The FOMC is likely to cut the federal funds rate (FFR) by 25bps tomorrow. Among the meeting participants, there might be one or more dissenters to the decision who favor a 50bps cut and one or more dissenters opposed to any cut. The Summary of Economic Projections may also indicate that FOMC participants are divided on whether and when further cuts might be necessary. Tomorrow's rate cut isn't really needed. Still, a majority of the FOMC is likely to view it as an insurance policy against further weakening of the labor market, even though GDP continues to grow at a solid pace and inflation remains almost a point above the Fed's 2.0% y/y target.

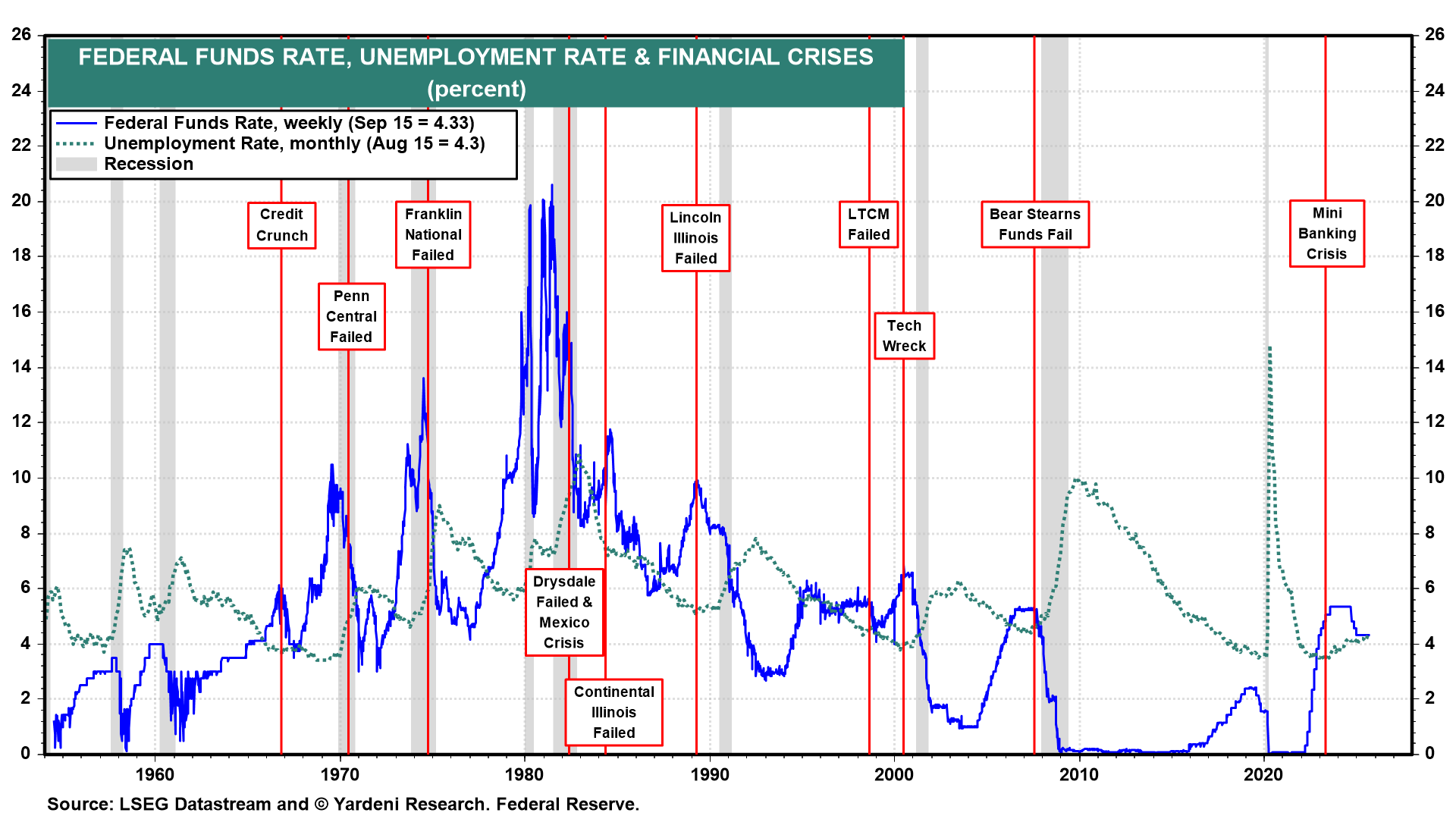

More often than not in the past, monetary easing cycles started when the previous tightening of monetary policy triggered a financial crisis that quickly turned into an economy-wide credit crunch and a recession. Easing at such times is clearly warranted. But the Fed cut the FFR by 100bps at the end of last year even though there was no credit crunch and no recession (chart). That makes another round of rate cuts in this cycle more likely to cause inflation to remain above the Fed's target, while fueling speculative fires in the stock market.

Today, in response to stronger-than-expected August retail sales, up 0.6% m/m, the Atlanta Fed's estimate for Q3's real GDP growth rate was revised up from 3.1% to 3.4%. The estimate for real consumer spending was revised up from 2.3% to 2.7%.