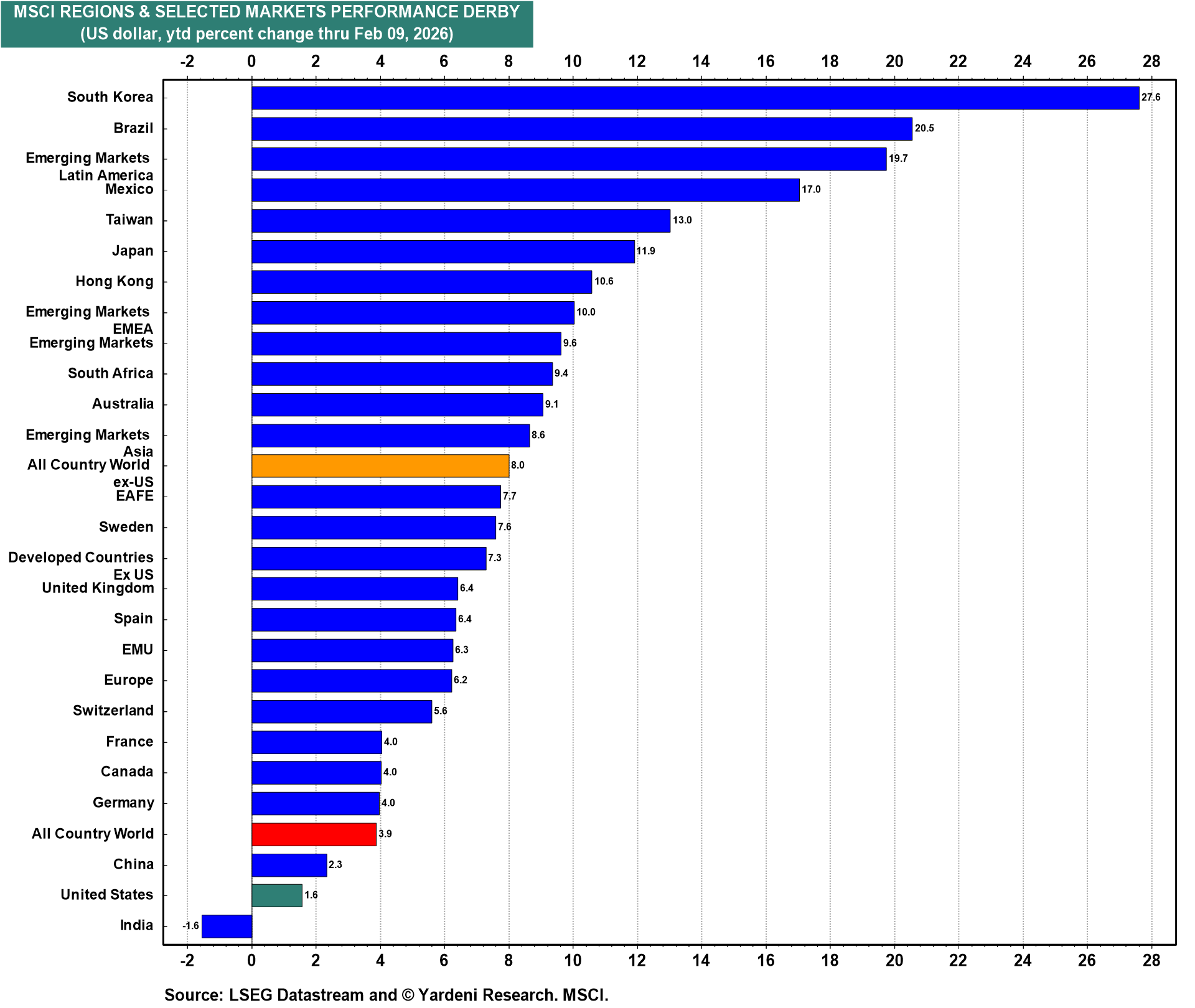

The US MSCI continues to underperform in the global stock market derby as it did last year (chart). Does this mean that American exceptionalism, which was touted as recently as 2024, is kaput? Is this another sign of de-dollarization? We don't think so. America remains exceptional, and foreigners continue to invest in the US. However, there are plenty of exceptional companies overseas that have also attracted global investors.

But why did the US MSCI start to underperform in 2025? Perhaps, investors have been impressed with the resilience of the global economy in the face of Trump's Tariff Turmoil last year. Late last year, we also concluded that the outperformance of the All Country World ex-US MSCI might be sustainable for a while, as global investors sought to rebalance away from the US because it accounted for a whopping 65% of the All Country World MSCI's market capitalization.

So far, the star performers in the global MSCI derby have been South Korea, Brazil, Mexico, Taiwan, and Japan. All of them, except Japan, are included in the Emerging Markets MSCI. Japan's stock market rose by as much as 5.7% today after the LDP won a "supermajority" (two-thirds of the seats) in Sunday's House of Representatives election. This result effectively removes political gridlock, allowing the government to proceed with fiscal programs to stimulate the economy.

The ratios of the US MSCI to the Emerging Markets MSCI (in local currencies and in US dollars) have been on an upward trend since 2010 (chart). These ratios peaked at the start of 2025 and have been trending lower since then.