Stock prices got a boost around mid-day today when White House Press Secretary Karoline Leavitt told reporters during a briefing: “The President can simply provide these countries with a [trade] deal if they refuse to make us one by the deadline, and that means the President can pick a reciprocal tariff rate that he believes is advantageous for the United States and for the American worker.”

We've been observing and agreeing with the notion that the stock market rally since April 9 suggests that investors believe that the tariff issue will be mostly behind us by the end of the summer. On April 9, President Donald Trump postponed his April 2 Liberation Day reciprocal tariffs for 90 days. Today, that deadline has been rescinded.

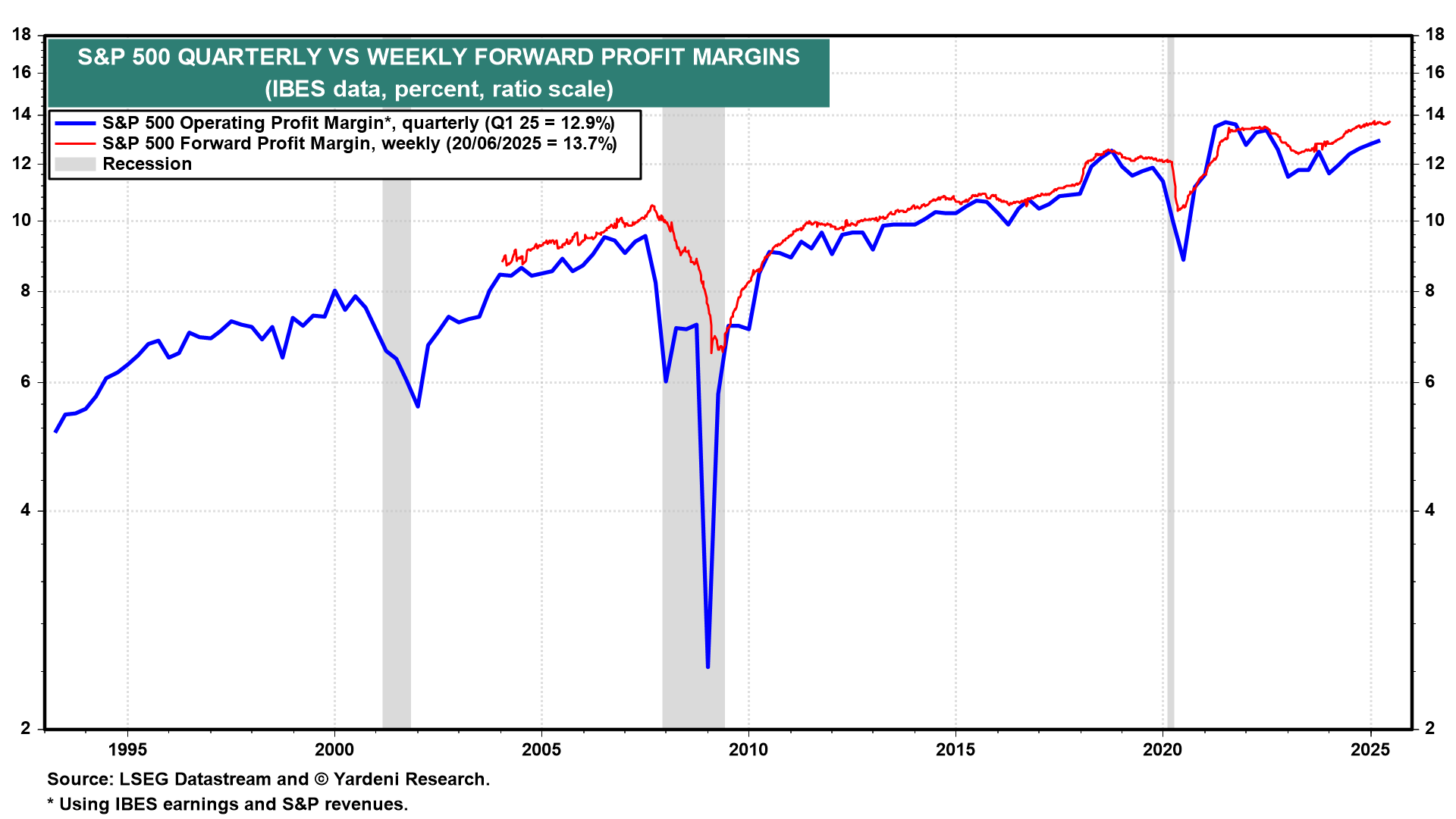

Trump's Tariff Turmoil from April 2 through today (June 26) has had remarkably little impact on the forward profit margin of the S&P 500 so far (chart). It has been essentially flat since the start of this year but at roughly a record high of 13.7%.

That's remarkable since a tariff is first and foremost a tax on a company that imports goods. So the importer must send a check to the US Treasury to pay the duty on the imported goods. A 10% across-the-board tariff on all goods imports could potentially raise $400 billion over a 12-month period. For comparison, federal corporate tax receipts totaled $516.7 billion over the past 12 months (chart).