That's the basic message of the FOMC's minutes released today. The word "restrictive" was mentioned seven times mostly in the following context: "In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time."

The core PCED was up 3.7% y/y through September (chart). So the Fed won't cut the federal funds rate until inflation is closer to 2.0%. We optimistically think that could happen by mid-2024.

The first time Fed Chair Jerome Powell publicly stated that the central bank was "not even thinking about thinking about raising rates" was on June 10, 2020 during a press conference following the FOMC meeting, where the Fed decided to keep its benchmark interest rate unchanged at a range of 0% to 0.25%.

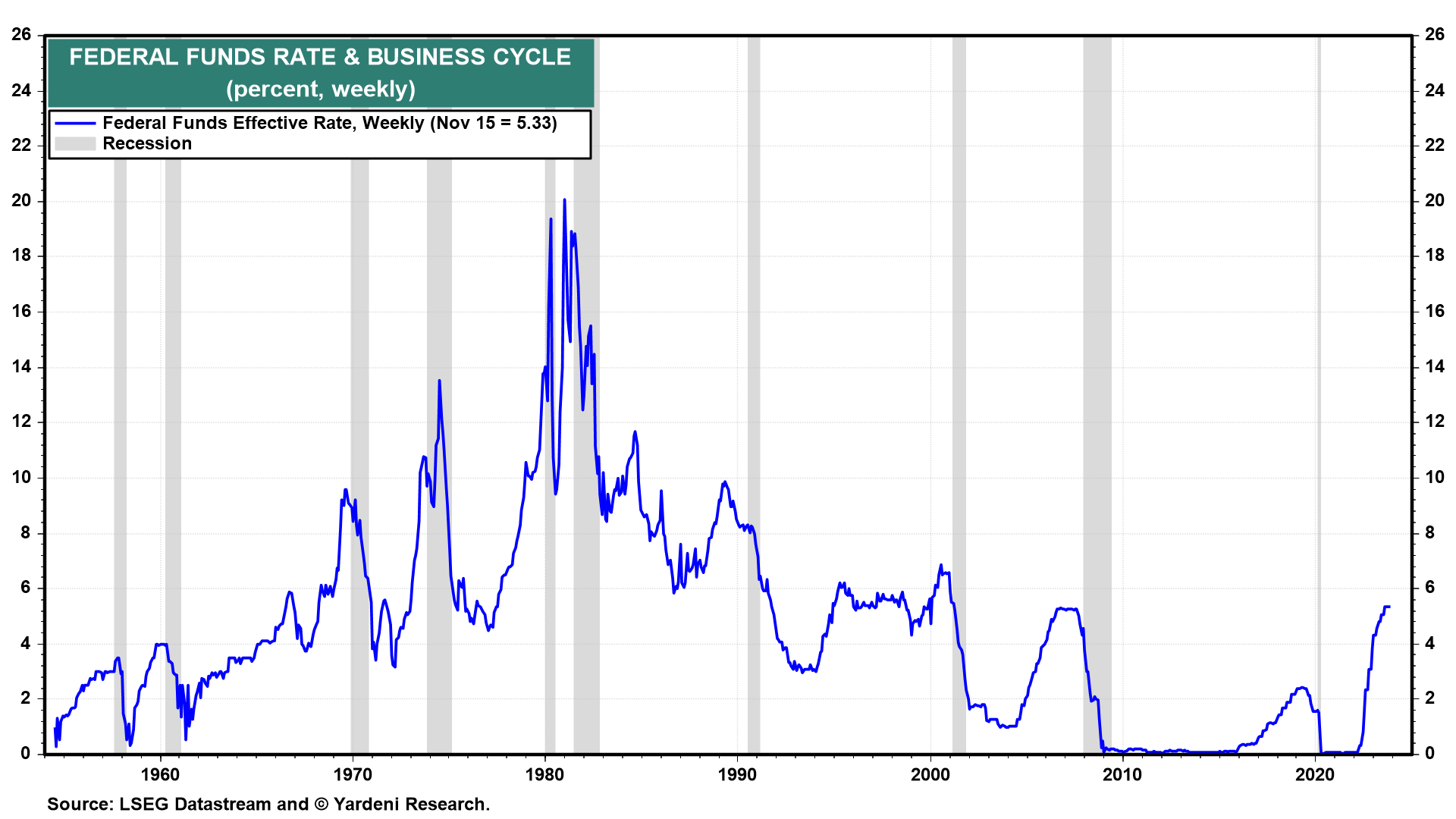

The rebound in inflation during the second half of 2021 forced Powell and his colleagues to start thinking about raising interest rates, which is what they began to do aggressively in March 2022 (chart).