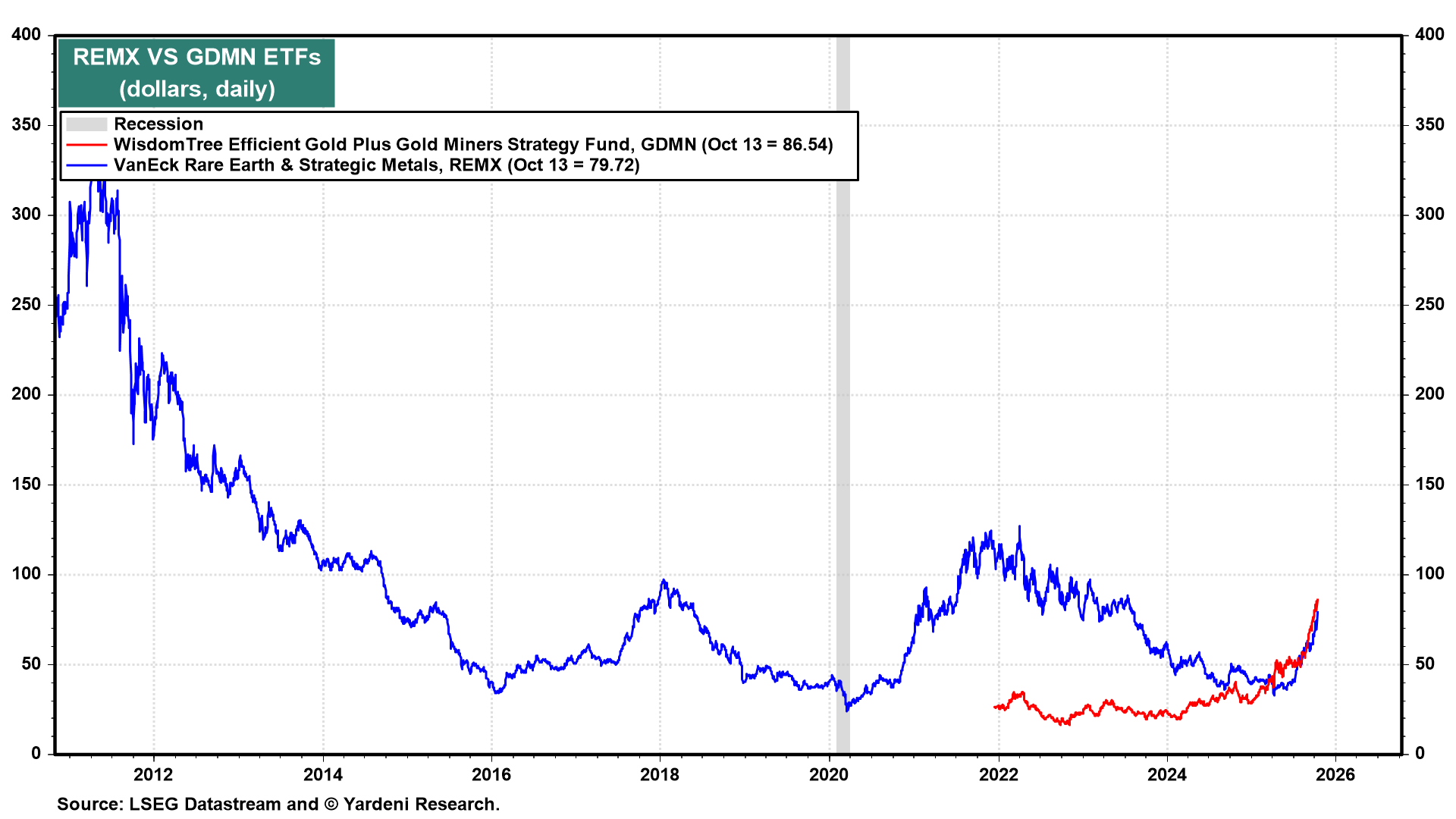

Investors are mining for gold and rare earth minerals. The SPDR Gold Shares ETF (GLD) and the VanEck Rare Earth & Strategic Metals ETF (REMX) are up 57.3% and 104.4% ytd (Fig. 1 below). The trading volumes of both have increased sharply in recent weeks (Fig. 2 and Fig. 3). Both have been benefiting from rising geopolitical tensions between the US and both Russia and China.

On October 21, 2024, we wrote: “Gold is traditionally viewed as a hedge against inflation, yet it has rallied to new highs as inflation has moderated. Perhaps gold is now a hedge against US economic sanctions. After Russia invaded Ukraine in February 2022, Russia’s foreign exchange reserves held by the US and its allies were frozen. Since then, some officials and commentators have proposed seizing those assets, which amount to nearly $300 billion, and using the proceeds to defend and rebuild Ukraine. Not surprisingly, China and other countries have been increasing their allocations of gold in their countries’ international reserves.”