Fed Chair Jerome Powell spoke at Stanford University today about the economy and monetary policy. He said, "I think we've gotten to what is, knock on wood, a pretty good place." He added, "We're using our tools to try to bring inflation down the rest of the way to 2%, while all the while keeping the economy strong as well."

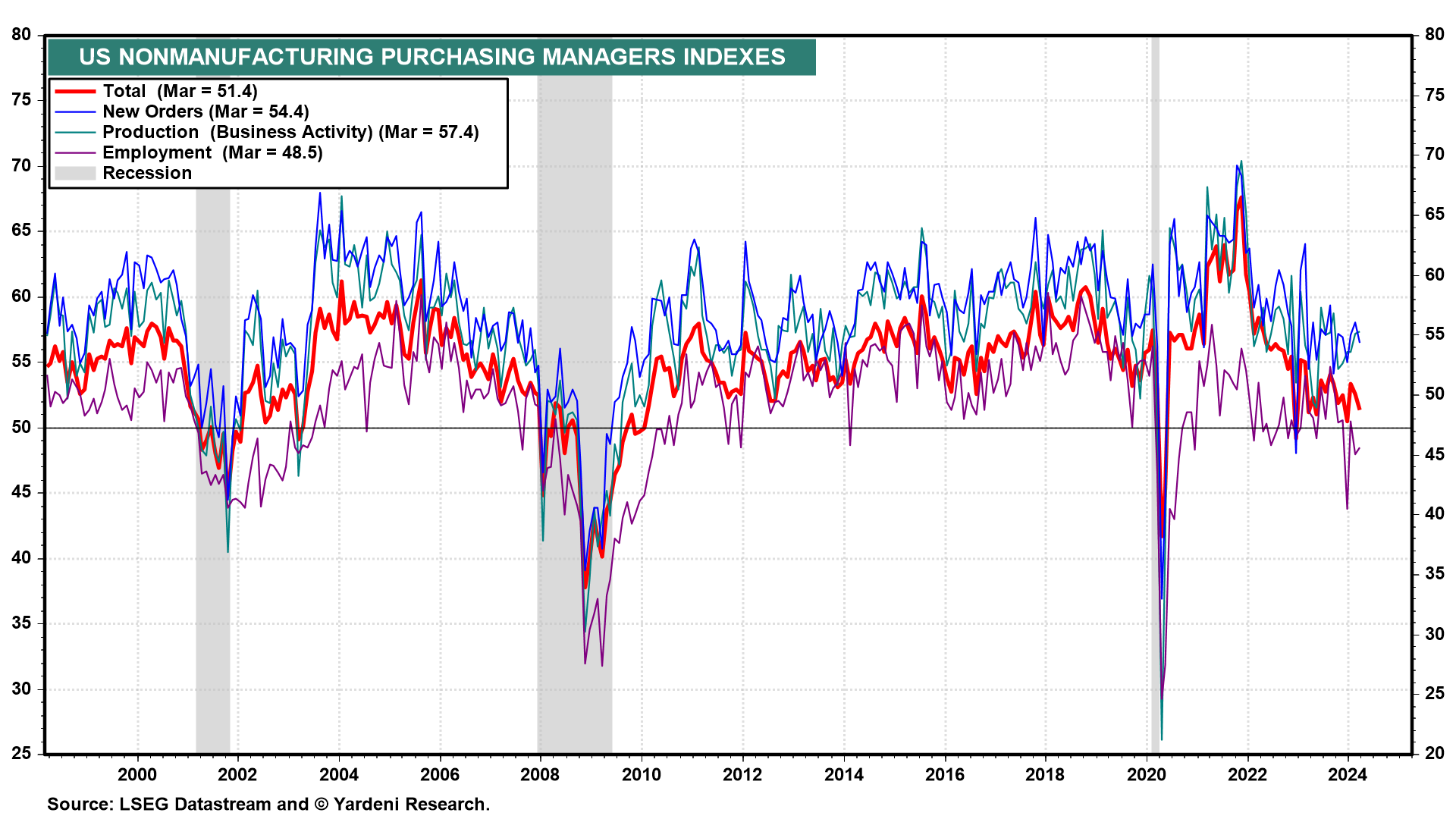

Today's data releases were mixed. According to ADP, private payrolls gained 184,000 during March—more than expected. The March NM-PMI was a bit weaker than expected at 51.4 (chart). But the new orders (54.4) and production (57.4) components remained strong. The employment index (48.5) has been relatively weak in recent months, but that doesn't square with the ongoing strength in services payrolls.

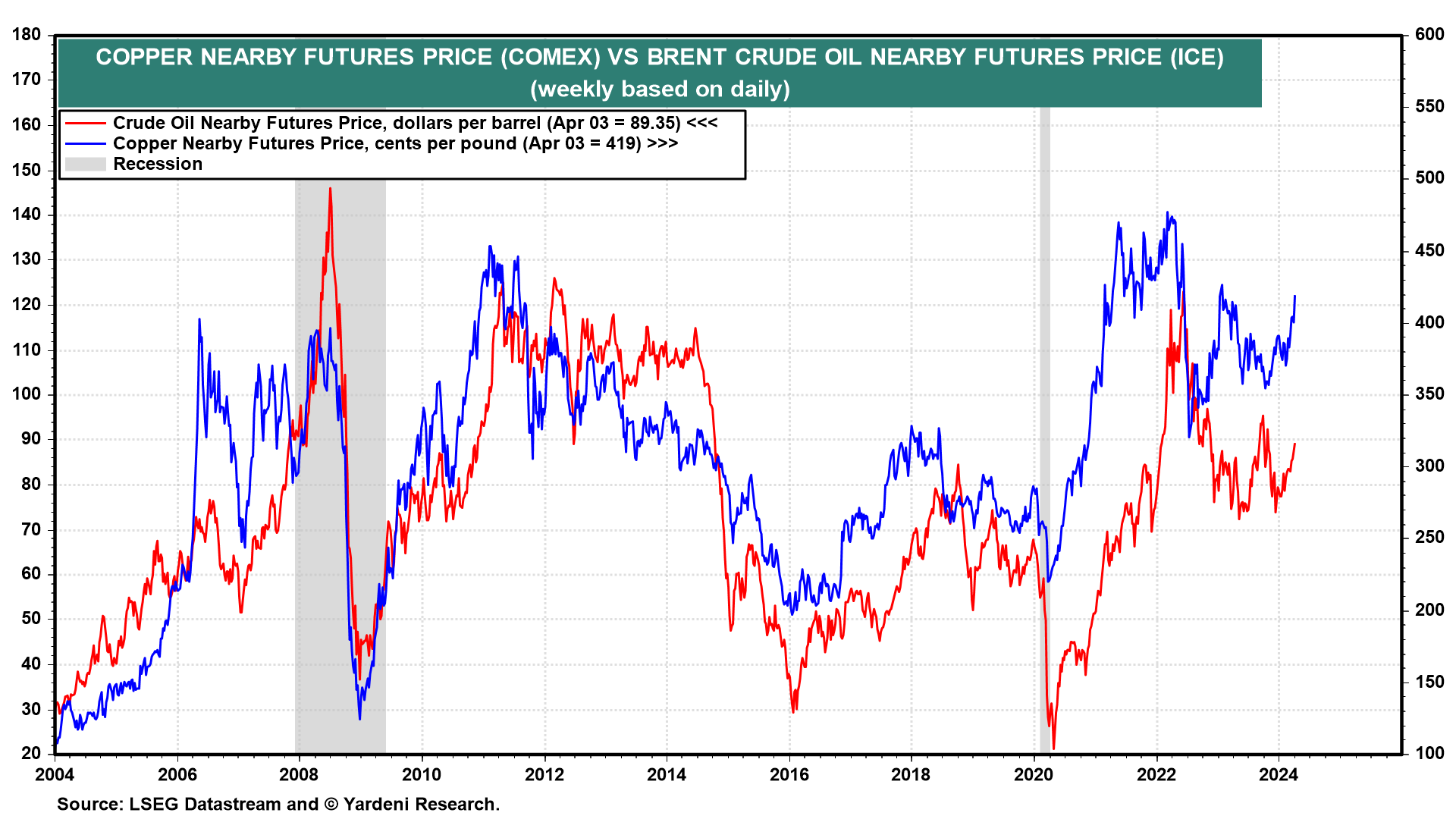

The price of copper continued to rebound suggesting that speculators are speculating that China's economy is improving as suggested by the the March Chinese M-PMI release (chart). The price of a barrel of Brent crude oil remains on the verge of breaching $90.

Stock prices were mixed today in line with our expectations for a pause in the powerful near-vertical rally since October 27, 2023. Apparently everyone agrees with Powell that the economy is in a "good place"--maybe too many people are thinking so.

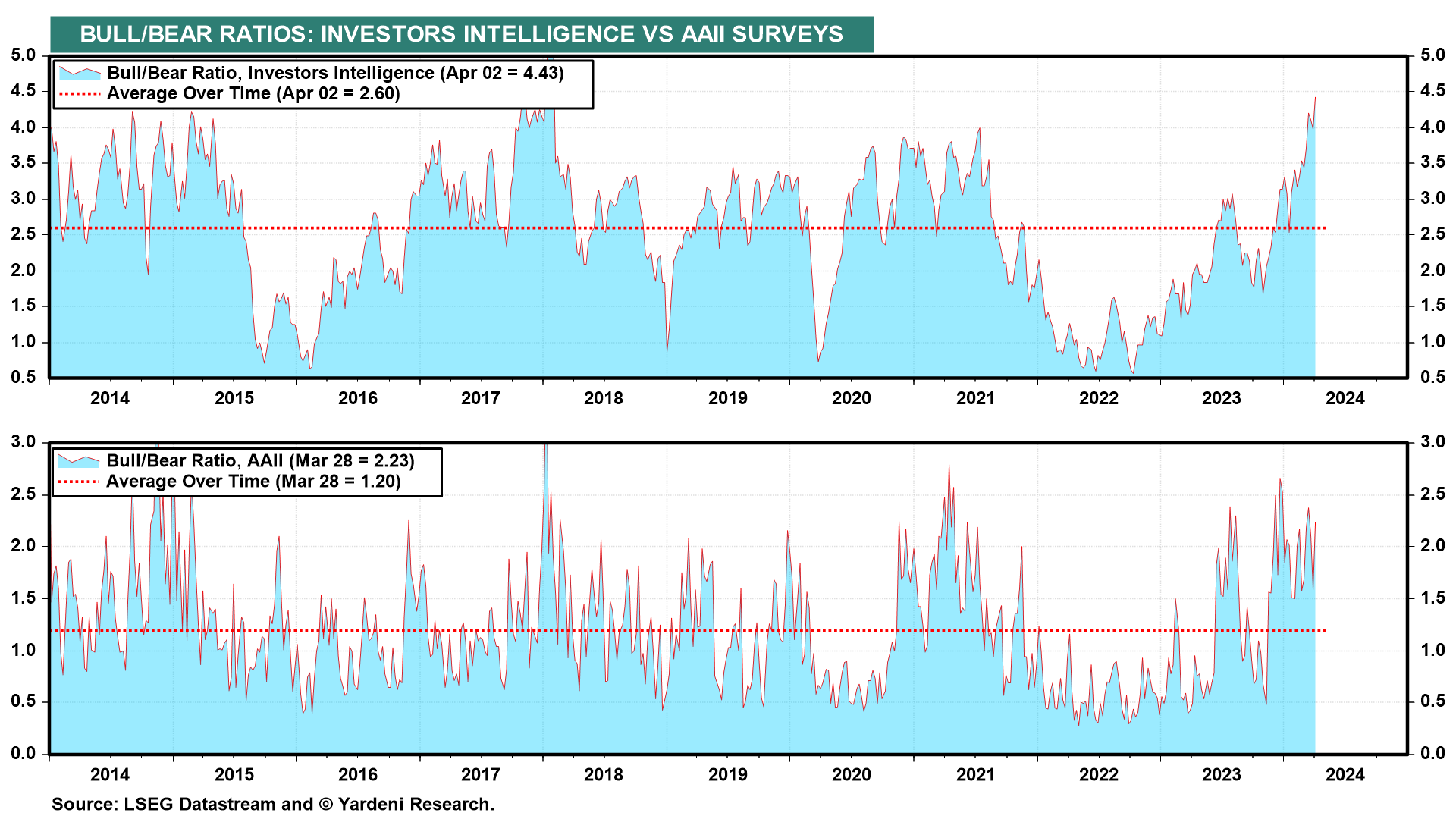

The Investors Intelligence Bull/Bear Ratio climbed to 4.43 this week—the highest since February 5, 2018 (chart). Bullish sentiment climbed for the second week to 62.5%—the most bulls since summer 2021. Meanwhile, bearish sentiment fell to 14.1% this week, the fewest bears since late January 2018. As of March 28, the AAII Sentiment survey also showed a sharp increase in bullishness relative to bearishness.