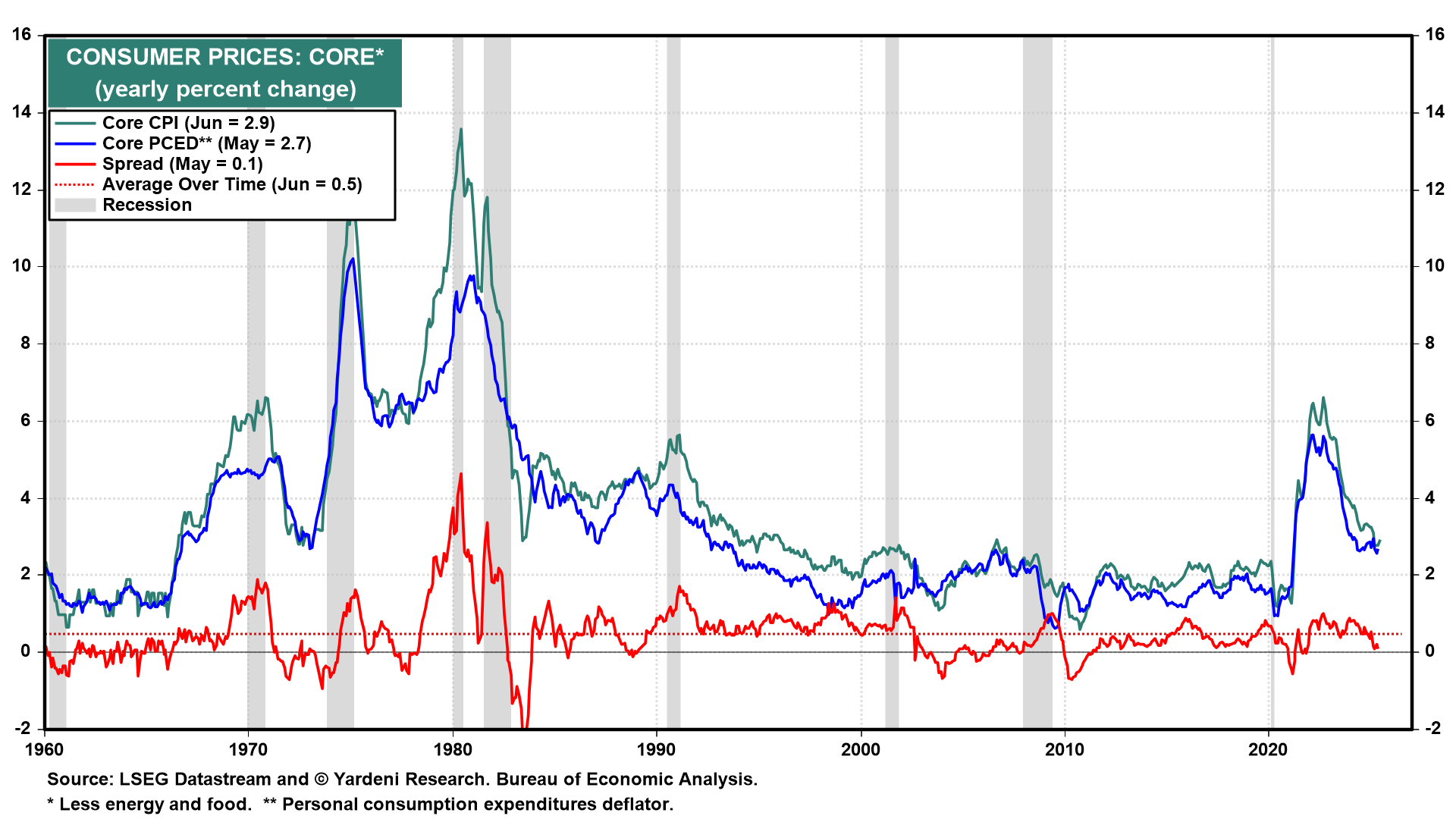

Today's CPI report for June suggests that consumer price inflation is no longer declining toward the Fed's 2.0% target. Instead, it might continue to hover around 3.0% for a while as it has recently (chart). Trump's tariffs may be a contributing factor, though their impact remains debated. The core CPI inflation rate upticked to 2.9% last month, hinting that the core PCED inflation rate (at 2.7% in May) might have followed a similar trend.

President Donald Trump is pushing for the Federal Reserve to cut the federal funds rate (FFR) from 4.33% to 1.00%. This reduction would lower net interest payments on the federal debt, helping to reduce the US budget deficit. A lower FFR could also weaken the dollar, boosting exports and reducing imports. However, Fed Chair Jerome Powell and most Federal Open Market Committee (FOMC) participants are reluctant to cut rates, especially to 1.00%, due to concerns that Trump's tariffs could hinder progress toward the Fed's 2.0% inflation target.

The June CPI report reinforces the FOMC's cautious stance. Although Trump's tariffs may not yet be significantly driving inflation, they appear to be contributing to inflation stalling at around 3.0%, supporting the FOMC's hesitation to lower the FFR.

Let's have a closer look at today's CPI data: