This morning's jobs report for August was a good one even though the unemployment rate rose to 3.7% from 3.5%. It did so because 786,000 workers entered the labor force, while the household measure of employment rose 442,000. The new entrants shouldn't have any problem finding jobs, while an increase in job seekers may take the pressure off employers to raise wages to attract workers. Indeed, wage inflation moderated a bit during August to 0.3% from 0.4% in July.

This morning's report is consistent with our "growth recession" outlook, notwithstanding the 315,000 increase in the payroll measure of employment:

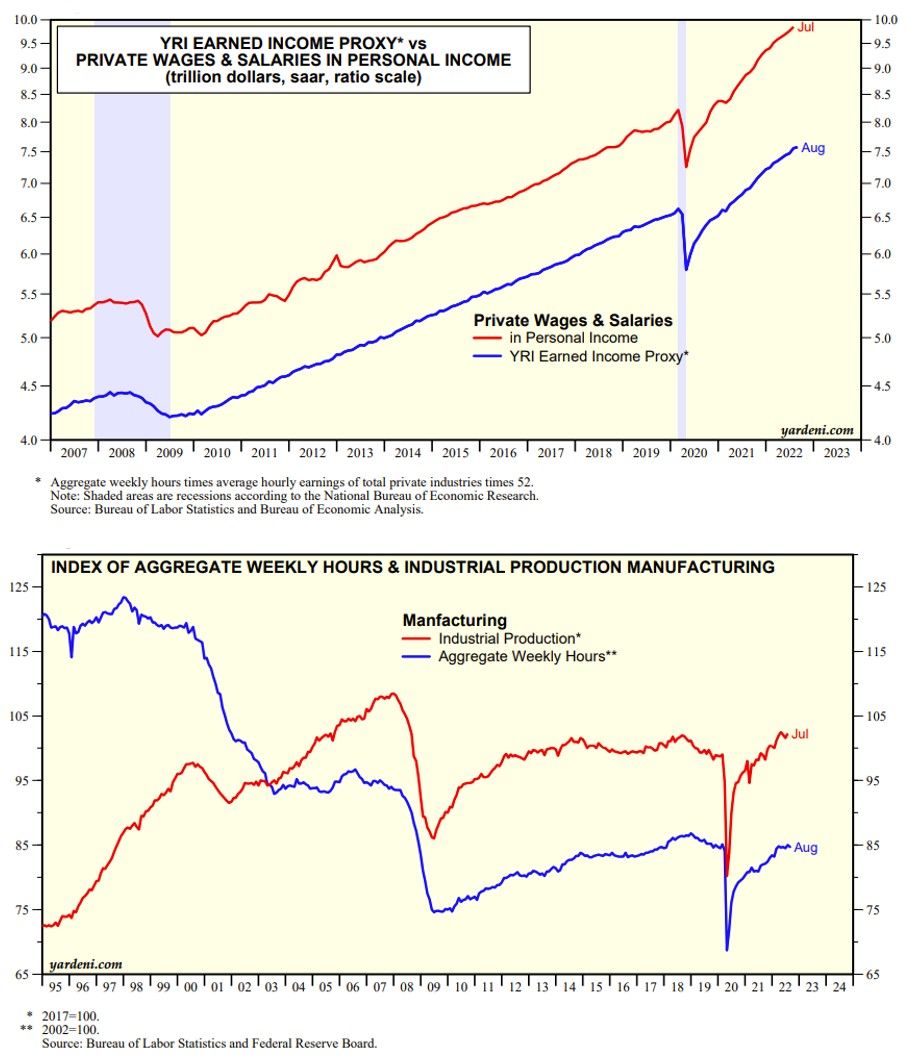

(1) Our Earned Income Proxy for private wages and salaries in personal income rose just 0.3% m/m during August because aggregate weekly hours was flat as the average workweek declined 0.3% offsetting the increase in payrolls (chart below). Personal income is one of the four components of the Coincident Economic Indicators (CEI), while the average workweek is one of the 10 components of the Leading Economic Indicators.

(2) Aggregate weekly hours in manufacturing was flat during August (chart below). That suggests industrial production was relatively weak in August, which was confirmed by yesterday's M-PMI report. Industrial production is one of the four components of the CEI.

We still expect the Fed to raise the federal funds rate by 75bps in late September. We still think the terminal rate for this rate will be 3.50%, not 4.00% or higher.