Monthly employment reports have been suspenseful enough in recent months, but the real drama surrounding September's hotly anticipated figures is whether they will even be released on Friday. They won't be if the government shuts down on October 1 amid partisan bickering.

Assuming the data come out, we expect them to show that the economy remains more buoyant than the conventional wisdom acknowledges given how surprised the financial markets were by last week's upward revision to Q2's real GDP growth rate. It's now up from an initial 3.3% (saar) to 3.8%.

Additionally, the upward revision to Q2's consumer spending now places the series at a 2.6% pace, compared to the initially reported 1.6% rate. Increases in spending on services like transportation, finance, and other categories suggest that Americans are generally working and feel confident enough about wage trends to make purchases.

Layoffs remain low, meanwhile, as evidenced by last week's reading on initial unemployment claims, which declined 14,000 to 218,000 for the week ended September 20.

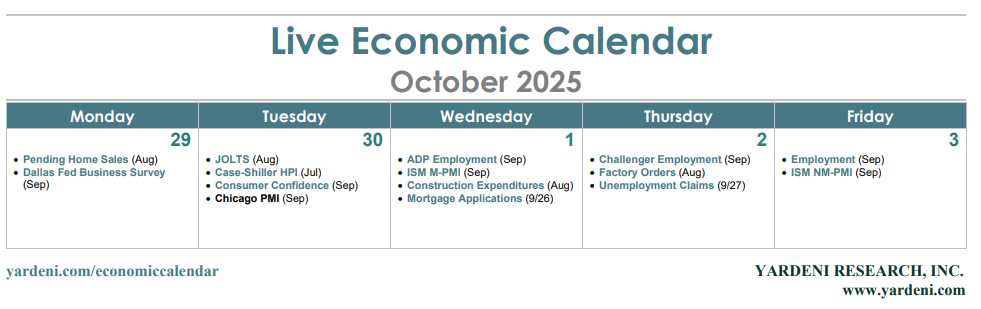

We'll hear lots of jabbering from several members of the Federal Open Mouth Committee this week. The reports coming out this week—such as consumer confidence (Tue), Job Openings and Labor Turnover (Tue), purchasing managers' activity (Wed and Fri), and factory orders (Thur)—could influence FOMC members’ views on whether interest rates should be cut again before year-end. But we don’t expect the releases to increase the odds of another Federal Reserve rate cut anytime soon.

Here's a look at the upcoming economic reports most likely to influence FOMC members’ thinking:

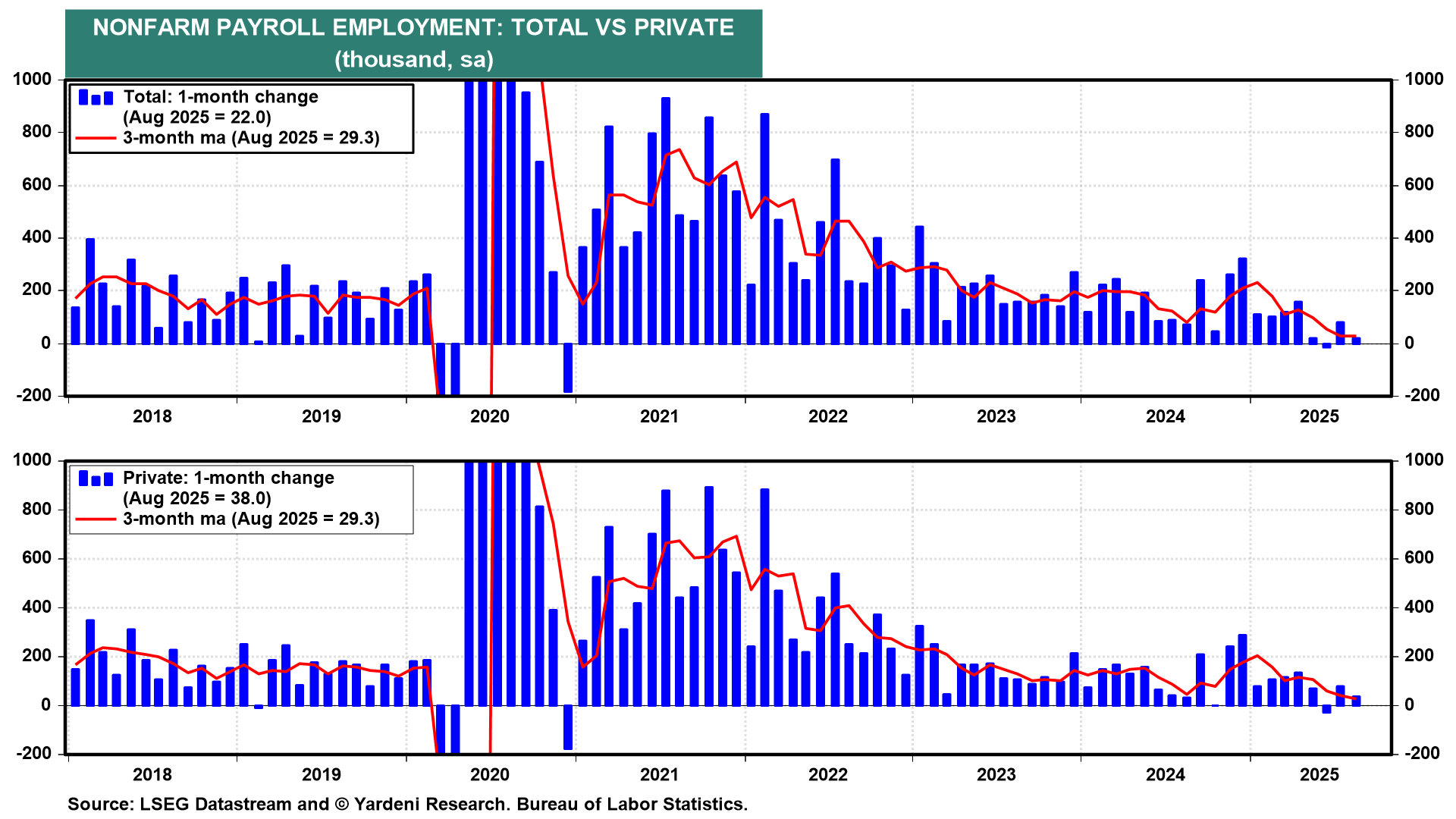

(1) Employment report. Three months ago, the 75,000 payrolls gain we expect in September (Fri) would've left the stock market unhappy. But after the drama surrounding the last two jobs reports, such a gain—and a 4.3% unemployment rate—would be the economic equivalent of comfort food.

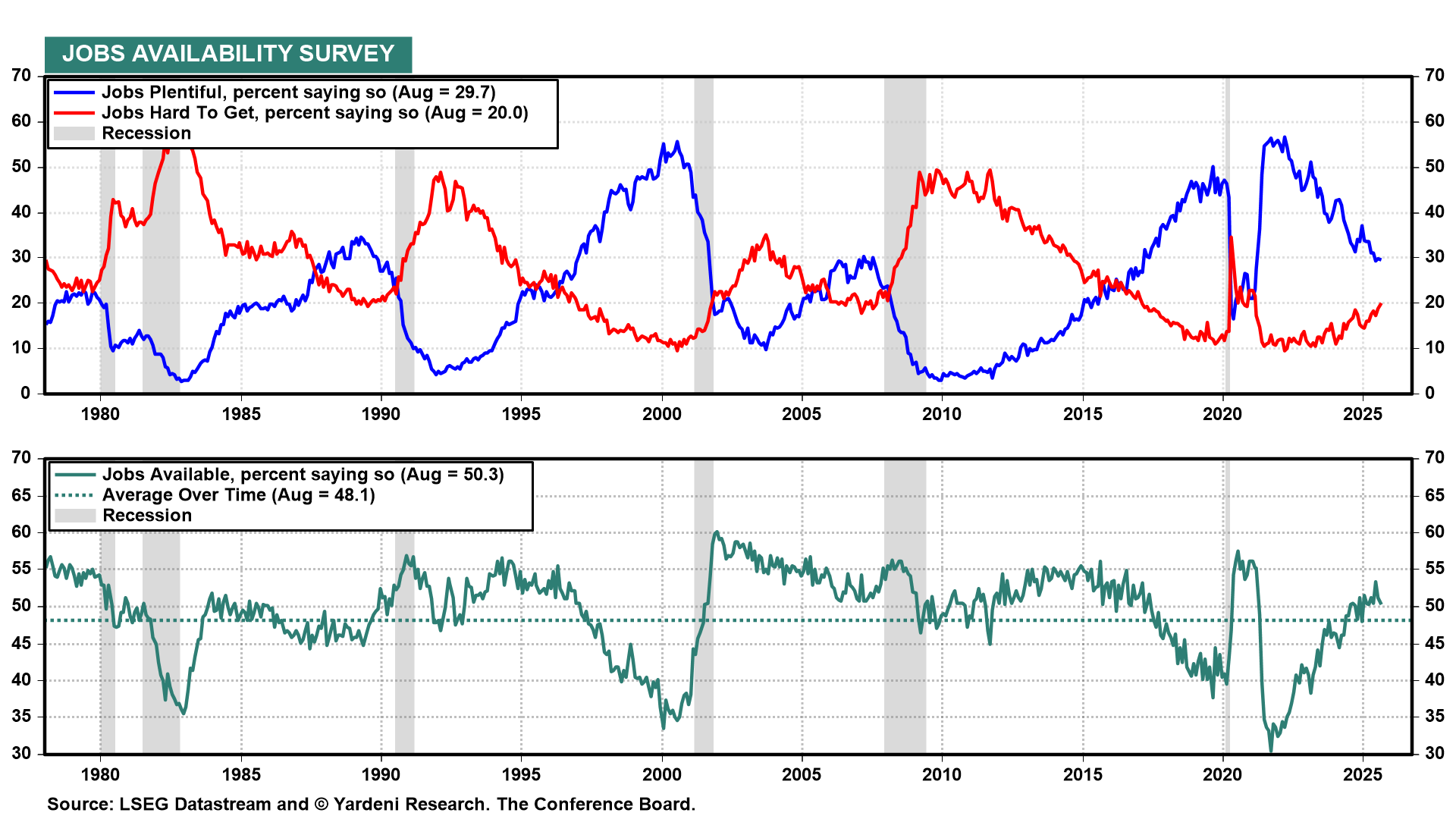

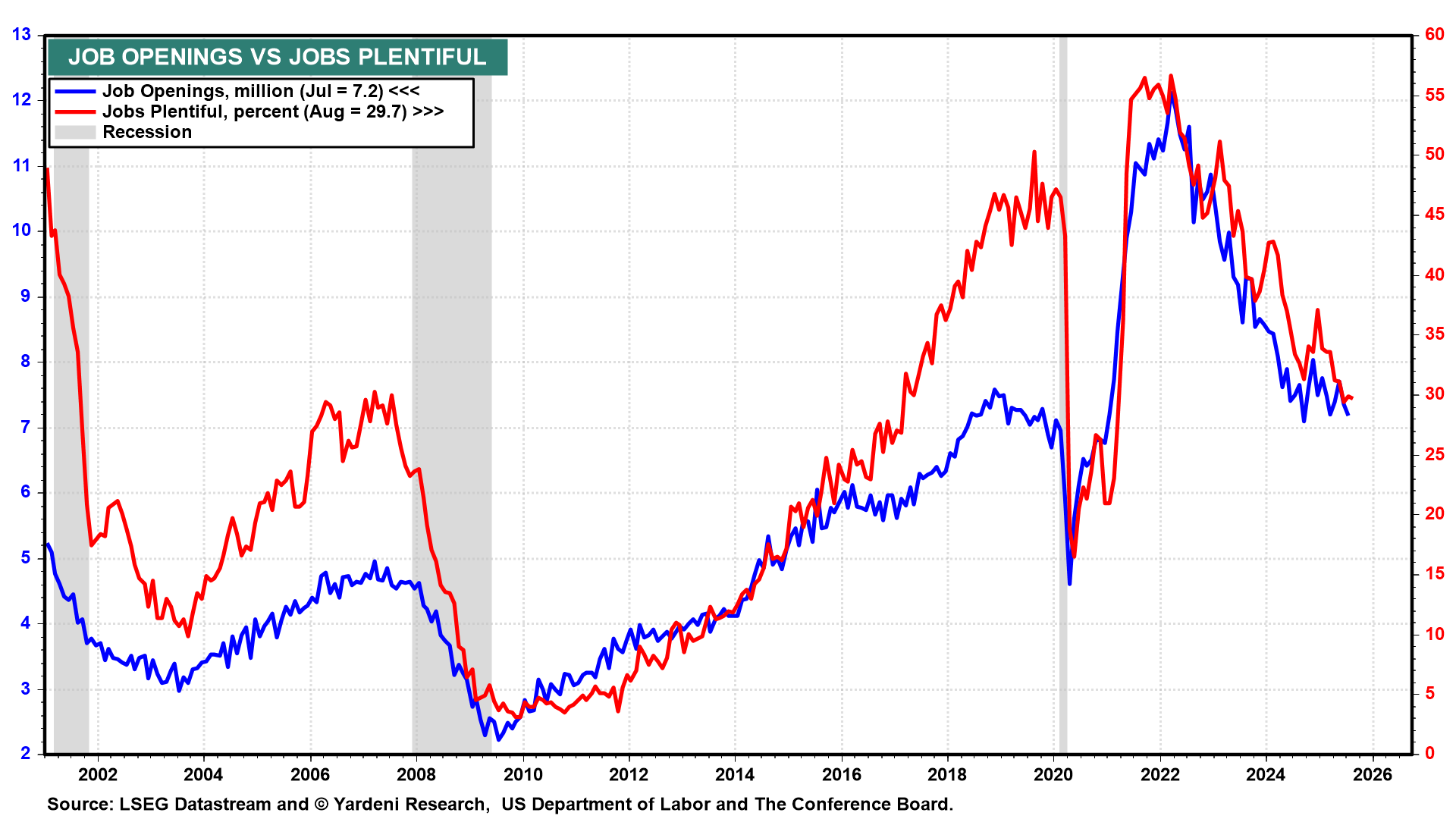

(2) Consumer confidence. After weakening in August, the Conference Board's Consumer Confidence Index survey (Tue) may show improvement in September. Labor market conditions aren't as dire as feared. The Trump administration is striking tariff deals. Stock prices are rising. The Fed cut the federal funds rate. So confidence should be improving. We will be watching the survey's labor market indicators for signs of stabilization (chart).

(3) JOLTS. With all eyes on the health of the US labor market, we expect the August JOLTS report (Tue) to confirm that labor market conditions remained solid last month. August's jobs plentiful series suggests that the month's job openings remained elevated (chart). Initial claims (Thu) should also confirm that layoffs remain low.

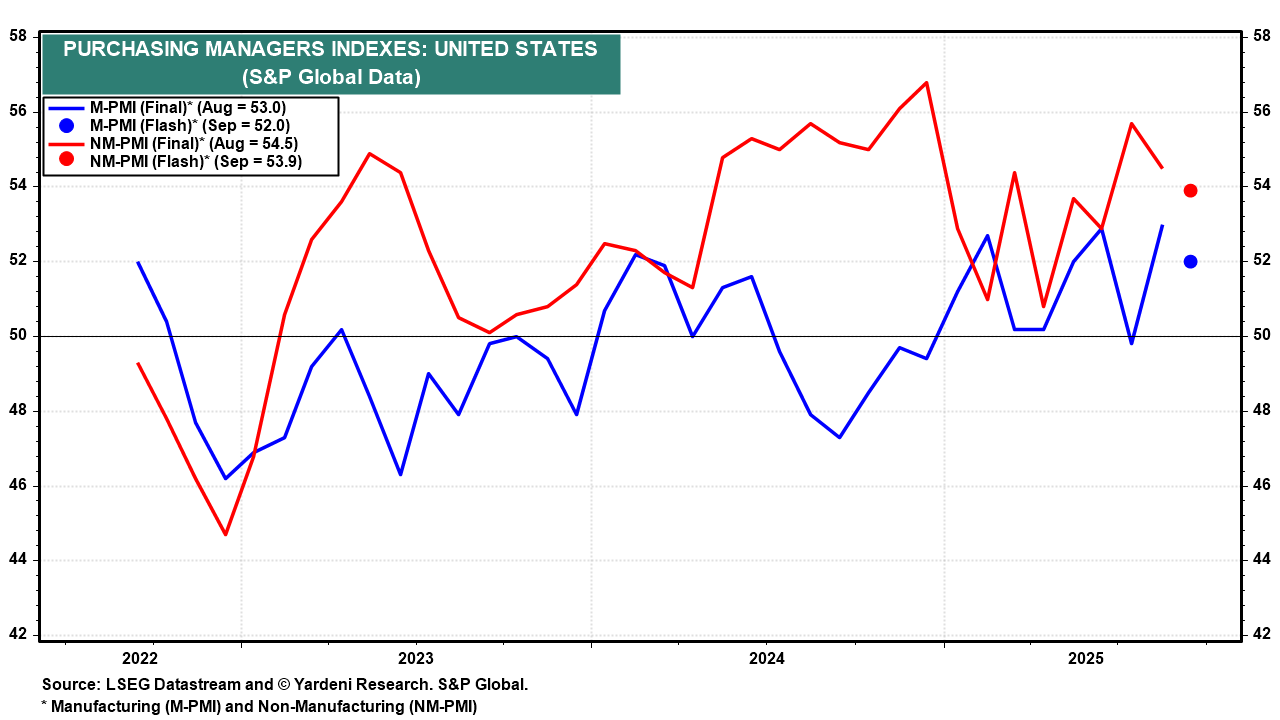

(4) PMI surveys. The volatility we've seen in purchasing managers' readings is likely to persist. The ISM US Manufacturing PMI (Wed) increased to 48.7 in August, but remained below the 50.0 mark. The ISM Services PMI (Fri) did expand in August, coming in at 52. The S&P Global flash estimates of the two PMIs edged down in September but remained solidly above 50.0 (chart).