Good news bears were on the loose today. It was a risk-off day in financial markets despite strong earnings and economic news. Nvidia reported better-than-expected Q3 results yesterday after the market closed. This morning, we learned that payroll employment rose more than expected in September and that initial unemployment claims remained subdued last week. Nevertheless, it was a bad day for stock investors.

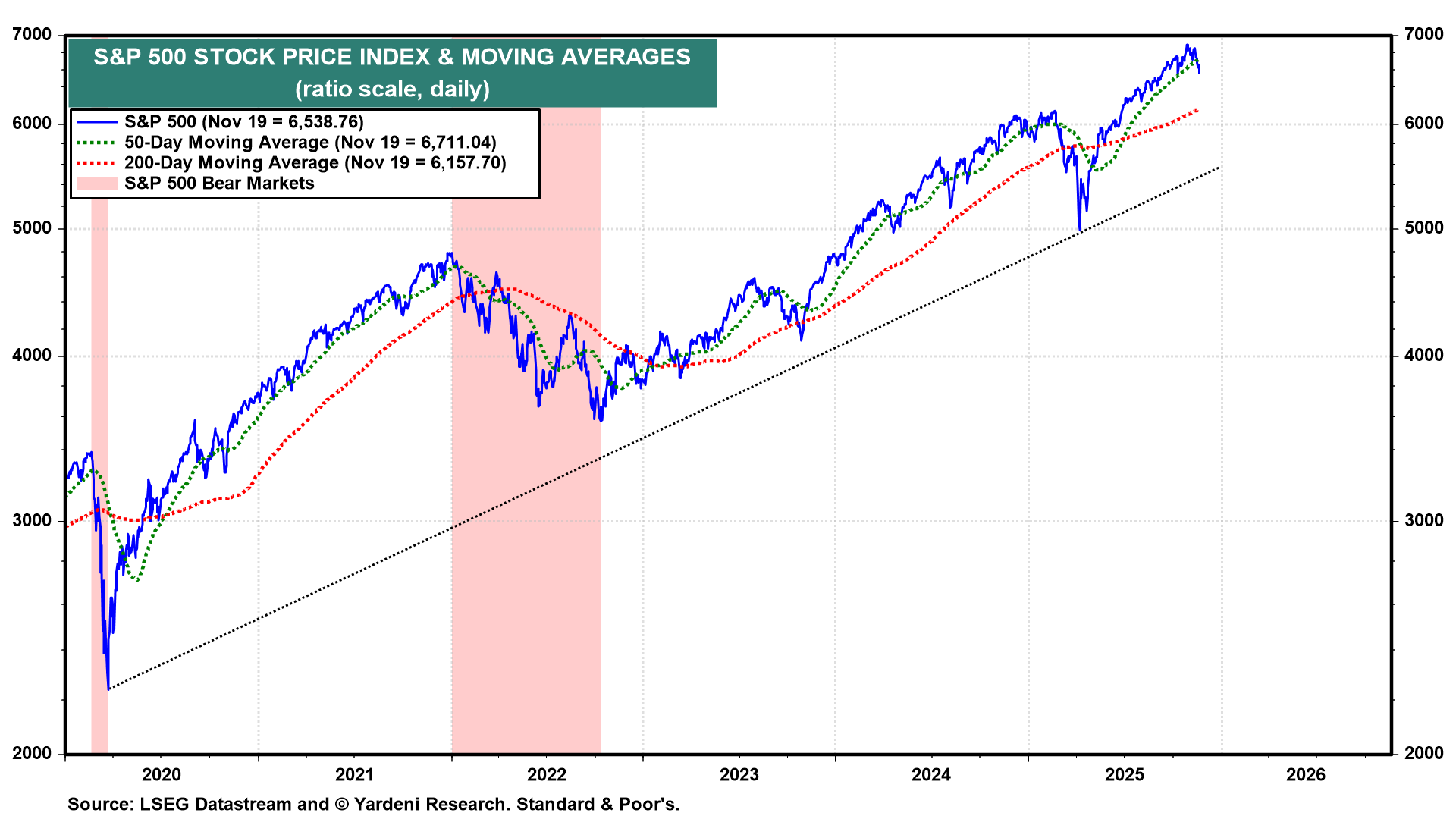

The stock market pullback that we expected at the start of this month may be turning into an outright correction, especially for the Nasdaq. The S&P 500 is down 5.1% from its October 29 record high. The Nasdaq is down 7.8% over this period (chart). Both fell below their 50-day moving averages today. We doubt that either will fall to their 200-day moving averages, currently at 6,157.70 and 20,158.34.

Let's review why sentiment has turned so bearish so quickly before we answer the question in the title:

(1) AI bubble Fears. Weighing on the stock market is widespread uncertainty about the impact of AI infrastructure spending on the earnings of the AI data center corporations. Nvidia's strong report didn't do much to resolve the known unknowns about AI spending. Also unnerving investors are recent reports that Softbank and Thiel Macro sold all their Nvidia shares. Michael Burry (the "Big Short") continues to raise doubts about the accounting practices of the major AI companies.

(2) Bitcoin's freefall. We attribute some of today's stock market selloff to the ongoing plunge in bitcoin's price (chart). There has been a strong correlation between it and the price of TQQQ, an ETF that seeks to achieve daily investment results that correspond to three times (3x) the daily performance of the Nasdaq-100 Index (chart).

We've attributed the weakness in bitcoin to the GENIUS Act, which was enacted July 18. It establishes a regulatory framework for payment stablecoins in the US, thereby eliminating bitcoin's transactional role in the American monetary system. It's possible that the rout in bitcoin is forcing some investors to sell stocks that they own.

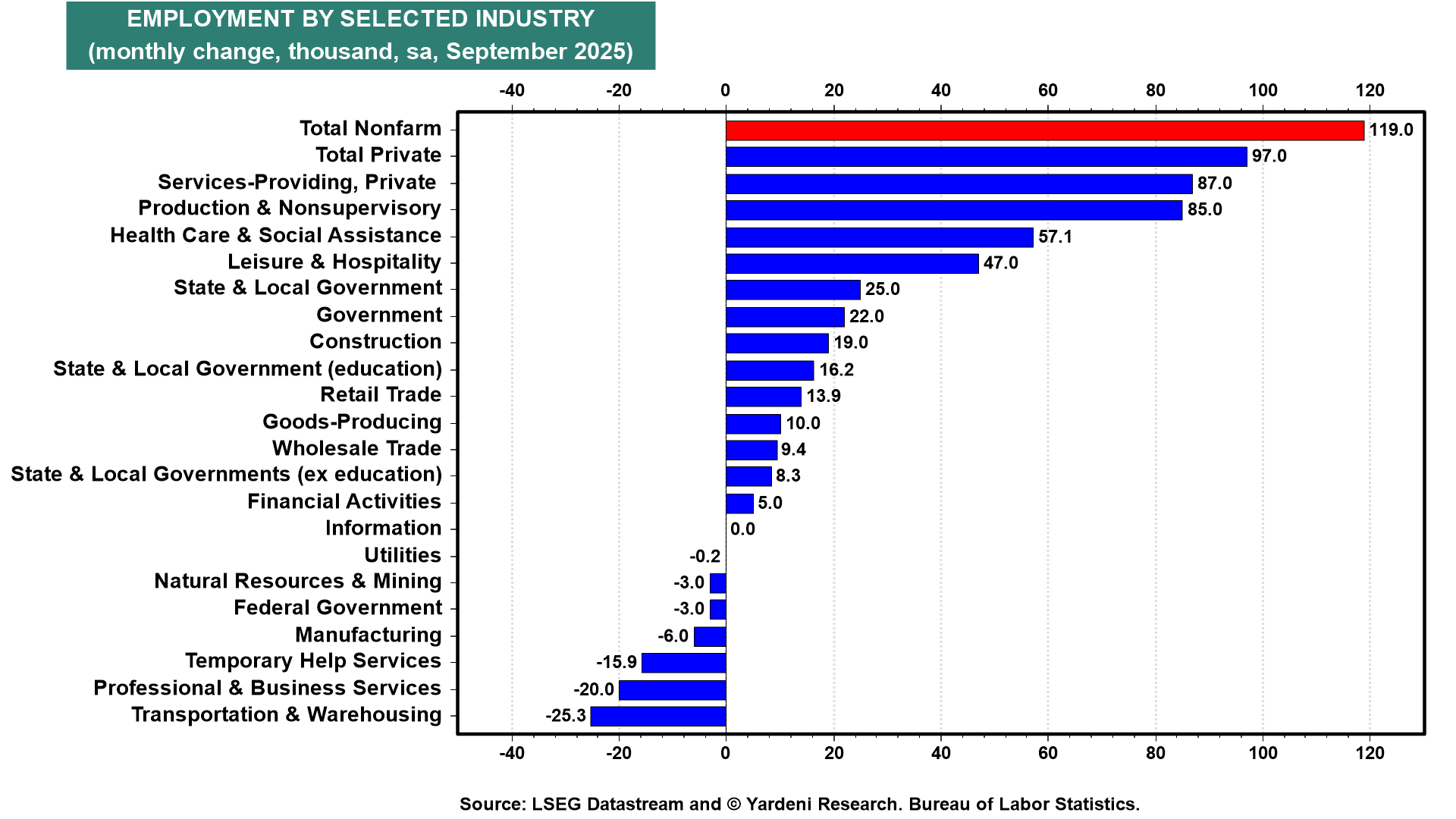

(3) Labor market & Fed concerns. Today's September employment report showed an increase of 119,000, more than twice the widely expected 50,000 (chart). The three-month average monthly change was 62,300. Most economists now agree that the "breakeven" payroll gain is between 30,000 and 50,000. However, the unemployment rate edged up to 4.4% from 4.3% in September.

Investors are confused about what the Fed will do next. Stronger-than-expected employment reduces the likelihood of a Fed rate cut at the FOMC's December 10 meeting. But the uptick in unemployment might convince the committee to go ahead with another 25bps rate cut. Today's talking Fed heads sounded cautious about doing so, adding to the stock market's downdraft.

(4) The economic growth question. Aggregate total hours worked in private industries has been flat at a record high in recent months through September (chart). That's concerning. Several factors explain why the labor market's job engine has stalled. Yet, real GDP has been running around 4.0% (saar) during Q2 and Q3. This implies robust productivity growth. Forthcoming productivity data should boost stock prices.

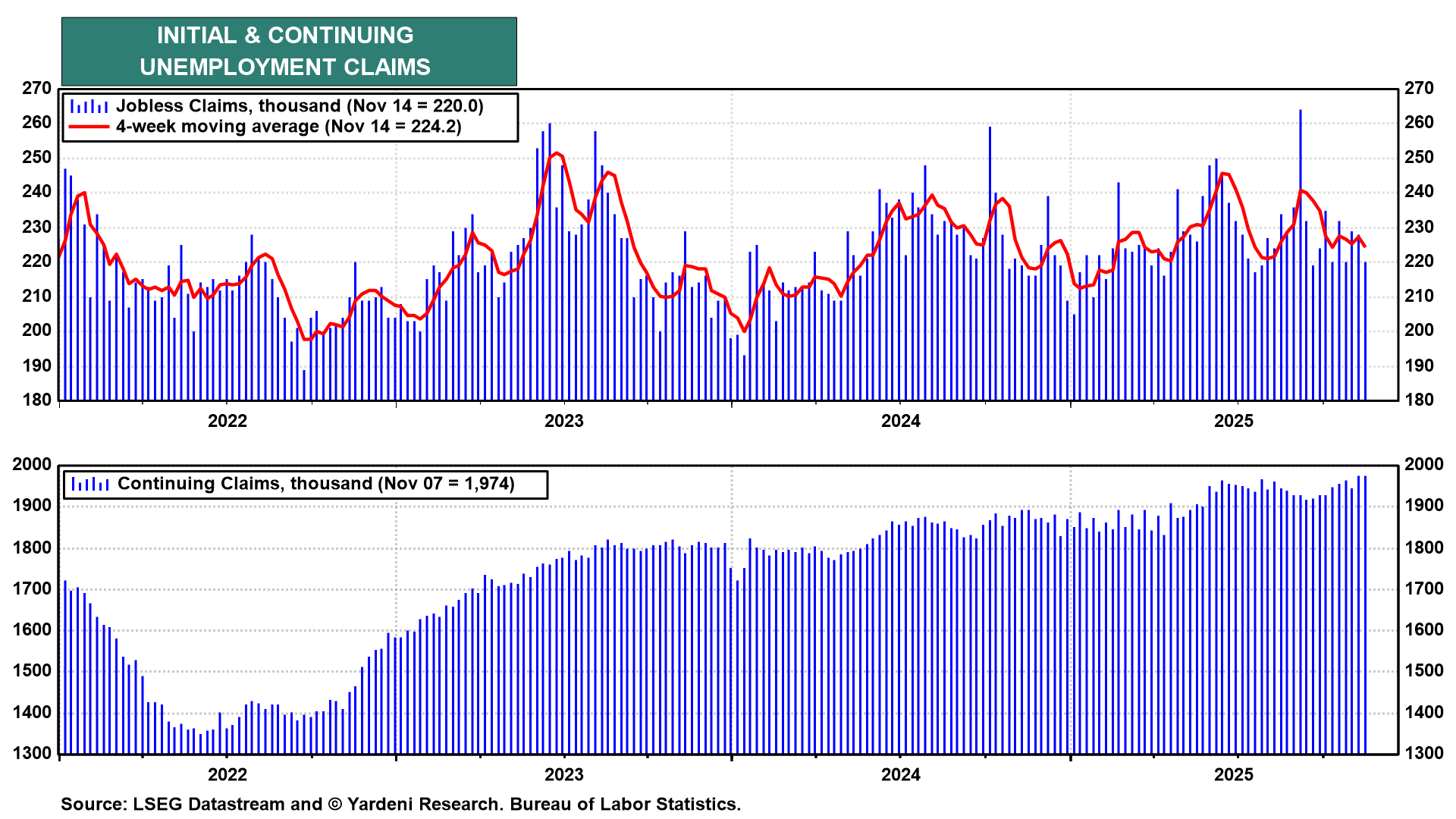

(5) Low fires and low hires. Today's unemployment insurance claims report also unsettled investors. Initial claims remain low, suggesting that layoffs are relatively low. However, continuing claims have been rising in recent weeks, indicating that it is harder to get hired, so the unemployed are staying unemployed for longer periods.

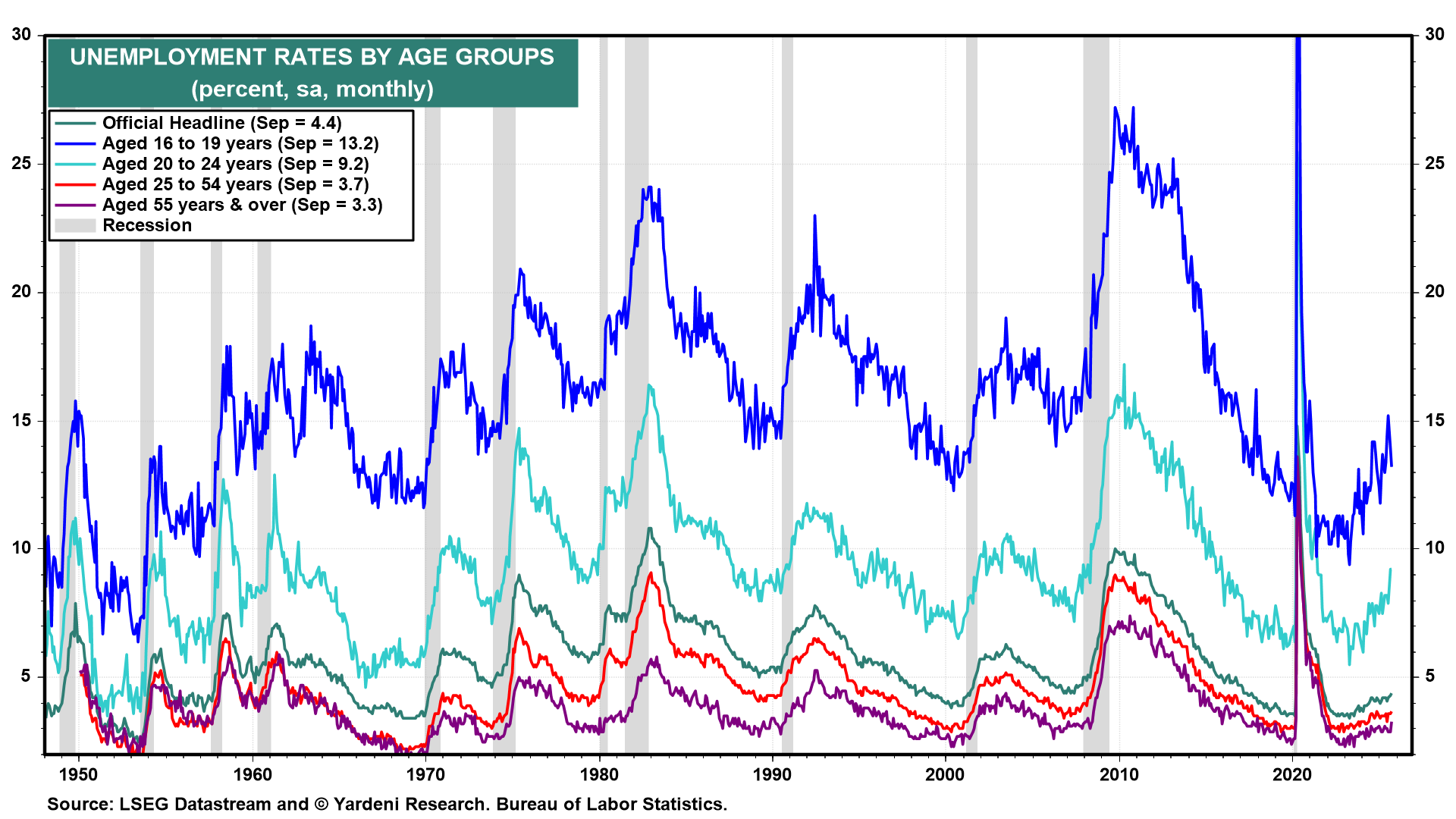

During September, the unemployment rate rose, driven by a jump in the jobless rate for 20-to-24-year-olds (chart). College graduates are having a tough time finding jobs. It is a problem that may be attributable to AI, and one that the Fed can't fix with rate cuts.

(6) Bottom line. We continue to bet on the economy's resilience and on productivity-led economic growth. Earnings should continue to rise well into next year and beyond. The quality of earnings is generally good. AI bubble jitters could weigh on the market for a while longer, creating buying opportunities among both the Magnificent-7 and the Impressive-493. If the pullback turns into a correction, we might have to push our 7000 yearend target for the S&P 500 into early next year. Meanwhile, rapidly spreading bearishness means that this pullback should end soon.