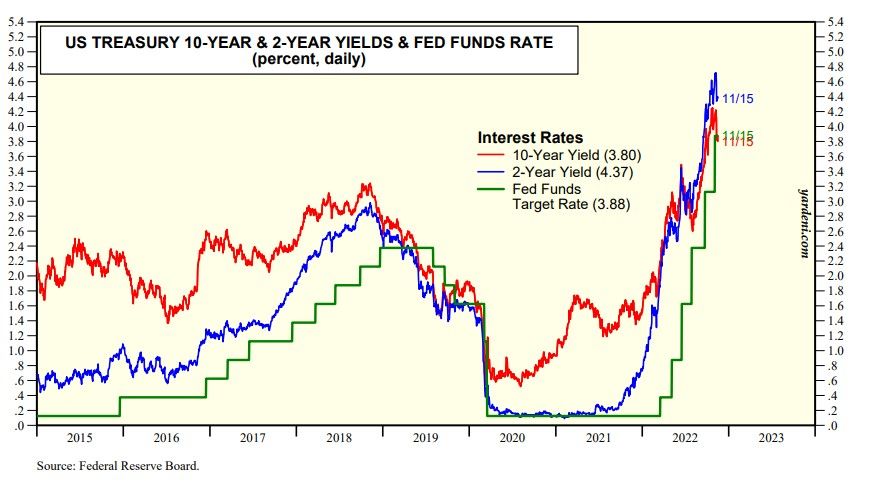

Last Thursday’s lower-than-expected CPI inflation rate for October was greeted with a huge rally by stock and bond investors. They continued to discount the possibility that inflation has peaked and is heading lower following today’s PPI report for October. As a result, they seem to be concluding that the Fed’s monetary policy tightening cycle will be peaking sooner rather than later, with a terminal federal funds rate just below 5.00% rather than above that level. Indeed, the two-year US Treasury note yield is down from 4.73% on November 3 to 4.35% today. In addition, they seem to be signaling that the 10-year US Treasury bond yield, which fell to 3.77% today, might have peaked at 4.25% on October 24.

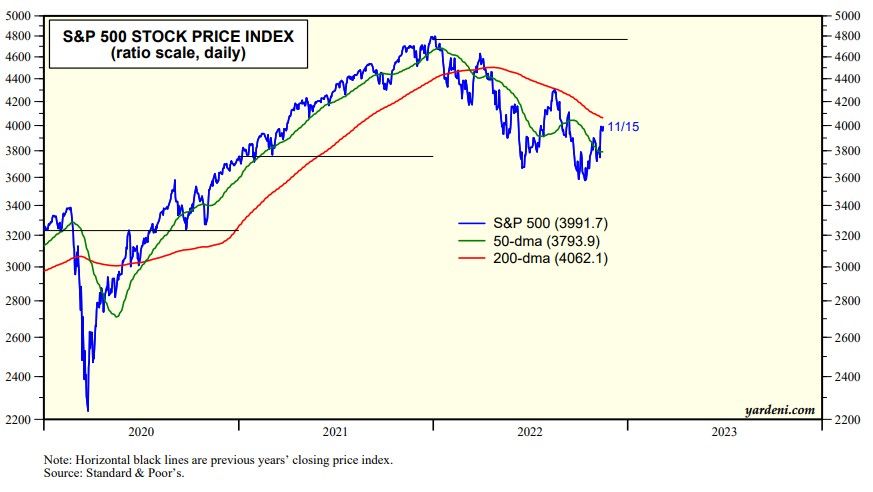

We don’t have a problem with any of that since it has been our forecast in recent months and supports our forecast that the bear market in the S&P 500 bottomed on October 12 at 3577. Admittedly, during the summer, we argued that the June 16 low of 3666 might have been the bottom. Our October 31, 2022 Morning Briefing was titled “Bear Bottoms.” We wrote: “The stock market has been working on forming a bottom since September, finding support around the June 16 low of 3666…” We predicted that the October 12 bottom would hold “if inflation shows clear signs of moderating in coming months, as we continue to expect.”

Our October 18 Morning Briefing was titled “Going Fishing.” We were fishing for reasons to call the bottoms in bond and stock prices. We observed that when the yield curve inverts, it’s time to anticipate a peak in the 10-year US Treasury bond yield, which we predicted would be 4.00%-4.25% in early November. We concluded that the June 16 low might provide support for the S&P 500 after all and that a year-end rally could push it back up to the August 16 high of 4305. So far, so good with the S&P 500 closing at 3991 today.