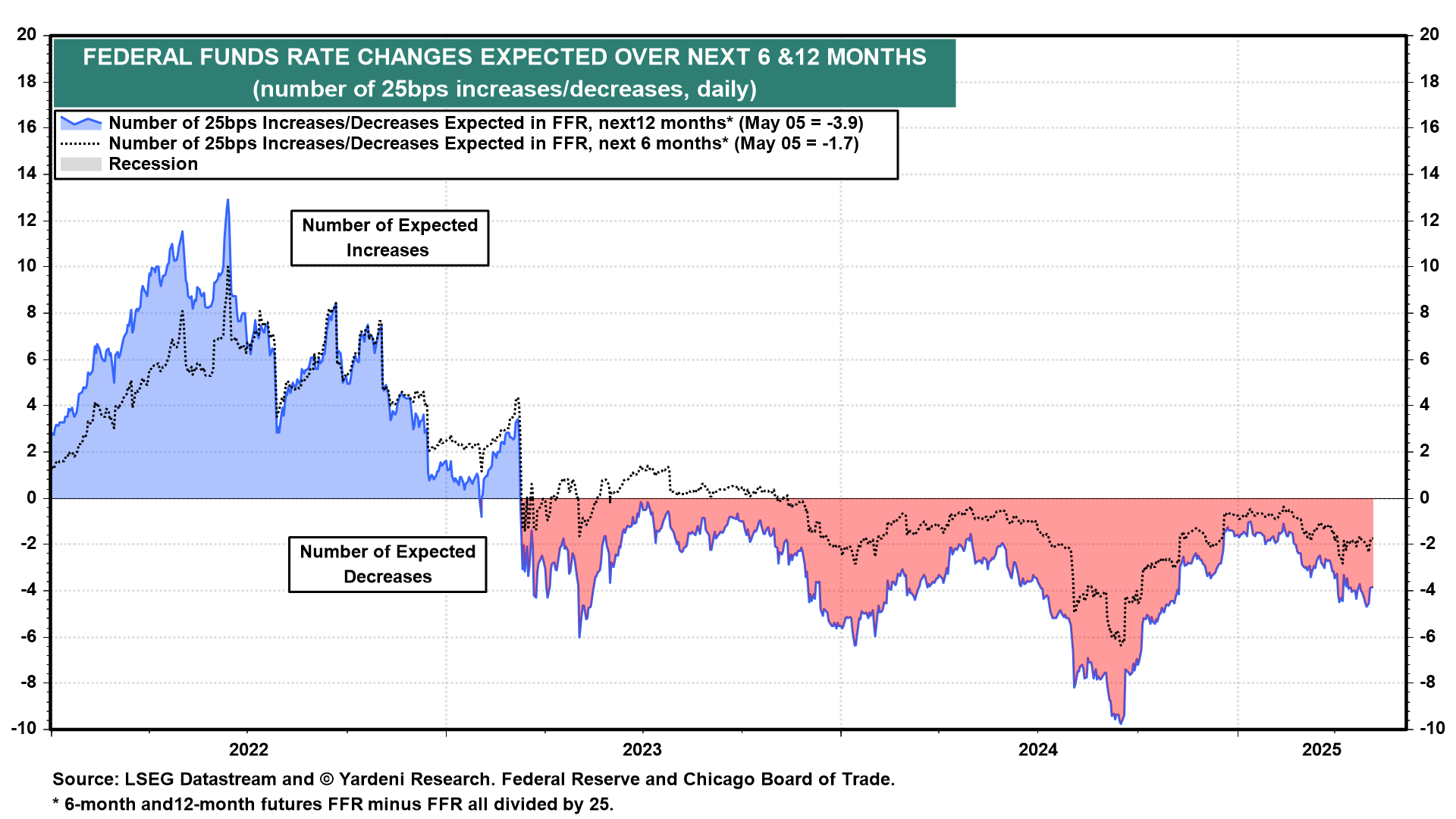

The federal funds rate (FFR) futures market has consistently been predicting several cuts in the FFR since March 2023 (chart). The Fed did deliver three rate cuts totaling 100bps from September 18 through December 18, 2024. Since then, Fed officials have said that they are in no hurry to lower the FFR again. Nevertheless, the FFR futures market is currently anticipating two rate cuts over the next six months and four rate cuts over the next 12 months. We've been in the none-and-done-in-2025 camp since the last rate cut. We remain in that camp.

We reckoned that the economy would remain resilient. We still think so, but Trump's Tariff Turmoil (TTT) is stress-testing the resilience of the economy. It will probably slow economic growth and boost inflation. A short bout of stagflation is likely.

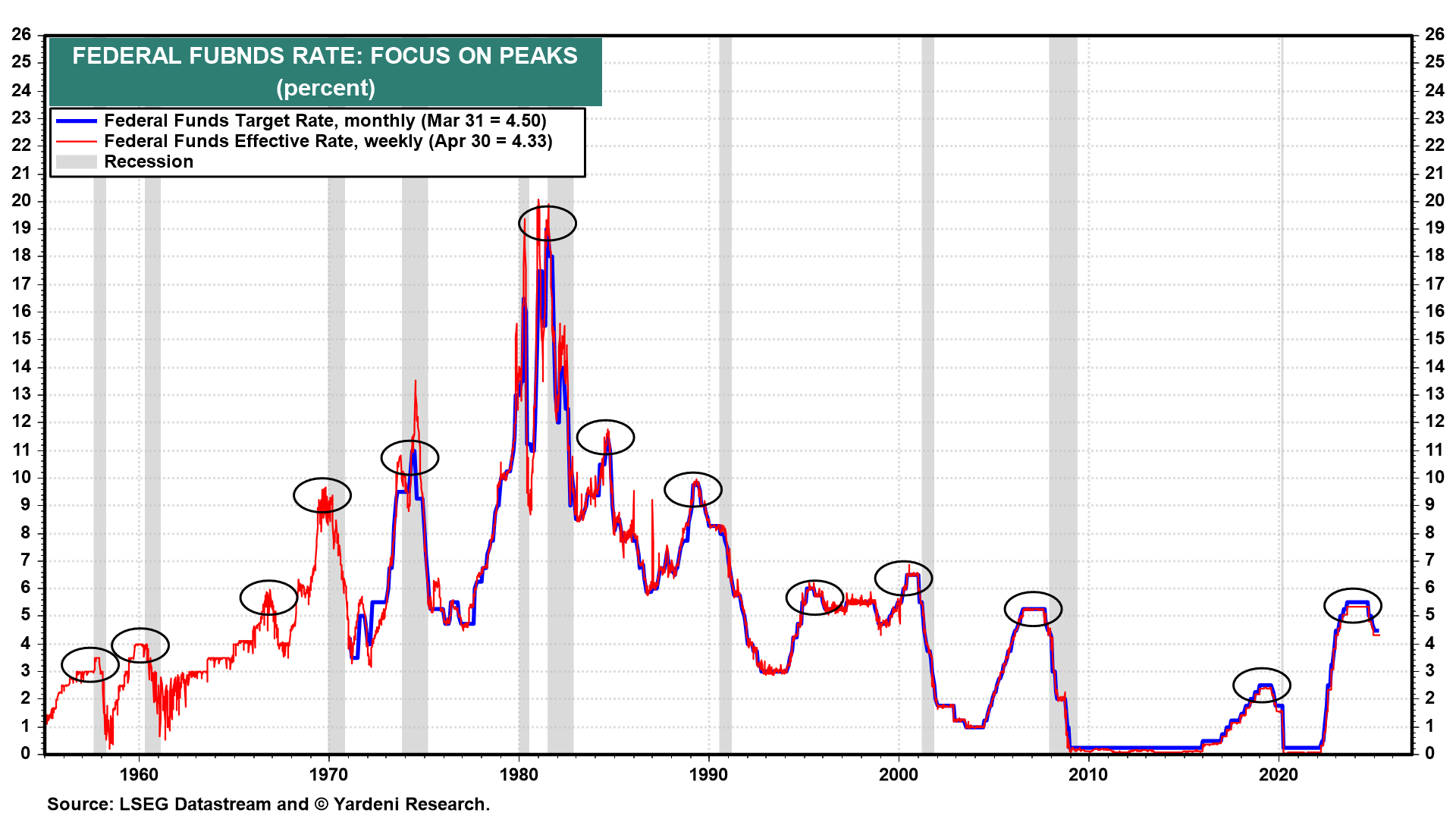

In the past, Fed tightening cycles caused recessions, which forced the Fed to lower the FFR (chart). So far, there has been no recession following the latest tightening cycle. Yesterday, we lowered our subjective odds of a recession from 45% to 35%, as TTT concerns are ebbing somewhat and the labor market remains robust. A recession is still possible. More likely is slower growth with higher inflation over the rest of this year. Given that likelihood, the Fed should remain on hold.

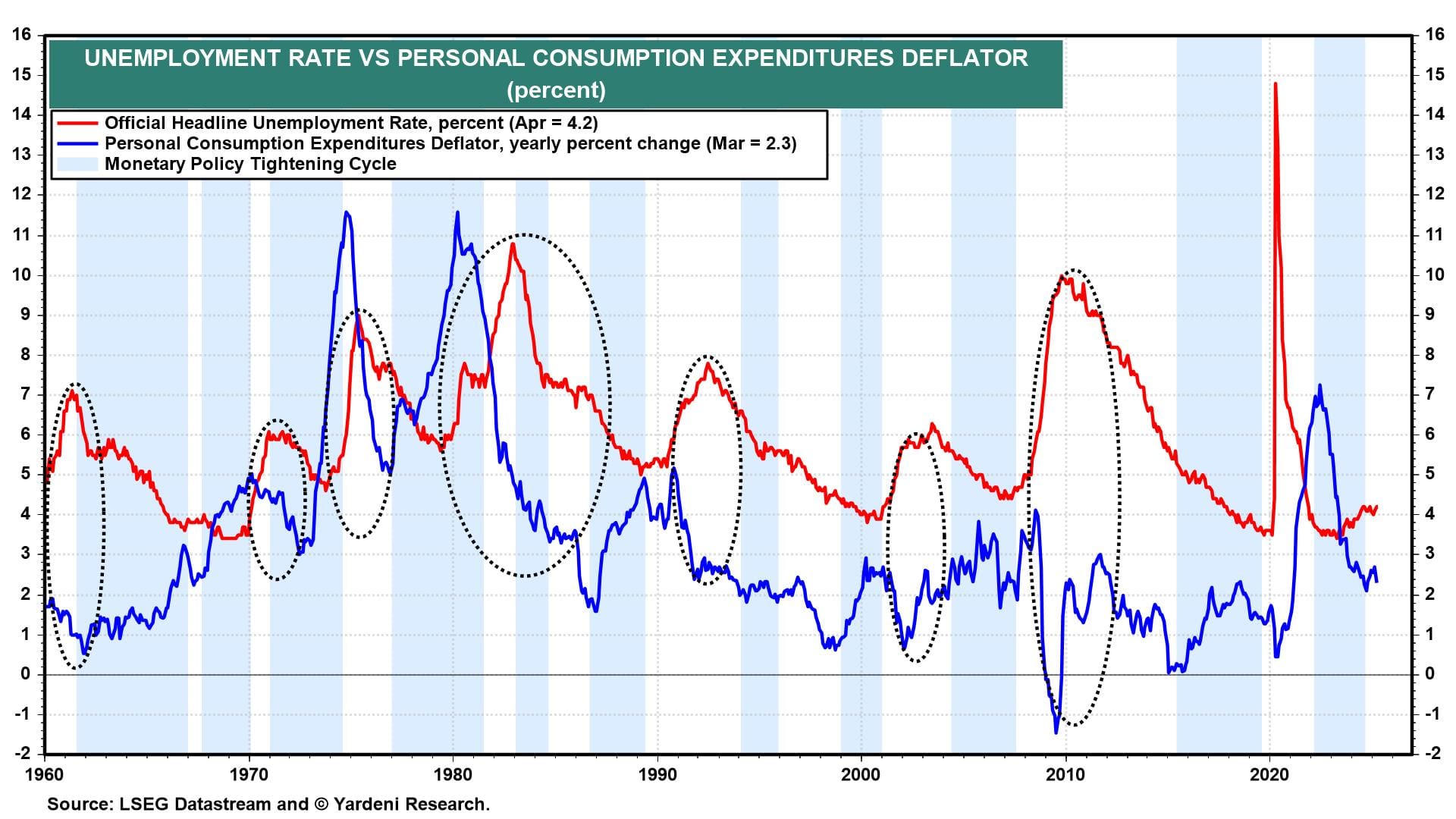

In the past, rising unemployment and falling inflation caused the Fed to lower the FFR (chart). This time, the unemployment rate remains low, and so does inflation. The former is likely to rise less rapidly than the latter in coming months. Given that likelihood, the Fed should remain on hold.

So far, initial unemployment claims are consistent with the unemployment rate remaining just above 4.0% (chart).