As the latest episode of the “Trump versus Xi” series airs this week, it's perhaps fitting that the shuttered US government won't be releasing most key data for September. What happened last month, after all, may matter little if the two biggest economies engage in a trade war. The impact of the 130% tariff that President Donald Trump threatens to impose on China, effective November 1, would be an immediate bad shock for GDP, employment, and inflation in both countries.

Or not. Trump doesn't seem to know whether he will meet with Chinese leader Xi Jinping in Seoul during the October 31-November 1 Asia-Pacific Economic Cooperation summit. Thankfully, both Xi—who just tightened curbs on rare earths exports—and Trump suggest negotiations aren't dead. Given the disastrous consequences, it is likely that talks will resume.

In a post on Truth Social this afternoon, Trump said that China's economic troubles would "all be fine" and insisted that the US "wants to help China, not hurt it." He added, "Don't worry about China, it will all be fine!" Trump also wrote: "Highly respected President Xi just had a bad moment. He doesn't want depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!"

Here at home, we’ll hear from Fed Chair Jerome Powell (Tue), who will share his latest take on the economic outlook. Also speaking this week: Fed Governors Michelle Bowman (Tue and Thu), Christopher Waller (Tue, Wed, Thu), Stephen Miran (Wed and Thu), and Michael Barr (Thu).

Upcoming corporate earnings releases may provide valuable insights into the economy's performance. Large financial institutions reporting this week include BlackRock, Citigroup, Goldman Sachs, JPMorgan, and Wells Fargo (Tue). A day later, Bank of America and Morgan Stanley (Wed) report.

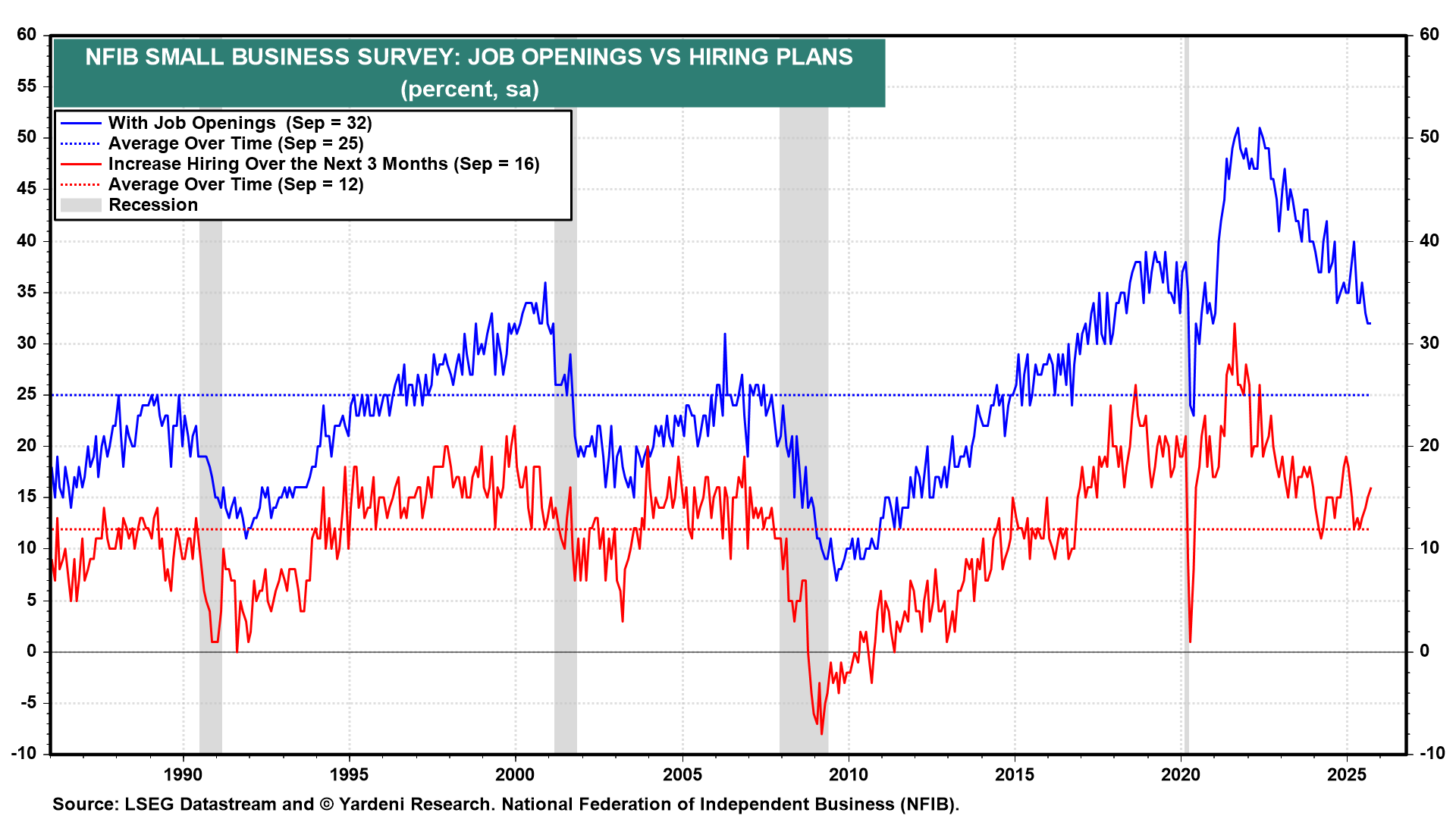

Here’s a look at the data releases most likely to influence the Fed's thinking on the need for more rate cuts:

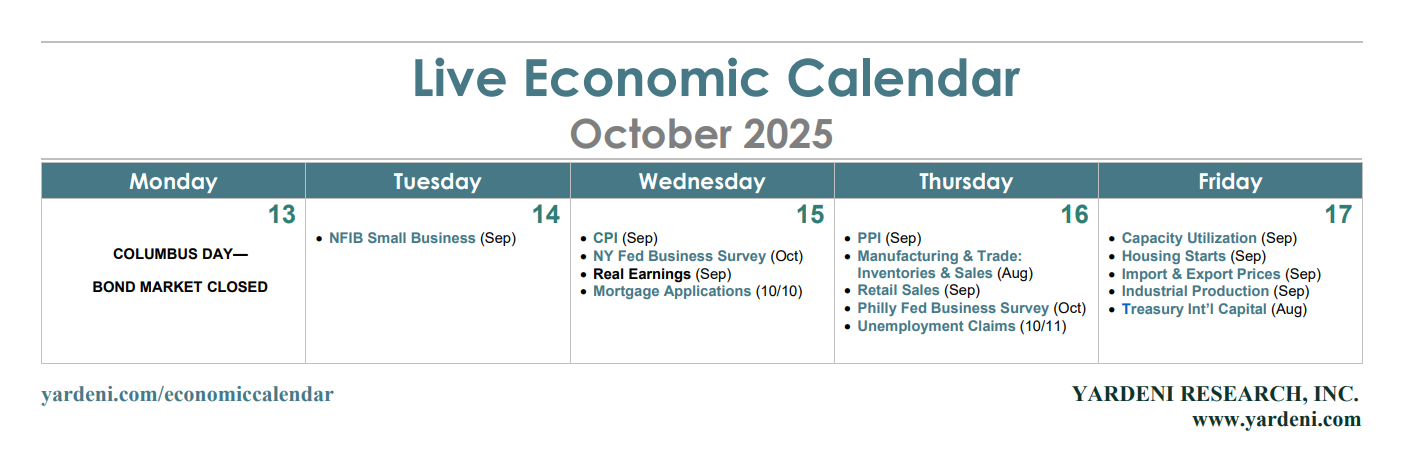

(1) CPI. Notwithstanding the government shutdown, September's inflation data will be released this week. The headline and core CPI inflation rates (Wed) likely rose 2.99% y/y and 2.95% y/y during September, according to the Cleveland Fed's Inflation Nowcasting. This would confirm our view that Trump's tariffs didn't boost inflation but did keep it from falling to the Fed’s target of 2.0% by now (chart).

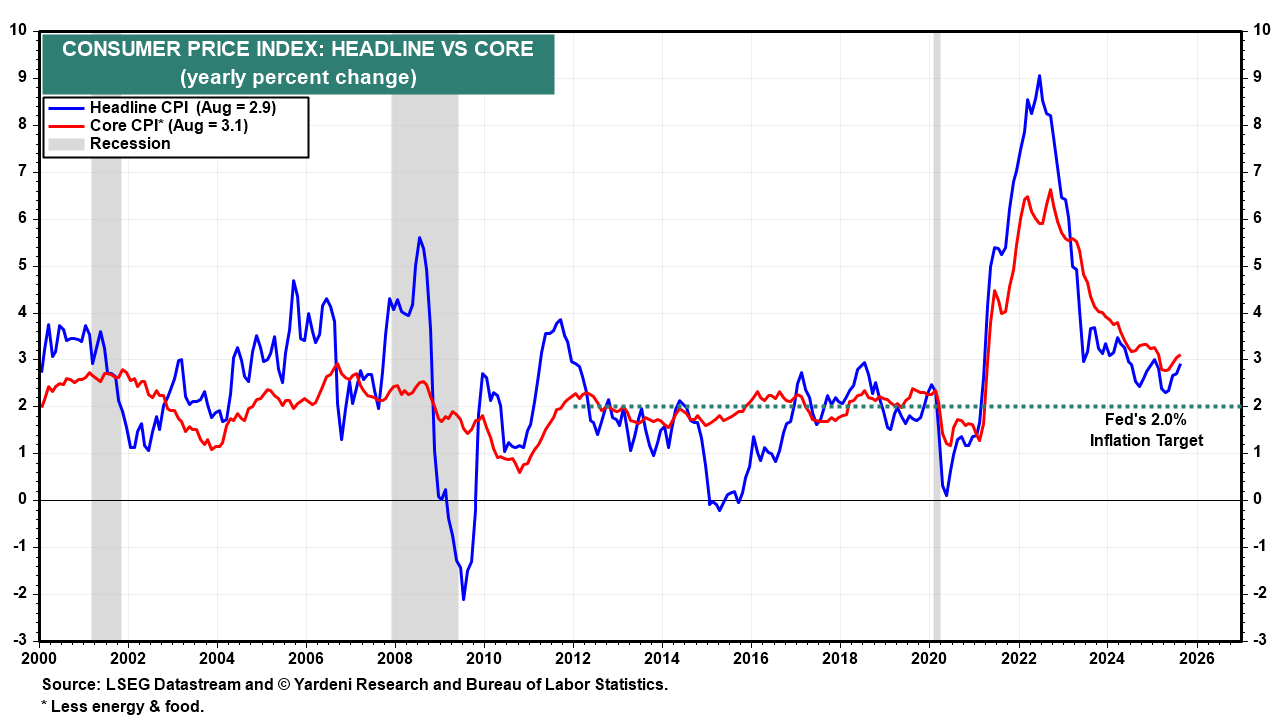

(2) PPI. The real drama surrounding the September PPI (Thu) is whether last month's surprising 0.1% drop was an aberration or an indication of receding inflationary pressures. We expect that September's PPI total final demand was closer to 3.0% y/y than 2.0% y/y (chart).

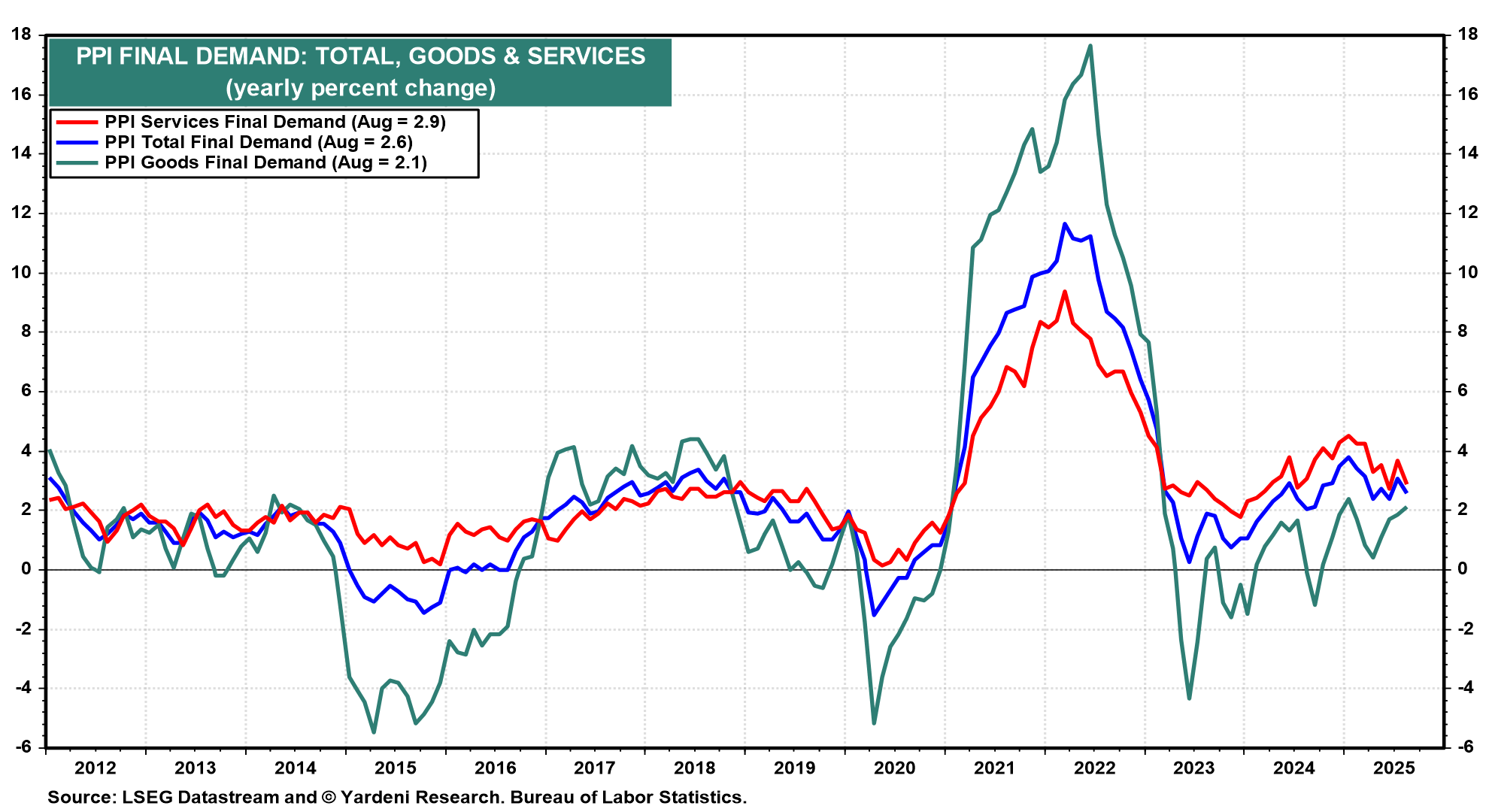

(3) NFIB survey. September's NFIB survey of small business owners (Tue) will be among the few sources of information about the labor market until the government reopens. We will be focusing on job openings and hiring plans (chart).

(4) Regional Fed surveys. We will be looking for any signs of a rebound in the NY Fed monthly business index (Wed) after the 20.6-points plunge in September to -8.7. Meanwhile, the Philly Fed's October business index (Thu) will show whether the 24-point jump in September to 23.2, the highest reading since January, was a fluke or not.