On Tuesday at 10:00 a.m., the Bureau of Labor Statistics (BLS) will publish its preliminary benchmark revision for March 2025 employment data. This coincides with the release of the Quarterly Census of Employment and Wages (QCEW) data for Q1-2025.

The preliminary revision will estimate how much the monthly payroll report overstated (or understated) actual job growth between April 2024 and March 2025. The final benchmark revision will be incorporated in the January 2026 employment report in February 2026. The revision is expected to range between -450,000 and -750,000, suggesting that productivity might be revised upward over this period. Furthermore, that would confirm widespread expectations of a Fed rate cut on September 17. The 10-year Treasury bond yield could fall below 4.00%, though not if the PPI and CPI inflation rates run hotter than expected later this week.

The first look at August inflation comes not a moment too soon, following last Friday's weaker-than-expected employment report. The anemic 22,000 payrolls gain increased the odds of a Fed rate cut. All that stands between the financial markets and the liquidity jolt they crave are reasonably tame figures for August's PPI (Wed) and CPI (Thu). Yet tame figures aren’t a given.

Wall Street, meanwhile, will have a busy week on the tech front: Apple is expected to unveil a variety of new iPhone models. AMD, Broadcom, Meta, and Nvidia are slated to make closely watched presentations at a Goldman Sachs conference in San Francisco. Oracle, Adobe, and the original meme stock GameStop will report earnings.

Overseas, markets will pay close attention to Japanese leadership intrigue after Prime Minister Shigeru Ishiba said he's stepping down. Investors in Europe will brace for the possible collapse of France's government following a no-confidence vote (Mon) targeting Prime Minister Francois Bayrou.

At home, here's a look at the week’s economic releases with the most significant potential to influence the outlook for Fed policy over the remainder of this year:

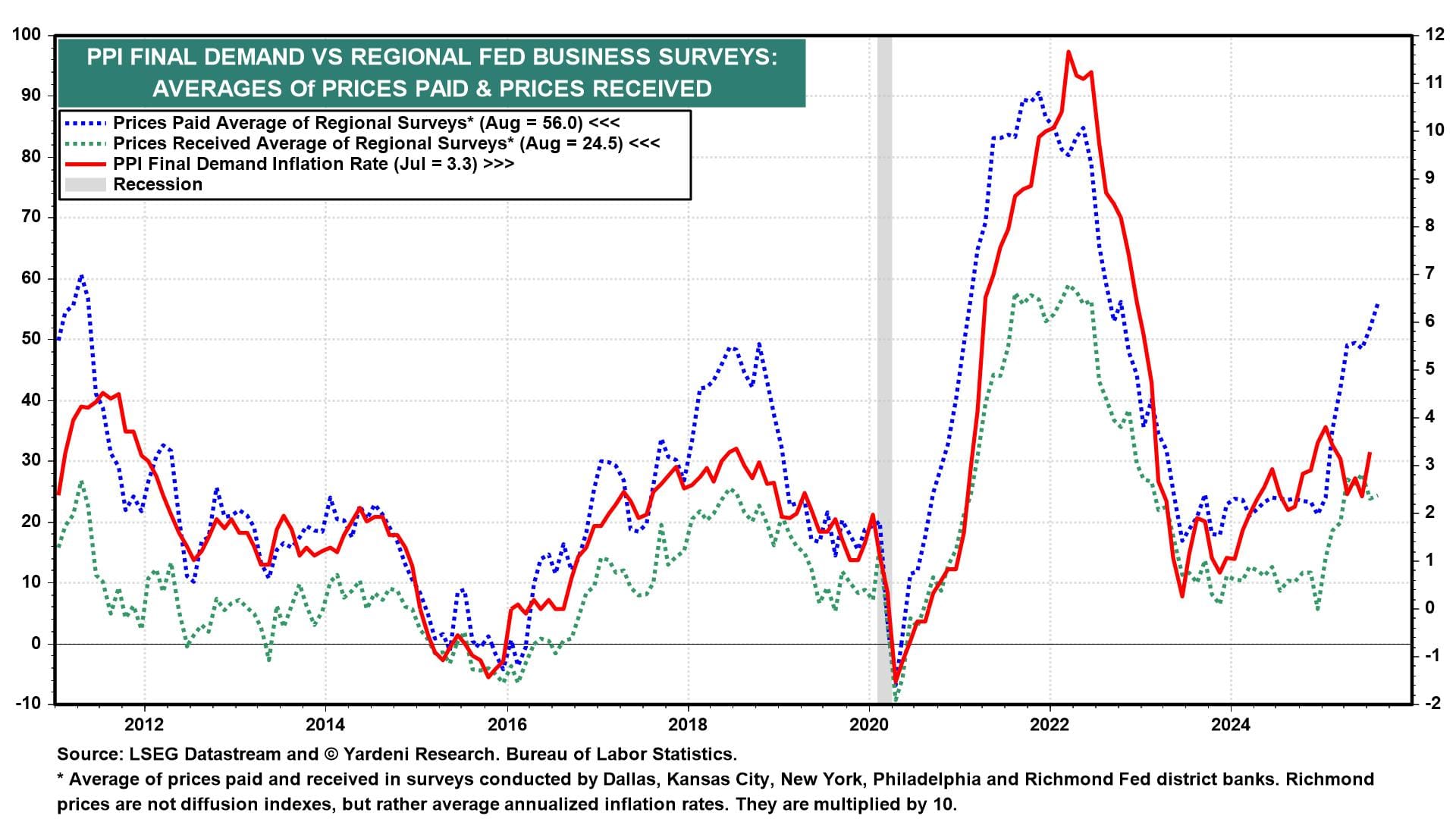

(1) PPI. August's PPI (Wed) is expected to be up 0.3% m/m following July's 0.9% jump. On a y/y basis, the PPI rose 3.3% in July. The PPI excludes tariffs, but goods inflation likely rose as the costs of imported materials and parts have been boosted by tariffs, as shown by the recent jumps in the regional indexes of prices paid and received (chart).

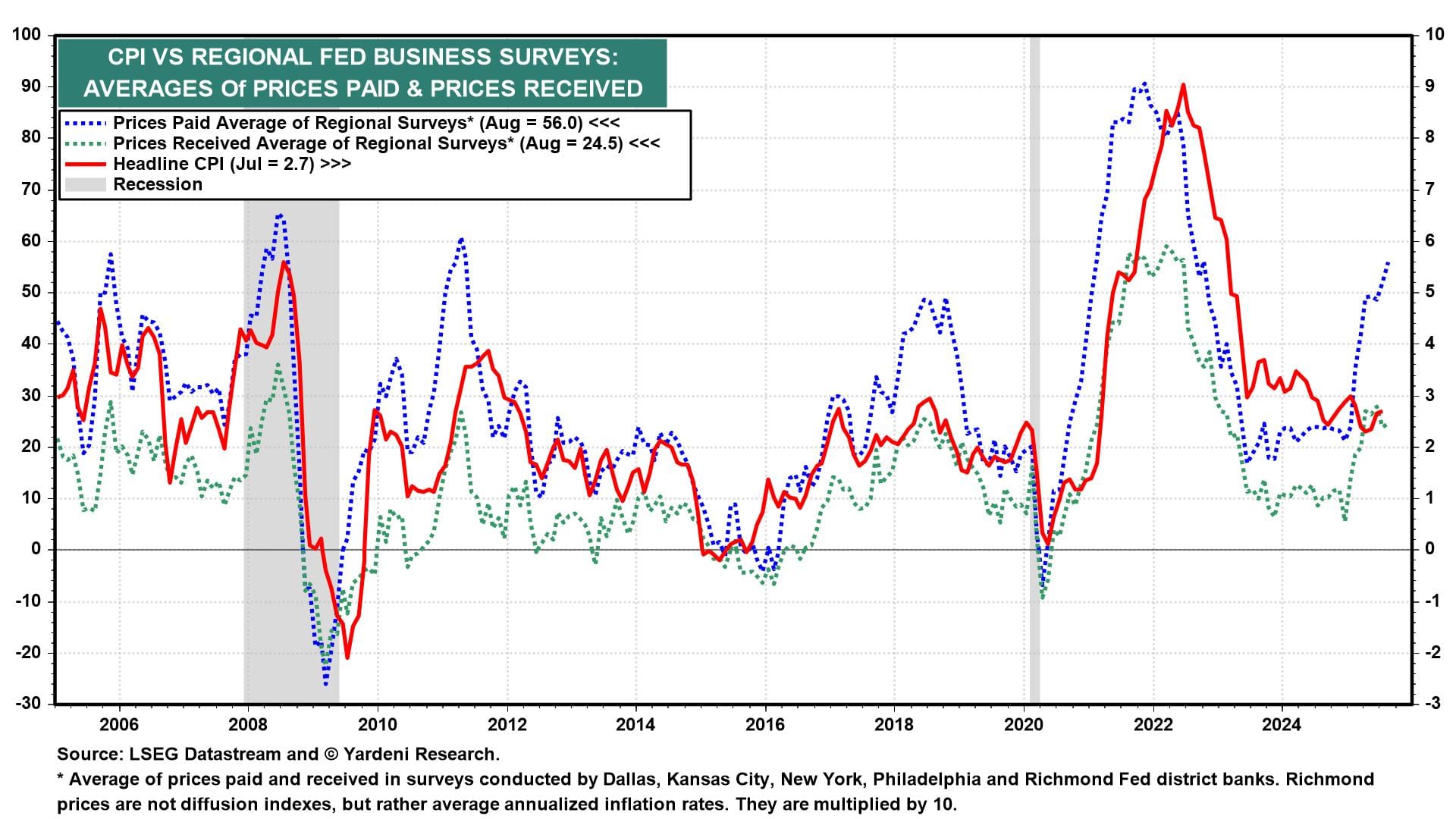

(2) CPI. August's CPI (Thu) may show that underlying inflation pressures are enough to keep the pace of Fed easing moves up for active debate. The Cleveland Fed's Inflation Nowcasting model expects the headline and core CPI inflation rates to increase 2.84% y/y and 3.05%, respectively. Again, the regional indexes of prices paid and received are also showing upward pressure on the CPI inflation rate.

(3) Initial jobless claims. With initial unemployment claims (Thu) hovering around the four-week average in the vicinity of 231,000, the rate of layoffs remains low. The trouble for businesses is more the availability of labor than weakening demand.

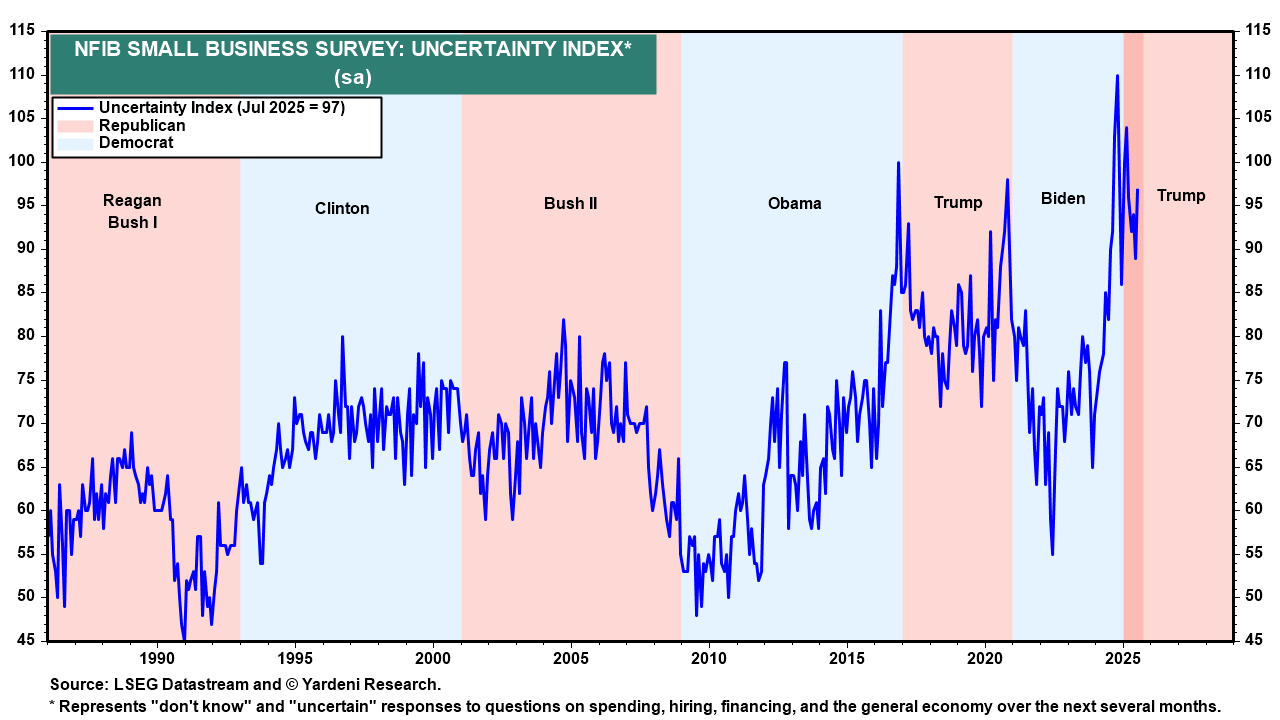

(4) NFIB survey. Given the widening range of options on the health of the labor market, surveys provided by groups like the National Federation of Independent Business (NFIB) take on greater importance. In July, NFIB’s small business optimism measure rose to 100.3, the highest level since February. Yet so did the uncertainty index, rising to a five-month high of 97 (chart). Such conflicting signals show why the trajectory of the Fed's rate moves isn’t as straightforward as markets believe.