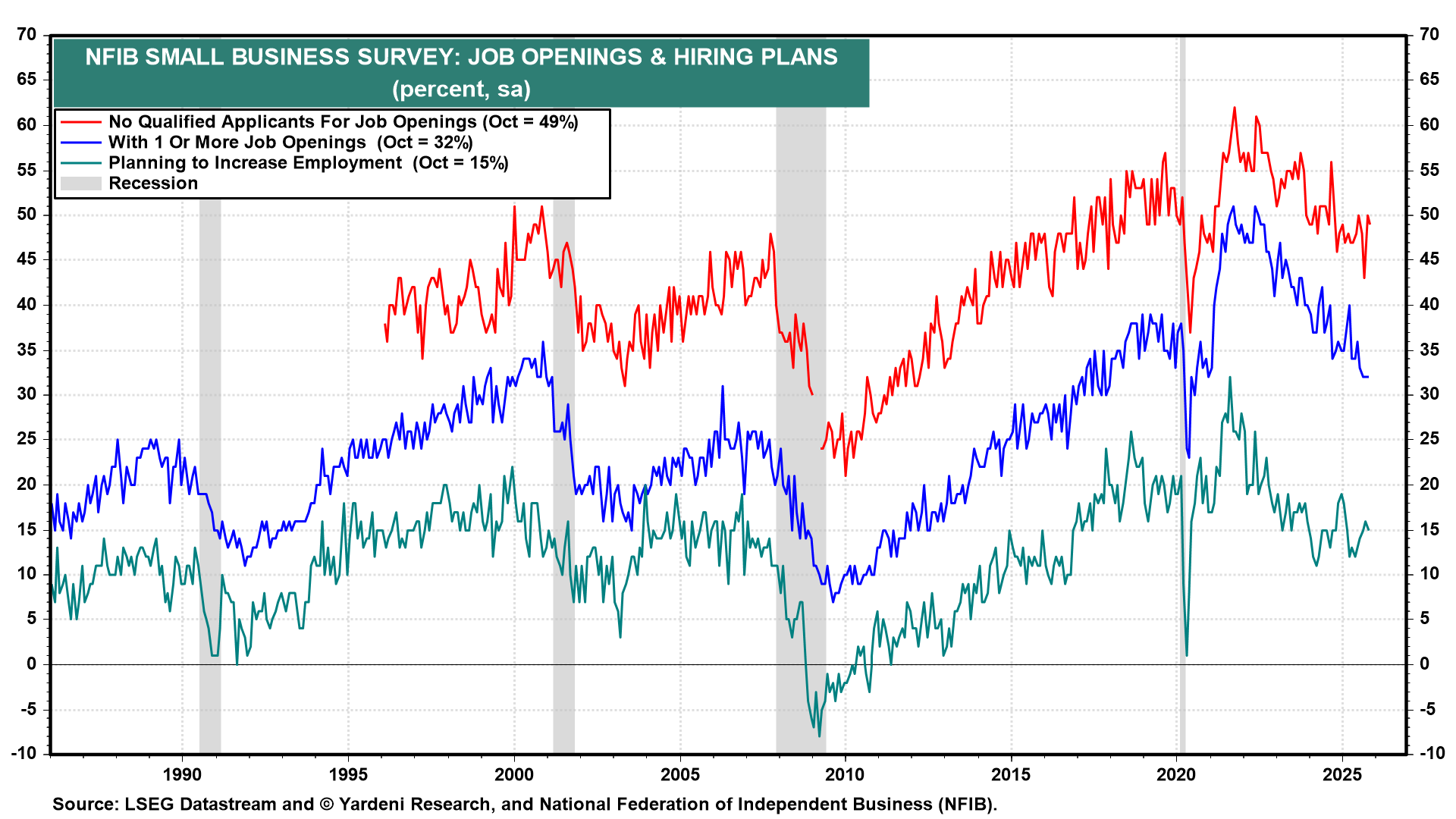

(4) Private surveys. There’s still much to glean from soft data as we wait for US government data to catch up. The week begins with the New York Fed's inflation expectations series for November (Mon). A day later, November's National Federation of Independent Business (NFIB) survey (Tue) gets released. The spotlight will be on the survey's employment indicators (chart). We expect they will hold their ground.