As the polar vortex generates arctic blasts around the US, things are about to heat up on the economic data front. The week ahead includes arguably the two most consequential releases with respect to the outlook for Federal Reserve policy—January's employment and CPI reports.

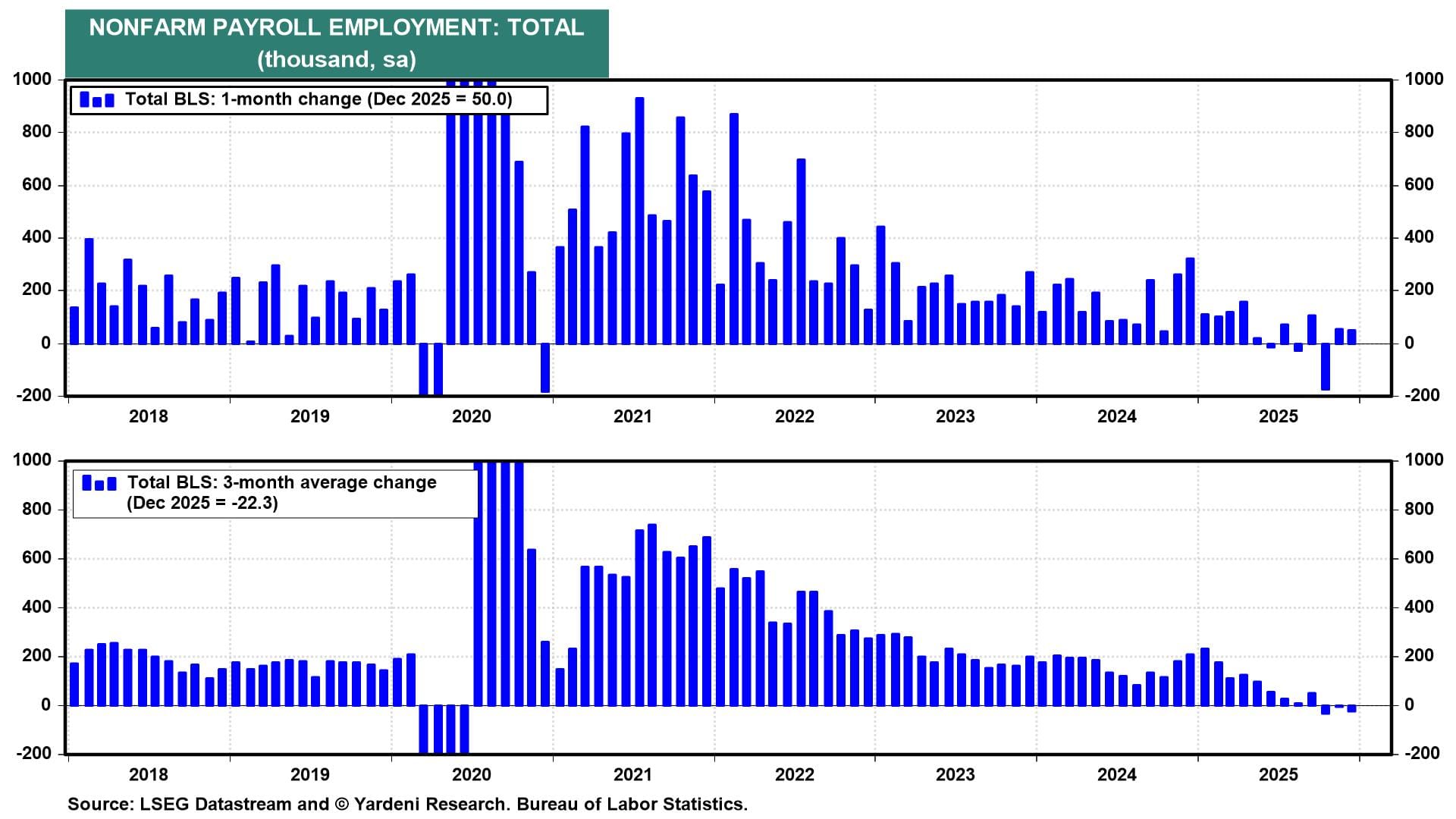

Thanks to recent government shutdowns, the employment (Wed) and CPI (Fri) releases are unusually close together. The jobs report is especially important, as the January data typically includes annual revisions to employment conditions. There might be some noteworthy downward revisions in the year through March 2025.

An interesting point of reference will be the Fed's view of the likely overstatement of jobs growth. In December, Fed Chair Jerome Powell said his research team believed official data might be overestimating jobs growth by as much as 60,000 jobs per month since April. With jobs growth averaging just under 40,000 a month during that period, there's no telling what the coming revisions might mean for the Federal Open Market Committee's March meeting.

This week features speeches by several Fed officials, including Governors Christopher Waller (Mon), Stephen Miran (Mon and Thu), and Michelle Bowman (Wed). Among Fed presidents with FOMC votes this year, we'll hear from the Cleveland Fed's Beth Hammack (Tue) and the Dallas Fed's Lorie Logan (Tue).

Wall Street will provide its own indicator of sorts following last week's new record high for the Dow Jones Industrial Average above 50,000. The AI-driven shakeout among tech heavyweights warrants close attention. So does the "old economy" trade putting previously out-of-favor sectors—oil & gas, chemicals, transportation, and regional banks—back in the spotlight. Not to mention gold's recent bull run as bitcoin tumbles.

Here are the data releases with the greatest potential to move markets and influence Fed views on the need for additional rate cuts:

(1) Employment. We expect nonfarm payrolls (Wed) to have increased by 60,000 in January following December's 50,000 gain (chart). Close attention should be paid to the magnitude of revisions to past data. Downside surprises could put pressure on Powell to back a rate cut later this month, even though we don't believe that the Fed can fix what ails the job market.

(2) CPI. The markets are on the lookout for additional evidence that inflation continued to creep lower in January. December's 2.6% y/y rate matched a four-year low in the core CPI inflation rate (chart). The Cleveland Fed’s Inflation Nowcasting model points to a 0.22% m/m (2.45% y/y) increase in core inflation. We'll also get the Q4-2025 employment cost index (Tue), December's import/export prices (Tue), and the New York Fed's January inflation expectations survey (Mon).

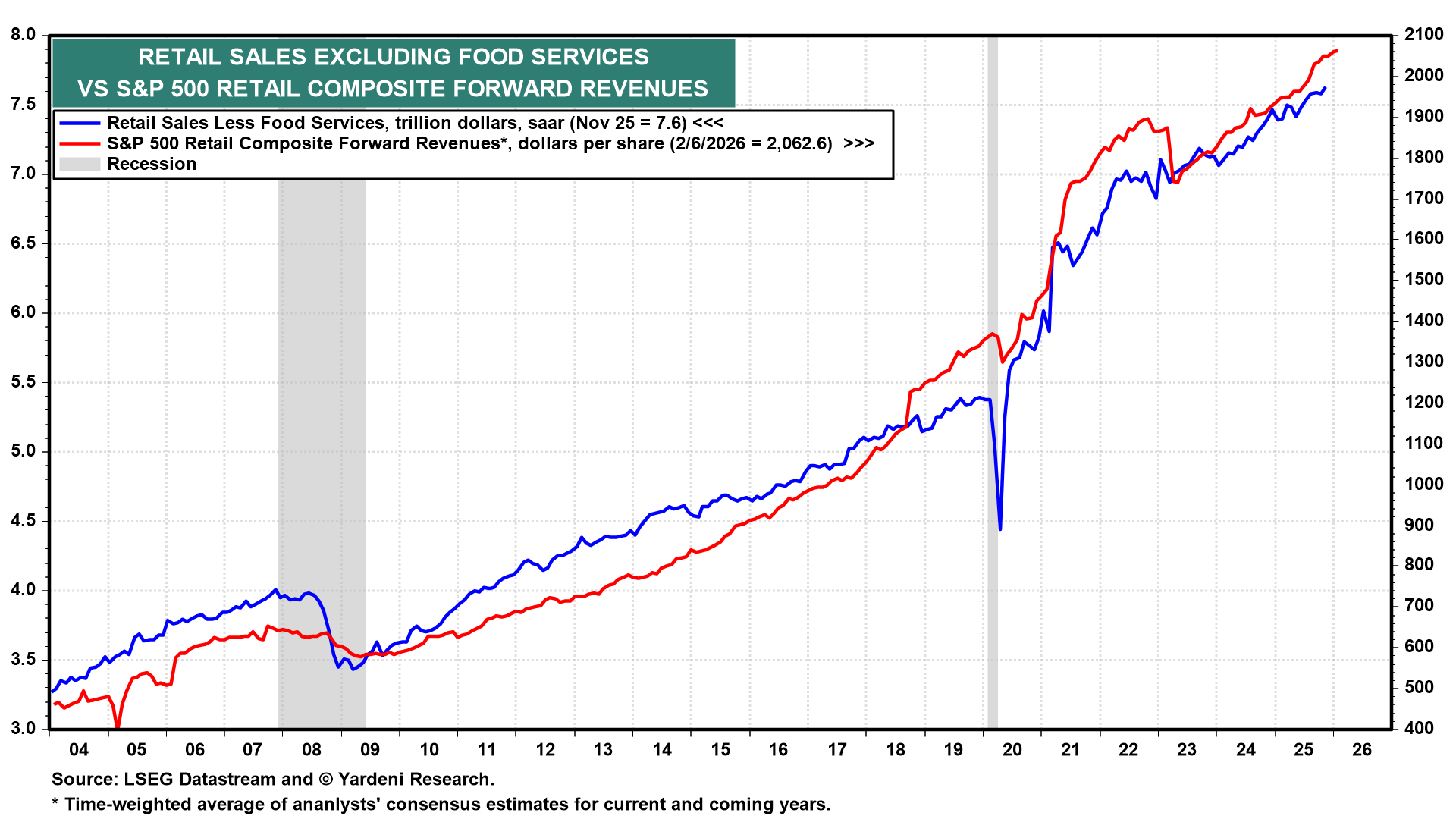

(3) Retail sales. Despite anxiety about the cost of living and a shaky job market, household spending remains resilient. In December, retail sales (Tue) are likely to have increased solidly yet again following November's 0.6% m/m increase. Looking ahead, larger annual tax refunds should keep spending humming along. The forward earnings of the S&P 500 Retail Composite rose to a record high during the February 6 week (chart).

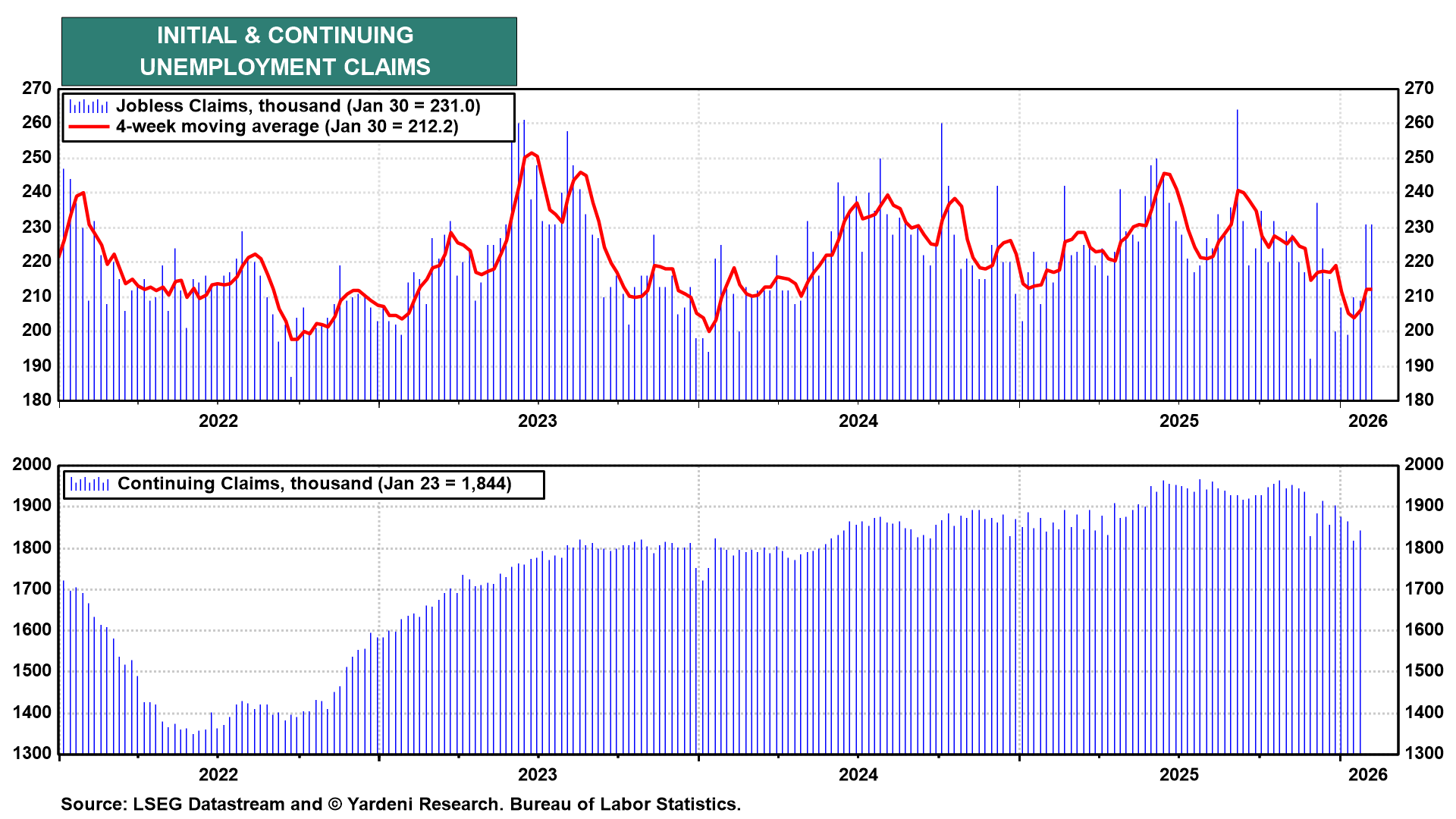

(4) Jobless claims. Initial unemployment claims (Thu) will attract greater-than-usual attention to confirm that last week's spike to 231,000 was indeed related to severe winter storms, not a sudden surge in layoffs. Odds are that it's the former and that the Fed will take solace in fresh evidence that the labor market is holding its own.