We warned you that they would be back soon. The FOMC's blackout period ended last Thursday. Fed officials have been squawking like hawks again since Friday. They are all sending more or less the same message. They are aiming to continue to hike the federal funds rate in 25bps increments a couple more times to 5.00%-5.25%. That should be restrictive enough to bring inflation down, but it will have to stay there for quite a while to do the job. However, it might have to go higher if inflation doesn't continue to moderate. They also are doing their best to hammer stock and bond prices so that financial conditions remain tight.

Today, Federal Reserve Bank of New York President John Williams delivered that message in a live interview at The Wall Street Journal’s CFO Network Summit in New York. He started off by endorsing the FOMC's December projections for the federal funds rate: "[T]he vast majority of my colleagues put in the funds rate ending this year between 5 and 5 ½ percent, with quite a few at 5 ¼ to 5 ½. My view is that still seems a very reasonable view of what we’ll need to do this year in order to get the supply and demand in balance, and bring inflation down."

That's the relatively bullish scenario that stock and bond prices have been discounting since last October. However, Williams warned that if the party persists, the hammering will continue until morale is broken: "So looser financial conditions or more supportive financial conditions, you know, might imply a higher interest rate to make sure that we’re getting to the goals that we’re trying to achieve."

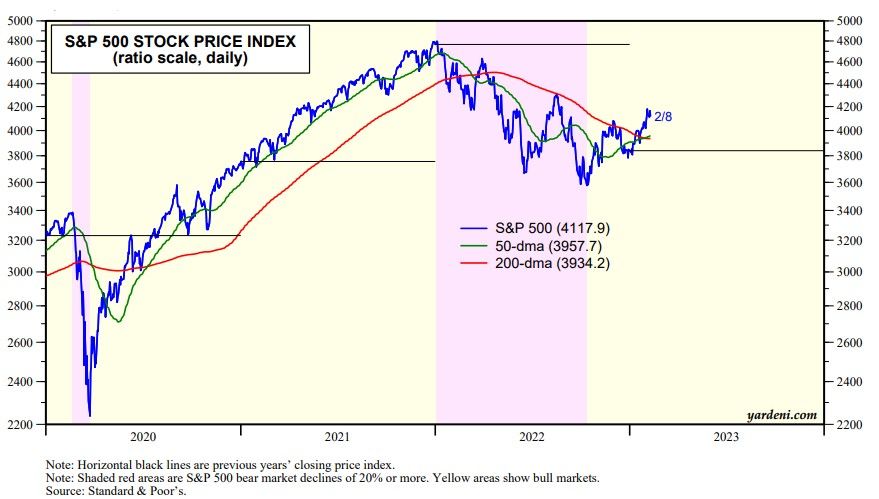

It may be hard to keep the current stock market rally going as long as Fed officials are threatening to hammer the economy and financial markets with higher rates (chart). Much will depend on January's CPI next Tuesday. A correction in the S&P 500 down to the uptrend line since October 12 is plausible.

The next FOMC blackout period won't start until March 11. Before that happens, Fed officials will have a few days to squawk about February's employment report, which will be released on March 3.