During this holiday-shortened week, investors will receive a cornucopia of data now that the government is open again. Some of the data will be a bit stale. But they should indicate how Q3 ended for the economy.

September's retail sales report (Tue) should show a solid increase, with strength in spending by higher-income shoppers more than offsetting the weakness in spending by lower-income workers. This dichotomy is supported by healthy corporate earnings from Walmart and Gap, which have prioritized higher-income shoppers. Home Depot, meanwhile, is finding that many higher-value purchases and remodeling projects are being scaled back.

Also out this week are September's PPI (Tue), the Fed’s Beige Book (Wed), and weekly jobless claims (Wed).

Here are the reports that might move the markets and influence the Fed’s thinking as the December 9-10 Federal Open Market Committee meeting approaches:

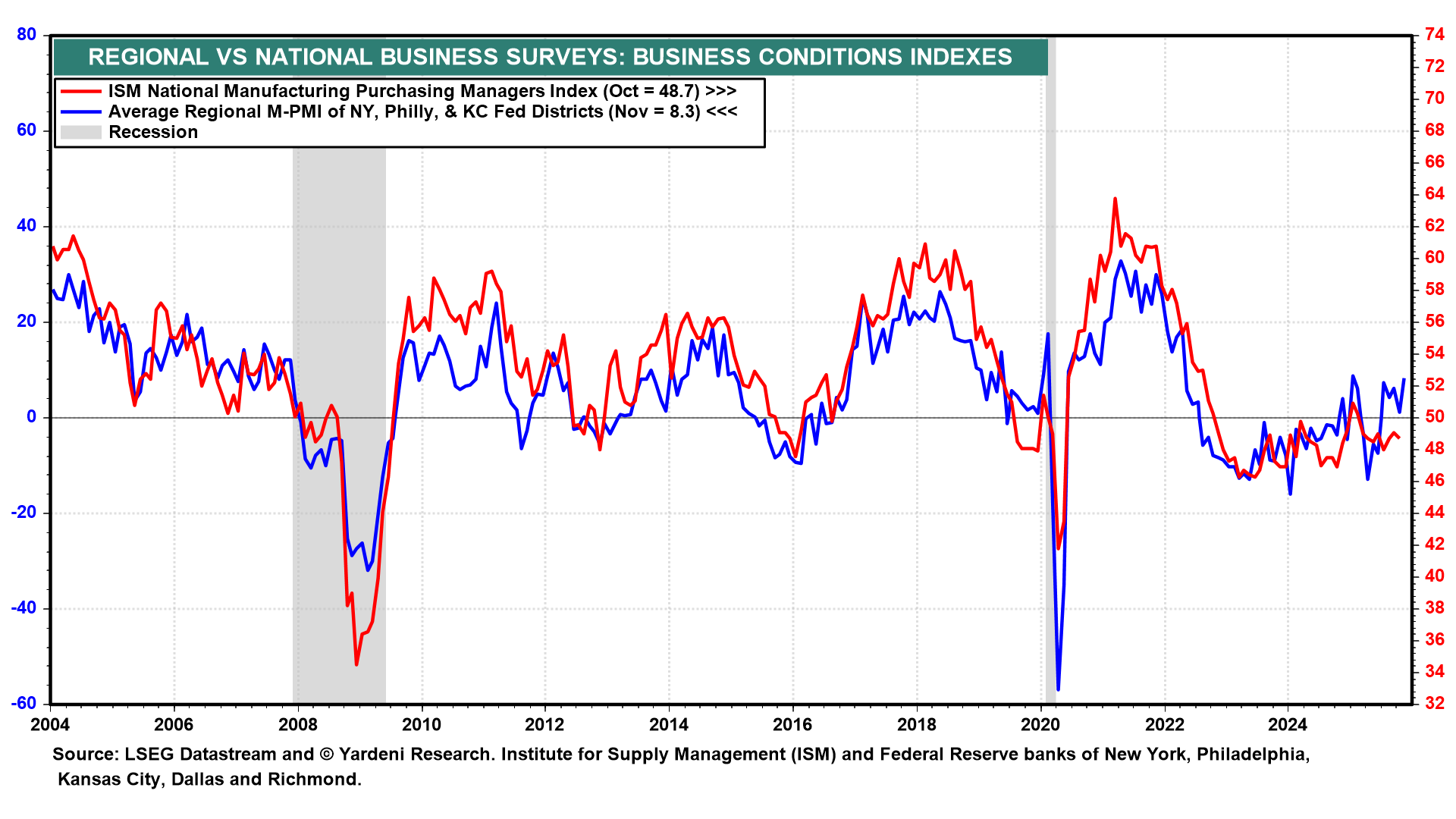

(1) Business surveys. The remaining two of the business surveys conducted by five of the Fed regional banks will come out for the Dallas (Mon) and Richmond (Tue) districts. They might confirm that business improved in November, as shown by the surveys for NY, Philly, and Kansas City. If so, then November's national M-PMI might rise above 50.0 (chart).

(2) Retail sales. September's retail sales growth remained relatively strong according to the Redbook Retail Sales Index (chart). Another positive development that month was strong auto sales, reaching 16.4 million units (saar). A surge in demand notably drove this performance as buyers rushed to purchase electric vehicles (EVs) before the expiration of consumer tax credits at the end of the month.

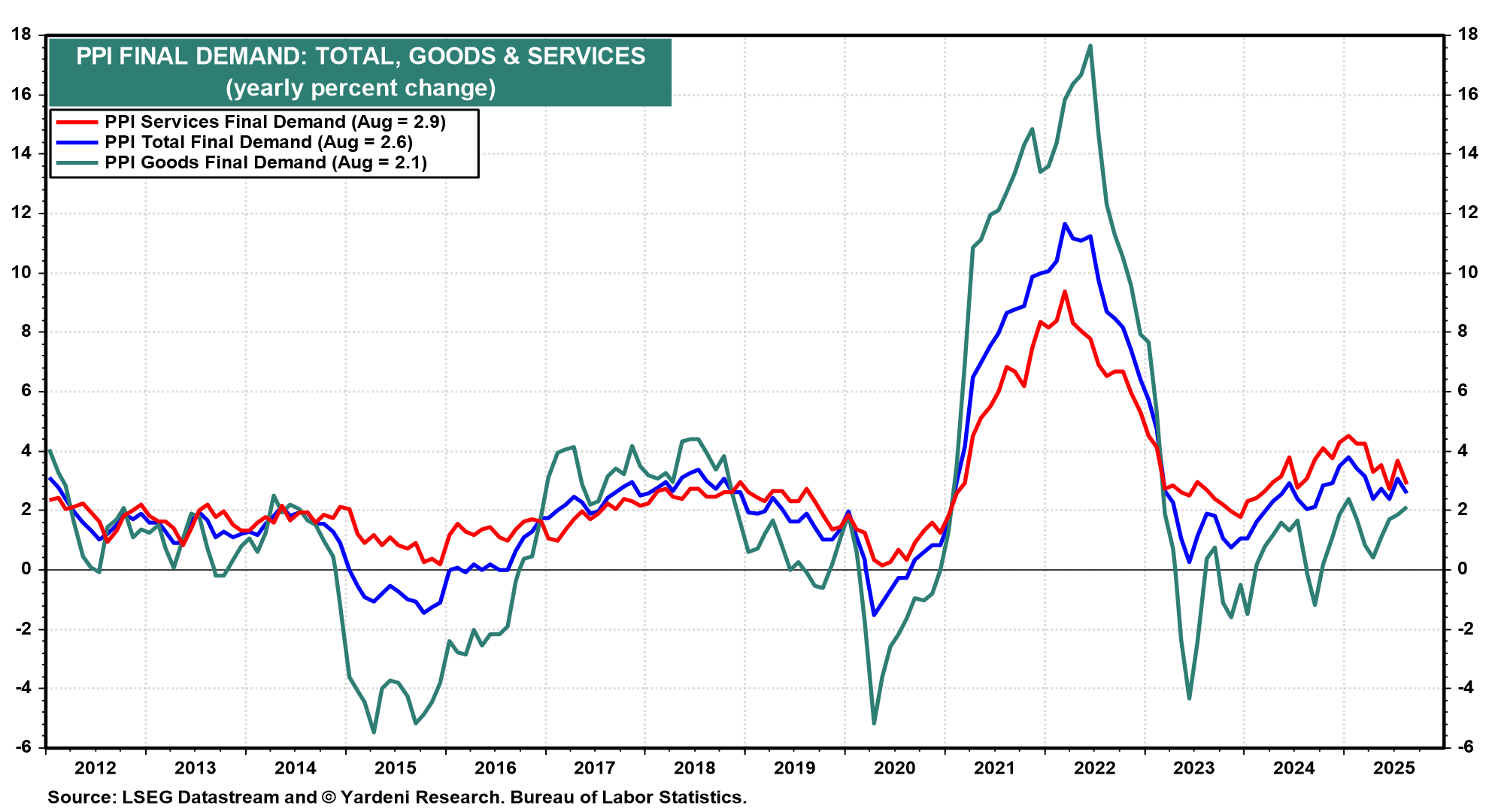

(3) PPI. September's producer price index (Tue) will garner considerable attention at the Fed, particularly after the September CPI surprised to the downside. The PPI might be hotter than expected if tariffs continued to push goods inflation higher (chart).

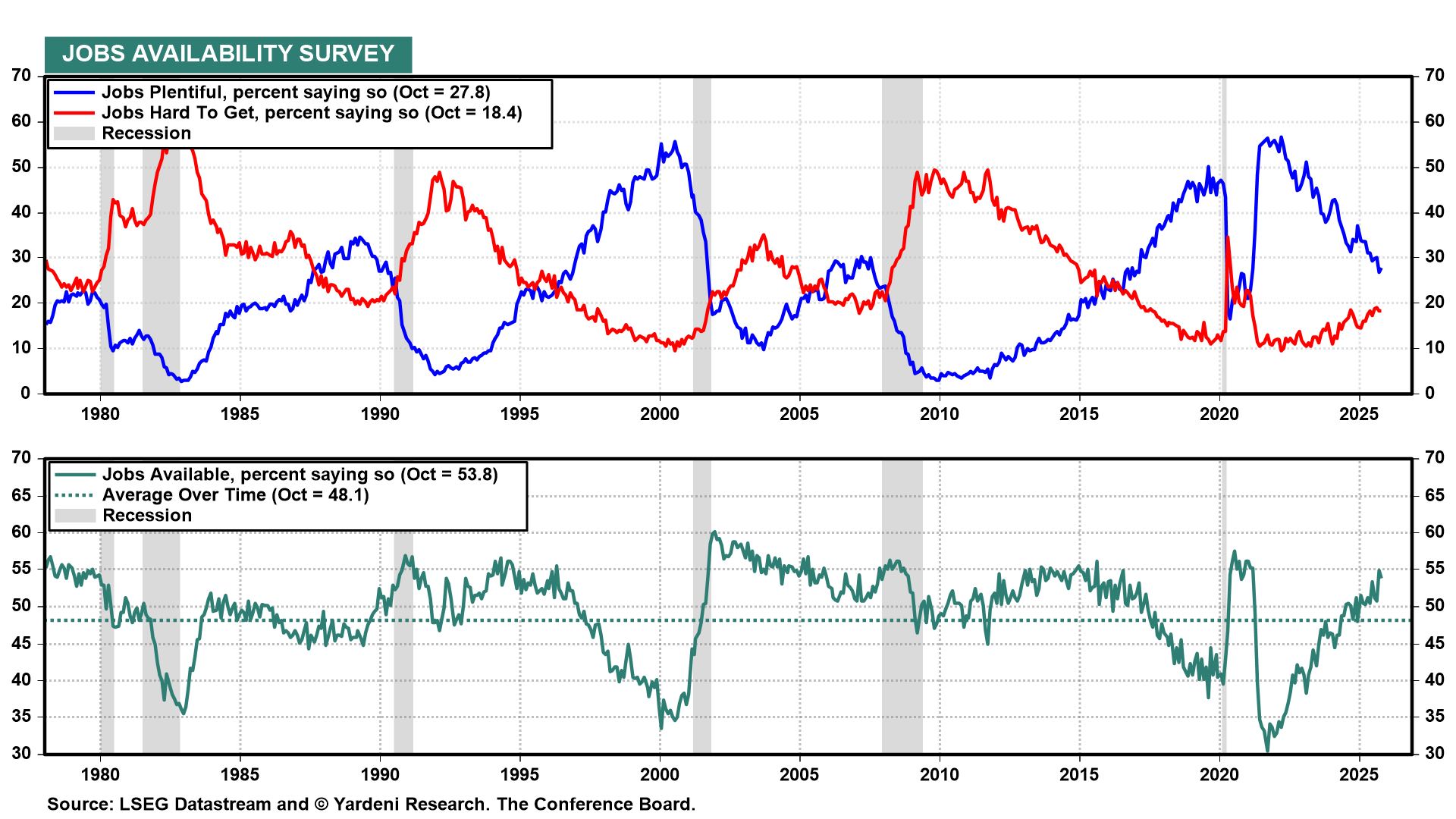

(4) Consumer confidence. November's Consumer Confidence Index survey will be among the most timely indicators. We will be focusing on the job availability responses (chart). They are likely to show that jobs are getting harder to find.

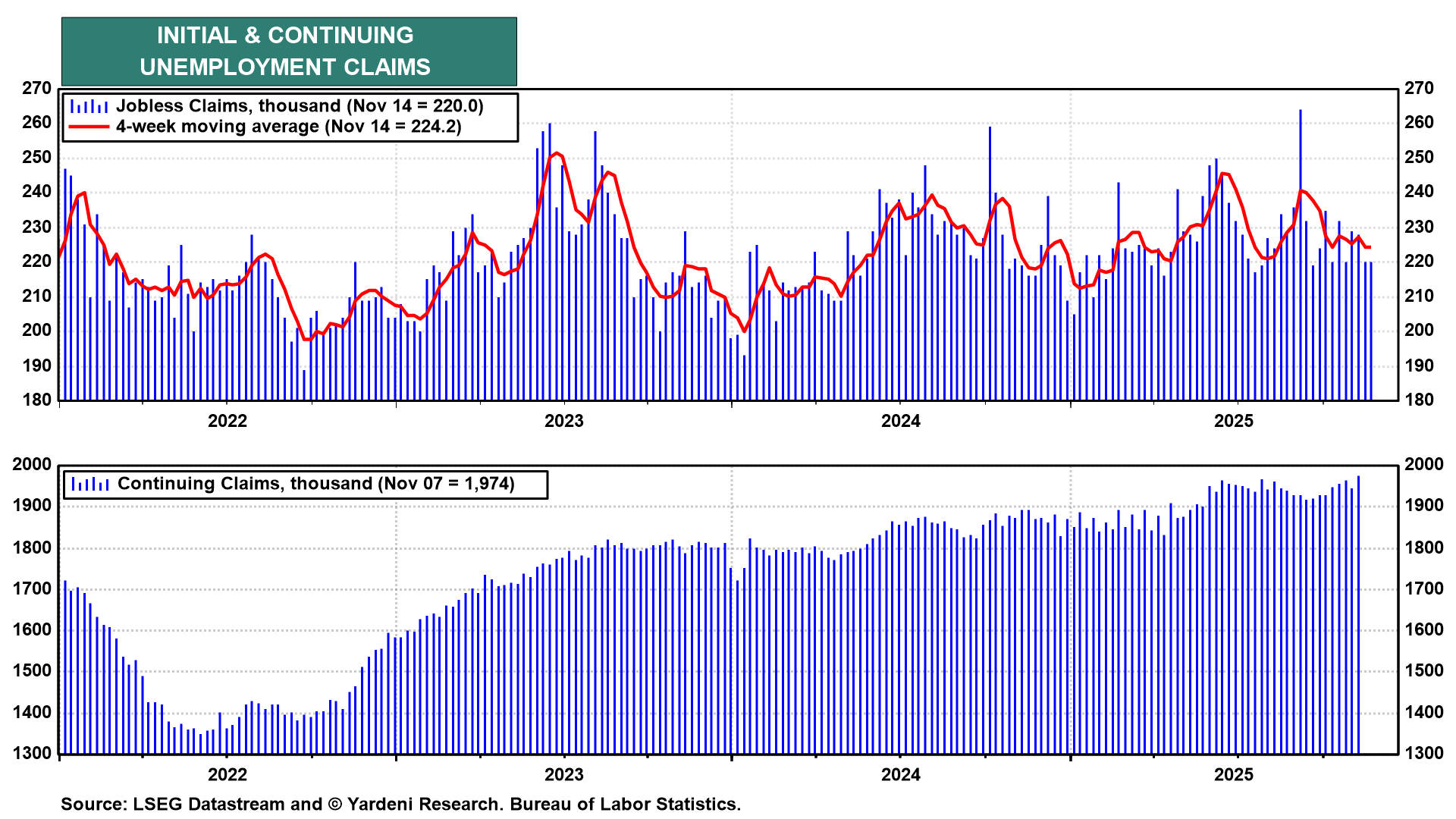

(5) Unemployment insurance. The weekly unemployment claims report (Wed) has been signaling that layoffs remain low, but it may be taking longer for unemployed workers to find a job (chart). September's employment report also sent a mixed message, as the payroll gain exceeded expectations but the unemployment rate rose to 4.4%.