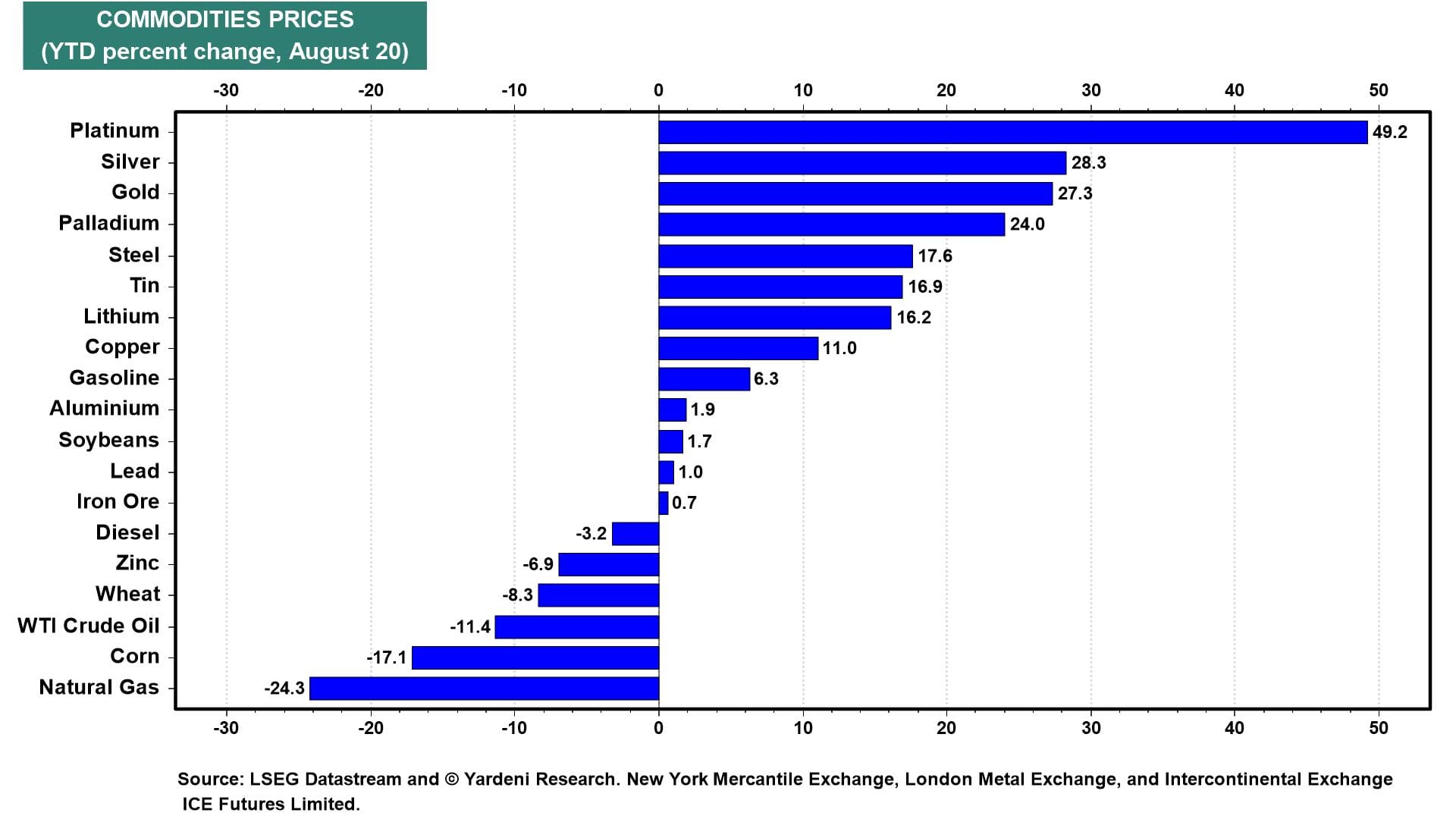

On balance, there aren't a lot of inflationary pressures in the commodity markets. Precious metals are on top of the leaderboard so far this year among the major commodity price gains (chart). Platinum, gold, and silver are ranked #1, #2, and #3. These shiny metals have become safe havens for many investors as a result of unsettling geopolitical crises in the Middle East and Eastern Europe. Global trade tensions have also heightened demand for these metals.

US tariffs on steel have boosted the price of this commodity. Lithium is also up ytd, by a percentage in the double digits, on supply concerns. The price of copper has been volatile this year. It is currently up 11.0% ytd. Iron ore is also up, but not by much, due to sluggish growth in China. That could change once the Chinese start building a $167 billion Tibetan mega dam, the largest one on Earth.

Grain prices are flat to down so far this year on record corn and soybean yields. The price of a barrel of crude oil is down this year on weak global demand and ample supplies. It may have more downside if there is a ceasefire between Russia and Ukraine. Natural gas is down despite Trump's deal with Europeans to buy more US natural gas. There is plenty of it and it will take some time before Europe is a major buyer of US gas.

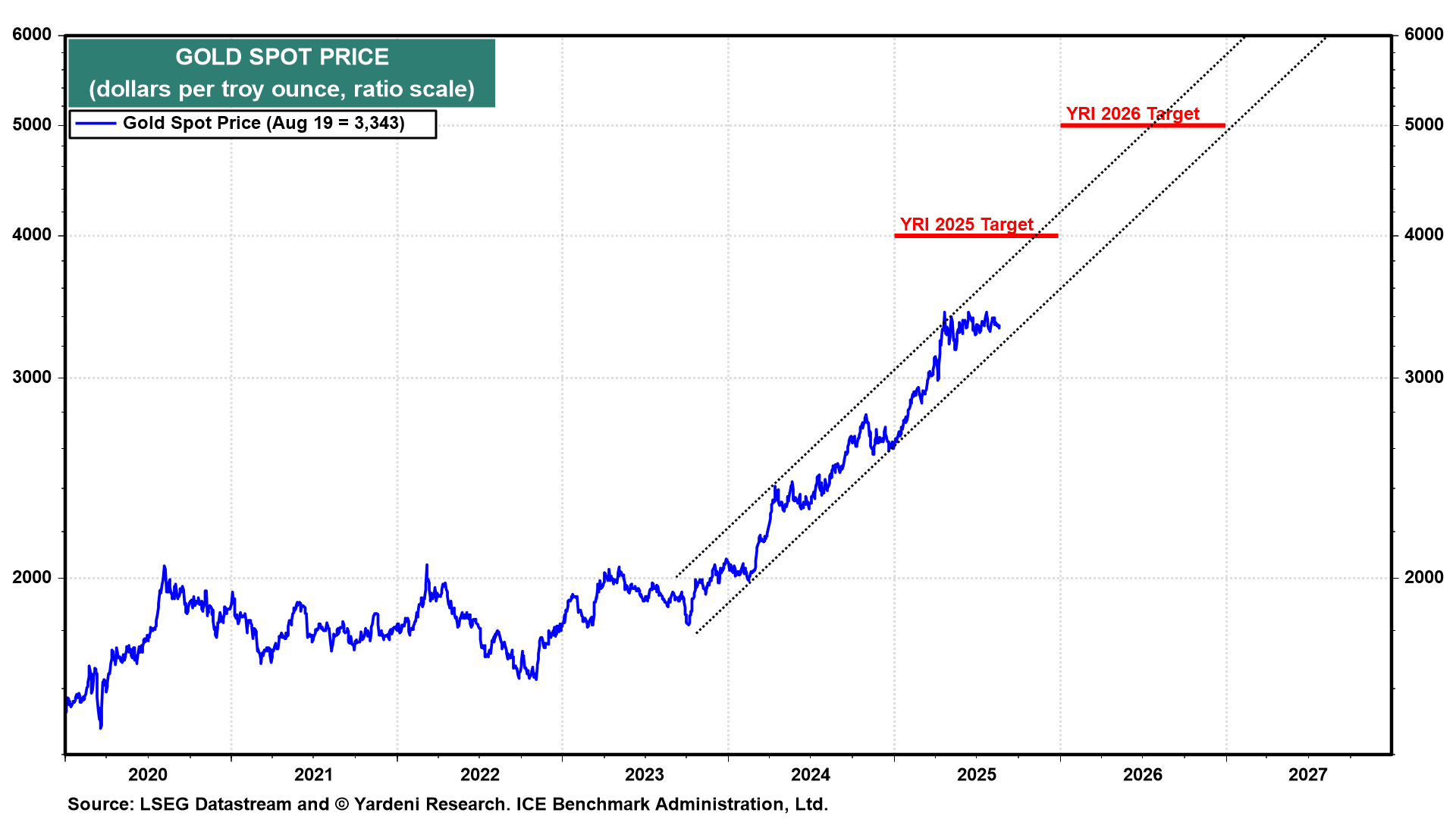

The spot price of gold has been consolidating its 2025 gain since the spring (chart). It topped out at a record high on April 22, i.e., before the US bombed Iran's nuclear facilities on June 21. The abating of Trump's Tariff Turmoil and the prospects of a ceasefire in the war between Russia and Ukraine have put a lid on the gold price for now. The price appears to be aiming to find support at the bottom end of the upward channel that started in late 2023, before moving to new record highs. We are still targeting a gold price of $4,000 per ounce by the end of this year.

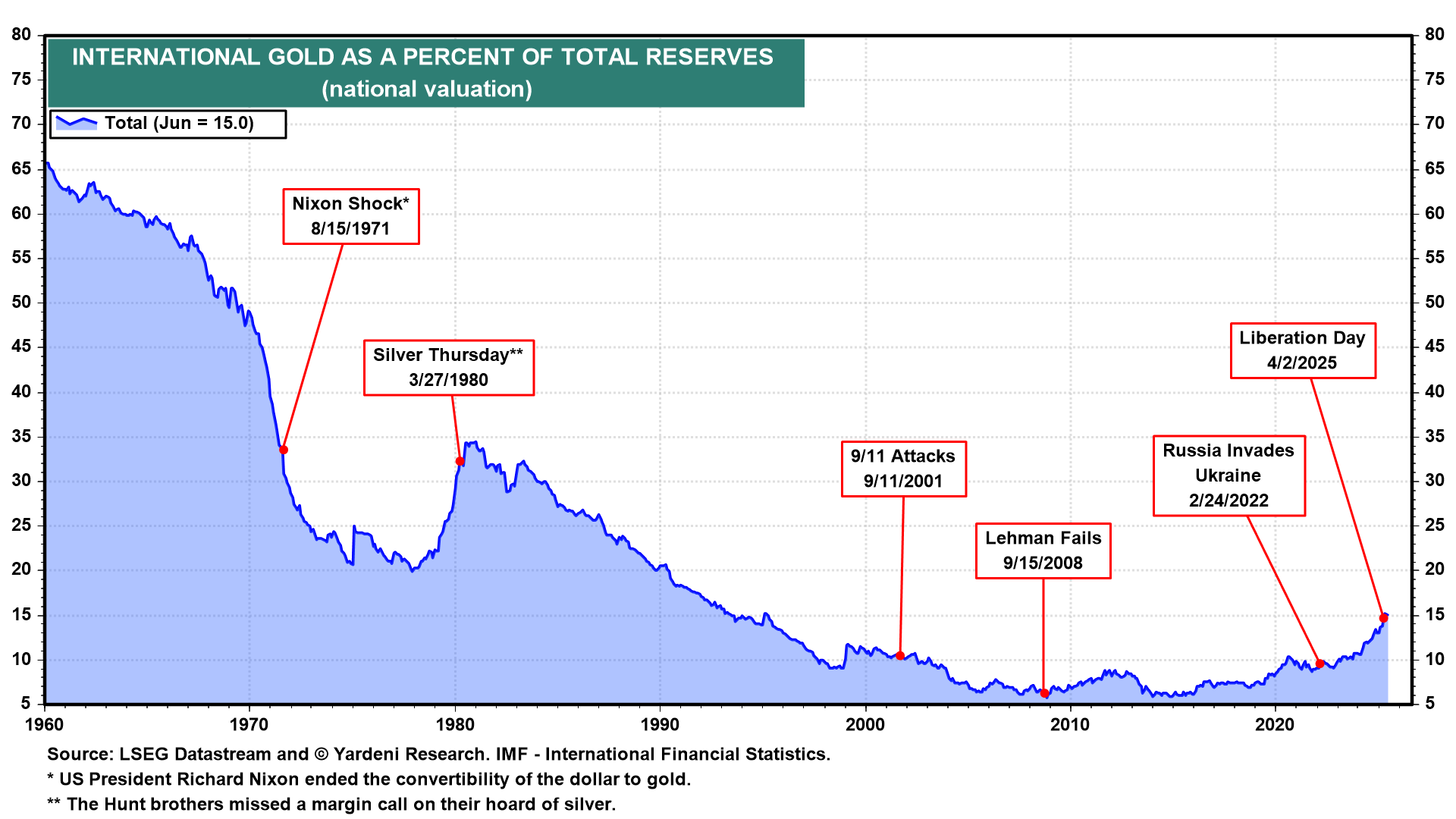

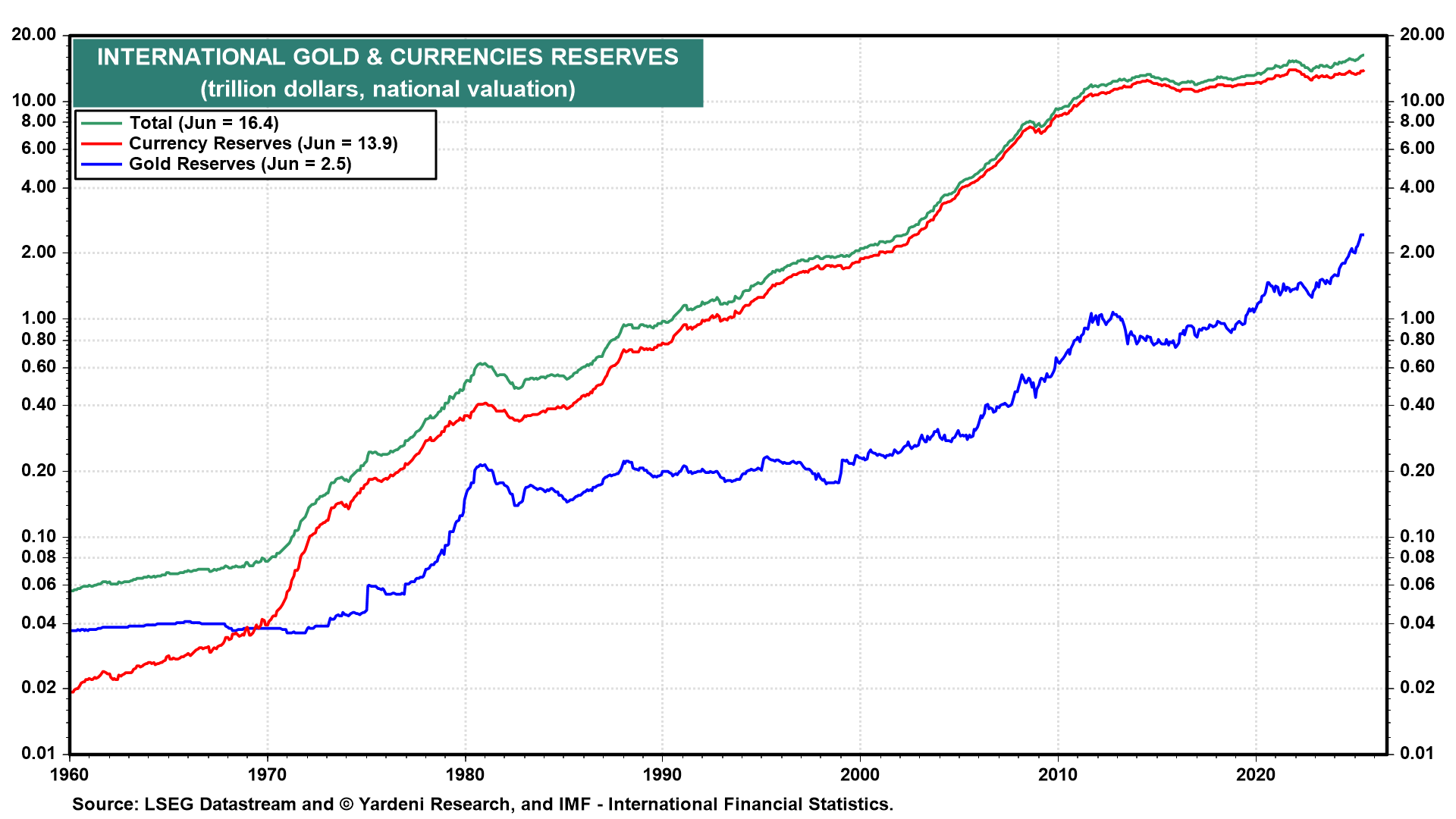

The price of gold has been rising ever since the US froze the foreign exchange reserves of Russia after the country invaded Ukraine in February 2022. The central banks of countries that don't share America's values and interests have been buying more gold and selling dollars (chart).

During June, international reserves rose to a record $16.4 trillion, consisting of $13.9 trillion of currencies and $2.5 trillion of gold.

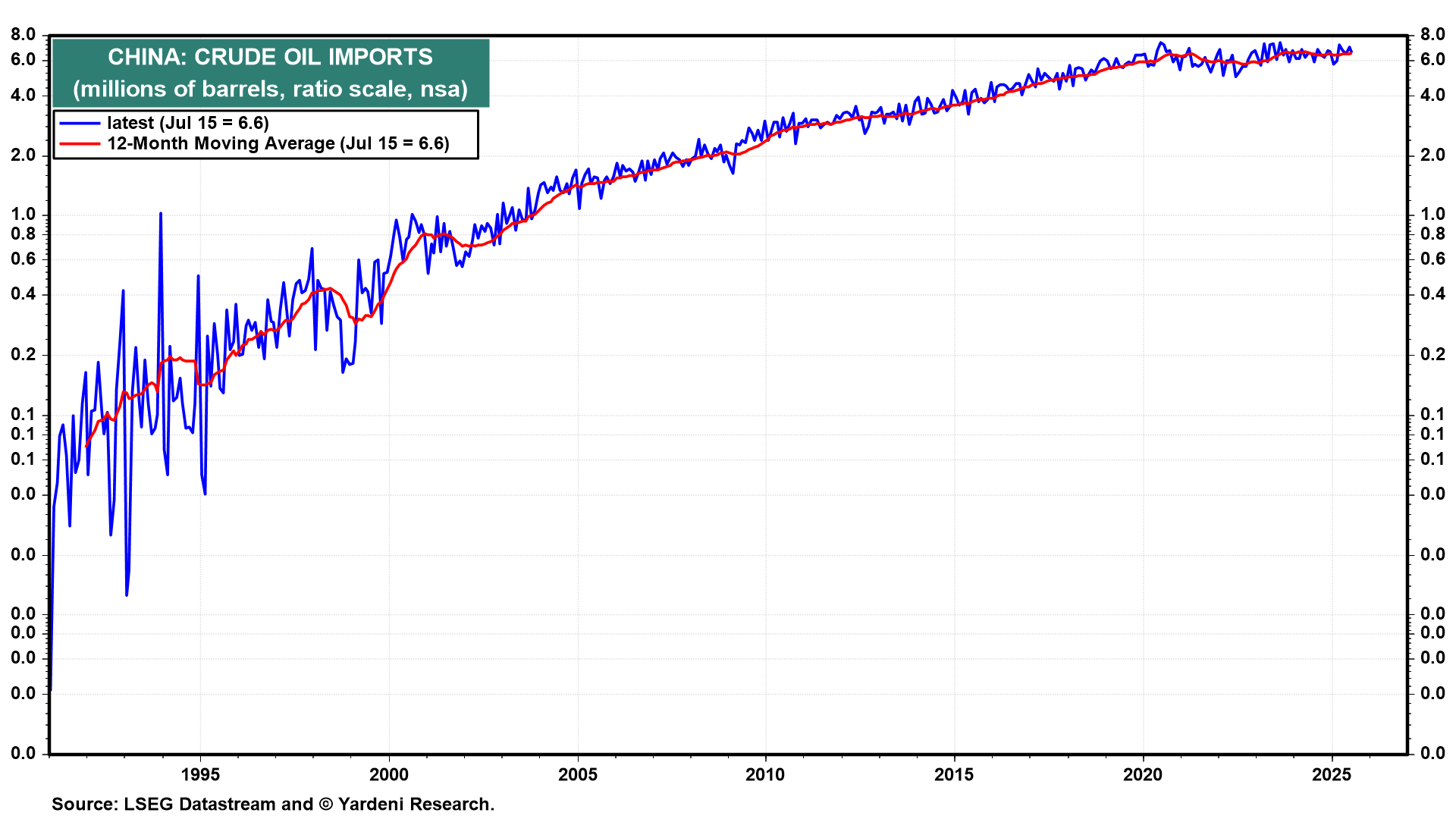

By the way, helping to keep a lid on oil prices is the flattening of Chinese crude oil imports (chart). That may be because the Chinese are driving more EVs.