Today was just another day in the stock market. The S&P 500 rose to another record high of 6875.16. Also closing at record highs were the Nasdaq, the DJIA, and the Russell 2000. Been there, done it! More record highs are likely when the Fed cuts the federal funds rate by 25bps on Wednesday.

On Thursday, President Donald Trump and Chinese President Xi Jinping are expected to meet. The stock market rose today on reports that they will agree on a framework for a potential trade deal. That would amount to a ceasefire in their trade war, with both the US 100% additional tariff on Chinese imports and severe Chinese restrictions on their exports of rare-earth minerals and magnets to the US postponed. Hooray!

The stock market also rose on more AI news (hype?) today. Qualcomm made headlines today with a significant leap into the AI data center market, unveiling new chips that sent its stock soaring over 11%. It is collaborating with HUMAIN, a Saudi AI startup, to deploy 200 megawatts of AI infrastructure starting in 2026. Qualcomm now aspires to be a serious contender against Nvidia and AMD in the AI accelerator space. The more competition, the merrier as the stock prices of all three rose.

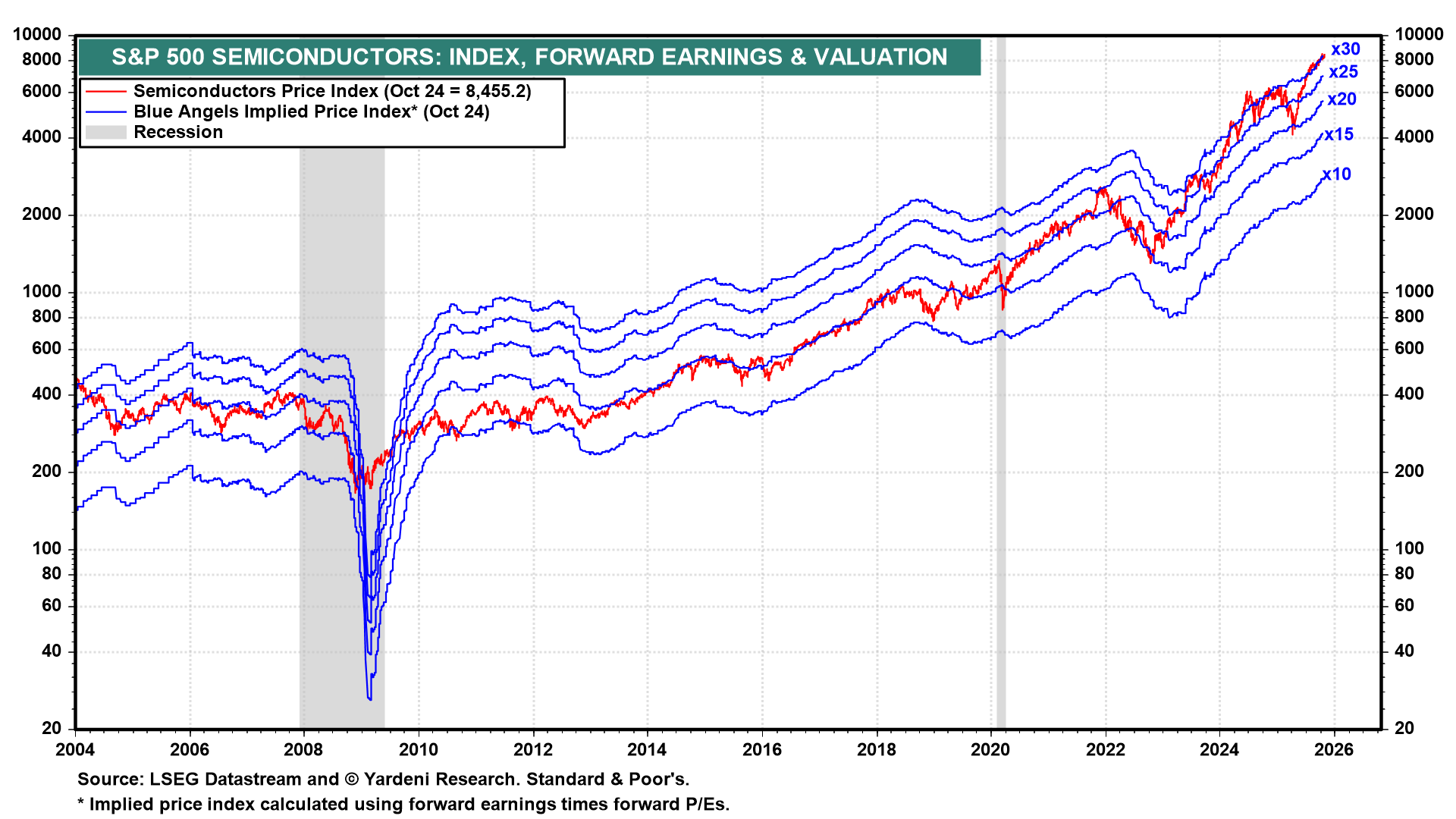

Semiconductor stocks were once viewed as very cyclical because their earnings were cyclical (chart). So the industry's forward P/E tended to be around 15.0 during the period between the Great Financial Crisis and the Great Virus Crisis. Now it is at 30.0 as forward earnings has soared to record highs over the past couple of years.

The forward earnings of the S&P 500 Semiconductor industry was cyclical because the forward profit margin of the sector was cyclical (chart). It had a boom/bust cycle. During good times, the companies sold lots of chips and built-up inventories, exacerbating downward pressure on their prices during the bad times.