Like the late comedian Rodney Dangerfield, the dollar has been getting "no respect" recently. A few officials of the Trump administration want to see a weaker dollar. America's adversaries would like to replace it as a key currency. Doomsayers predict a major dollar crisis in response to the huge US trade and federal government deficits. We remain constructive on the dollar for the following reasons:

(1) The DXY dollar index remains in an upward channel, though it is retesting the lower bound of that channel (chart). DXY is a fixed-weight index that measures the value of the US dollar against a basket of six major foreign currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. The euro makes up nearly 58% of the index. It is unlikely that the euro will replace the dollar as the leading reserve currency, in our opinion.

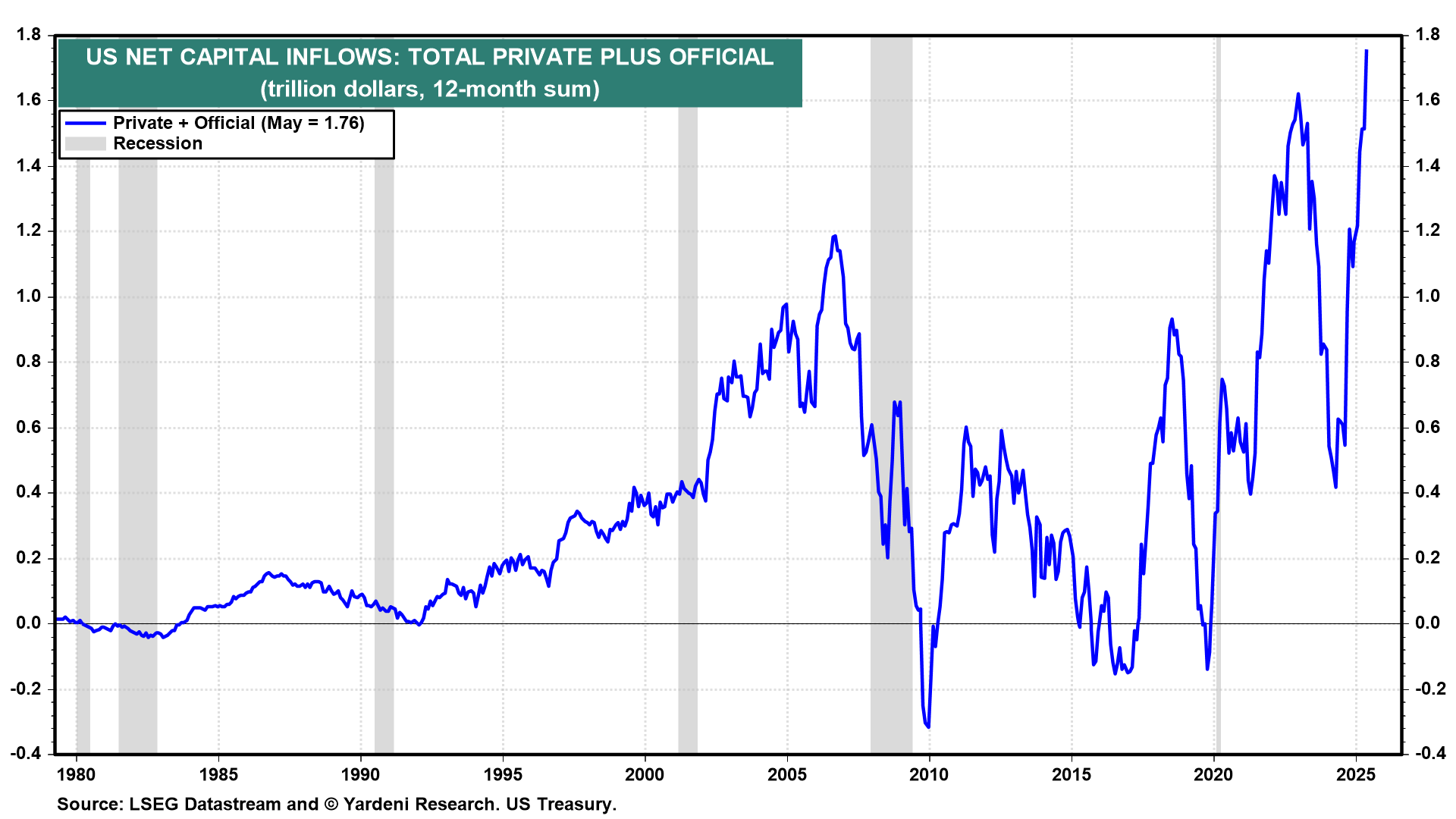

(2) The US has the largest and most diversified capital markets in the world. Foreign investors are attracted to the liquidity and relative safety of the US capital markets. Indeed, over the past 12 months through May, their US net capital inflows attributable to private plus official foreign accounts totaled a record $1.76 trillion (chart)!

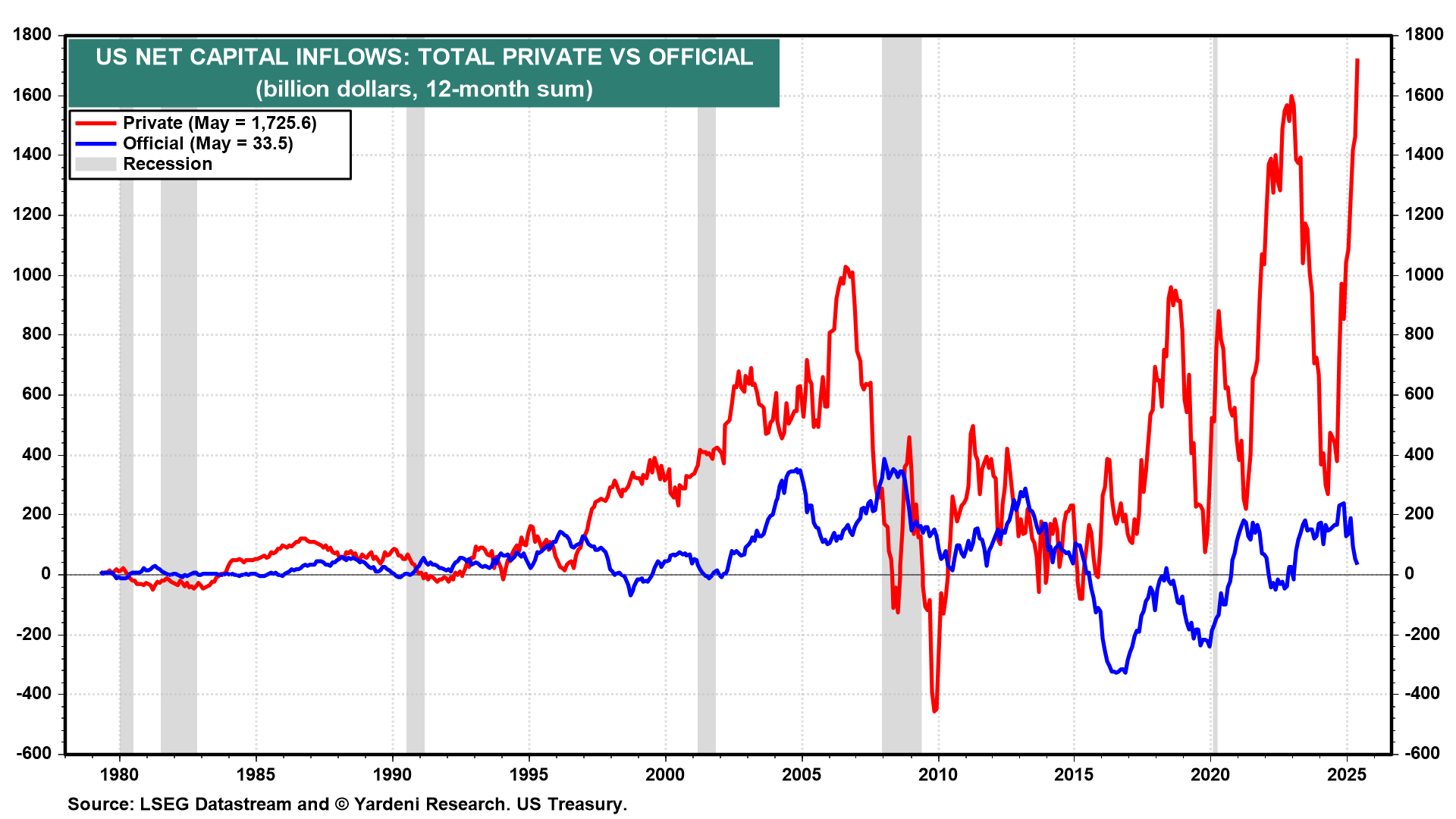

(3) Foreign official accounts have been minor contributors to US net capital inflows. The recent record $1.7 trillion in net inflows (on a 12-month basis) has come mostly from private foreign accounts (chart).

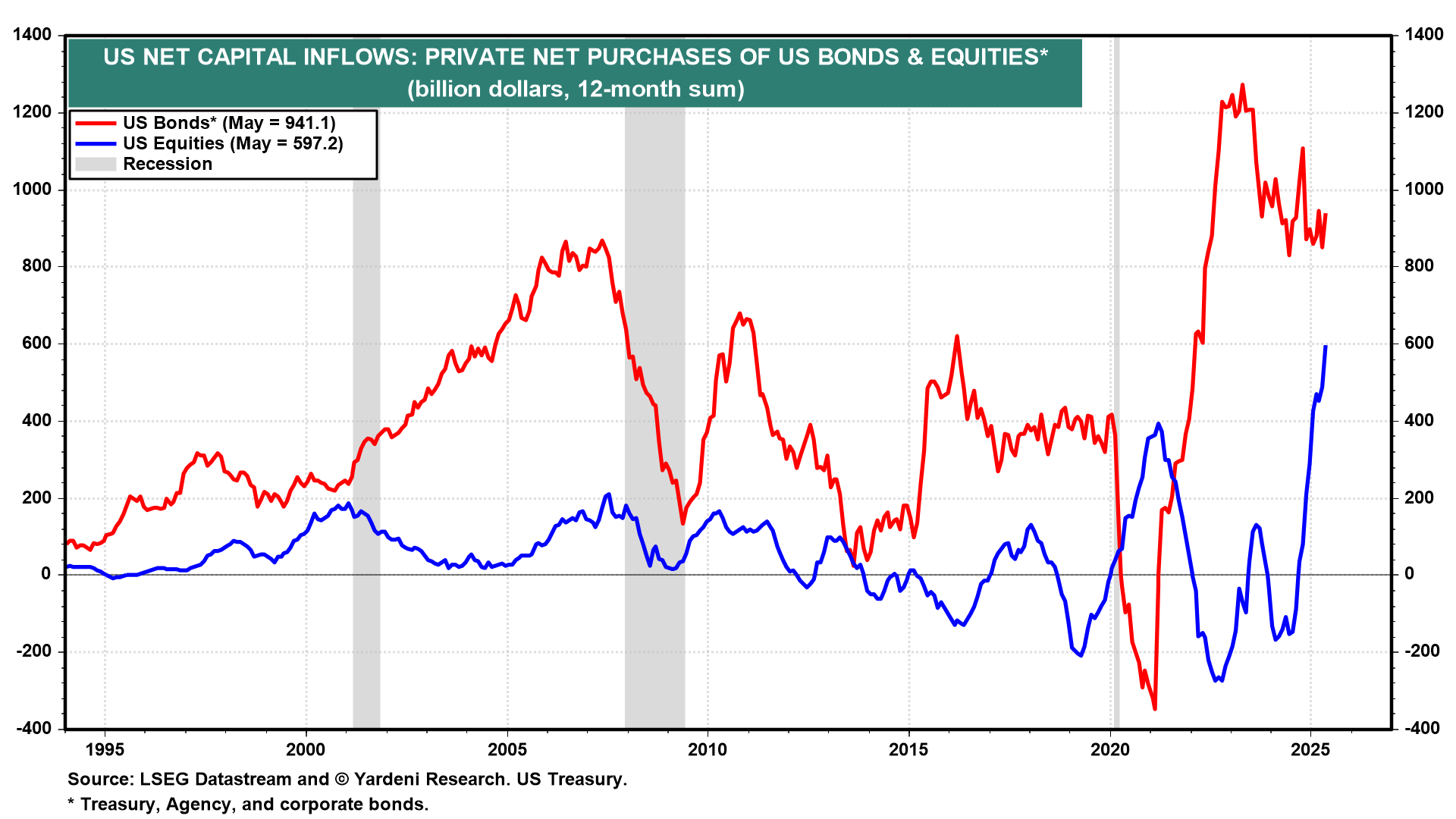

(4) Private foreign accounts had record net purchases of US equities over the past 12 months through May totaling $597 billion! Net purchases of US bonds totaled a whopping $941 billion (chart).

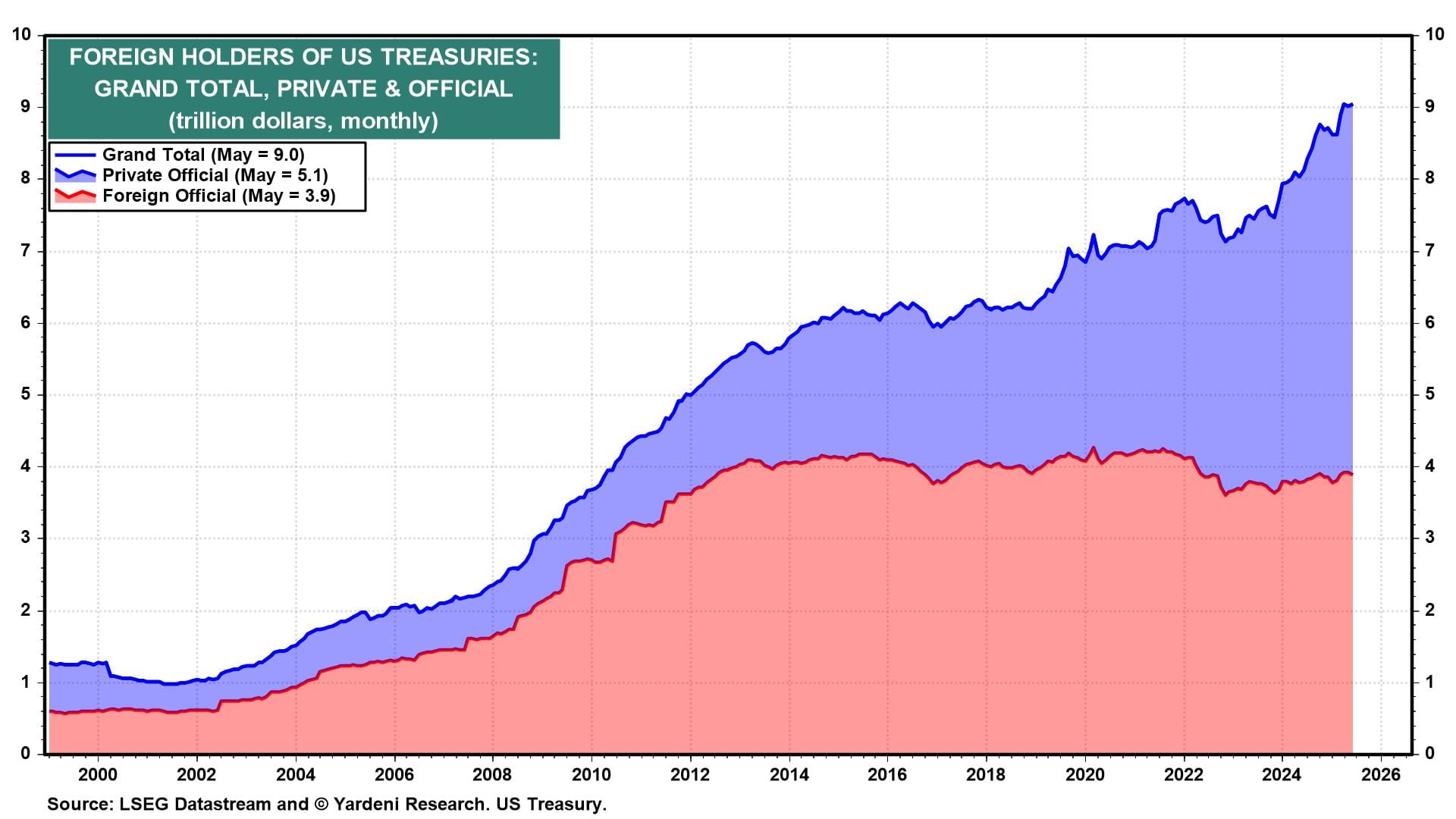

(5) Private foreign accounts held a record $9.0 trillion in US Treasuries during May (chart). Foreign official accounts' total holding of US Treasuries has been relatively flat at around $4.0 trillion since 2012. So recent years' growth in overseas demand has come from private foreign accounts. As global wealth has increased, so has the demand for US Treasuries, which remain the safest asset in the world.

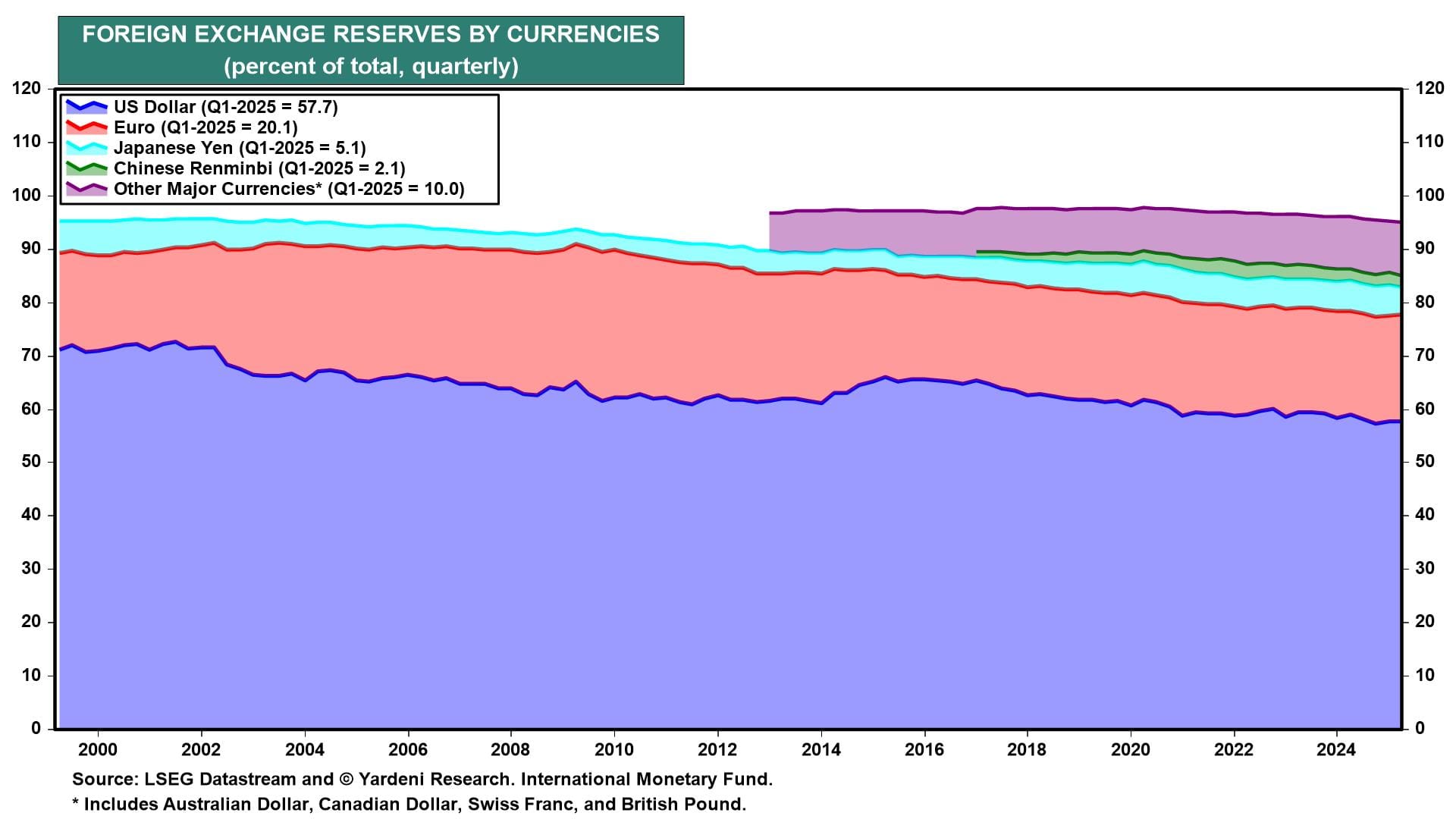

(6) The US dollar accounted for 57.7% of foreign exchange reserves during Q1-2025, according to IMF data (chart). The euro accounted for 20.1%, while the yen accounted for only 5.1%.

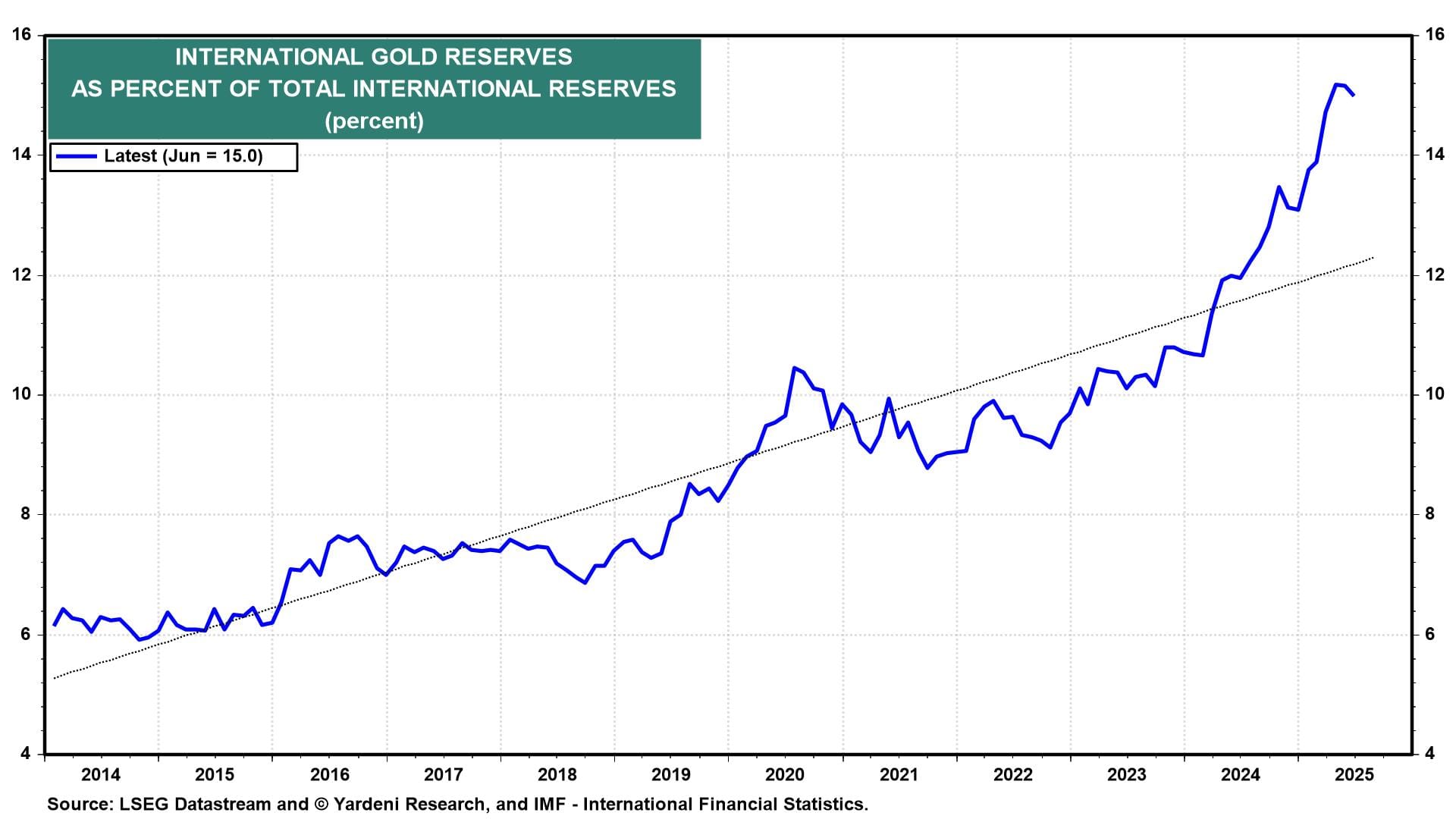

(7) Some of the recent weakness in the dollar might reflect the fact that gold's share of international reserves has been increasing since the US froze Russia's reserves when the country invaded Ukraine in 2022 (chart). The central banks of countries hostile to US interests have been buying more gold and holding onto fewer dollars as a result. That has been bullish for the price of gold.