There was a lot of news today that, on balance, didn't move the needle much in the financial markets, which are marking time until August's PPI and CPI reports are released on Wednesday and Thursday, respectively. Let's review all the non-events today:

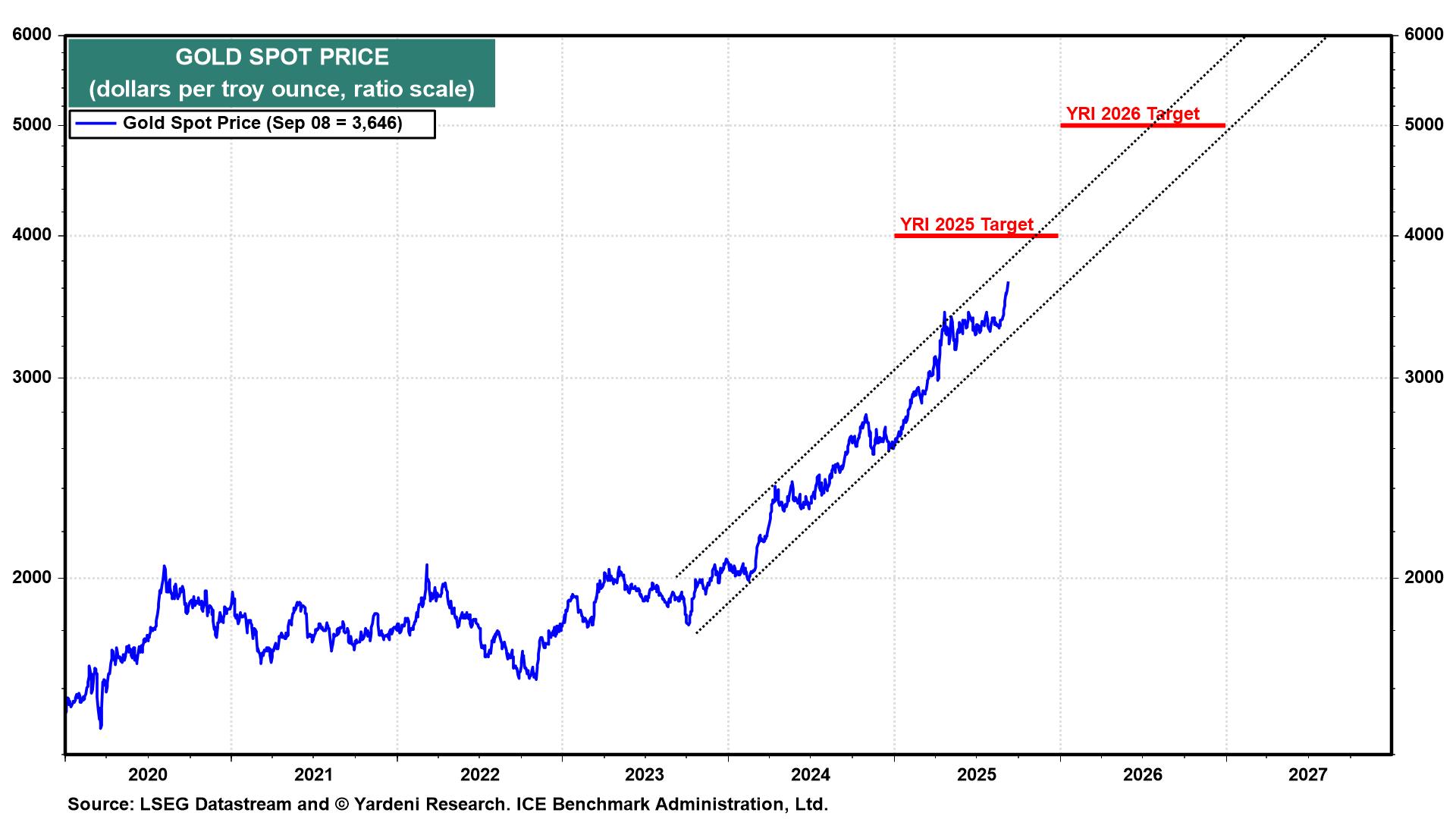

(1) Gold & geopolitics. The nearby futures price of gold jumped to yet another record high of $3,707 per ounce this morning on news that Israel attacked the leadership of Hamas in Doha, Qatar. Profit-taking pared some of the gain by early afternoon. The gold spot price is on track to reach our $4,000 target by the end of this year (chart). That has been our target since the price rose above $3,000 earlier this year. We turned bullish on gold when it rose above $2,000 last year.

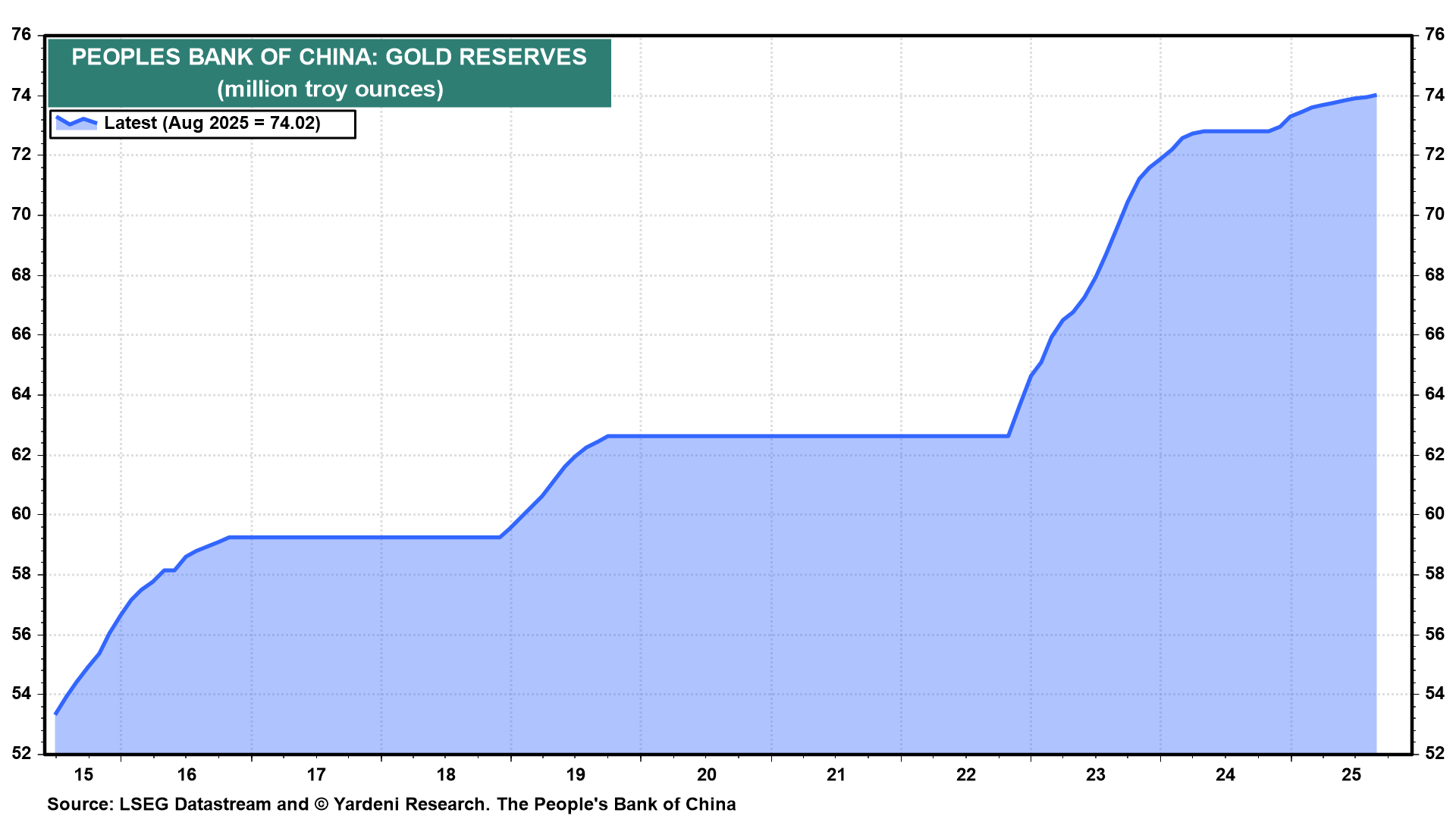

On September 6, Bloomberg reported that the People’s Bank of China increased its gold holdings in August for a 10th month, in a continued push to diversify its reserves away from US dollars.

(2) Uncertainty. There has been considerable uncertainty since Donald Trump won the 2024 presidential election in November. Uncertainty remained high after he imposed tariffs earlier this year. The Uncertainty Index, compiled by the National Federation of Independent Business (NFIB), reached a record high of 110 in October 2024, just before the election (chart). It has remained elevated but was down to 93 in August. Apparently, many of us are learning to live with high uncertainty resulting from Washington's erratic policymaking. As we've observed many times before, it is impressive how well the US economy and stock market perform despite Washington's meddling.