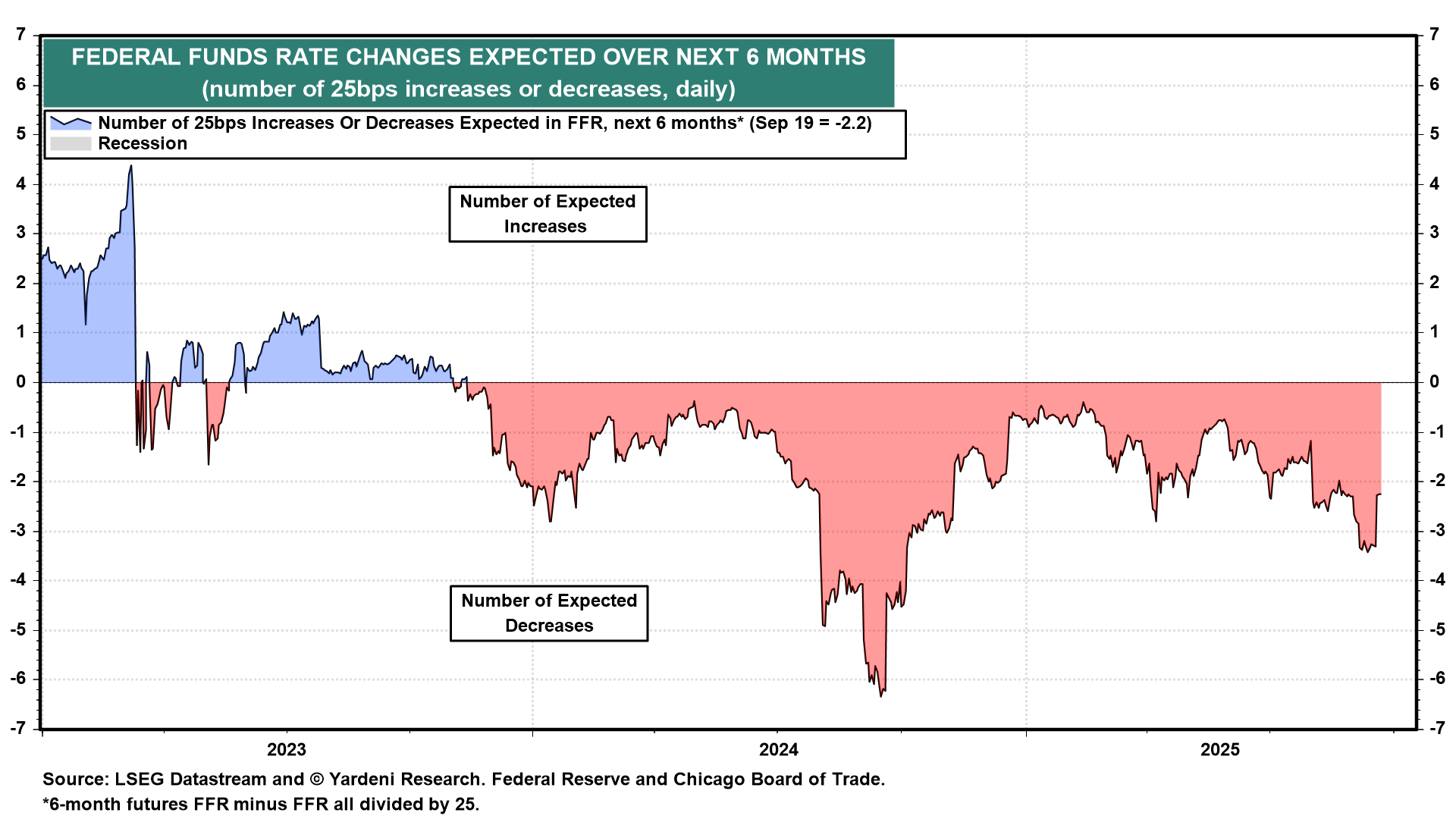

The week ahead will offer timely clues about both the American consumer and inflation. The economic releases this week might also influence financial market expectations about another Fed rate cut as soon as the October 28-29 Federal Open Market Committee (FOMC) meeting. The federal funds futures market was expecting three 25bps rate cuts over the next six months last week before Thursday's upbeat initial unemployment claims cut the outlook for cuts to two (chart). We are back in the none-and-done camp for the rest of this year.

The main data releases include weekly jobless claims and personal income, which include the Fed's preferred inflation measure. Before then, August updates on existing and new home sales could be illuminating. The same can be said about August durable goods.

There will also be ample opportunities to hear from Fed officials, including a speech by Fed Chair Jerome Powell (Tue) on the economic outlook. A day earlier (Mon), the lone dissenter at last week’s FOMC meeting, Governor Stephen Miran, will speak to the Economic Club of New York. Miran—the Trump administration economist rushed onto the Federal Reserve Board by the Senate in time for last week's FOMC vote—wanted a 50-basis-point cut, making him the only dissenter.

Here's a look at this week's economic reports with the most significant potential to put another Fed rate cut in play—or not:

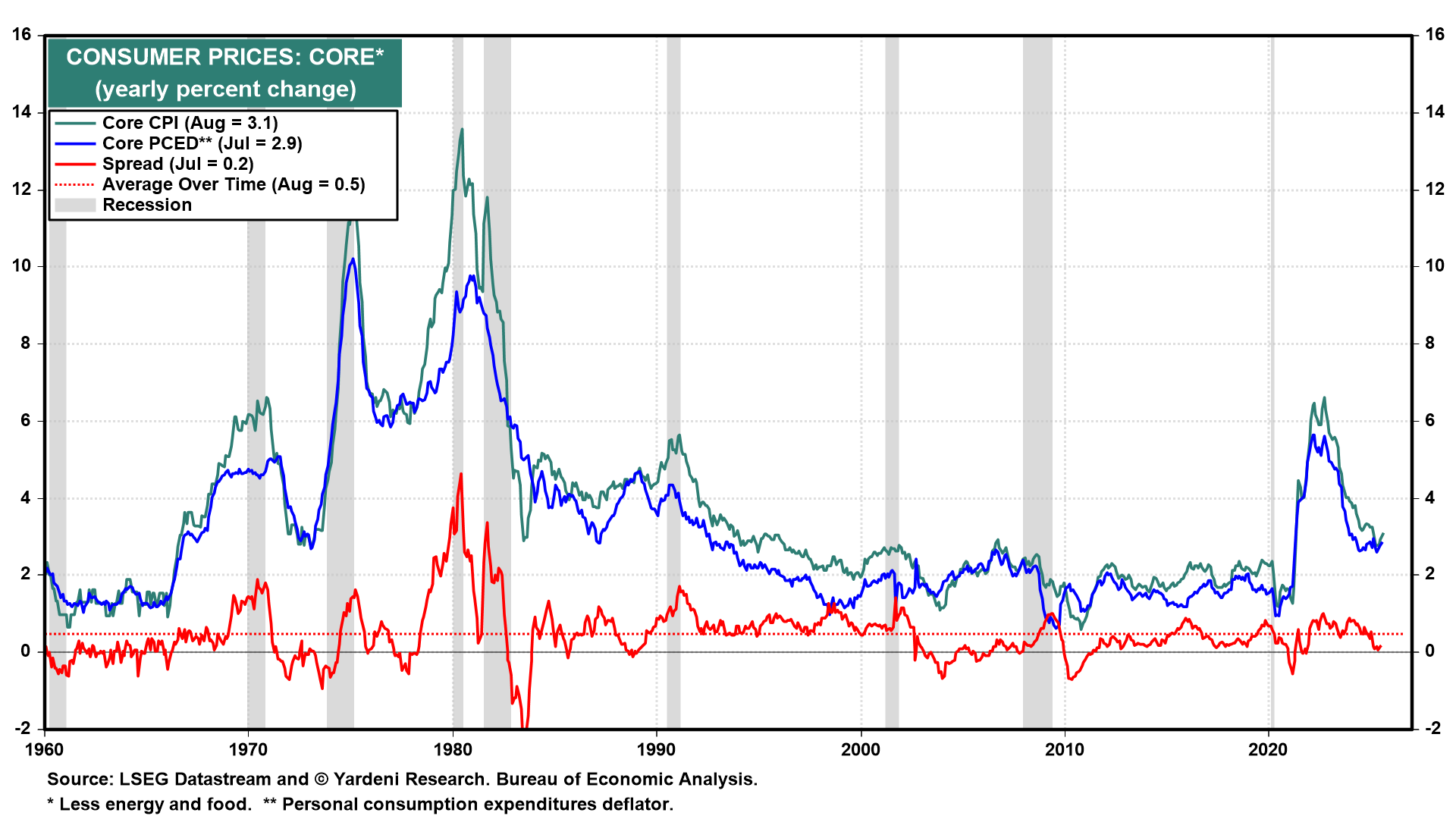

(1) PCED inflation rate. President Donald Trump, of course, has been urging the Fed to cut the federal funds rate down to 1.00% to add "rocket fuel" to the economy. However, the PCED (Fri) could show that core inflation—excluding food and energy—remained at a still-elevated annual rate in August (chart). The Cleveland Fed's Inflation Nowcasting model is showing a 3.0% y/y increase in last month's PCED inflation rate.

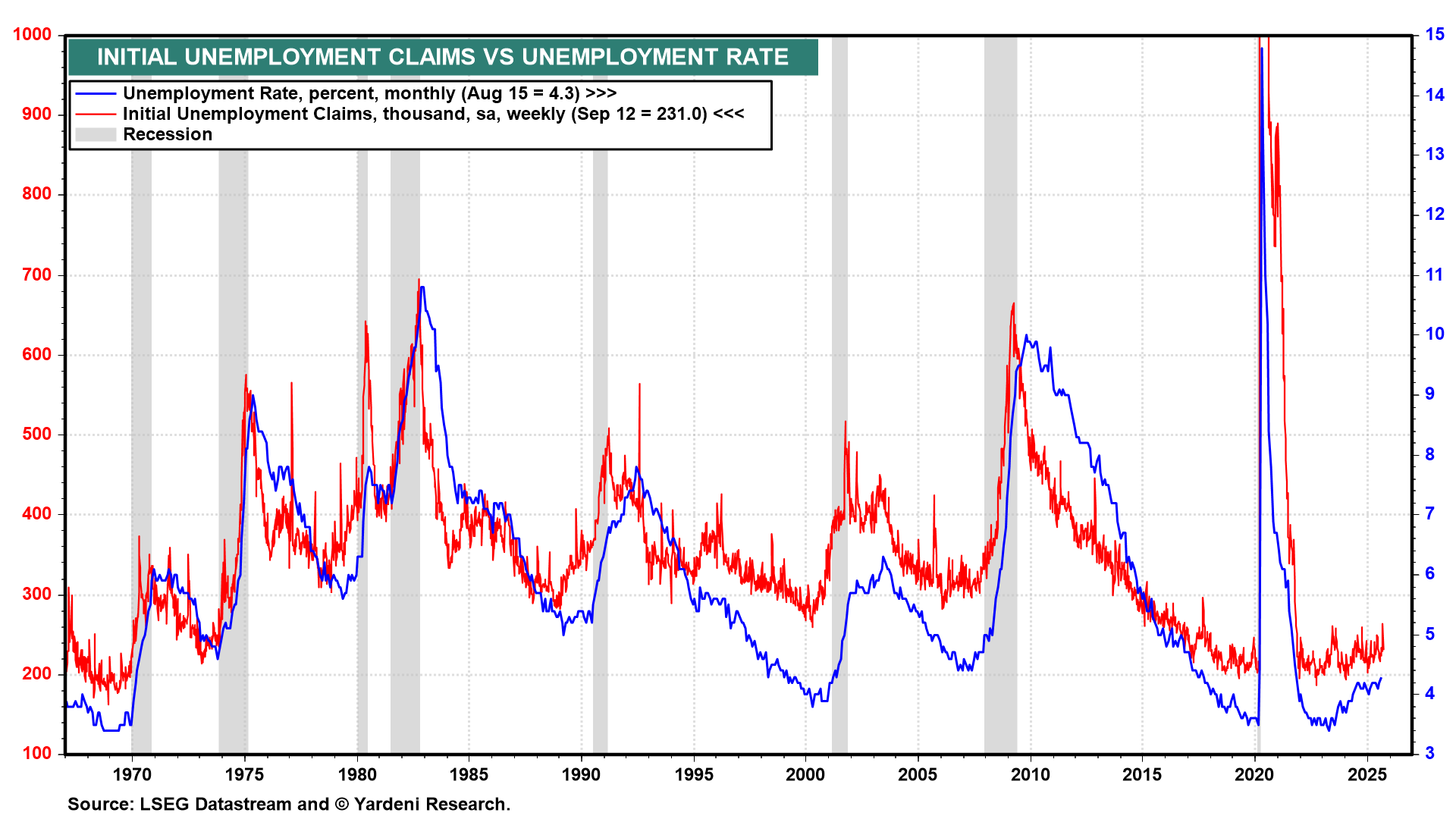

(2) Weekly jobless claims. Miran and his fellow doves could see their rocket-fuel dreams tempered somewhat by yet more evidence that layoffs remain low. While there's lots of noise in the employment data these days, weekly initial unemployment claims in the neighborhood of 231,000 would reduce the urgency for another Fed rate cut (chart).

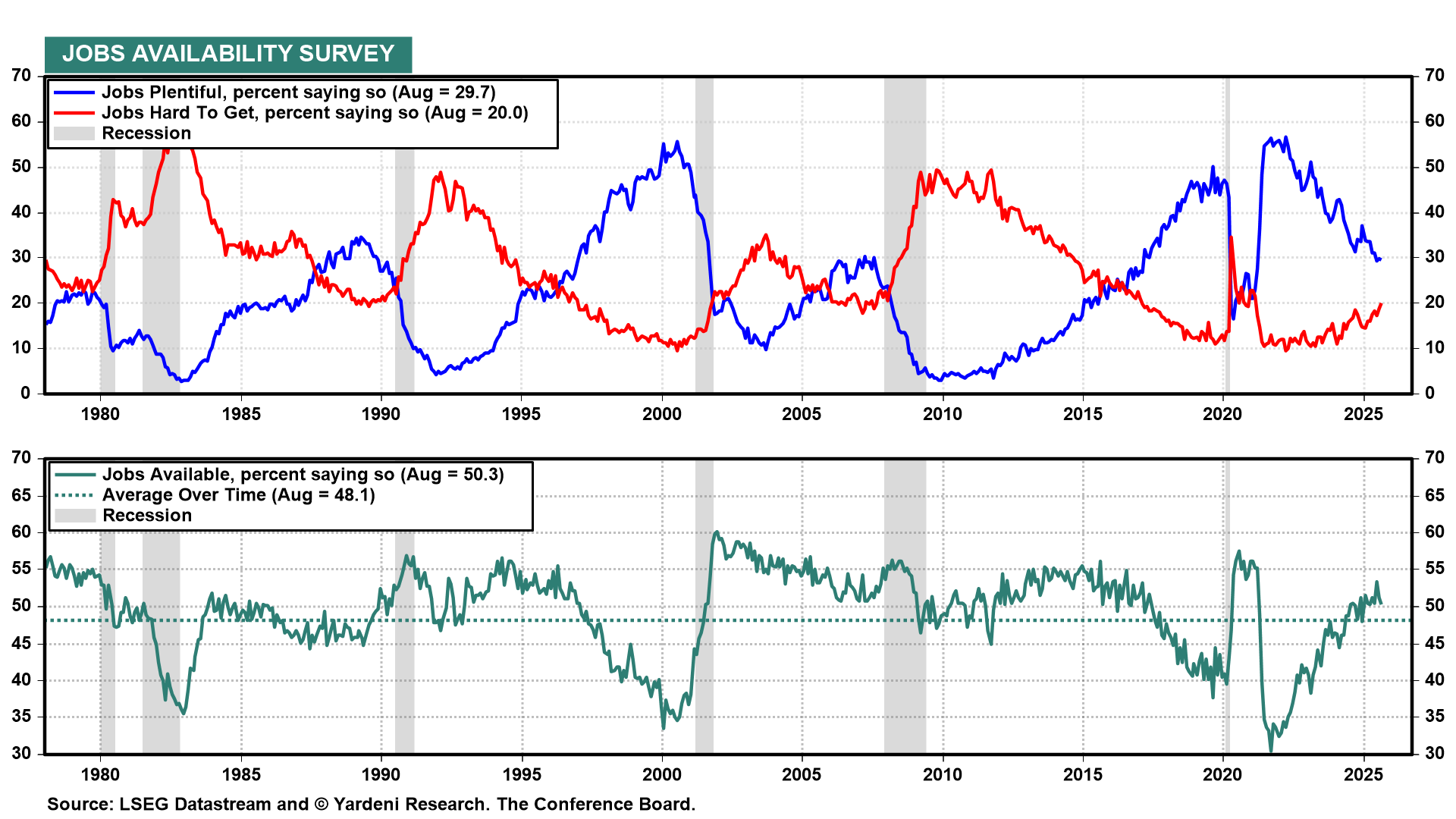

(3) Consumer confidence. The Conference Board's September Consumer Confidence Index (Fri) follows news last week that its Index of Coincident Economic Indicators rose 0.2% m/m in August to another record high. We will focus on the job availability series (chart).

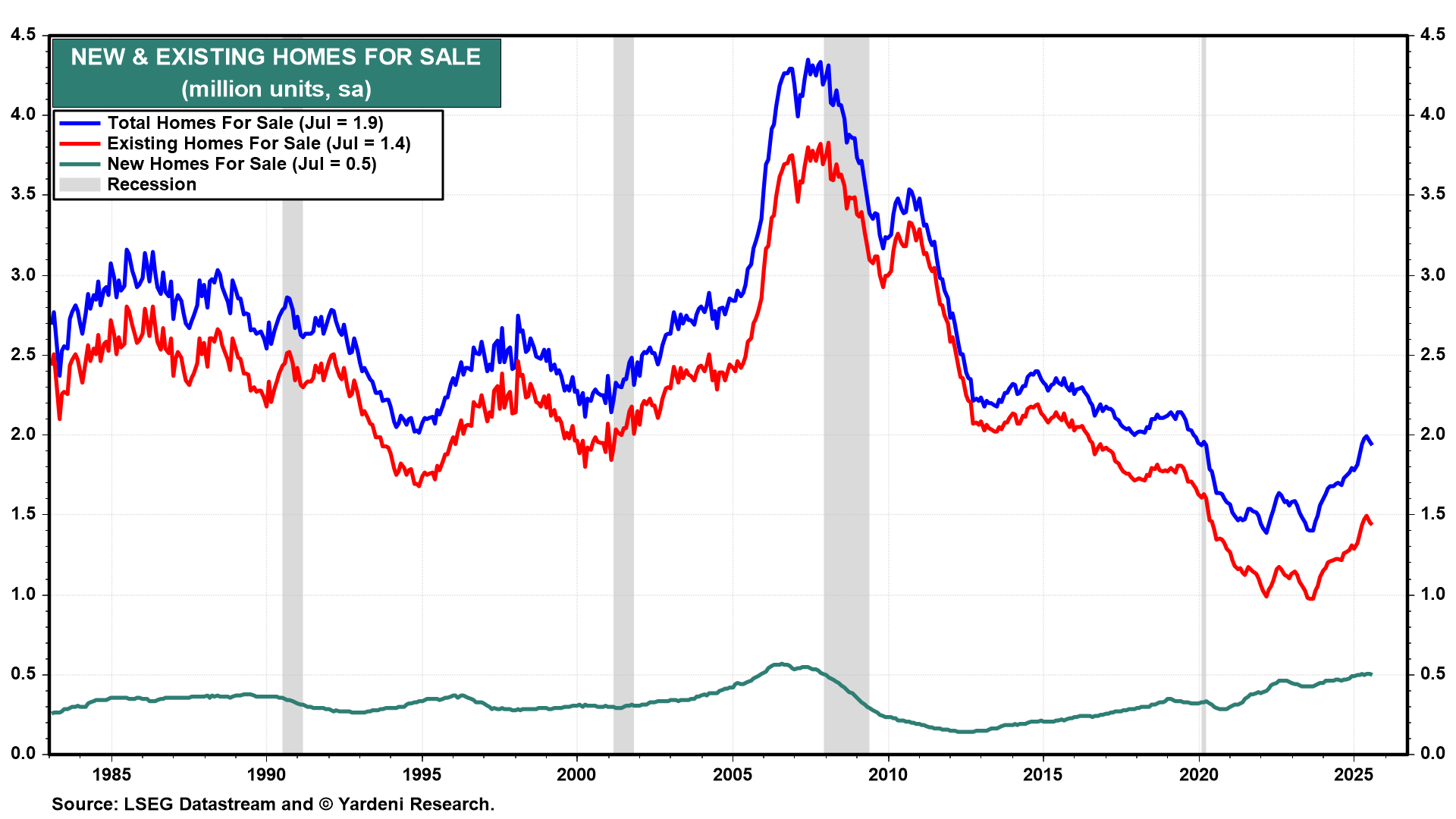

(4) Housing market. Odds are that the August readings on existing and new home sales (Tue and Wed) remained weak, while the inventory of unsold homes remained elevated (chart). The Fed's rate cut last week may not provide significant support to the housing market for the rest of the year if bond yields move higher.