This is one of those be-ready-for-anything weeks as wildcards abound for both US and global markets—most of them POTUS-related.

Investors will be glued to screens for any news involving the Justice Department's investigation of Federal Reserve Chair Jerome Powell. In addition, on Wednesday, the Supreme Court hears arguments over Trump's attempt to fire Fed Governor Lisa Cook.

Tariff developments could come fast and furious, following the President's weekend threat of a new 10% tariff on eight European countries opposing his designs on Greenland. SCOTUS might rule on the legality of Trump's tariffs this week. There might also be more Trump regime-change talk on Iran, further intrigue surrounding Venezuela, or actions against any other targets that get on his wrong side.

In Tokyo, the Bank of Japan is expected to leave interest rates unchanged on Friday. Yet, as a sliding yen triggers intervention chatter, the fate of the massive "yen-carry trade" hangs in the balance. China's Q4 GDP growth slowed amid the ongoing property crisis, which might elicit a policy response. And clearly, there's lots for the Davos set to discuss as they gather this week in the Alpine resort village. Trump is scheduled to address the gathering of globalists.

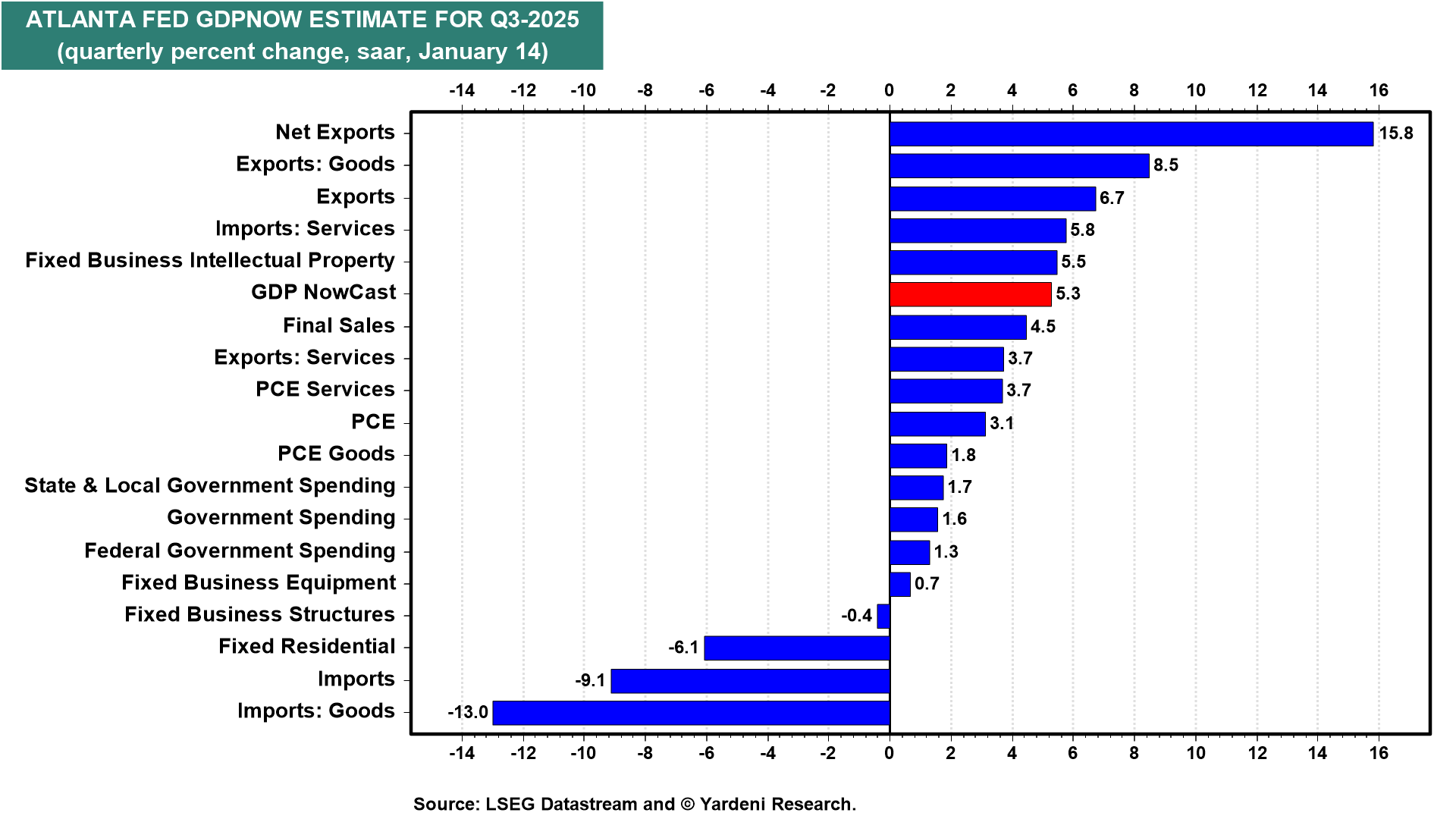

In the US, there's plenty of data to keep Federal Reserve officials and investors alike engaged in this holiday-shortened week. Q3's GDP revision could provide clarity on whether the initial 4.3% gain overstated the economy's health or was bang-on.

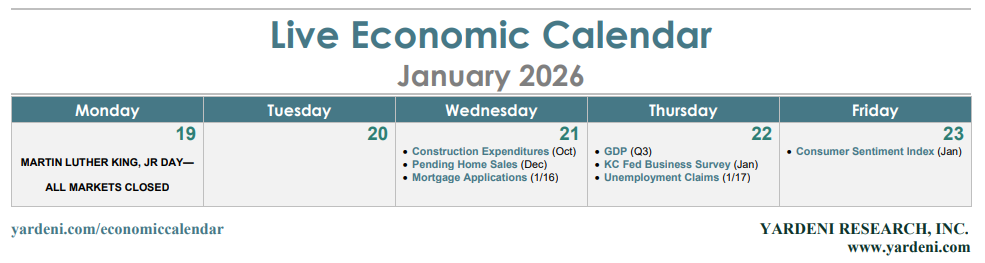

Here's a look at this week's data reports most likely to influence the FOMC's thinking ahead of next week's January 27-28 policy meeting:

(1) GDP update. The balance of data suggests that the economy remained quite strong in the last three quarters of 2025. Even as employment slowed markedly, household demand confounded the skeptics, while capital spending on AI boomed. While a small revision up or down in Q3's real GDP (Thu) is possible, Q4's real GDP is tracking at a 5.3% gain (chart).

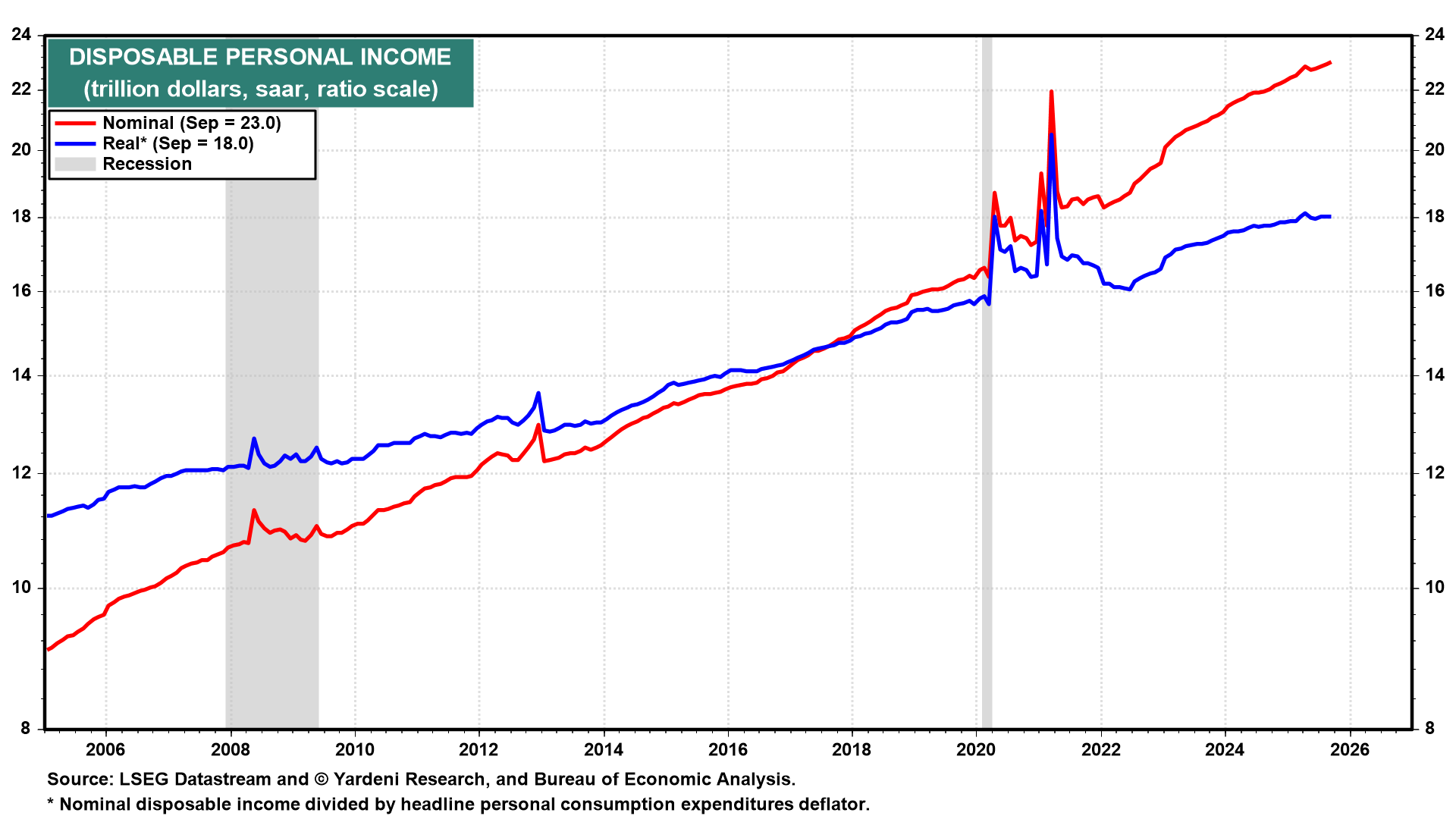

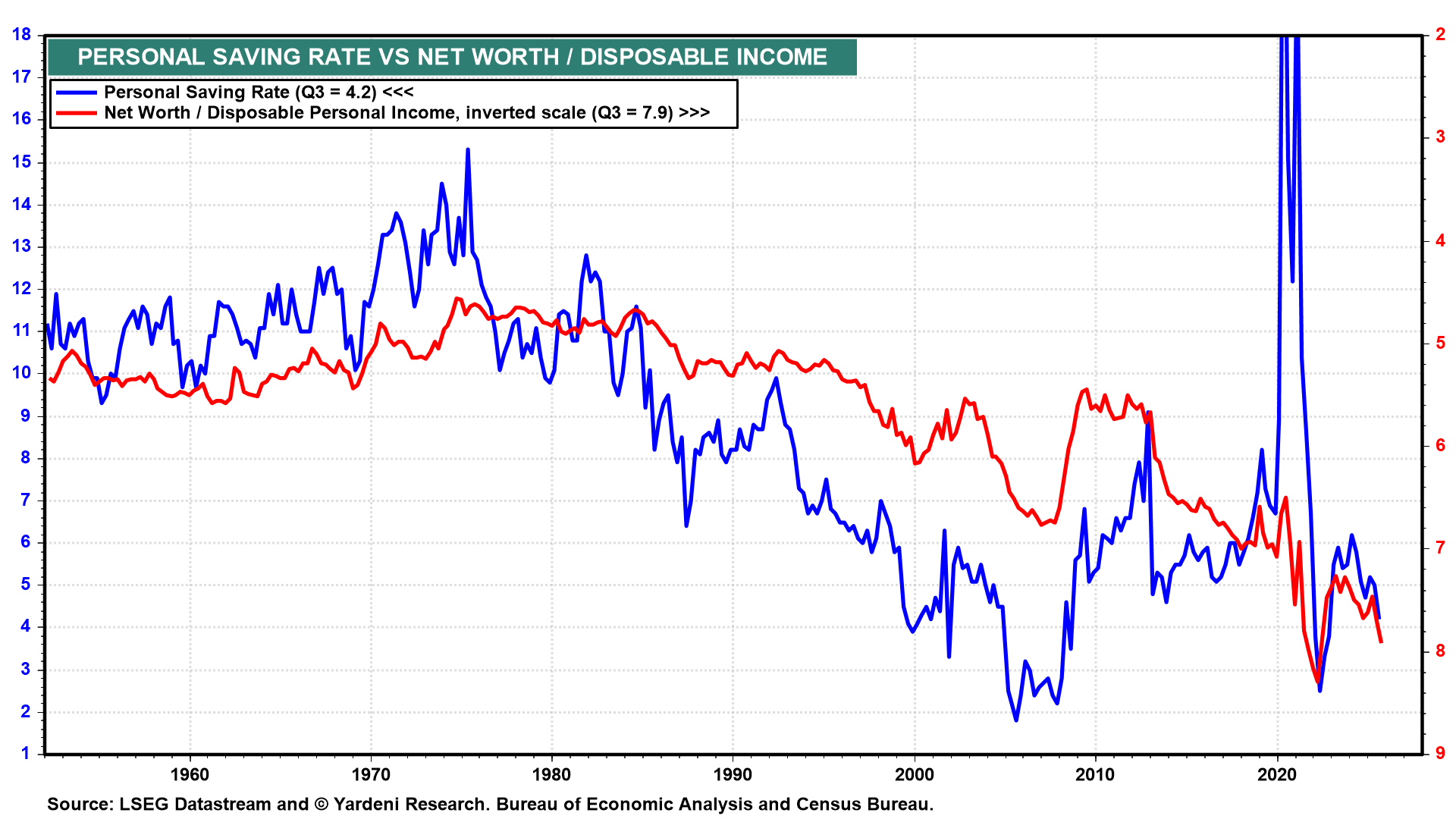

(2) Personal income, consumption, and saving. Personal income (Thu) for both October and November might confirm that real disposable income isn't growing much, if at all (chart). We would attribute that to retired Baby Boomers no longer earning labor income. Our thesis would be confirmed if consumer spending remains strong as the Baby Boomers dip into their retirement funds.

The personal saving rate (Thu) is likely to continue to fall in our narrative, especially if household net worth continues rising to new highs relative to disposable income (chart).

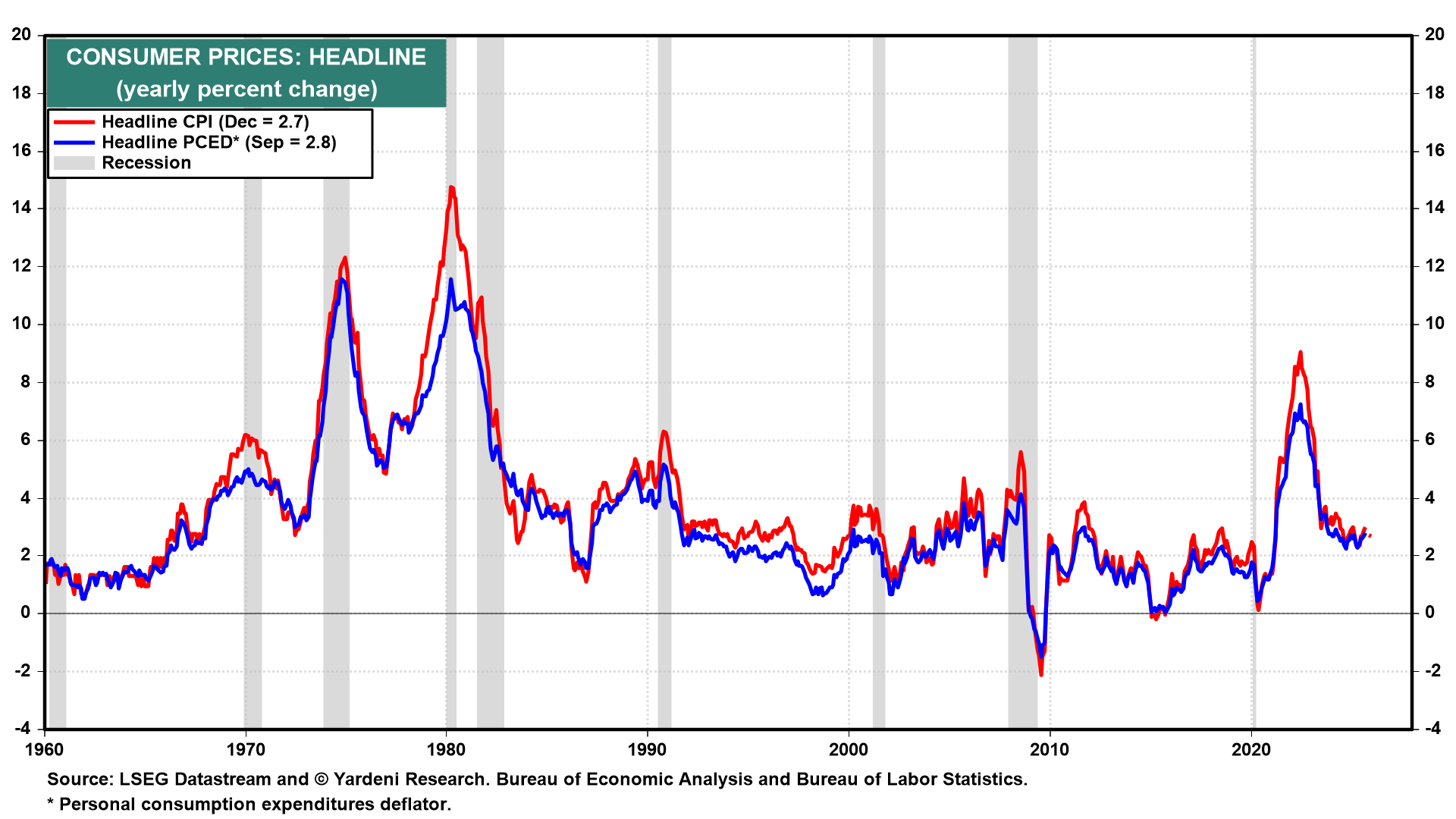

(3) PCE inflation. The Bureau of Economic Analysis will use the average of September and November CPI data to produce an October PCED reading (Thu). The Cleveland Fed's Inflation Nowcasting model is projecting headline and core PCED inflation rates of 2.65% y/y and 2.70% in November (chart).

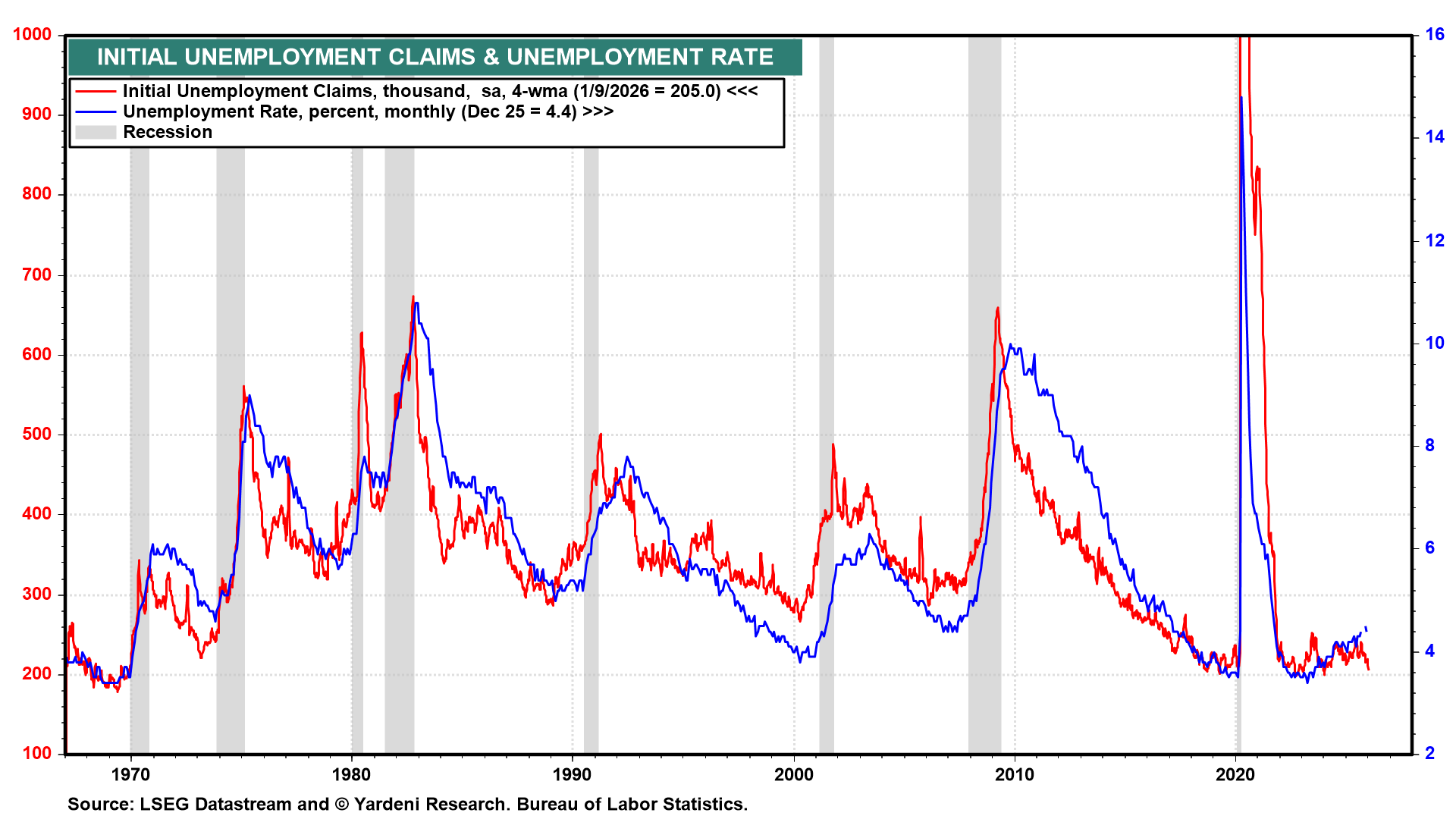

(4) Unemployment claims. Initial unemployment claims (Thu) have been falling in recent weeks, suggesting that January's unemployment rate likely dropped from 4.4% in December (chart).