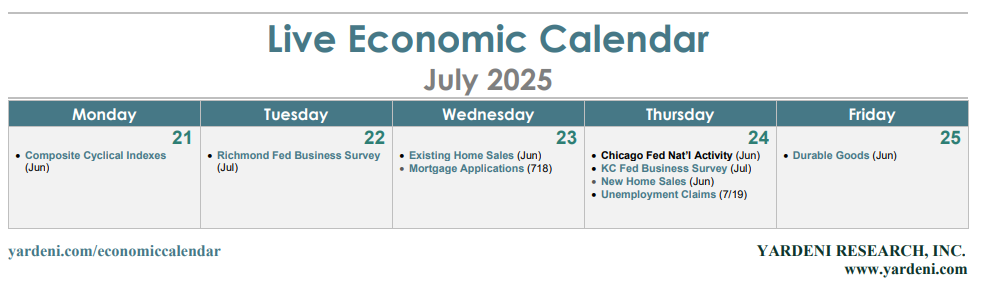

This might be a good week to take a summer vacation. The economic data calendar is light. On Monday, Fed Chair Powell will speak in Washington, perhaps offering an update on his views on employment, inflation, and interest rates. He won't comment on calls for his resignation. Vice Chair Michelle W. Bowman could make some news at the same conference the following day.

The European Central Bank is not widely expected to lower interest rates at its meeting on July 23-24, 2025. Analysts and market expectations, based on recent web sources, suggest the ECB will likely maintain current rates, with the deposit rate at 3.75%.

Here is a brief rundown of the US economic week ahead:

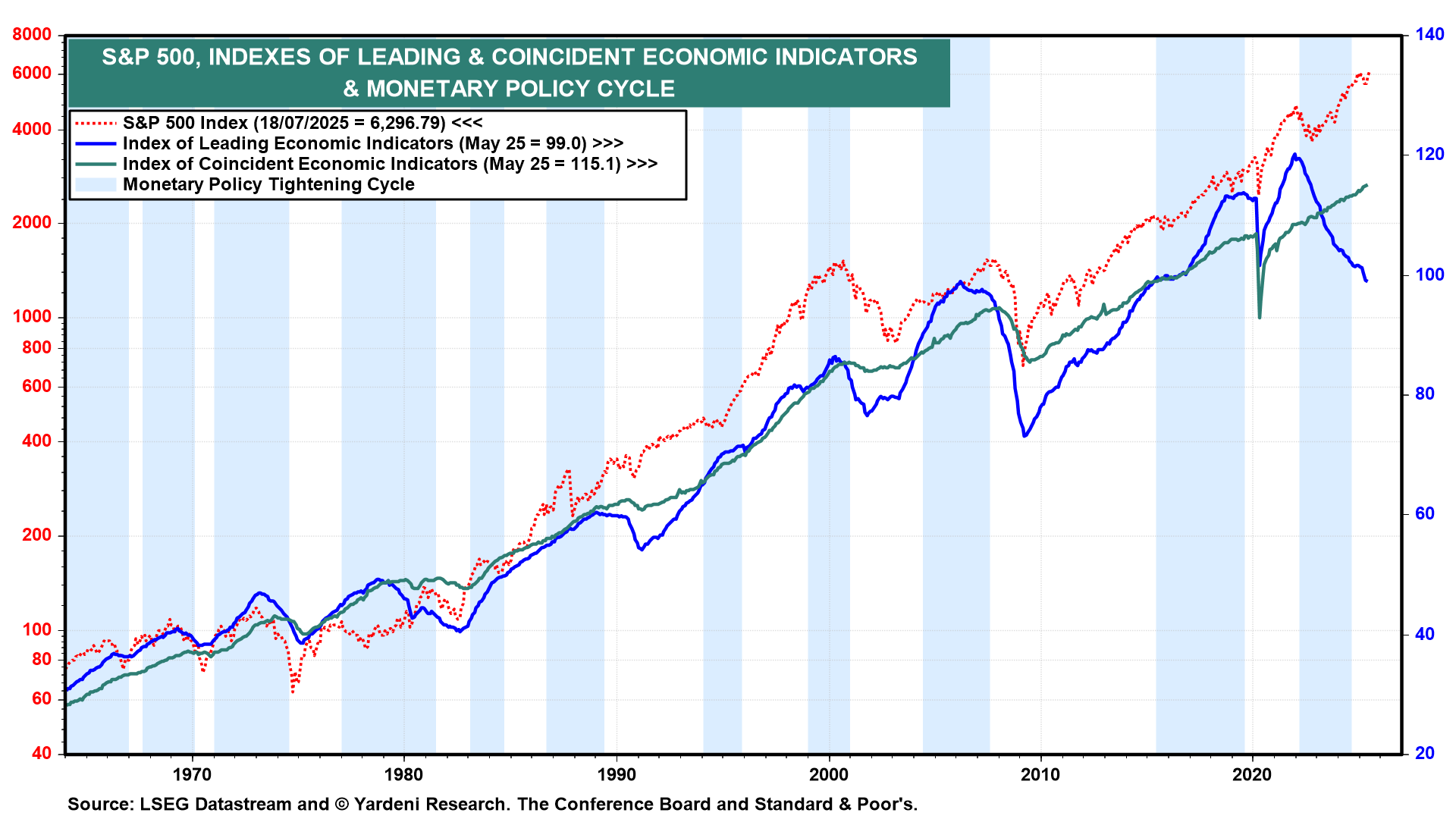

(1) Composite economic indicators. The week should begin on a reassuring note, as the Index of Coincident Economic Indicators (Mon) is expected to hit another record high in June, confirming that the economy remains resilient (chart). The Index of Leading Economic Indicators (LEI) has been a very misleading indicator of the economy and should be ignored. The S&P 500 is one of the 10 components of the LEI. It has returned to a record high.

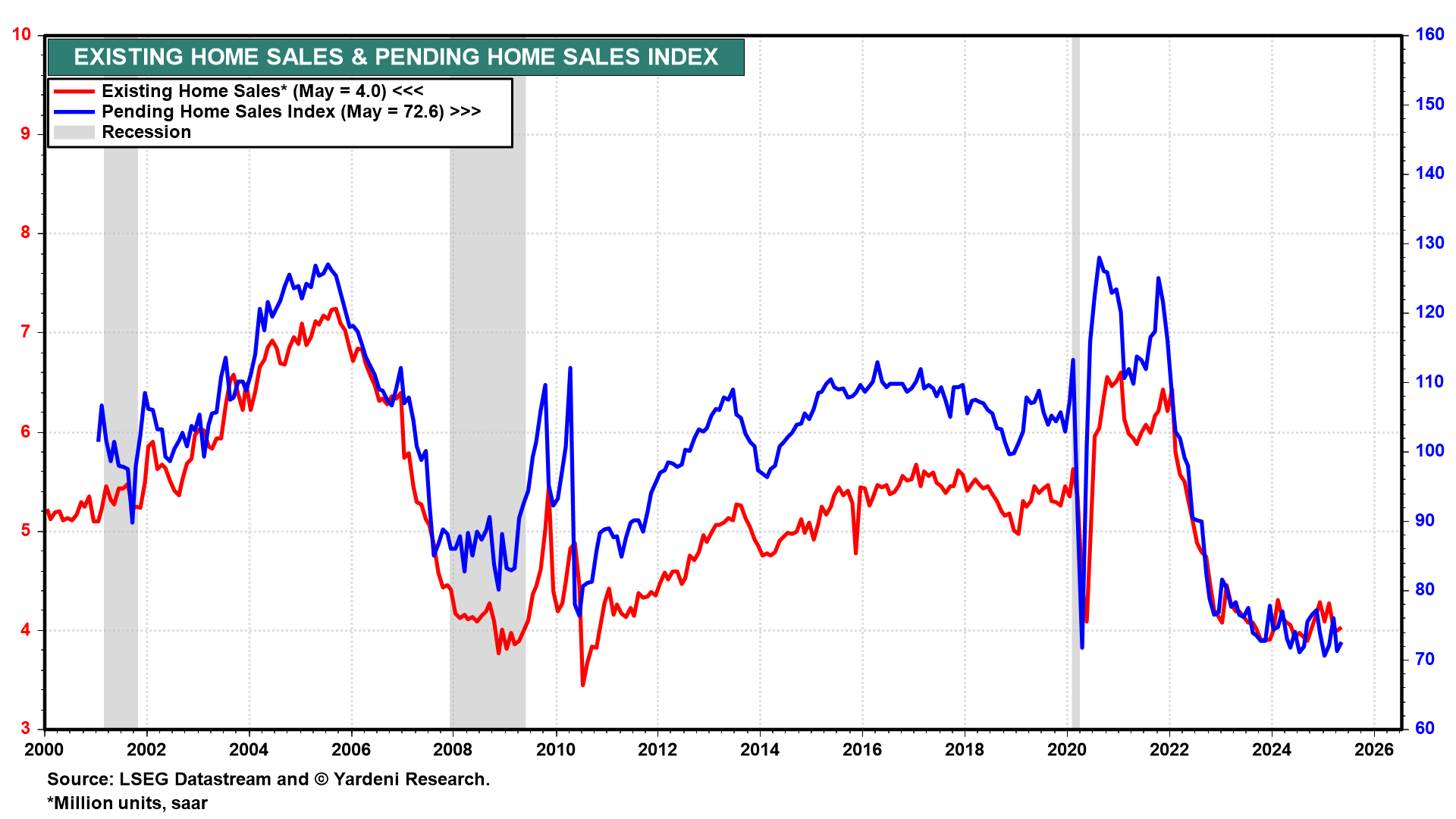

(2) Existing home sales. This week’s batch of housing indicators should show that the sector remains challenged by high mortgage rates and rising inventories of unsold homes. Existing-home sales (Wed) edged up 0.8% m/m in May and probably remained relatively depressed in June (chart).

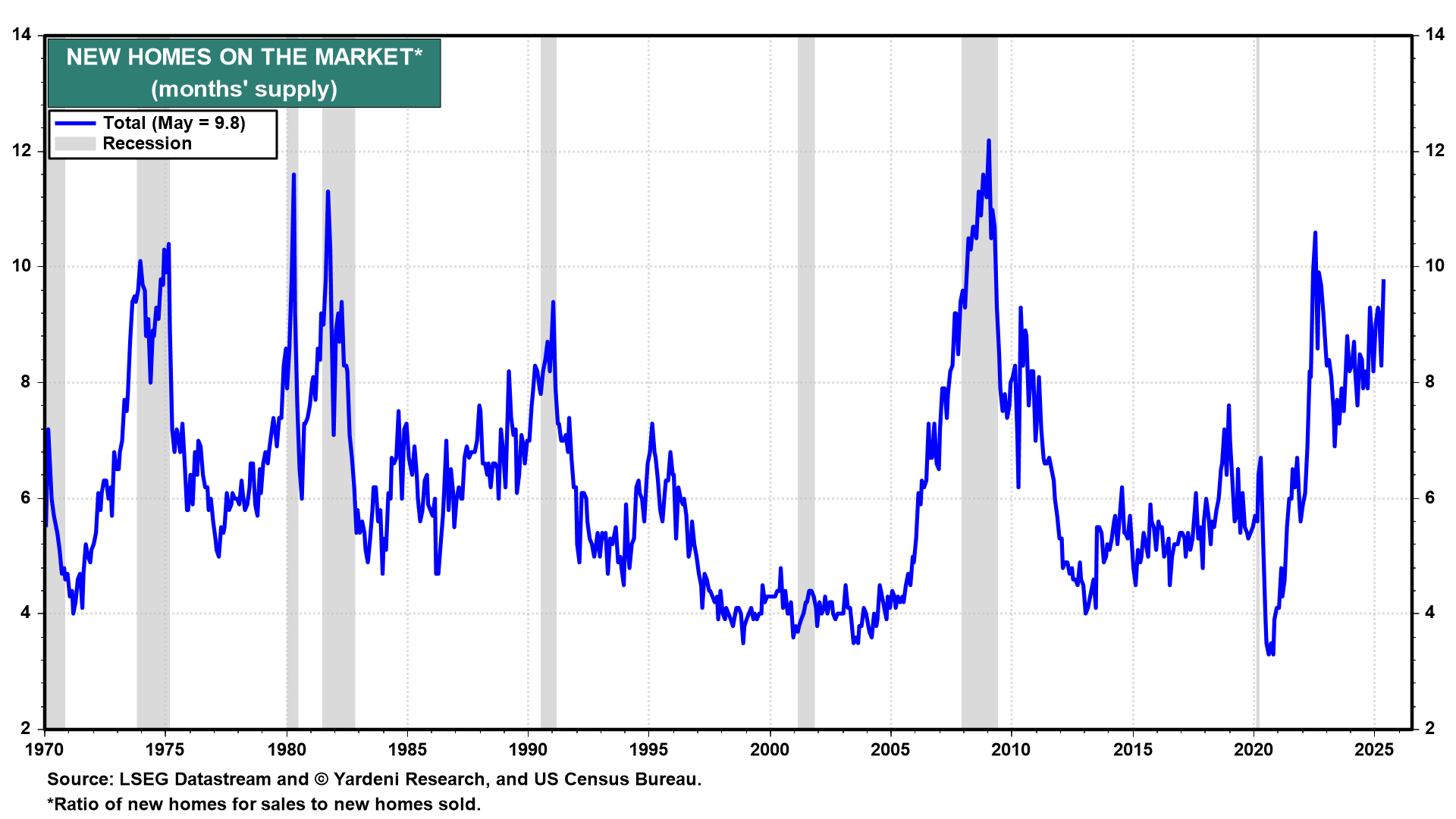

(3) New home sales. After tanking 13.7% m/m in May, new home sales (Thu) might uptick in June in response to the recent decline in mortgage rates and new home prices. The months' supply of new homes on the market rose to 9.8 months in May (chart).

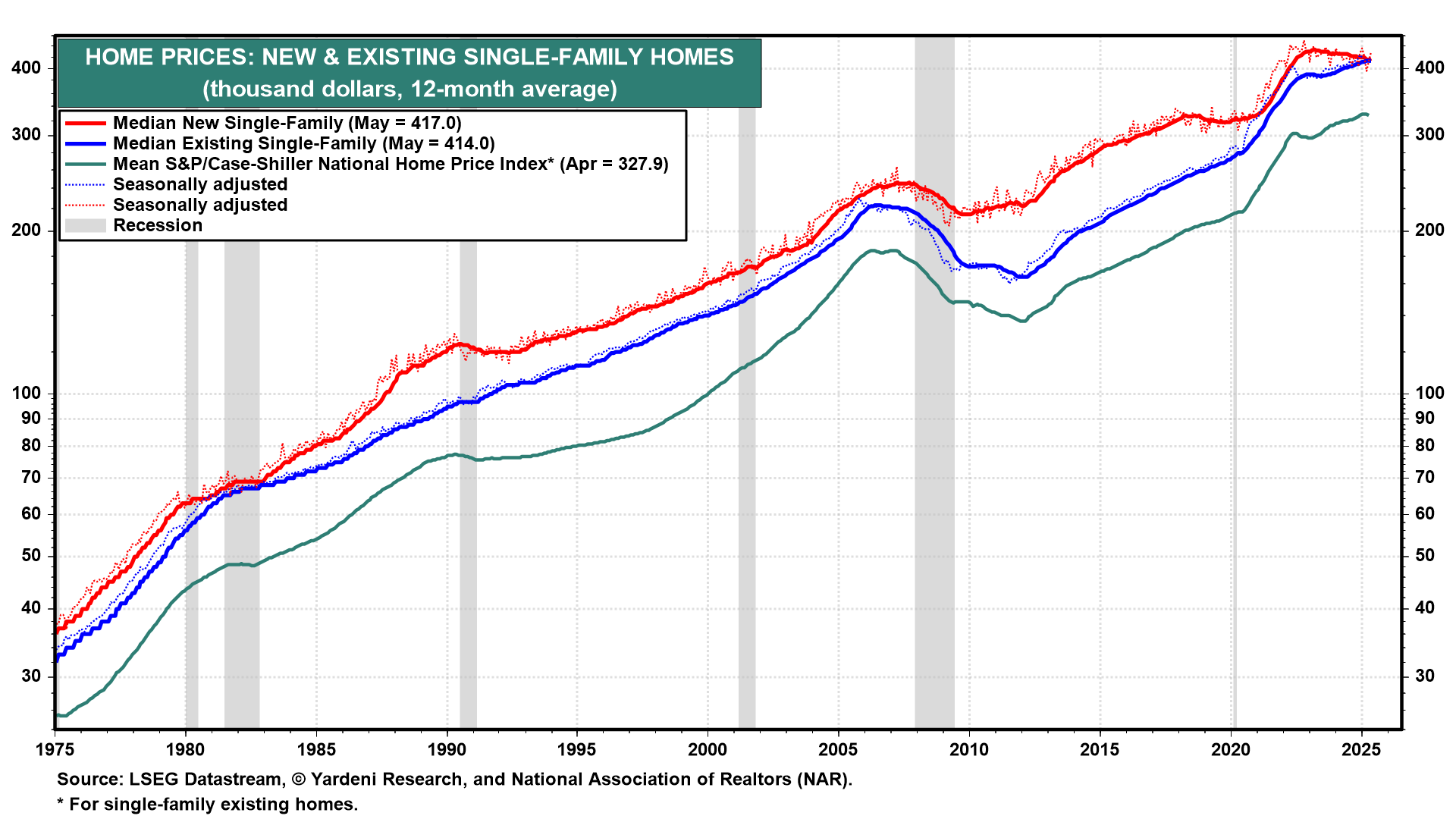

The ample supply of unsold new homes is weighing on new home prices (chart).

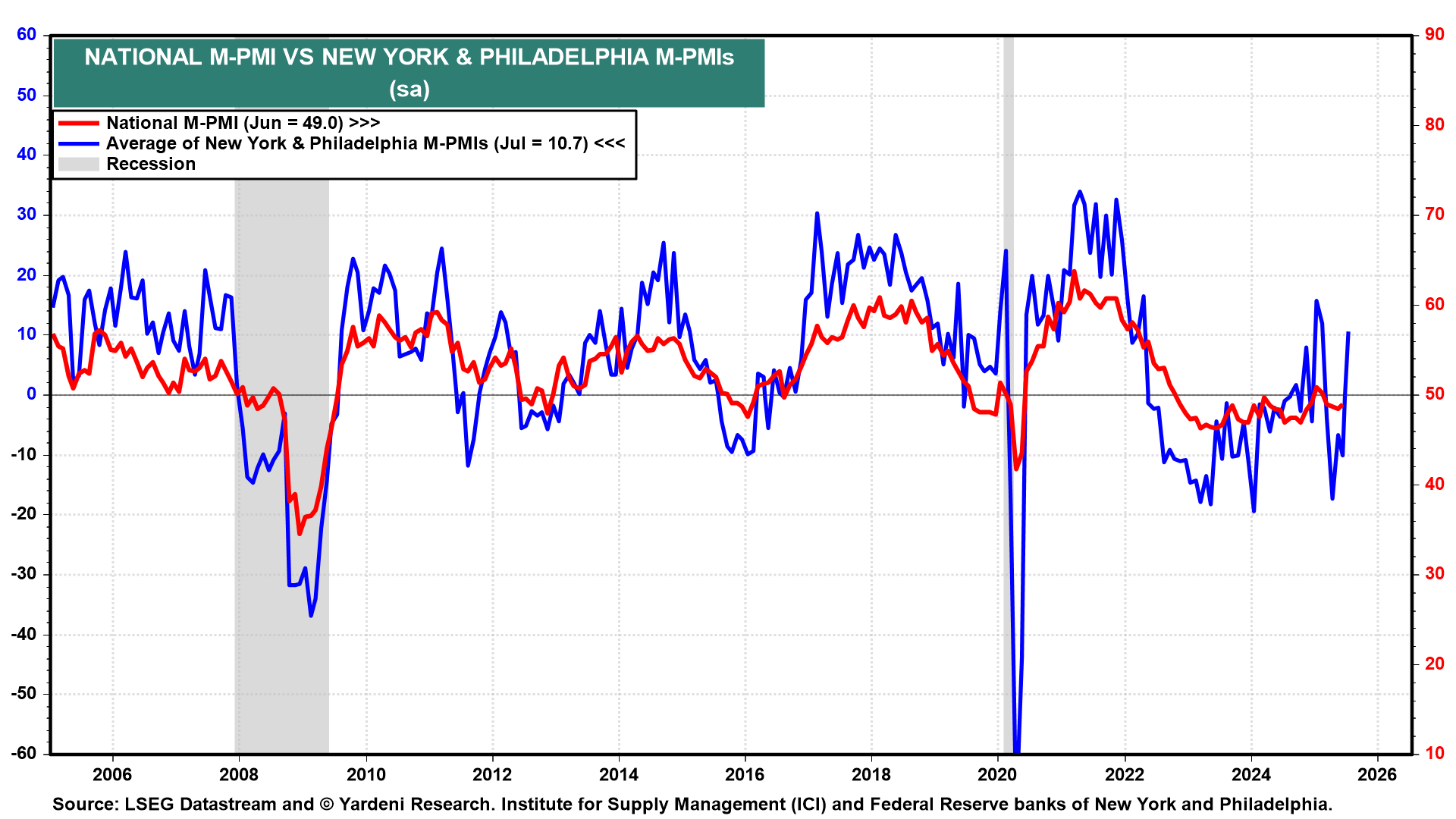

(4) Jobless claims and business surveys. This week’s initial unemployment claims report (Thu) is likely to confirm that the labor market remains robust. This week's regional business surveys from the Richmond Fed (Tuesday), the Chicago Fed (Thursday), and the Kansas City Fed (Thursday) should confirm the rebound in the New York Fed and Philadelphia Fed surveys (chart).