This is a big week on the monetary policy front, with the Federal Reserve, Bank of Japan, and Bank of Canada all holding policy meetings. Naturally, the main event will be the Federal Open Market Committee’s widely expected decision (Wed) to leave the federal funds rate unchanged. We are among those expecting no change. However, we do expect that Fed Chair Jerome Powell's press conference (Wed) will be relatively dovish, raising the odds of a September rate cut. Nevertheless, we remain in the none-and-done camp in 2025 for now.

On Friday, the markets will receive a highly anticipated update on US employment. We expect the data to confirm, yet again, that the economy remains resilient. By the way, Friday is also August 1, the drop-dead day for many trade deals with the US.

This week is full of reports that could influence the Fed’s thinking on whether slowing growth or accelerating price pressures is the bigger risk:

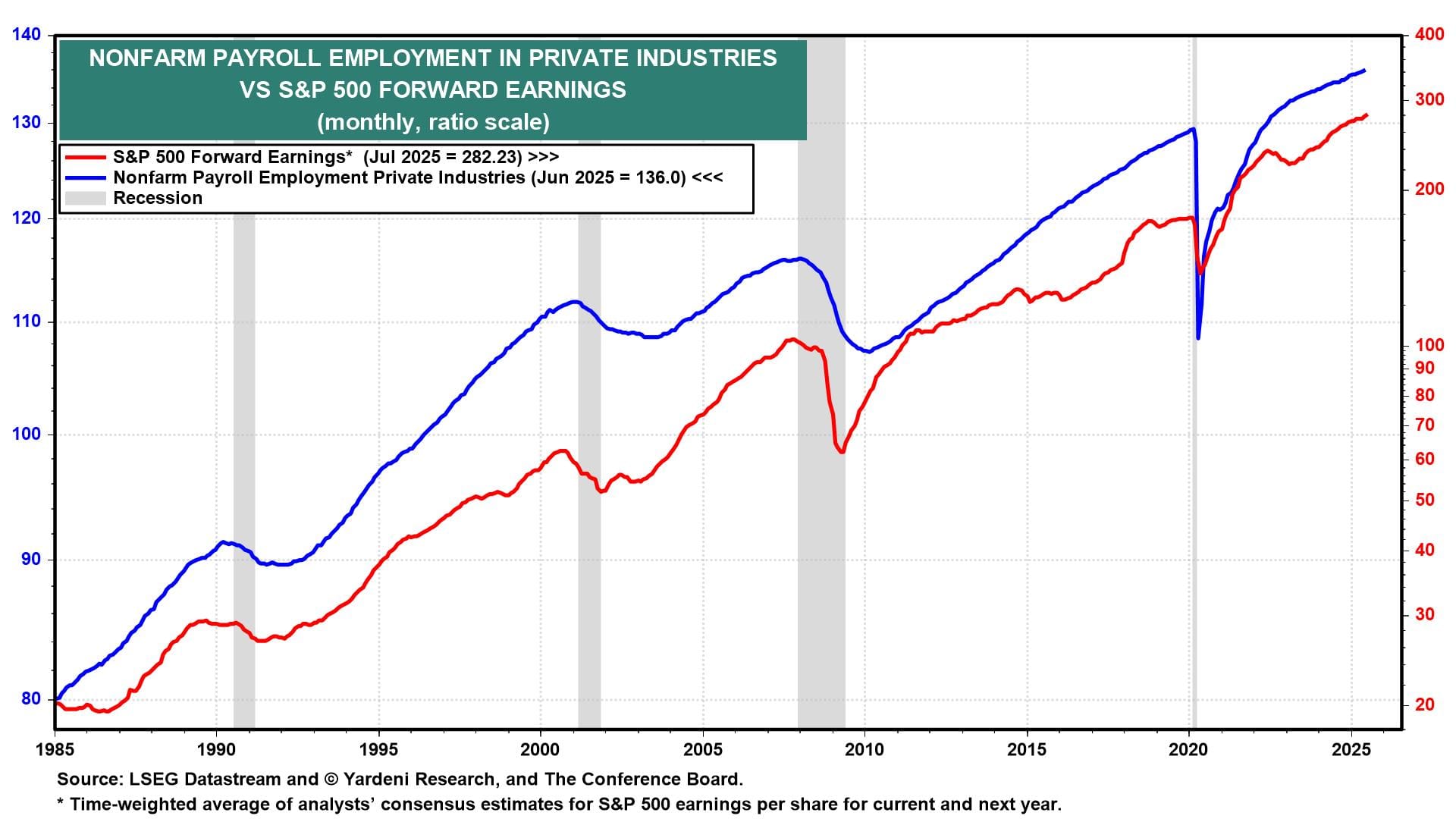

(1) Employment. We expect to see July payrolls (Fri) rise by around 115,000, down from 147,000 in June. It will likely reach yet another record high, consistent with the record high in corporate earnings, since profitable companies tend to expand their payrolls (chart). We expect any slowdown in payroll gains to be related to a shortage of workers rather than a shortage of jobs.

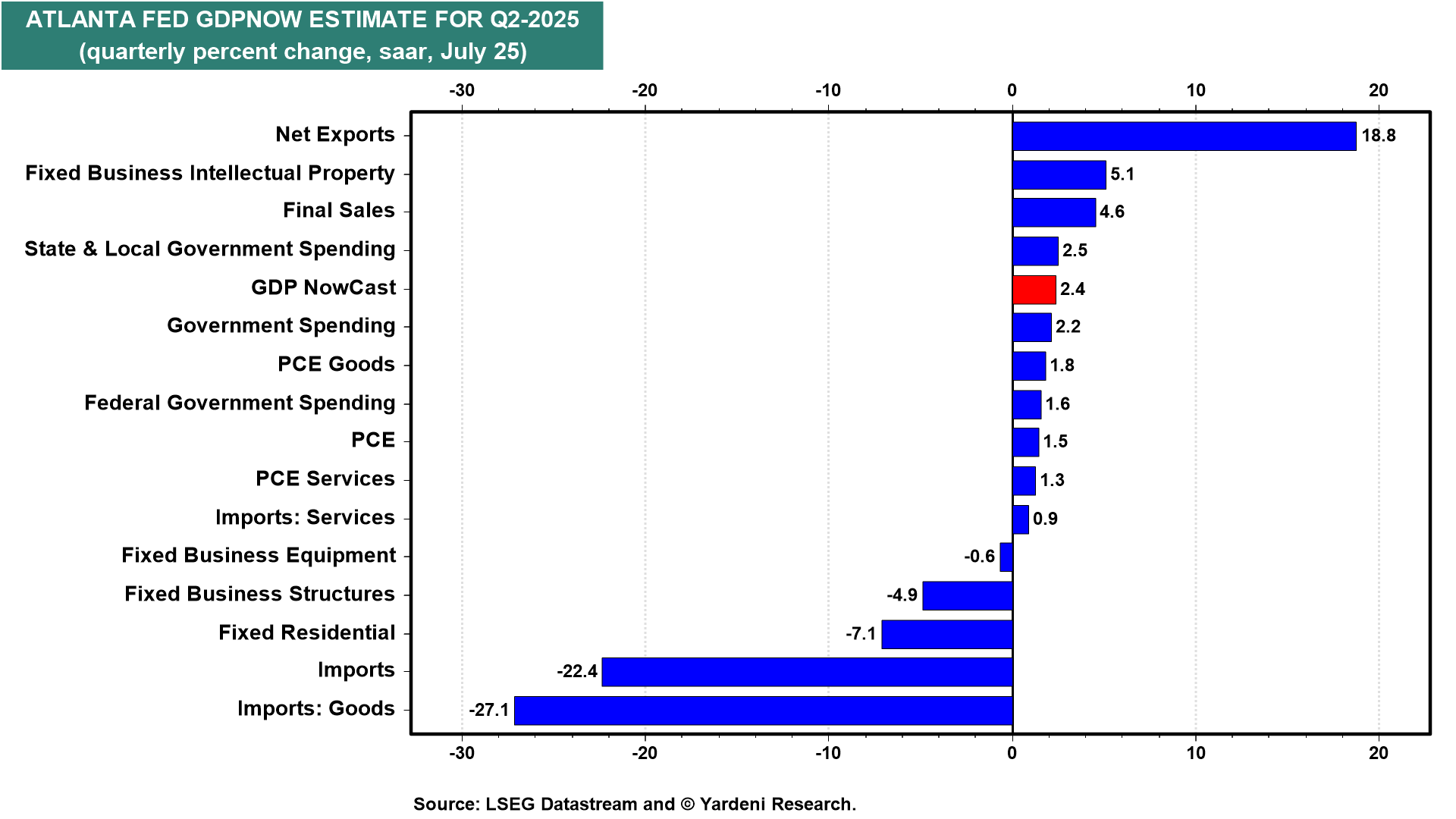

(2) GDP. After dropping 0.5% y/y in Q1, real GDP growth (Wed) is likely to expand at a 2.4% y/y rate. That is in line with the latest Atlanta Fed GDPNow tracking model (chart). While much of the rebound will likely be driven by a narrowing trade deficit, domestic demand should provide some support.

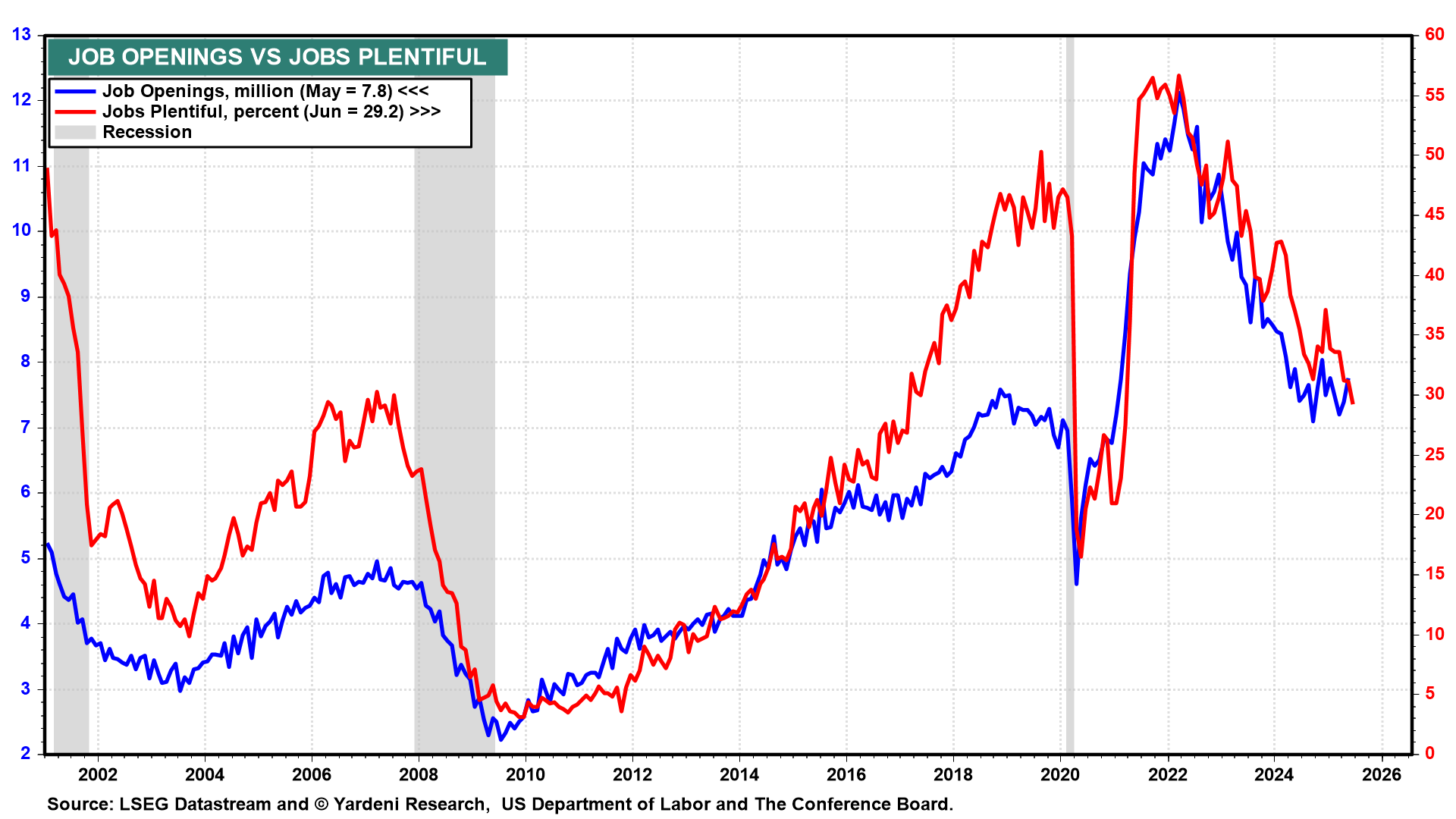

(3) Job openings. On Tuesday, the job openings data in June's JOLTS report should show that this series remains relatively high, as suggested by June's jobs plentiful series in the Consumer Confidence Index survey. That probably remained relatively high again in July (chart).

(4) Personal income. June's personal income and consumer spending (Thu) should rise based on the increase in payroll employment and retail sales during the month.

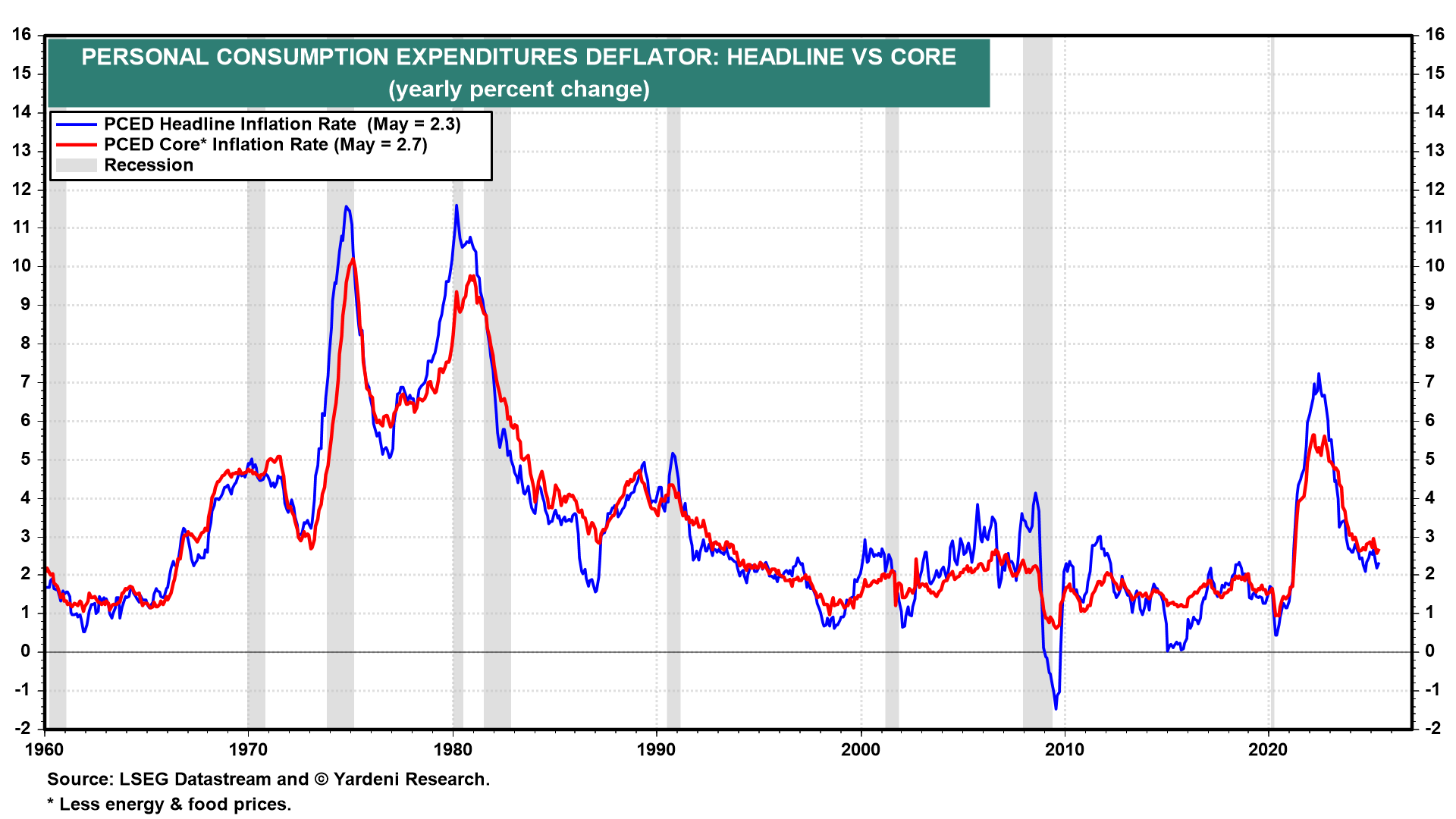

(5) Inflation. June's headline and core PCED inflation rates (Thu) are projected to be up 2.5% and 2.7% y/y, according to the Cleveland Fed's Inflation Nowcasting tracking model (chart). Both could be a bit hotter.