At the start of November, we expected a pullback in the stock market because the Bull-Bear Ratio we monitor indicated too many bulls. That's bearish from a contrarian perspective. Could the pullback be over already? It might be if the Fed delivers a rate cut on December 10.

The stock market took a gut-wrenching dive on Thursday last week. It's still not obvious why the drop occurred. But the immediate conclusion was that investors had lost their confidence in the AI trade. The free-fall in bitcoin also unsettled them. Thursday evening, we noted that a few participants on the Federal Open Mouth Committee said earlier that day that they were in no rush to lower the federal funds rate again at the December 10 FOMC meeting. The CME FedWatch Tool showed that the odds of a rate cut fell below 50%.

On Friday, FRBNY President John Williams came to the rescue with some dovish comments, and a couple of his colleagues said the same today. So the odds of a December rate cut jumped to 80.9%. Investors love the Fed Put.

So stock prices edged higher on Friday and rebounded strongly today, led by AI-related stocks, and especially by GOOGL, which jumped 6.3%. NVDA was a bit of a laggard, rising only 2.1%. It helped that bitcoin rallied from $81,180 on Friday morning back to $89,000 this afternoon.

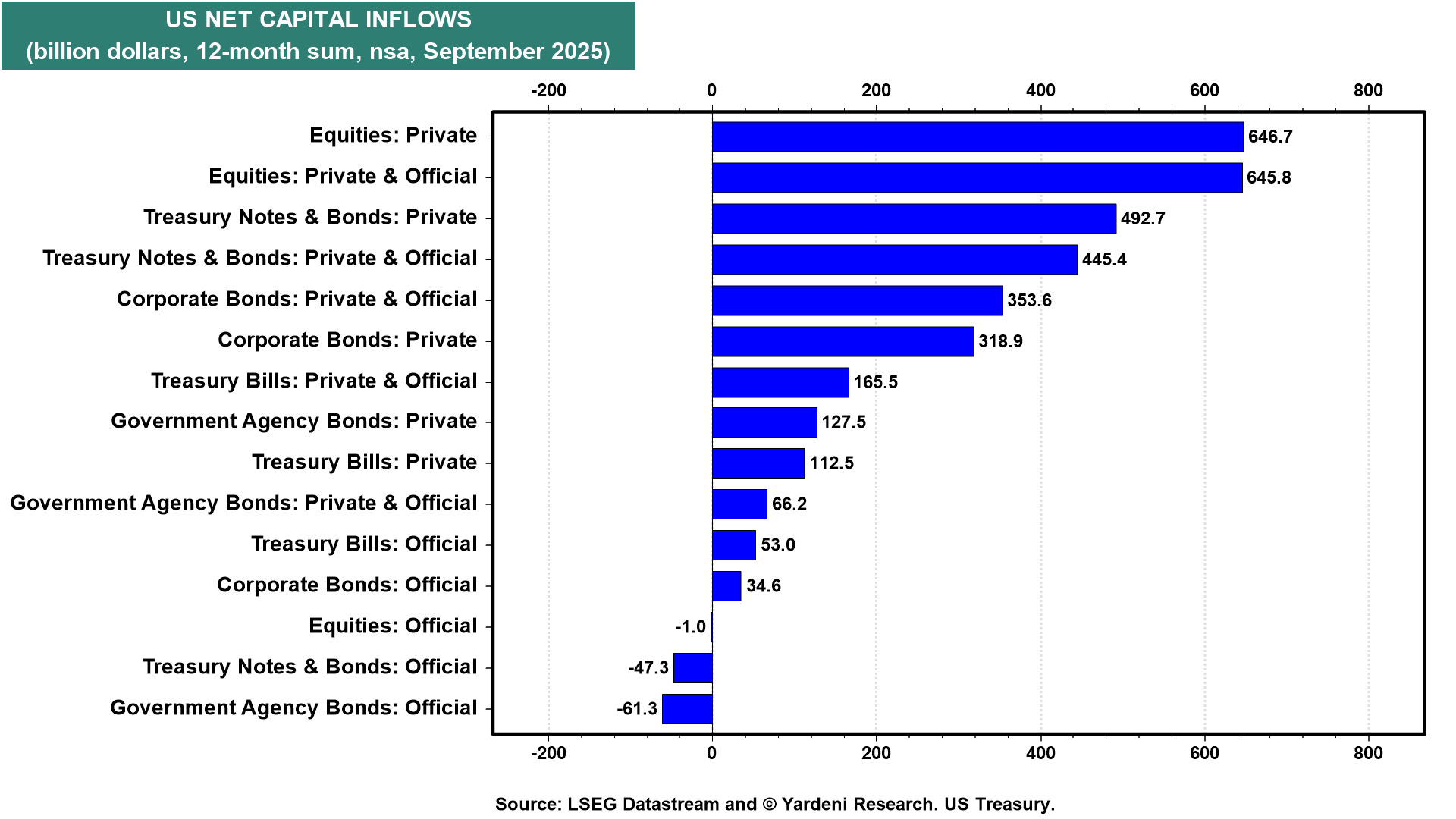

The DXY dollar index held firm around 100.00 despite the increased odds of a Fed rate cut. Supporting the US dollar are strong net capital inflows, which totaled $1.5 trillion over the past 12 months through September (chart). That's near the recent record high.

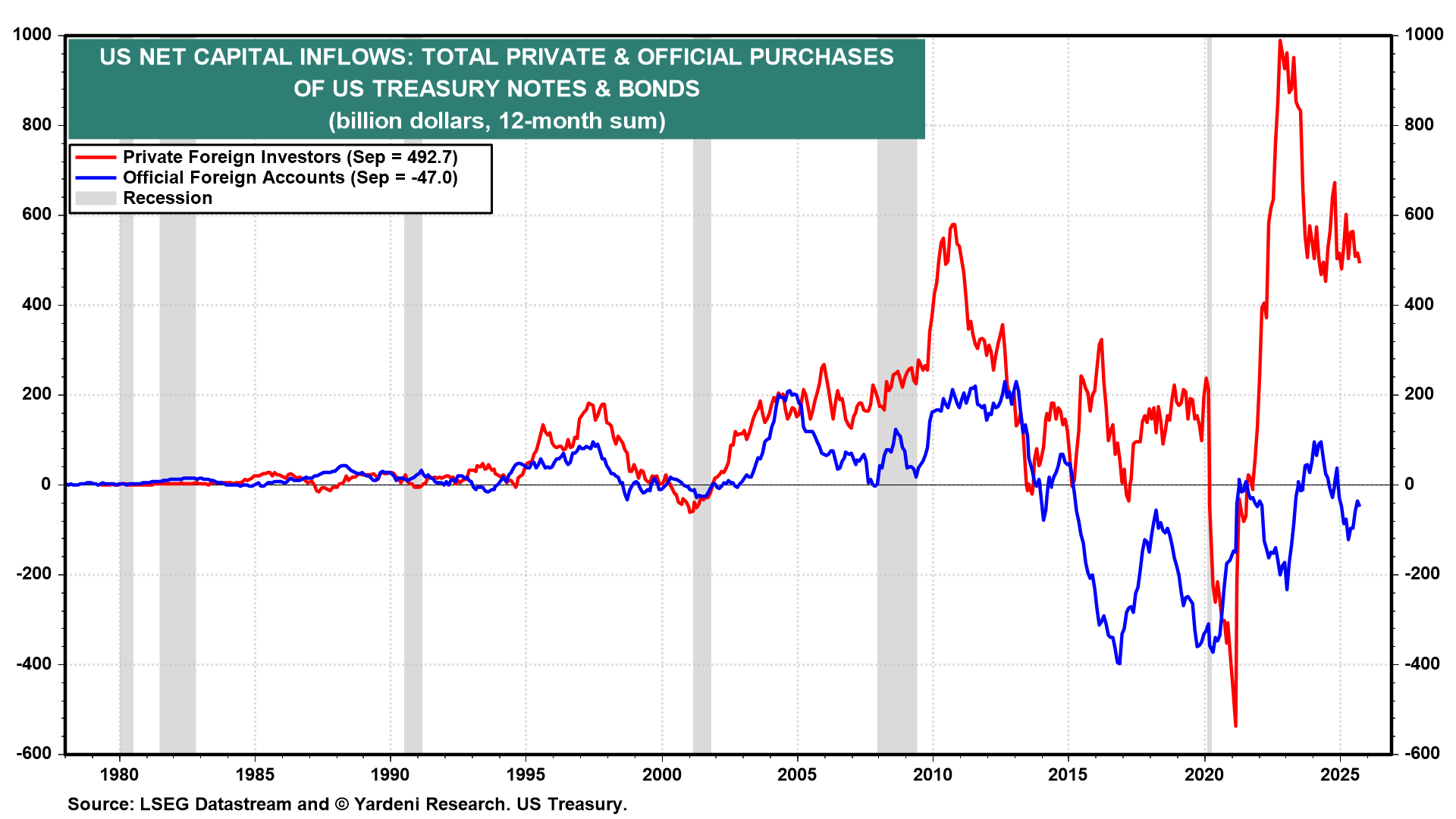

Contrary to the popular myth, foreign investors are not bailing out of US Treasuries and equities. Foreign private purchases totaled $492.7 billion in the former over the past 12 months (chart). However, central banks collectively did reduce their holdings by $47.0 billion.

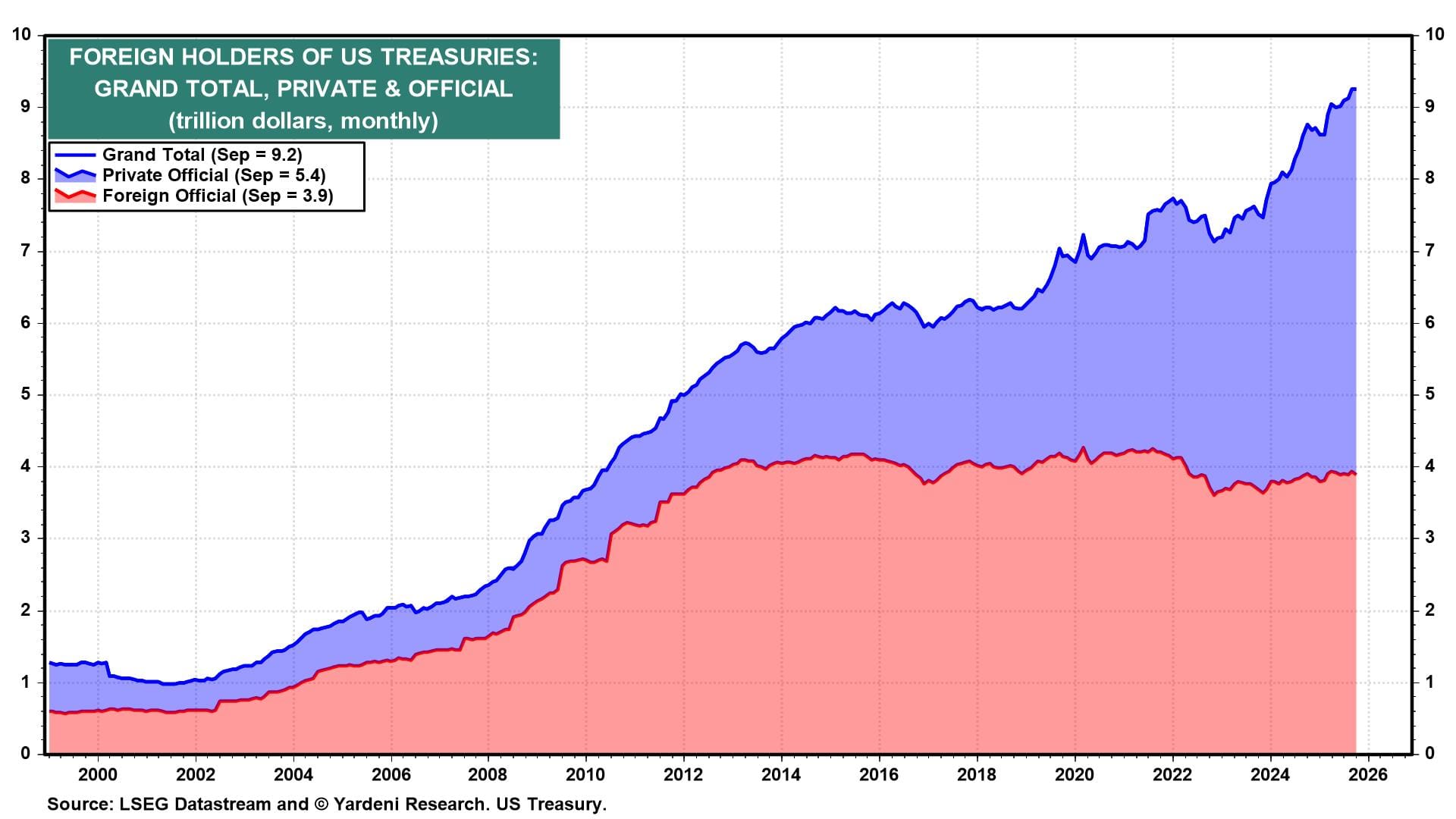

Foreigners held a record $9.2 trillion in US Treasuries during September (chart).

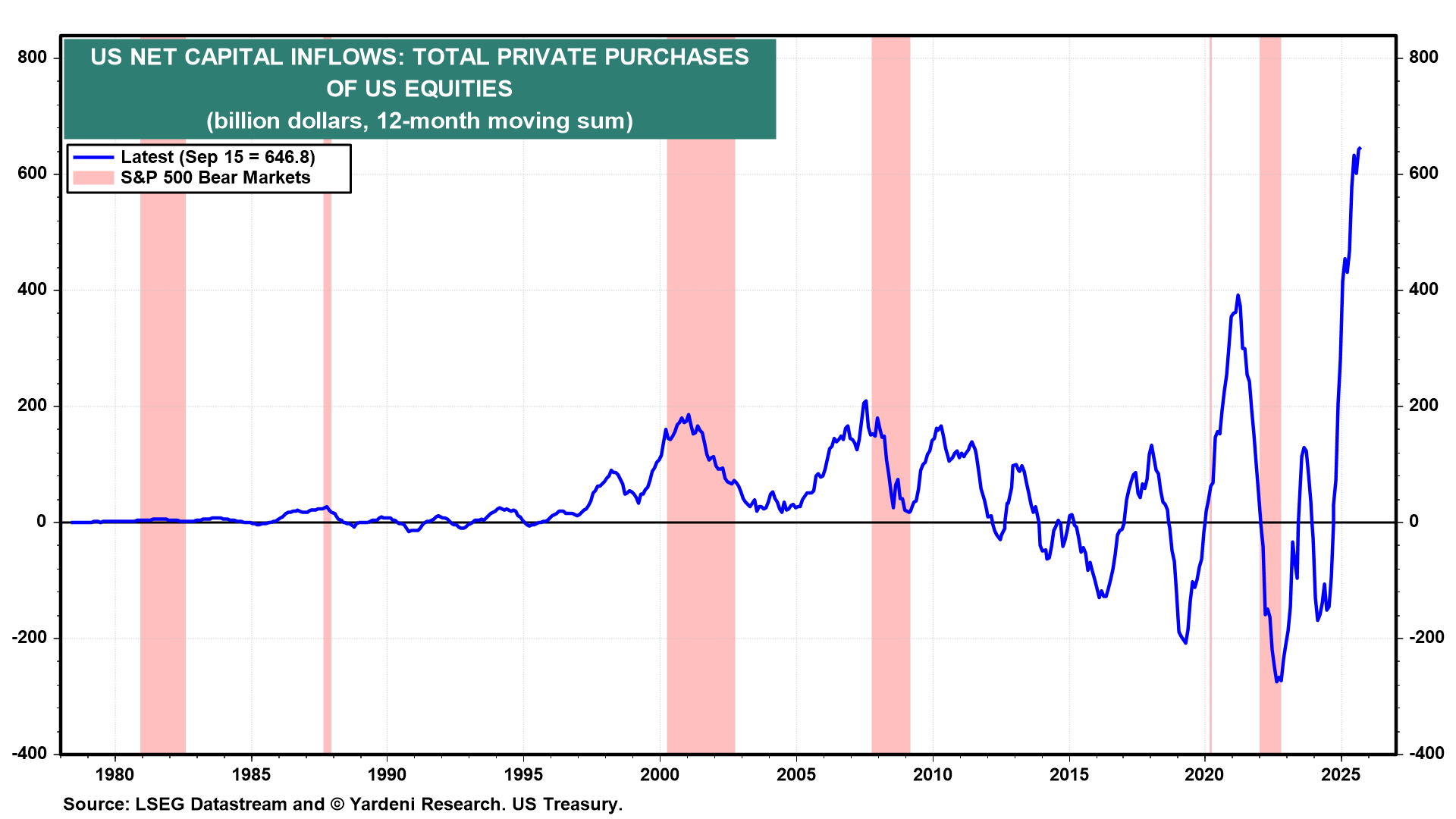

Most impressive, and somewhat surprising, is that foreign private purchases of US equities totaled a record $646.8 billion over the past 12 months (chart).

Over the past 12 months, foreign private purchases of US equities outpaced those of US Treasury notes and bonds (chart).