This holiday-shortened week could be a pivotal one for investors trying to gauge the outlook for Fed policymaking.

Highlights include a first estimate of Q4-2025 real GDP (Fri), December PCED inflation (Fri), February consumer sentiment (Fri), and the minutes from the January 27-28 Federal Open Market Committee meeting (Wed), when policymakers held rates steady.

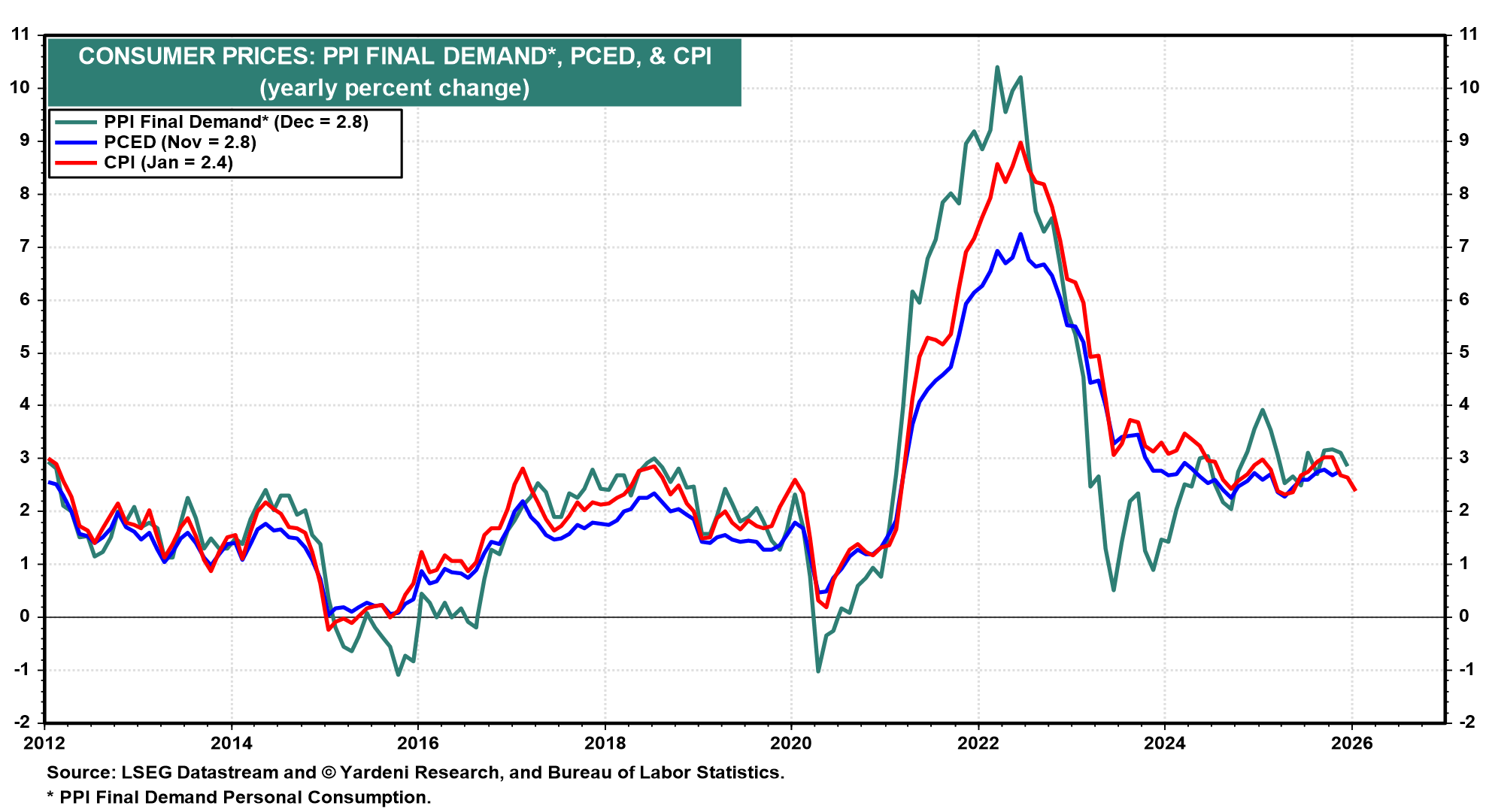

This fresh influx is especially welcome as the economy moves past the government-shutdown data distortions and into the AI-driven disorientation of the moment. Last week's figures, for example, were more of a Rorschach Test than an economic reality check. Some were cheered by the above-expectations 130,000 payrolls gain and 4.3% jobless rate in December; others harped on the downward revisions to previous months’ payrolls data. January's CPI rates (2.4% y/y headline, 2.5% core) were widely viewed as relatively subdued, though they held a few devilish details (see this afternoon’s QuickTakes note).

Markets are likely to pay especially close attention to the talking Fed heads this week. We'll hear from Fed Governor Michelle Bowman three times: on mortgage lending (Mon), supervision and regulation (Wed), and the banking outlook (Thu). Governor Michael Barr tackles AI and the labor market (Tue). Minneapolis Fed's Neel Kashkari, a voting FOMC member, also speaks (Thu).

Of course, Wall Street trading will be its own economic indicator. The Dow Jones Industrial Average crossing the 50,000 mark last week generated banner headlines. The milestone comes as an AI-driven shakeout—particularly in software stocks—keeps investors on edge. Uncertainty about the direction of Fed policy and bond yields surely doesn't help.

Here are the economic releases most likely to offer guidance on the timing of Fed rate moves (if any) over the next few months:

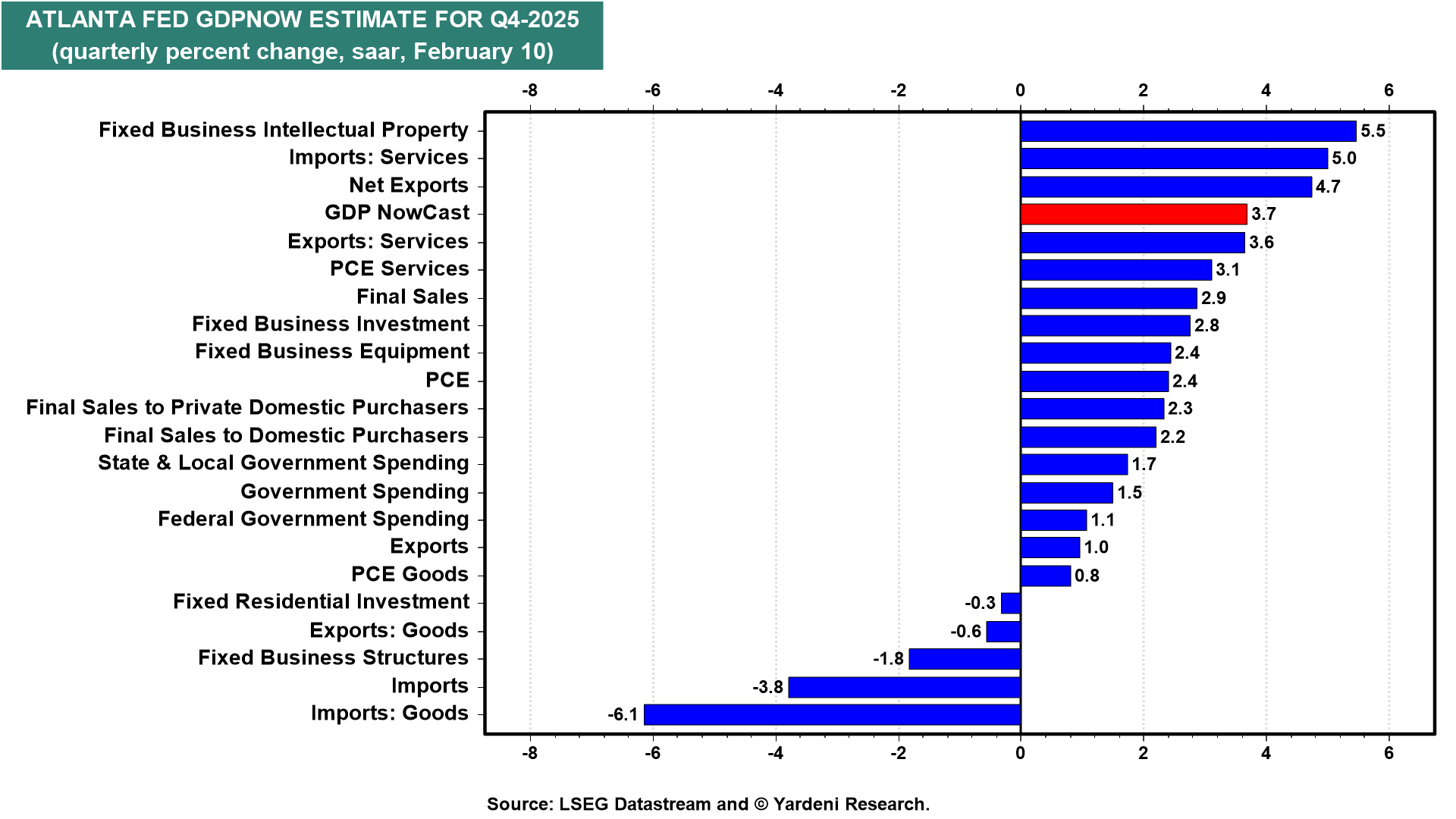

(1) GDP. The October-November government shutdown might have muddied the Q4 waters for GDP. A flat reading in December retail sales raised its own questions about how the economy ended 2025. Yet the Atlanta Fed's GDPNow tracker, which estimates a 3.7% saar growth rate, aligns with other evidence that the economy remains strong.

(2) PCED inflation. December's PCED inflation reading should confirm the recent disinflationary CPI news (chart). The Cleveland Fed’s Inflation Nowcasting model predicts a 2.8% y/y rate of increase in both the headline and core PCED rates in December with continued moderation of both in January and February.

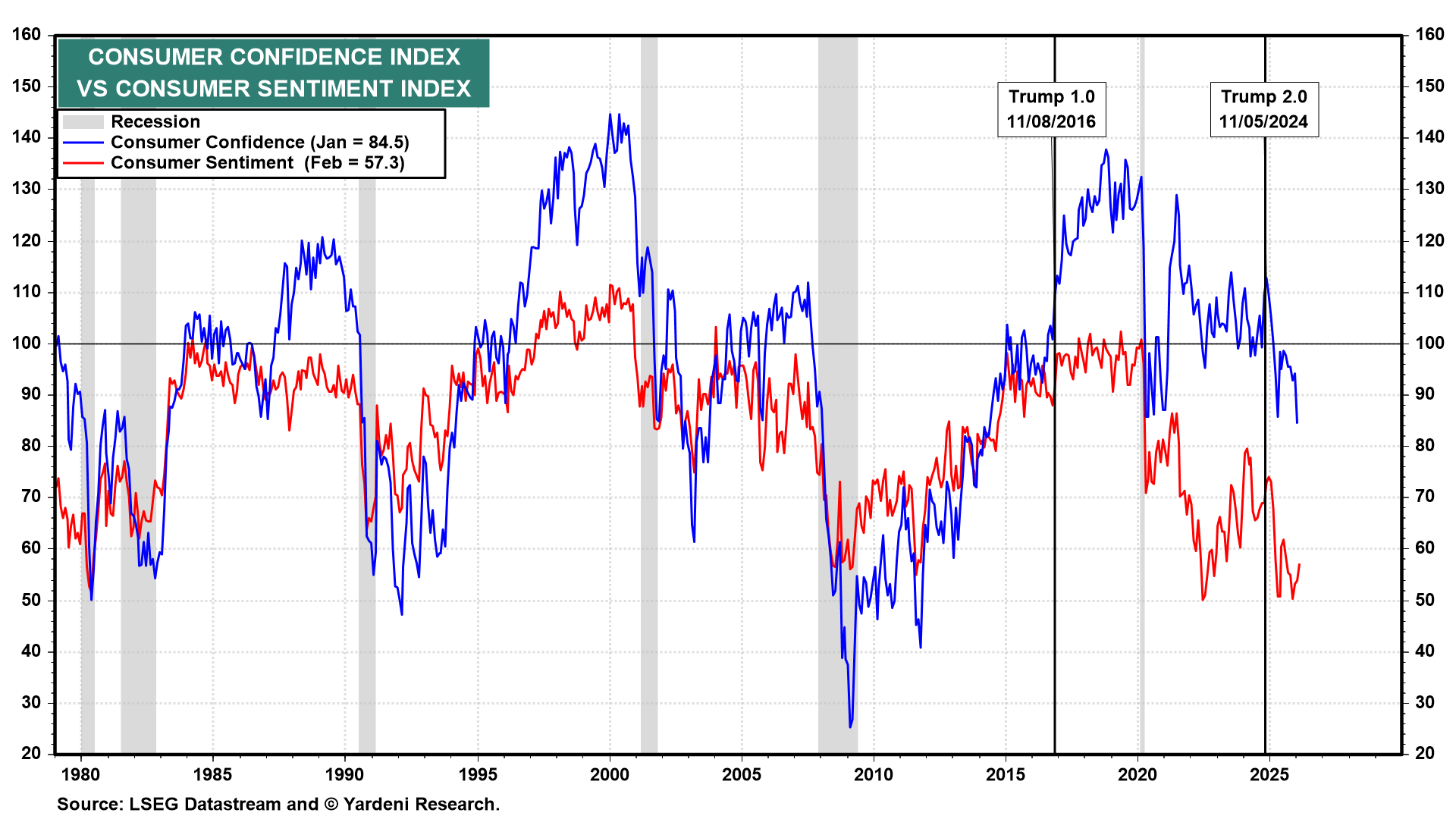

(3) Consumer sentiment. The University of Michigan's consumer sentiment index probably edged higher in February, according to an earlier estimate for the month (chart). Surveys of consumer confidence have been misleading indicators of consumer spending, which has remained solid. That may be about to change, but we doubt it.

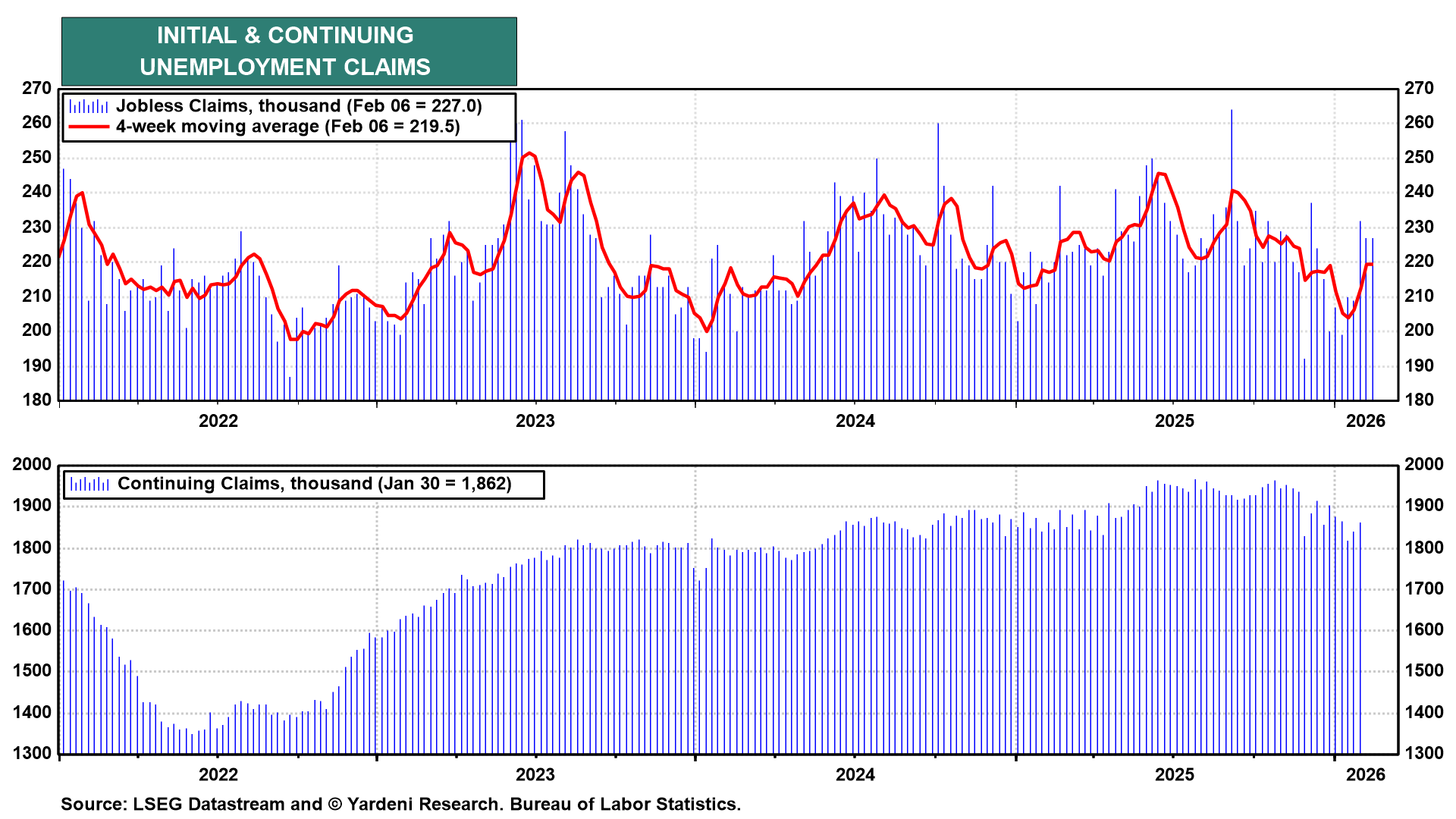

(4) Initial claims. The employment signals from the New York Fed's business surveys (Tue) and the Philly Fed's (Thu) could be illuminating. But initial unemployment claims should remain close to last week's 227,000 level, confirming recent signs of stability in the labor market (chart).