It may be July 4th week in the US, but we don't expect many fireworks on the economic data front. Of course, surprises could come from events in the Middle East, as Israel, Iran, and the Trump administration figure out whether the ceasefire will hold or missiles will start flying again. Surprises could also come from Trump's trade negotiations. A bunch of deals are expected in coming days.

On Capitol Hill, the Senate today passed a revised version of President Donald Trump's 940-page Big, Beautiful Bill, getting it closer to Trump's July 4 deadline. The question now is whether the House will embrace Senate alterations to the original House version of the legislation.

The markets will also pay close attention to a speech (Mon) by Federal Reserve Chair Jerome Powell. Speaking in Sintra, Portugal, Powell may drop a hint or two about whether last week's mixed data on trade, housing, and consumption might have altered his view that rate cuts aren't under serious consideration at Fed headquarters.

Fireworks or not, here's a brief look at this week's economic data highlights:

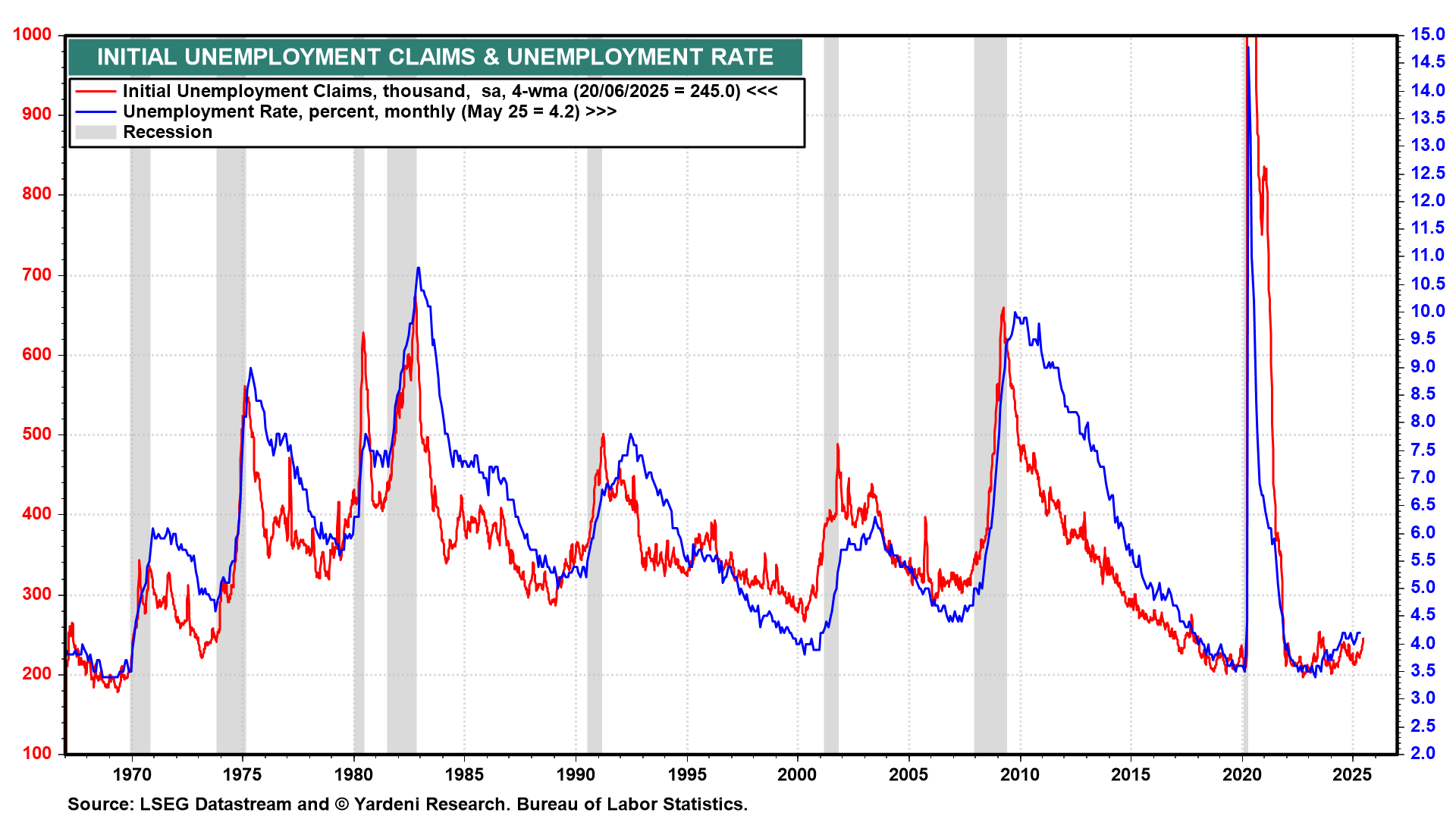

(1) Employment report. The release with the greatest chance of influencing the Fed's wait-and-see approach is the June jobs report (Thu). We're expecting hiring activity to remain reasonably brisk now that the fog of war is lifting in the Middle East and in US trade relationships. The jobless rate might tick up to 4.3% or even 4.4% given the modest upturn in initial unemployment claims (chart). We expect that a solid gain of 125,000-150,000 in payrolls should allay recession fears.

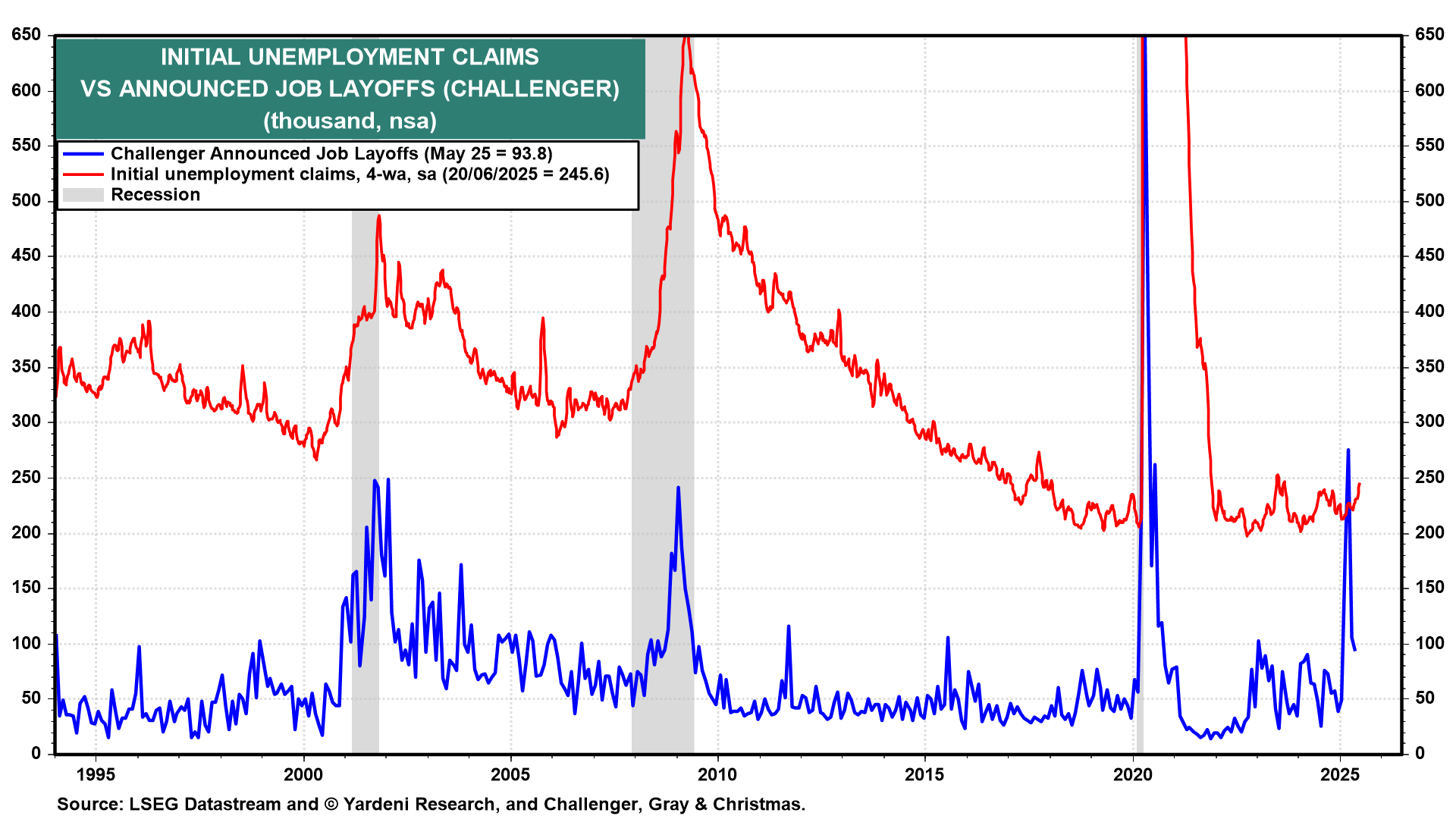

(2) Unemployment claims. We expect initial claims for unemployment insurance (Thu) to confirm that layoffs still remain low as reported by Challenger (Wed) (chart). Continuing claims may suggest the duration of unemployment is increasing for some. Yet overall, we look for fresh confirmation that industries from healthcare to leisure and hospitality are benefiting from the Baby Boomers’ splurging on restaurants, cruises, and other entertainment.

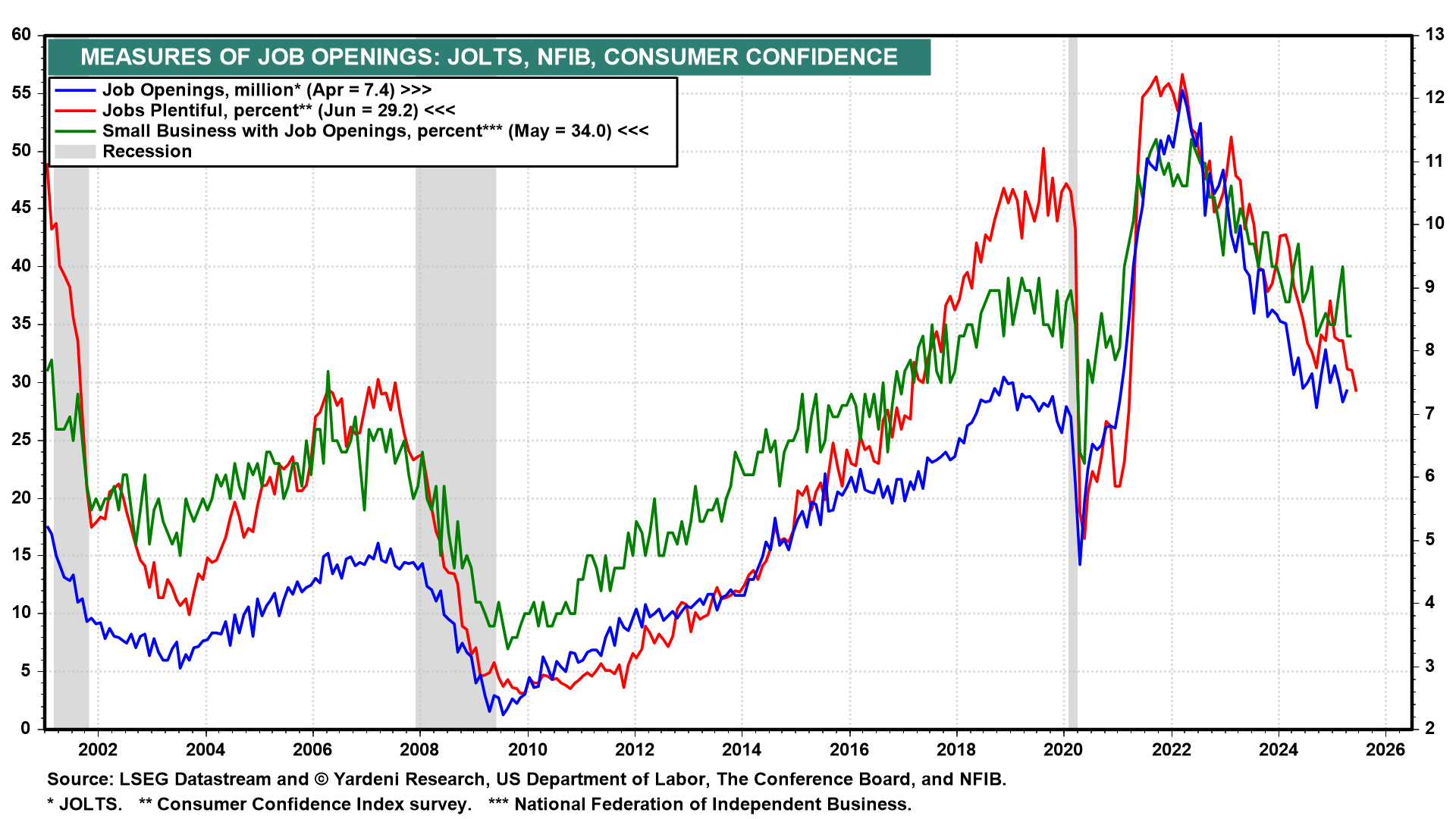

(3) JOLTS. The May Job Openings and Labor Turnover Survey (Tue) takes on greater importance as economists search for signs that the labor market is cracking. The healthy April reading surprised many, as the available jobs component increased by 191,000 from the previous month. We see little evidence to suggest that May’s reading won’t likewise point to solid employment conditions (chart).

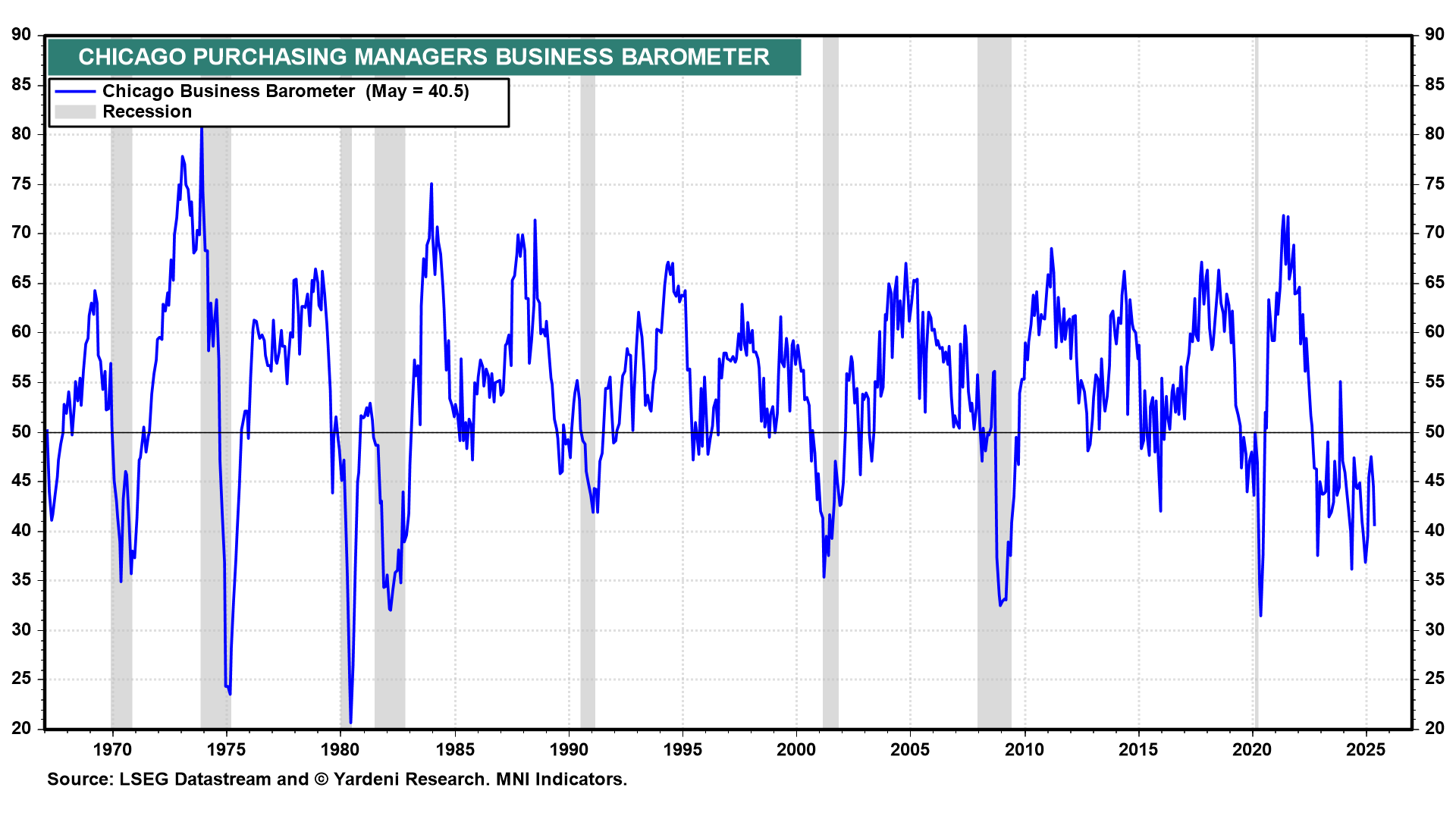

(4) Regional Fed surveys. The hard data/soft data disconnect continues to confound many. Given the strength of the former and tentativeness of the latter, regional Fed series could offer useful signals. May's Chicago Business Barometer (Mon), which is a regional purchasing managers' index, saw its 18th consecutive month of contraction (chart). The Dallas Fed's May business survey (Mon) also showed the trade war taking its toll. Going forward, both gauges bear watching for signs of stabilization after Trump delayed his "reciprocal tariffs" on April 9.

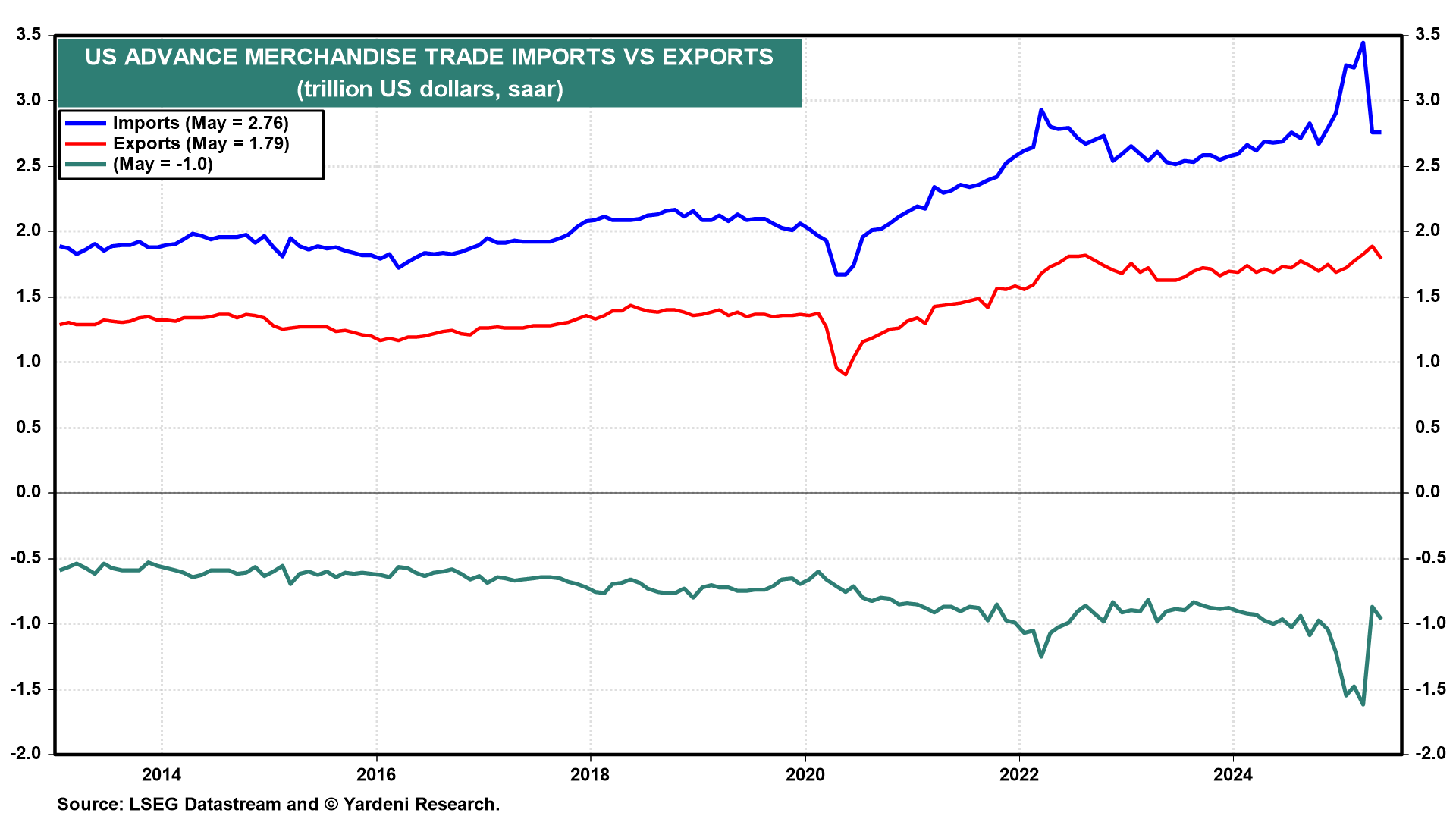

(5) International trade. The surge in the US international trade deficit (Thu) during the first three months of this year was a key driver of Q1's economic contraction. The question is whether the big drop in imports during April and May (in the advance report on trade) portends strong GDP growth during Q2 (chart). Any clear sign that economic activity is rebounding or steadying likely would validate Powell & Co.'s steady-as-she-goes stance on rates.