The week ahead has an anything-goes energy as a variety of key data and earnings reports vie for attention amid peak geopolitical intrigue.

Last week left quite an impression on global markets. Trading in gold and silver went off the rails. "Dollar debasement" concerns competed with yen-intervention chatter. Donald Trump's White House kept everyone on their toes, hinting at military action in Iran and threatening new tariffs. Yet President Trump clarified, too, naming Kevin Warsh as his choice for the next Fed chair. If confirmed by the Senate, he will start on May 15.

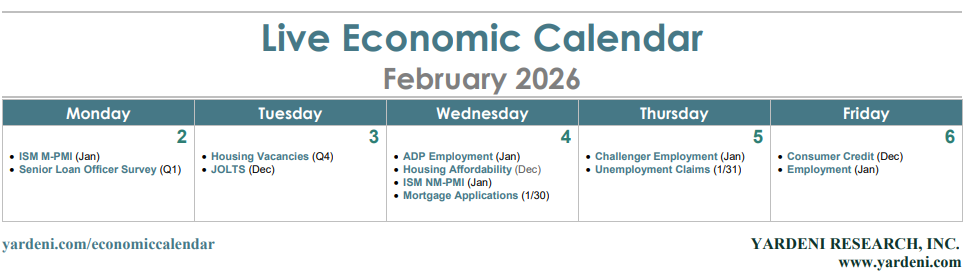

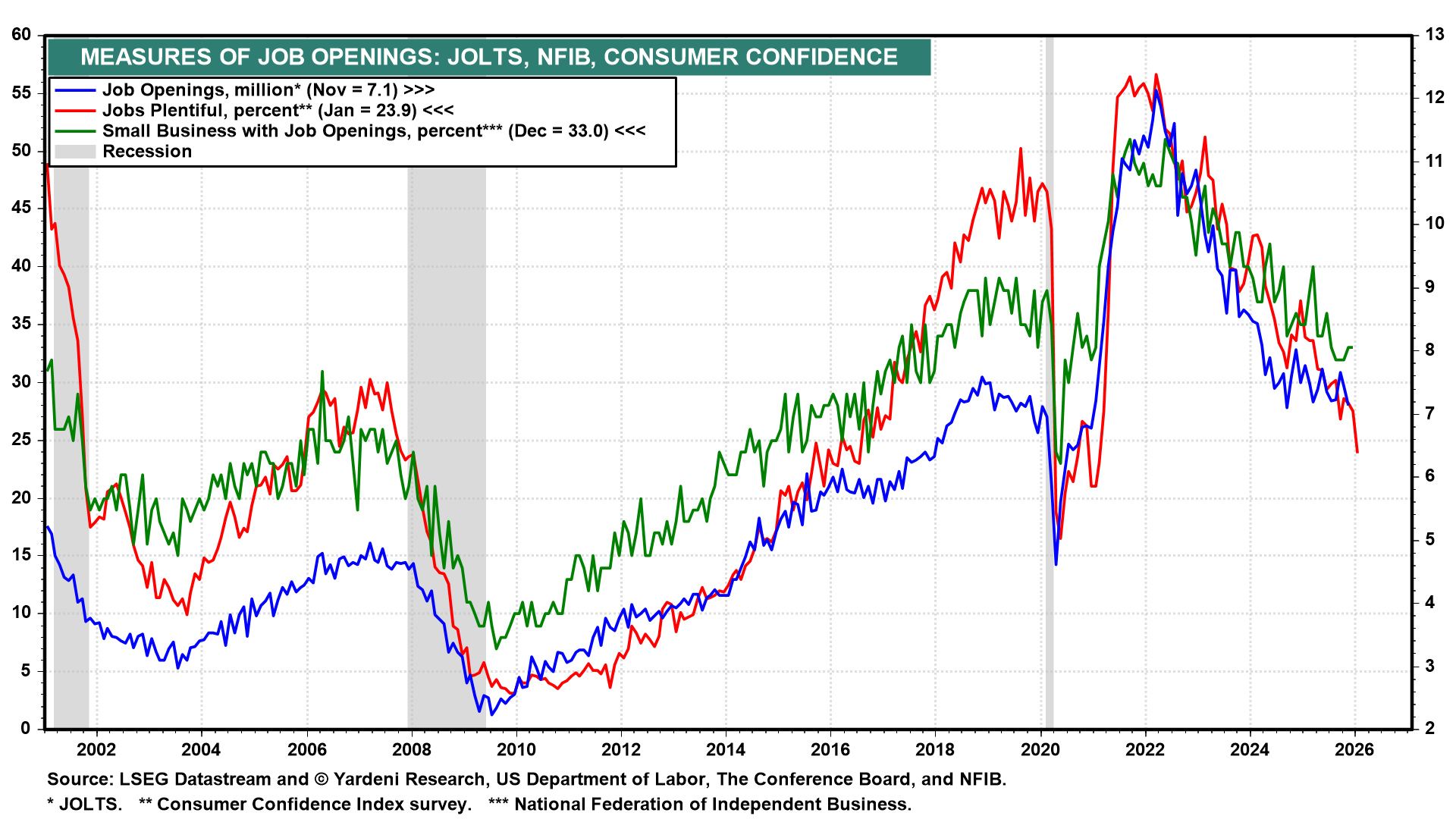

Investors will be assessing how this week's bevvy of labor market indicators might affect the timing of any future Fed rate cuts. They include December's JOLTS data (Tue), January's ADP release (Wed), January's Challenger layoffs survey (Thu), weekly unemployment insurance claims (Thu), and January's employment report (Fri).

Fed Governor Lisa Cook speaks on the economic outlook (Wed), followed by Vice Chair Philip Jefferson (Fri). It will also be a busy week for major central banks abroad, too. The European Central Bank (Thu) and the Bank of England (Thu) are expected to leave rates unchanged. The Reserve Bank of Australia (Tue) could tighten by 25 bps as inflation heats up.

We'll get corporate results from a wide variety of names that may offer insights into how the economy entered 2026. The Magnificent-7 earnings season continues, with Alphabet and Amazon reporting. Add updates from AMD, Palantir, and Qualcomm, and this could be a telling week for the speculative AI bets. Reports from PepsiCo, Philip Morris, Qualcomm, Uber, and Walt Disney could provide much-needed intel on how consumers are faring.

Here's a look at the key data reports this week that might influence the timing of the next Fed rate move:

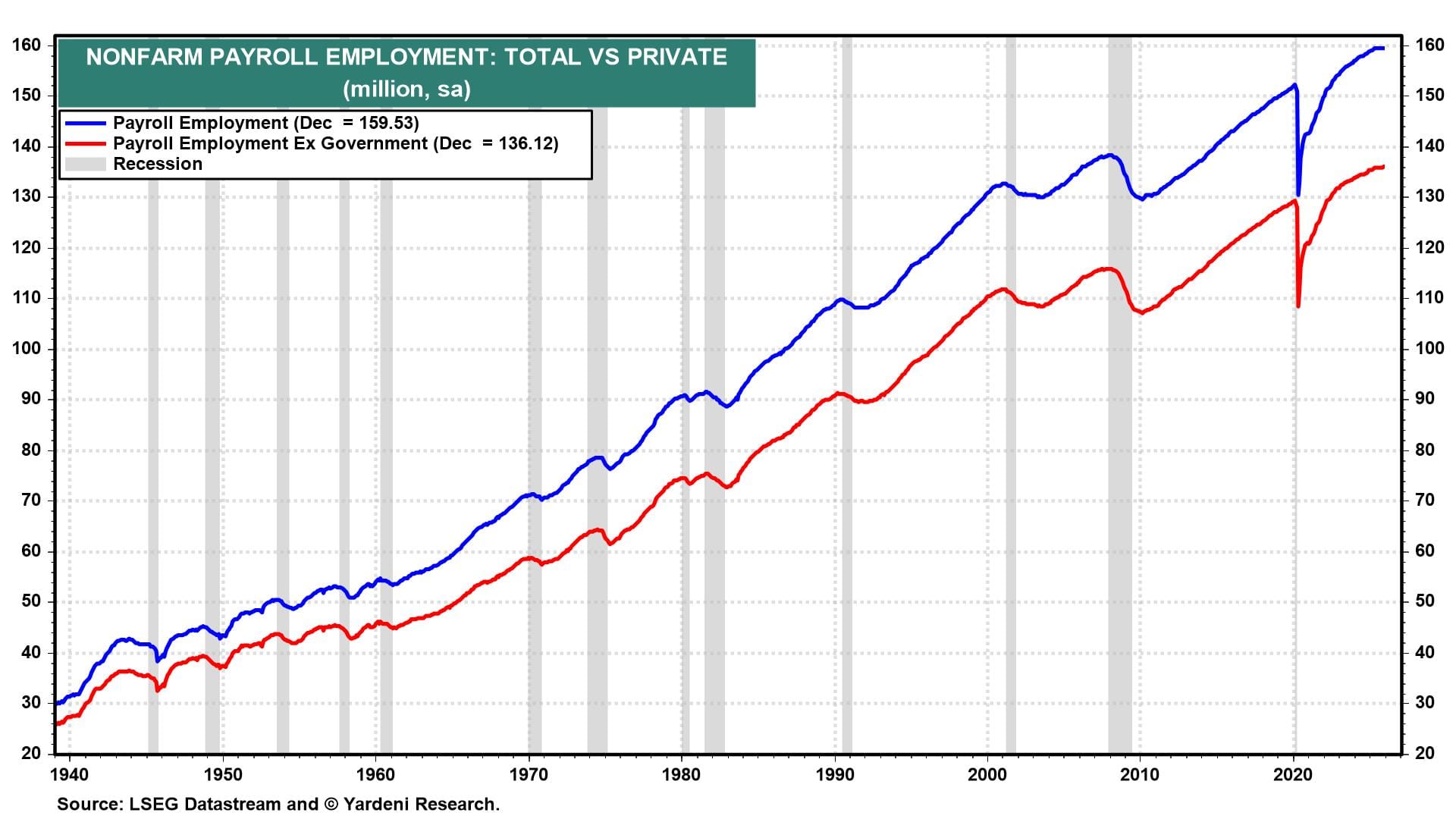

(1) Employment. We expect a slight improvement in the labor market in January, with payrolls rising by 60,000 following a 50,000 gain in December (chart). Any upside surprises could boost the dollar and buttress current Fed Chair Jerome Powell's contention that the US doesn't require fresh monetary stimulus.

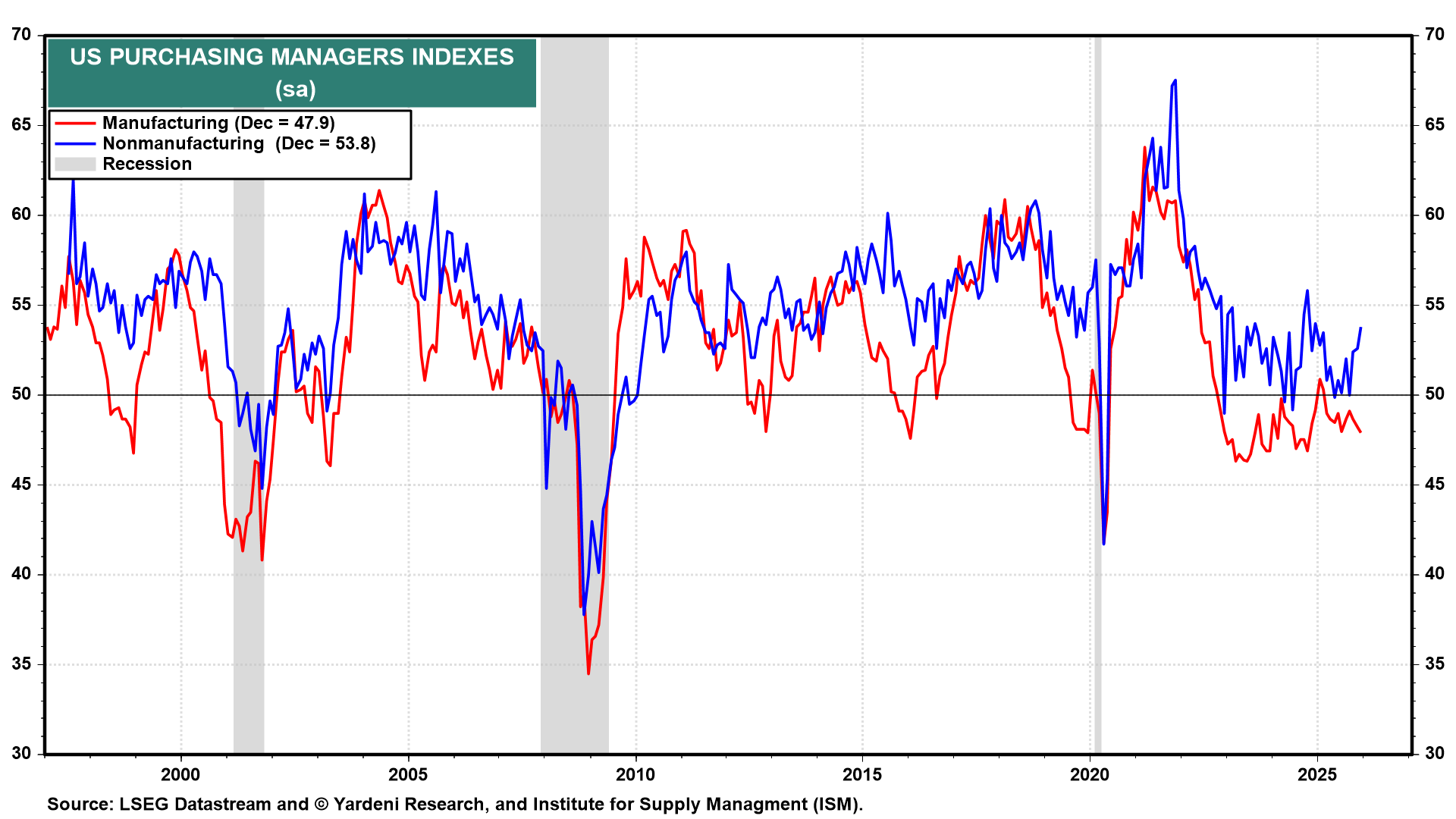

(2) Purchasing managers' index. The December surveys from the Institute for Supply Management made for mixed readings (chart). Manufacturing slumped to a 14-month low of 47.9. It should improve a bit in January. The non-manufacturing PMI (Wed) should remain well above 50.0. It was 53.8 in December.

(3) JOLTS. The November Job Openings and Labor Turnover Survey showed that job openings edged down (chart). The Conference Board's jobs-plentiful series suggests that job openings remain on a downward trend.

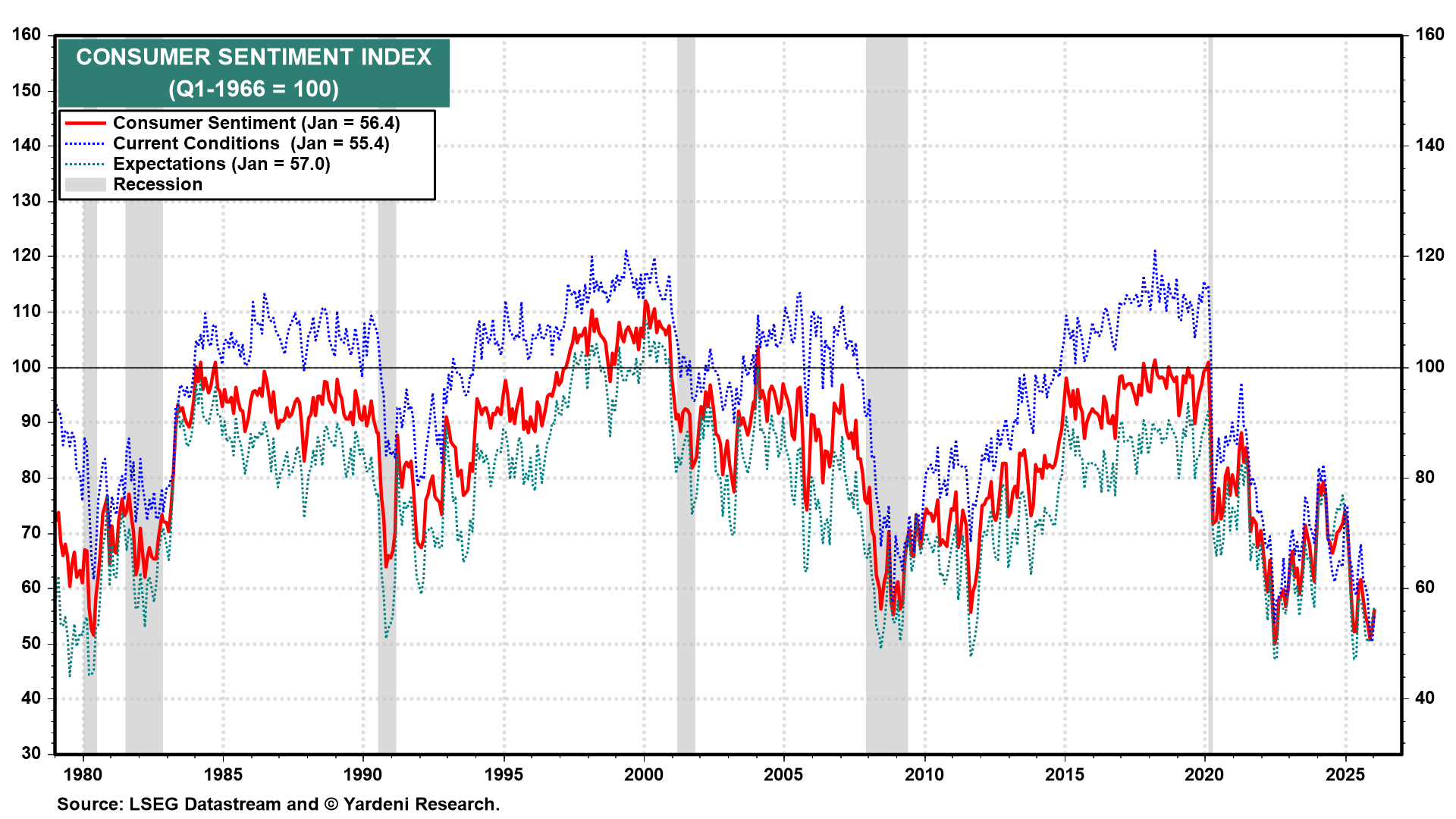

(4) Consumer expectations. The preliminary University of Michigan consumer sentiment reading for February (Fri) is likely to be steady to weaker following January's final 56.4 reading amid labor market concerns and elevated prices (chart). This survey data has been too pessimistic about the outlook for consumer spending for quite some time. Ignore it.