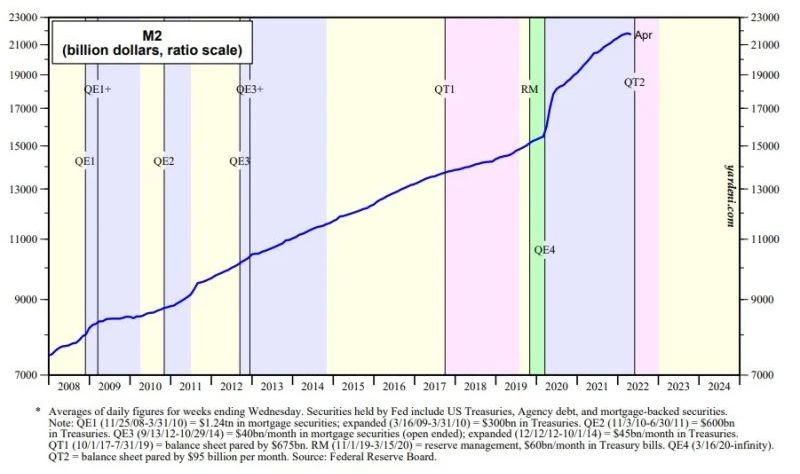

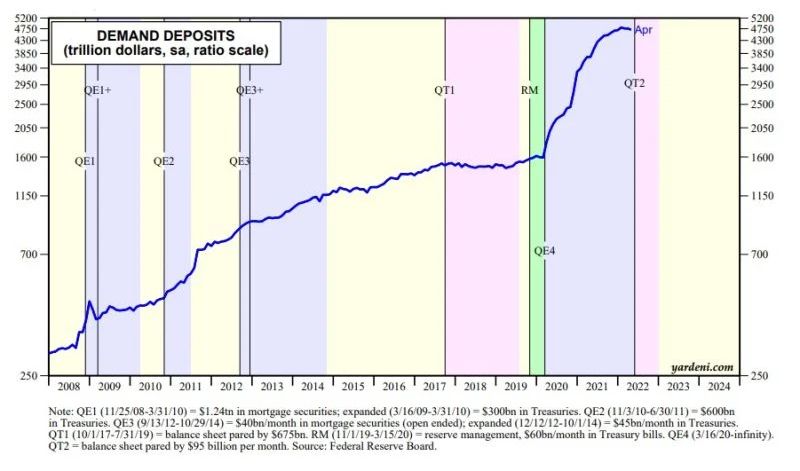

How worried should we be about April’s $81.2 billion drop in M2? And what about the $91.2 billion drop in demand deposits from January through April? Furthermore, the Fed is about to start a second round of quantitative tightening (QT2) in June. Won’t that dry up liquidity, causing a recession and further stock market losses? Maybe, but:

(1) M2 is still more than $3 trillion above where it would have been now based on its pre-pandemic trend line. The ratio of M2 to nominal GDP (i.e., the reciprocal of monetary velocity) has remained at a record-high 89% since mid-2020, up from 70% just before the pandemic.

(2) M2 continued to expand during the Fed’s first round of quantitative tightening (QT1) from October 2017 through July 2019. On the other hand, demand deposits were relatively flat. In any event, there was no recession back then, and stock prices continued to move higher.

(3) By the way, without seasonal adjustment, M2 was down only $6.6 billion during April.

In short, we wouldn’t be overly worried. With so much supportive liquidity remaining in the economy and with QT1 having triggered no recession, we don’t expect a recession this year or next. However, we are concerned about other recessionary developments, which have caused us to raise the odds of a recession from 30% to 40%.