The good news is that the Magnificent-7 are still magnificent. Three of them (Alphabet, Meta, and Microsoft) beat earnings expectations for Q1. We've been arguing that while AI may or may not make money for the providers of Large Language Models, the result will be more demand for cloud computing. That should be good news for at least four of the Mag-7.

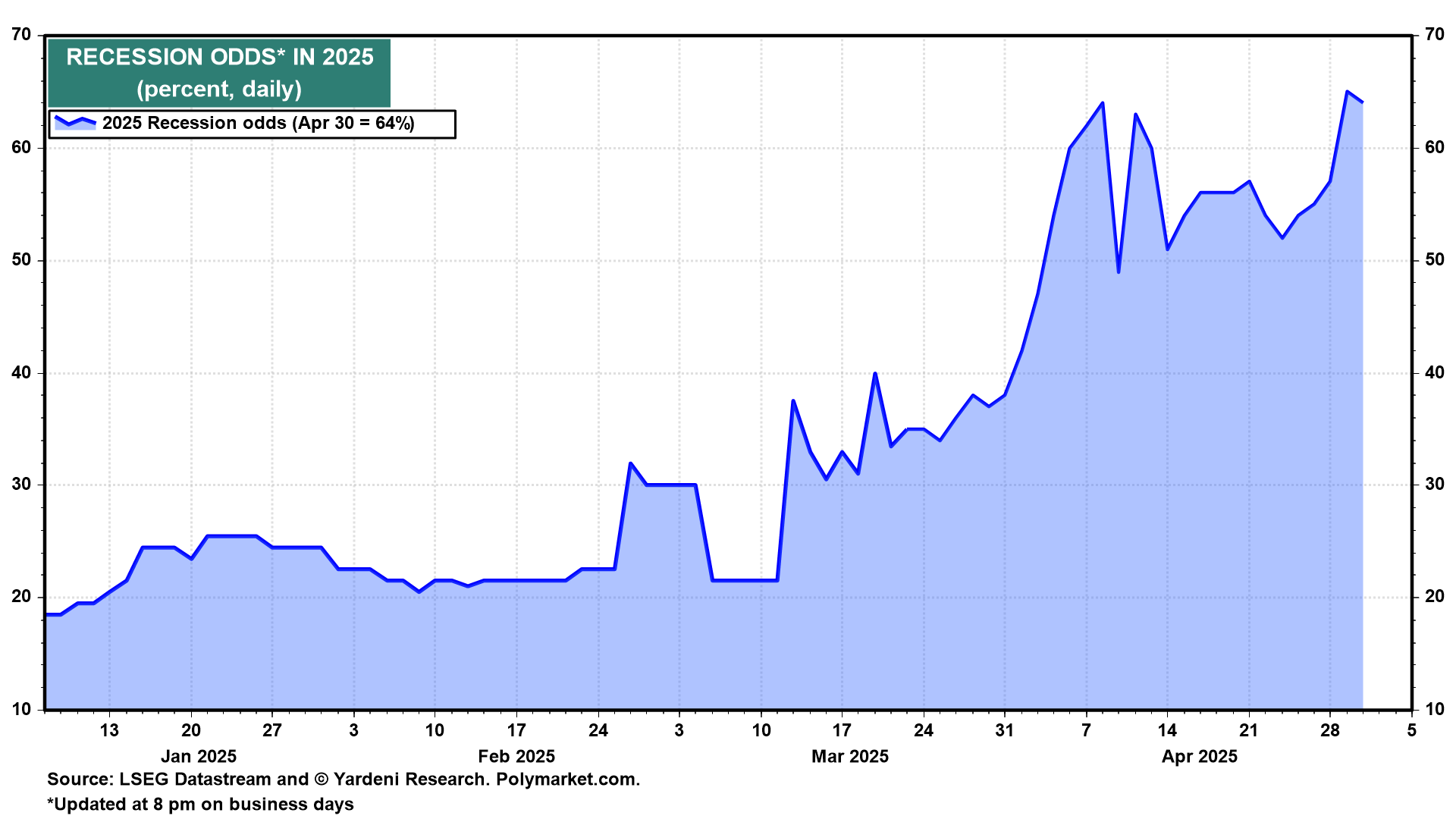

The bad news is that recent economic reports have boosted the probability of a recession in recent days, according to Polymarket.com (chart). Our subjective probability of a recession remains at 45%. Let's review the latest relevant economic indicators:

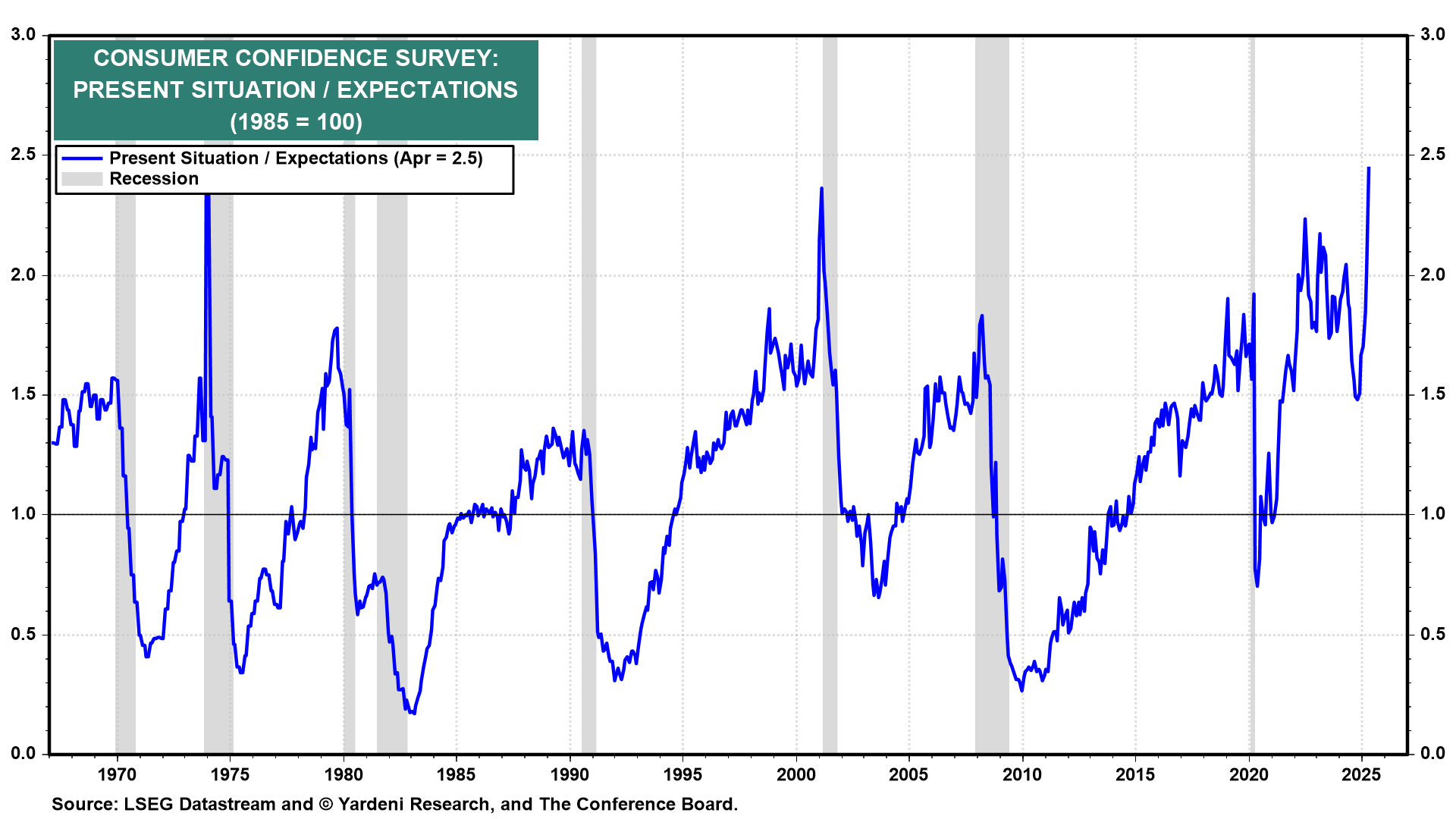

(1) Consumer confidence. On Tuesday, we learned that the Consumer Confidence Index (CCI) fell to a nearly five-year low in April, down 8 points to 86.0. It's the fifth straight monthly decline, the worst such stretch since 2008. The decline has been led by the CCI's expectations component. The present situation component is relatively upbeat. However, the ratio of the present to the expectations components soared in April as it did prior to past recessions (chart)

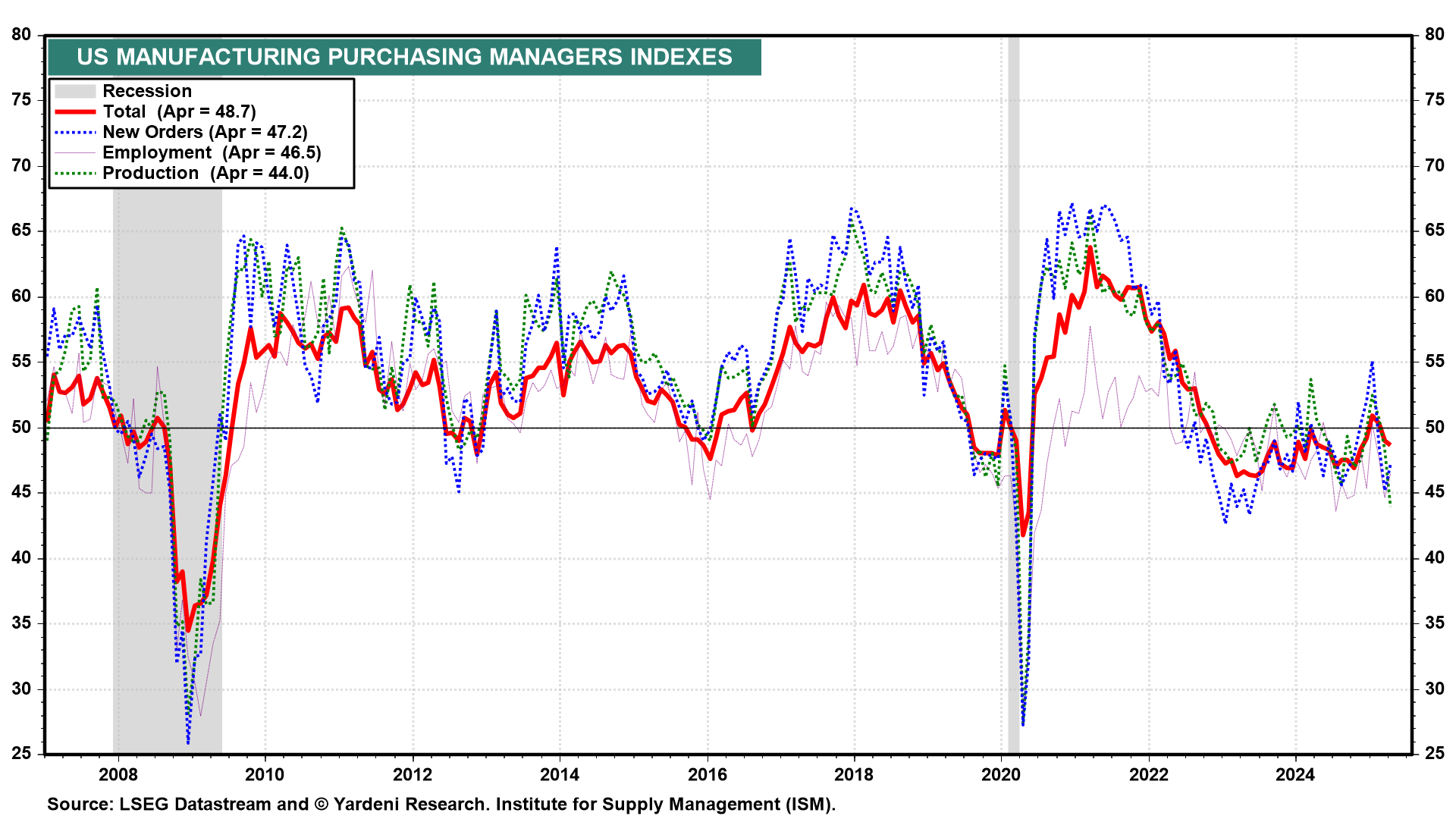

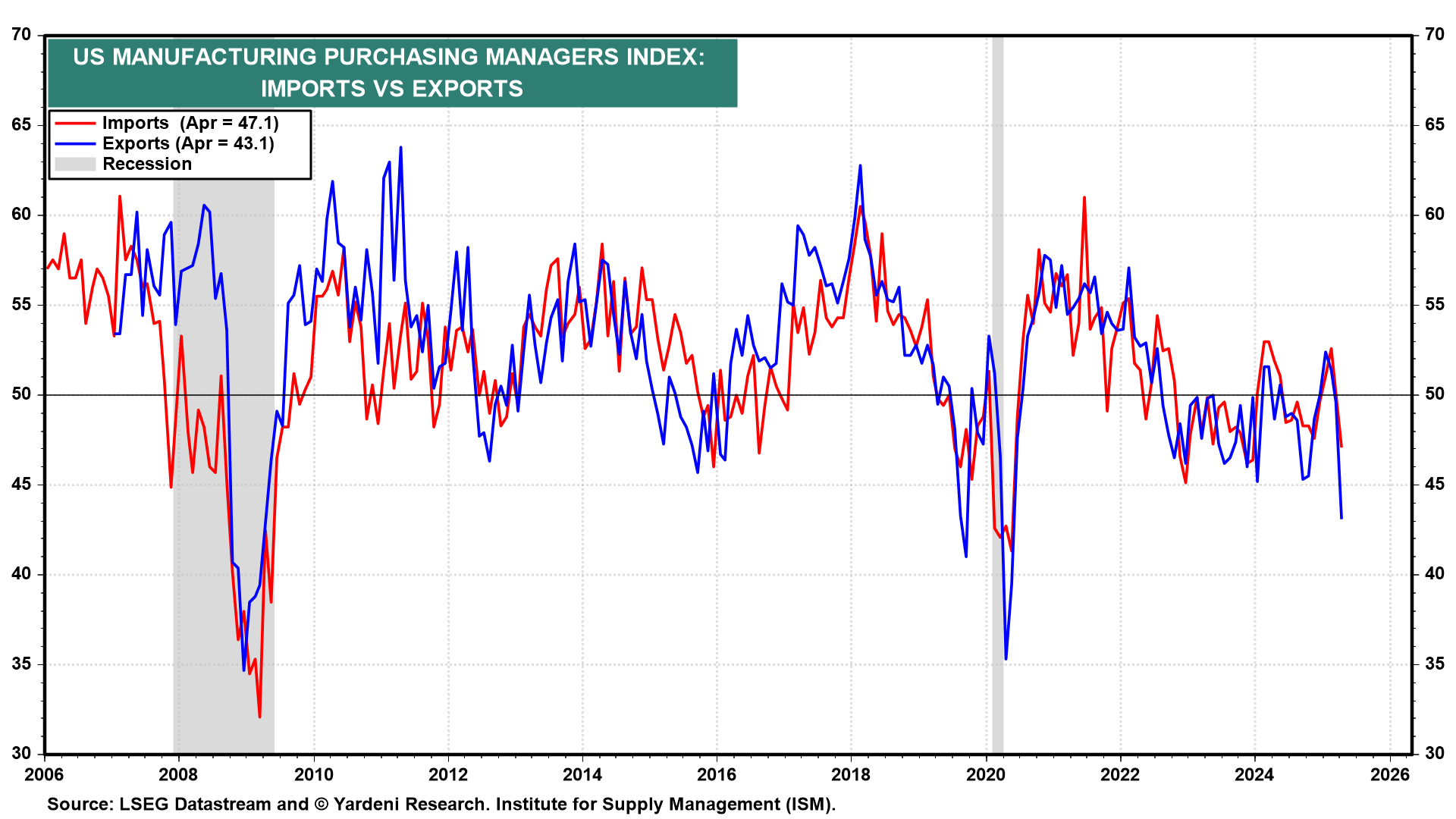

(2) Manufacturing. April's M-PMI edged down to 48.7 (chart). That's a second consecutive reading below 50.0. The production index was especially depressed at 44.0. The new orders and employment indexes were also below 50.0. The word "tariff" was mentioned 27 times in the report compiled by the Institute for Supply Management. Tariffs are putting upward pressure on the prices-paid index, which remained elevated at 69.8.

Both the imports and new export orders indexes fell in April (chart). The latter was the weakest since 2020, when Covid was spreading around the world.

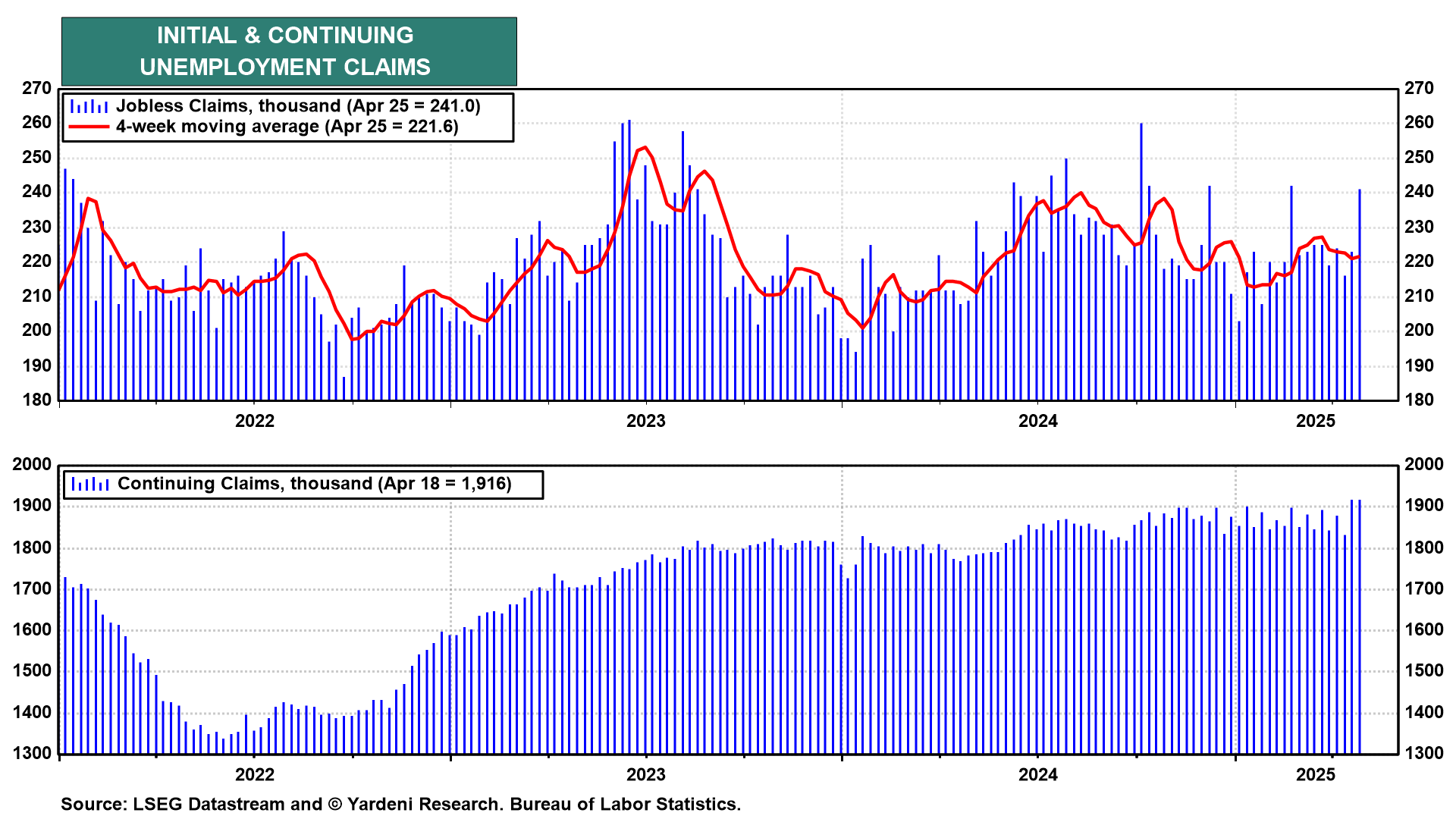

(3) Unemployment claims and layoffs. During the week of April 25, initial unemployment claims jumped by 18,000 to 241,000 (chart). New York accounted for 15,525 of the increase. Continuing claims remained relatively elevated for the second week in a row. However, none of these readings are proof-positive that a recession is imminent.

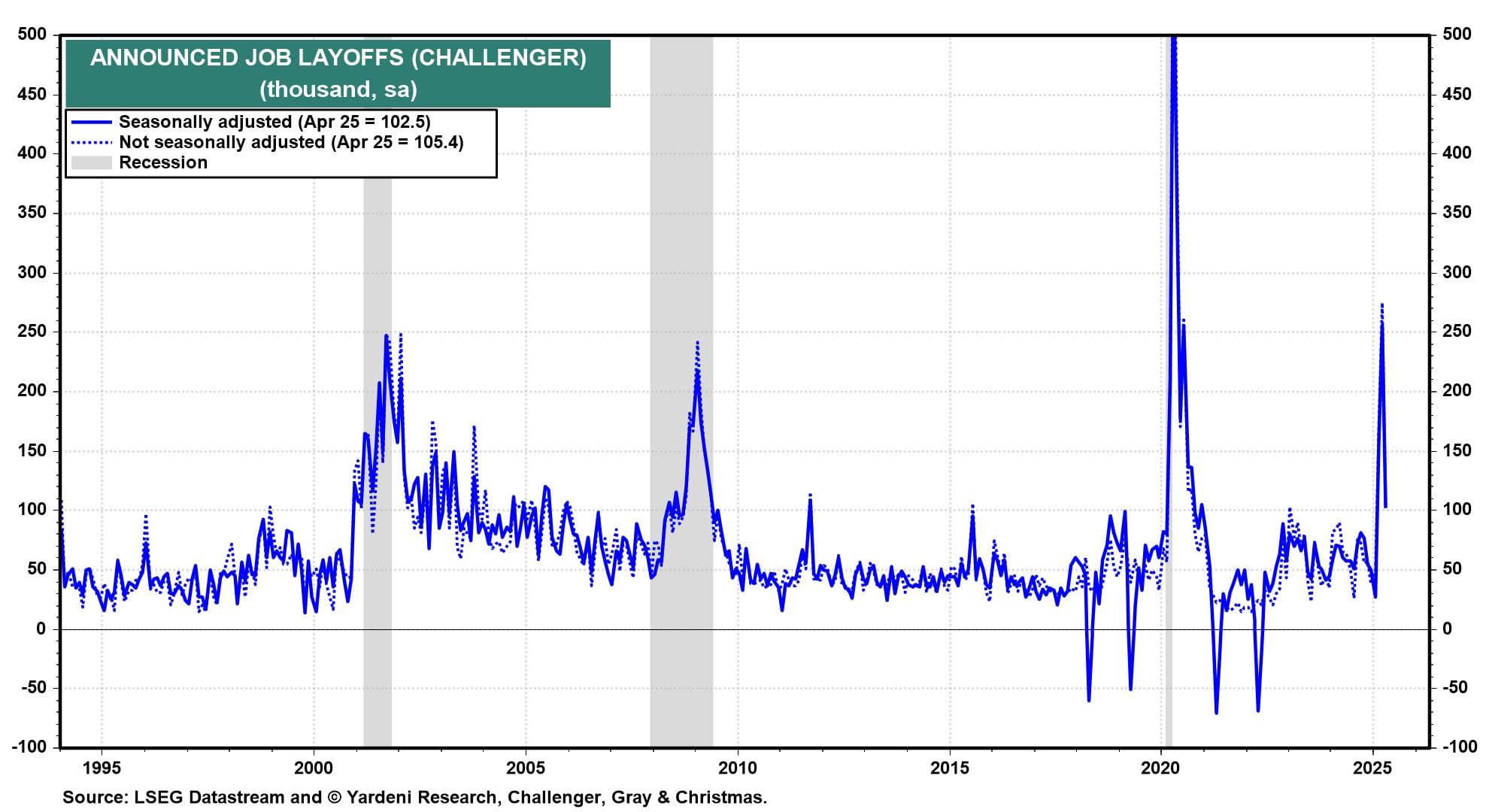

Global outplacement firm Challenger, Gray & Christmas said on Thursday that planned job cuts fell 62% to 105,441 last month (chart). Layoffs were, however, 63% higher compared to last year and April's tally was the highest for the month in five years.

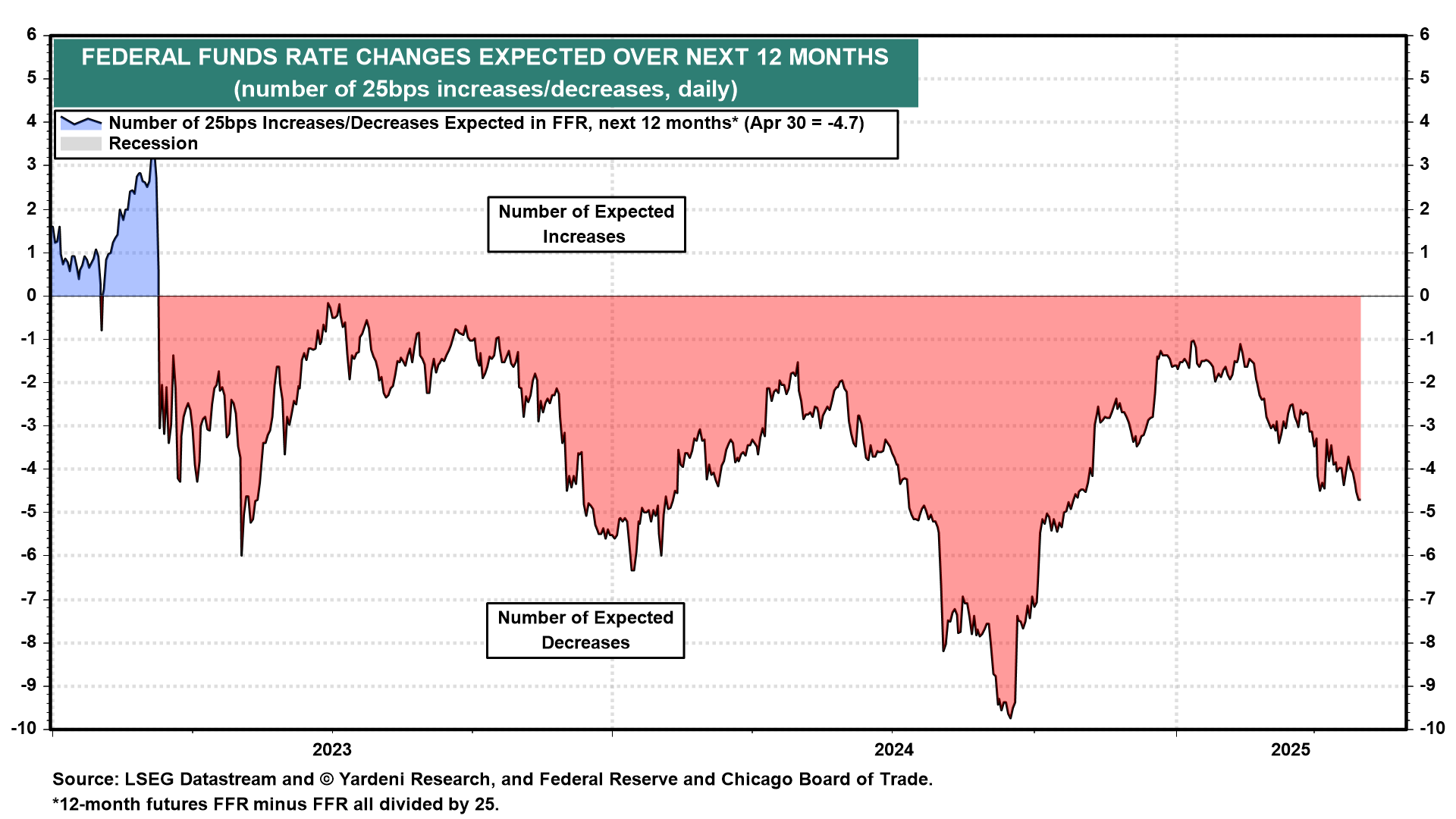

(4) The Fed. Following the latest batch of economic indicators, the federal funds rate (FFR) futures now show that the market expects four to five 25bps cuts in the FFR over the next 12 months. That helps to explain why the stock market has held up well in the face of the latest batch of relatively weak economic indicators. The bond market seems to be less convinced about Fed rate cuts.