The week ahead will see central banks commanding the spotlight as the Federal Reserve, European Central Bank, Bank of Japan, and Bank of England weigh in on both interest rates and the balance of economic risks.

All eyes will be on the Federal Open Market Committee, which is widely expected to deliver another 25bps rate cut on Wednesday. Given cooler-than-expected September CPI data, odds are rising that the Fed will cut rates for a third time this year in December as well.

President Donald Trump, never one to cede center stage, will garner loads of attention as he leaves behind a shutdown US government and makes the rounds in Asia. The US President's long-awaited summit with Chinese leader Xi Jinping in South Korea on Thursday could mend fences between the two biggest economies, according to news reports this evening.

US Treasury Secretary Scott Bessent said talks on the sidelines of the Asia-Pacific Economic Cooperation (ASEAN) Summit in Kuala Lumpur had eliminated the threat of Trump's 100% tariffs on Chinese imports, set to start on November 1. Bessent also said he expects China to delay the implementation of its licensing regime for rare earth minerals and magnets by a year while the policy is reconsidered.

Before then, Trump will be in Tokyo on Tuesday, where he and the new Japanese prime minister, Sanae Takaichi, will take the measure of each other. Though few expect fireworks, Japan's first female leader has talked of a "renegotiation" of the US-Japan tariff deal, particularly the $500 billion "signing bonus" Trump is demanding.

Trump will also meet Canadian Prime Minister Mark Carney in Seoul, where the ASEAN summit is taking place. Over the weekend, Trump raised tariffs on Canada by 10% in retaliation for a political ad by the Ontario province's premier that used 1987 archival footage of Ronald Reagan warning that tariffs "hurt every American."

Amid uncertainty about when the US government will release economic data, markets are sure to look for economic clues in earnings results from Alphabet, Amazon, Apple, Chevron, Eli Lilly, ExxonMobil, Mastercard, Meta, Microsoft, NextEra, UnitedHealth, and Visa.

Here's a list of economic reports most likely to offer some visibility into how the economy is faring:

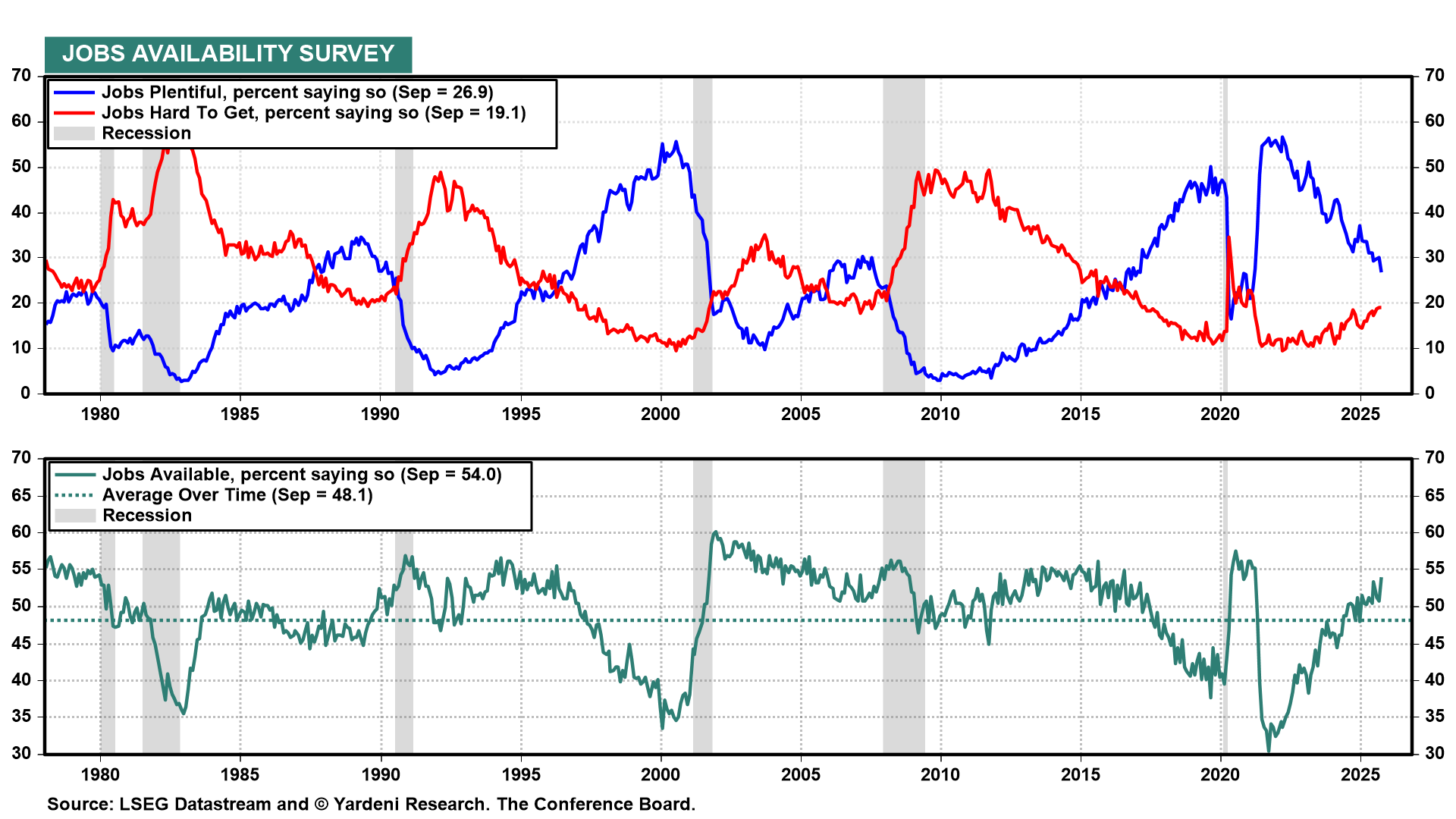

(1) Consumer confidence. The Conference Board's Consumer Confidence Index survey (Tue) likely remained steady in October around the 94 level. We'll be watching for signs of stabilization in the jobs availability data (chart).

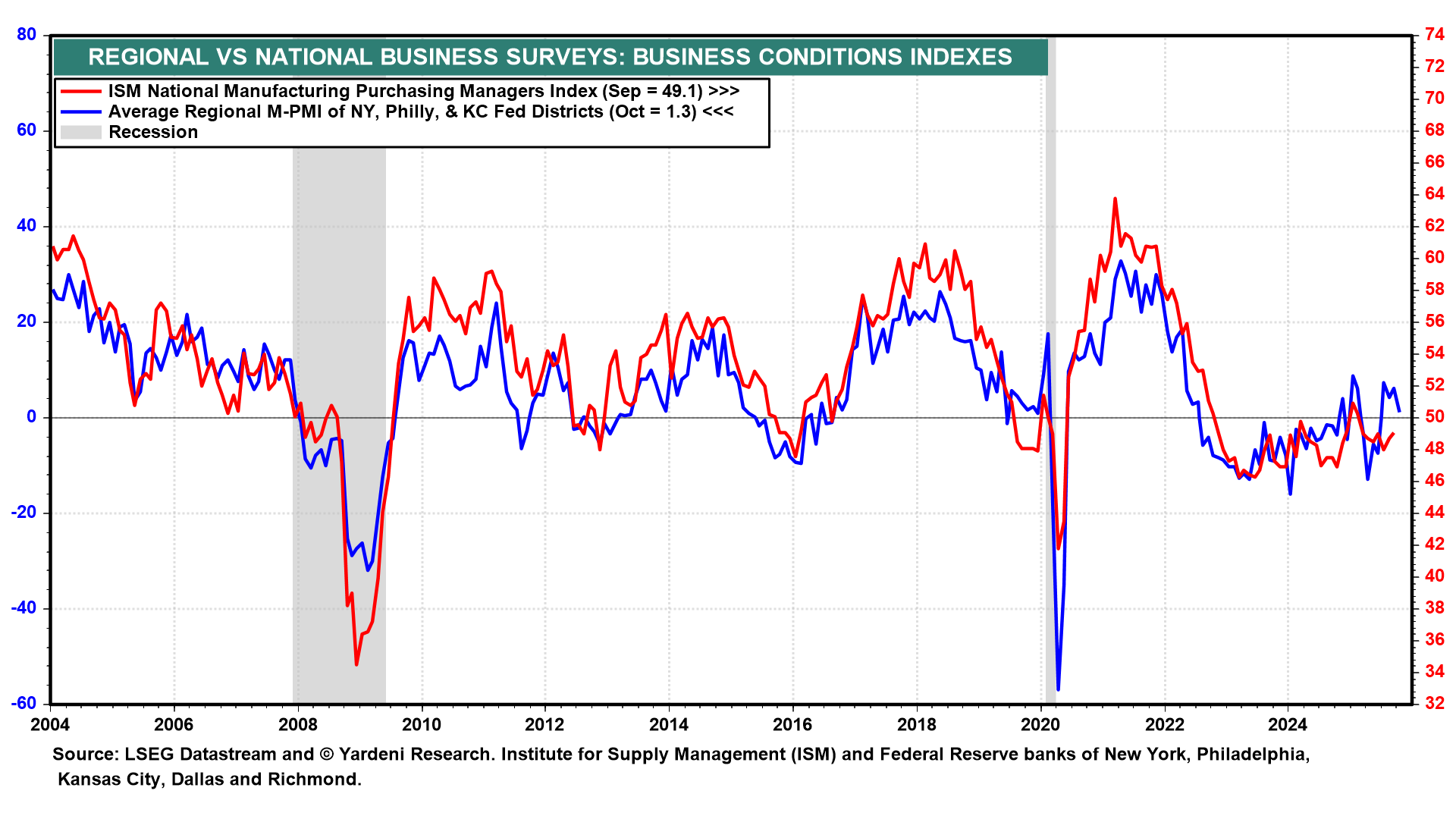

(2) Regional Fed business surveys. October business surveys from the Dallas Fed (Mon) and the Richmond Fed (Tue) could fill in some blanks about how the economy is faring. The average of the three available surveys weakened this month but suggests that the ISM M-PMI might still rise above 50 (chart).

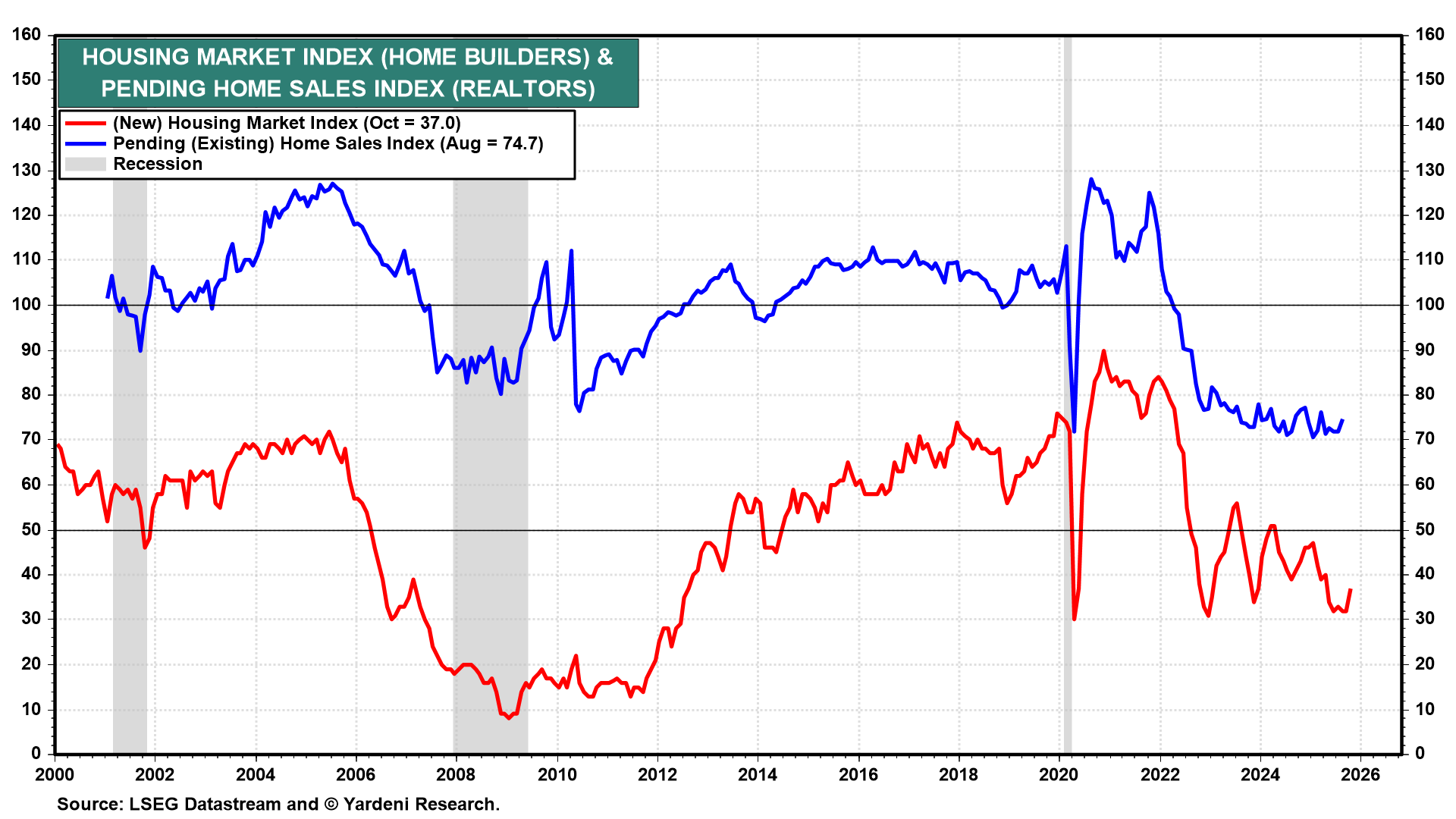

(3) Housing activity. September's pending home sales (Wed) from the National Association of Realtors probably remained relatively weak (chart).