This is a quiet week for key economic data releases, but it is even quieter due to the ongoing government shutdown. For financial markets, this informational void is equivalent to flying blind. That also applies to Fed officials who are undecided about the need to vote for a rate cut at the October 28-29 FOMC meeting. This week will offer investors insights into the internal dynamics of the September 16-17 FOMC, which concluded with a 25-basis-point interest rate cut. The minutes of that meeting will be released on Wednesday.

Financial markets are sure to tune into Fed speeches from Chair Jerome Powell (Thu), Governor Stephen Miran (Tue), Governor Michelle Bowman (Tue and Thu), Governor Michael Barr (Wed and Thu), and voting FOMC members Kansas City Fed President Jeff Schmid (Mon), St. Louis Fed President Alberto Musalem (Wed) and Chicago Fed President Austan Goolsbee (Fri).

Japan, meanwhile, is set to name its first female prime minister. On Saturday, staunch conservative lawmaker Sanae Takaichi prevailed in the Liberal Democratic Party's election. For the LDP to retain power, Takaichi must form a governing coalition with opposition parties, many of which favor tax cuts. Any signs Tokyo is about to add to the developed world's most significant debt burden could trigger a strong response from the Bond Vigilantes.

In the interim, here are the reports most likely to fill the void left by delayed government releases:

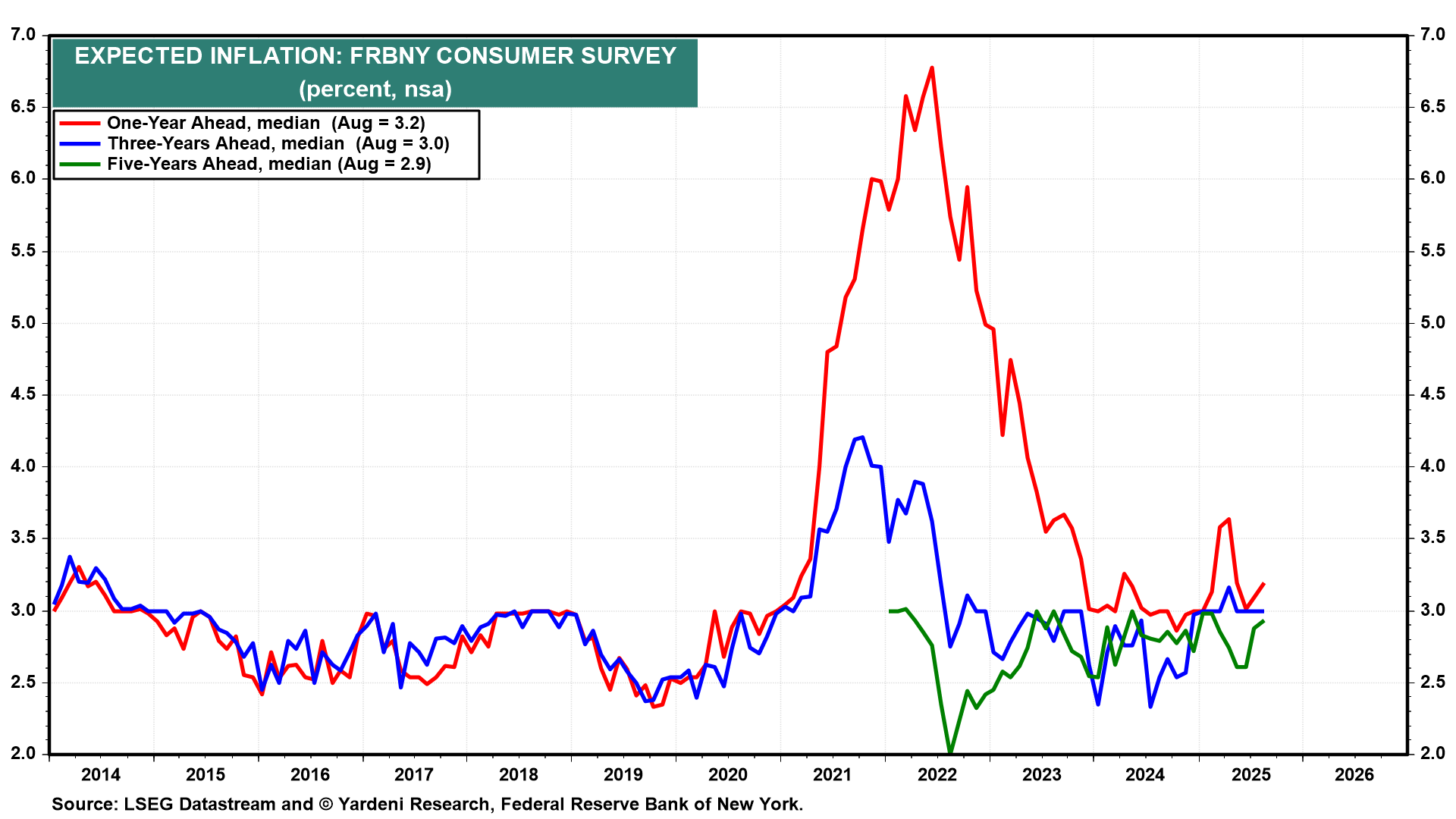

(1) Inflation expectations: The New York Fed's September Survey of Consumer Expectations (Tue) will offer a timely update on whether August's increase in households' inflation expectations was a blip or evidence of a worrisome upturn (chart).

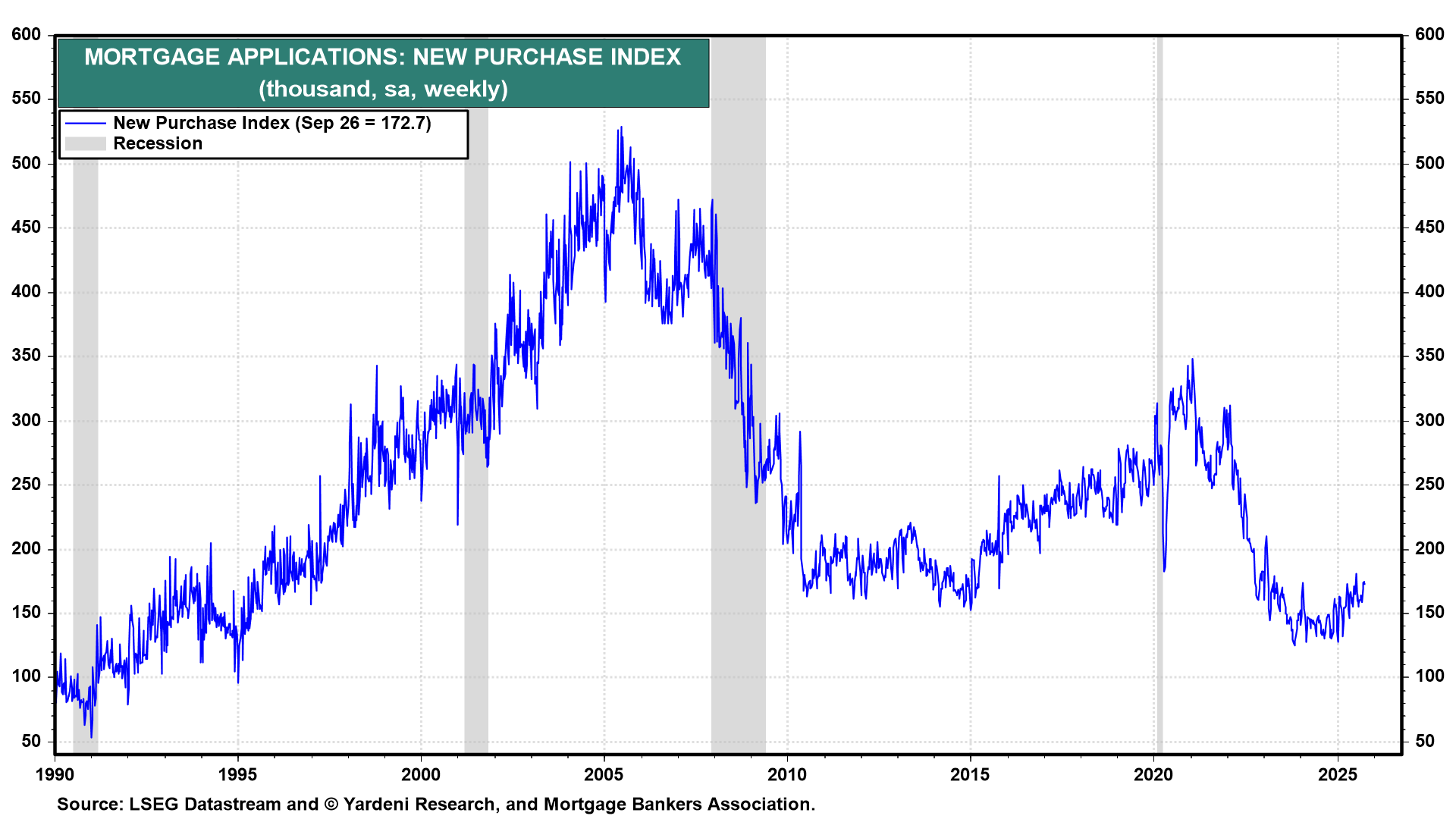

(2) Mortgage applications. Recent bond market volatility is causing considerable noise in the Mortgage Bankers Association's weekly data. Its new purchase index fell 1.0% during the week of September 26. If the Fed continues to pivot toward rate cuts, a rebound in housing activity seems likely.

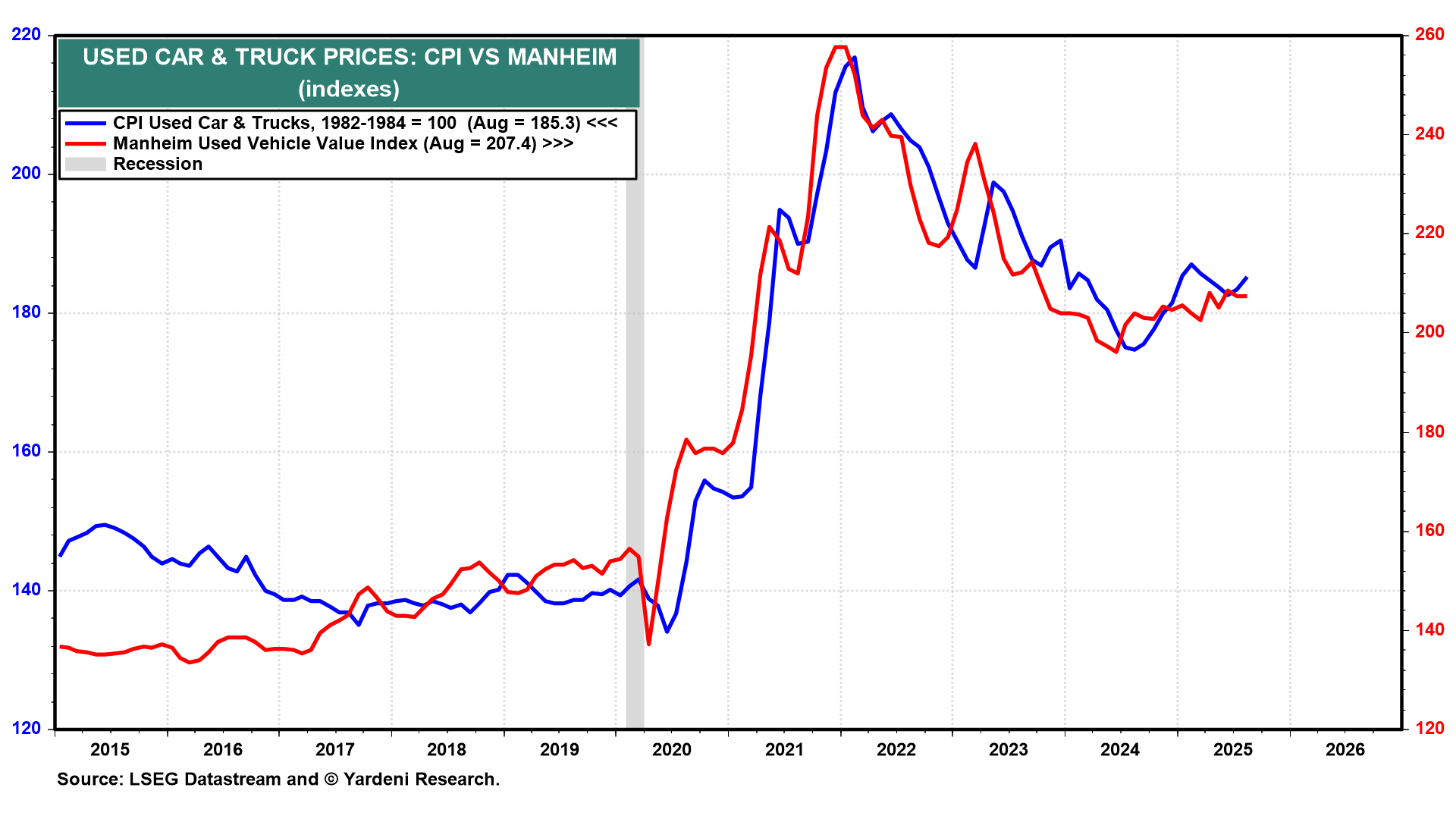

(3) Used car prices. The Manheim Used Vehicle Value Index (Tue) may be as good an indicator as the market will get of inflationary pressures in September for the time being. In August, the series rose 1.7% y/y. We will also be watching the Cleveland Fed’s Inflation Nowcasting. It is currently showing that the core CPI inflation rate was still running hot at 2.95% y/y during September. October’s rate is 2.93% so far.

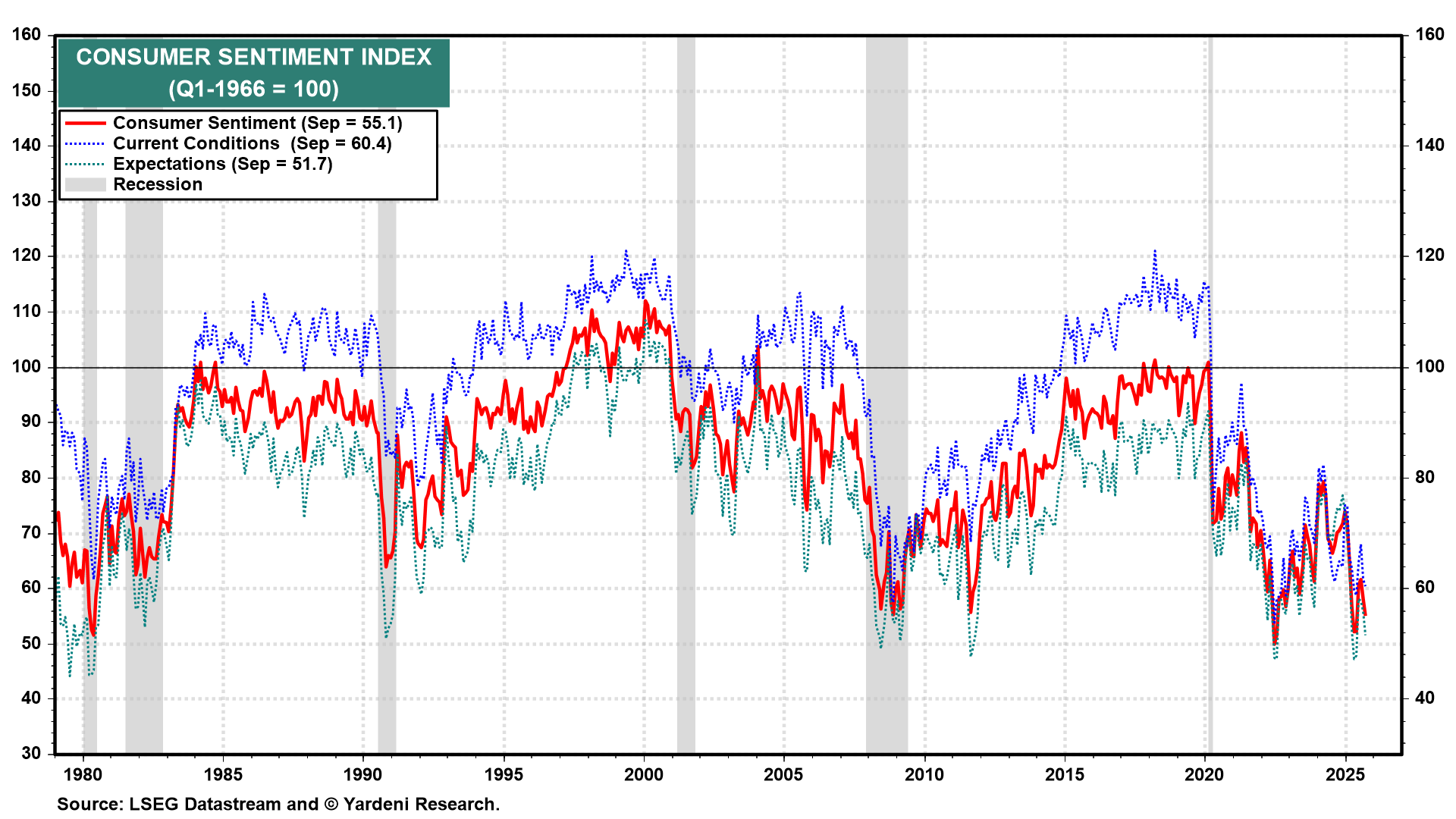

(4) Consumer sentiment. With the stock market on a tear, the Fed cutting the federal funds rate, and Trump's tariffs making fewer headlines, the University of Michigan's preliminary consumer confidence survey for October (Fri) should rebound. At the very least, it should confirm that the low level of layoffs and positive wealth effect are helping to stabilize consumer sentiment.