Contrary indicator alert! On Sunday, the WSJ posted an article titled "These Teenagers Know More About Investing Than You Do: Custodial investment accounts for minors have surged in popularity." According to the article, the kids are all buying technology stocks: "Brokerage executives say that technology behemoths that are ubiquitous in the lives of teens are often some of the most widely held shares."

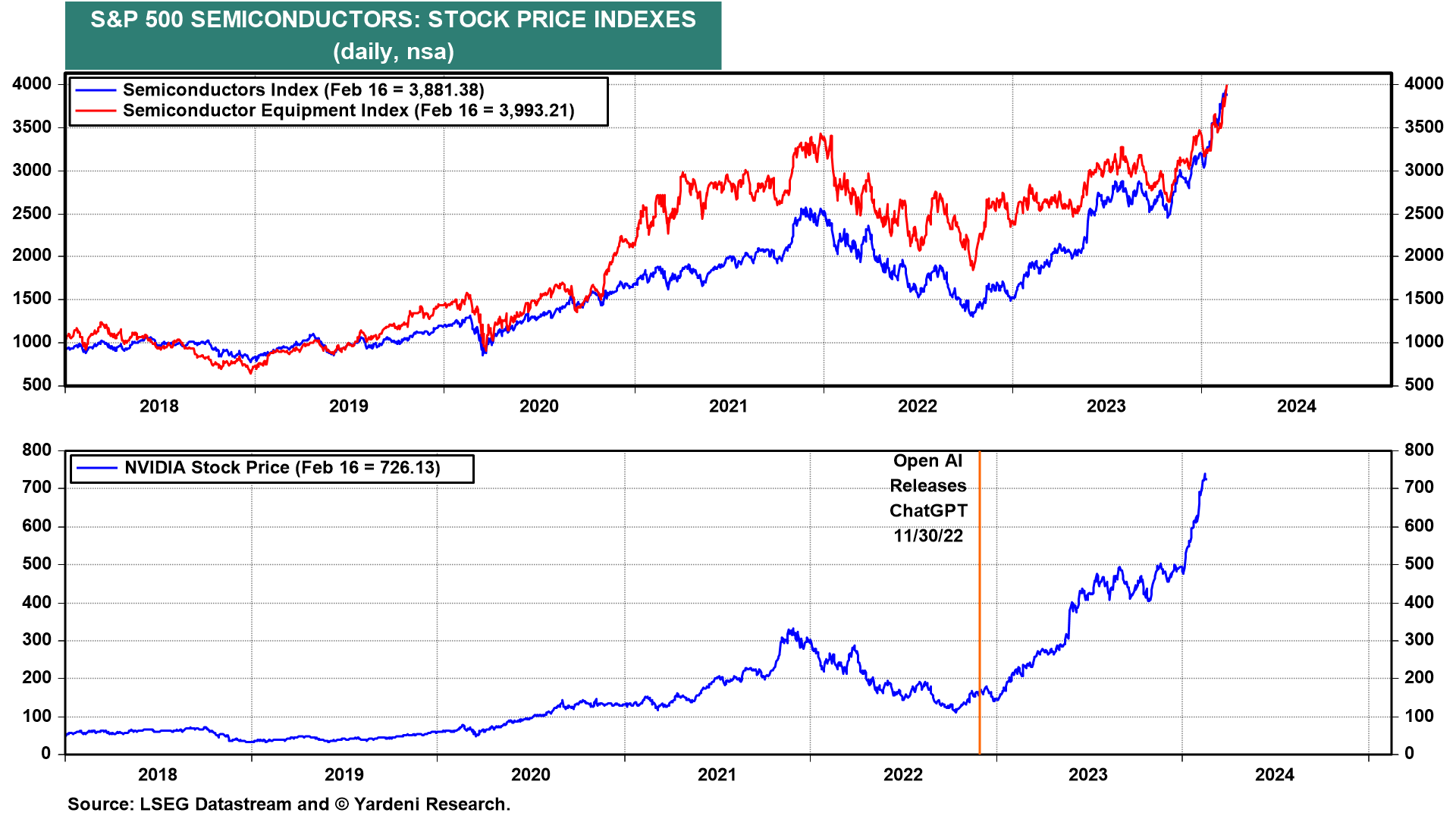

You have been warned: Headlines like these could turn the bull market into a meltup and then a meltdown. We continue to be alert to such signals that might send the S&P 500 to our year-end target of 5400 well ahead of schedule, say by mid-year. For now, Information Technology continues to lead the bull market as semiconductor stocks go parabolic along with Nvidia (chart).

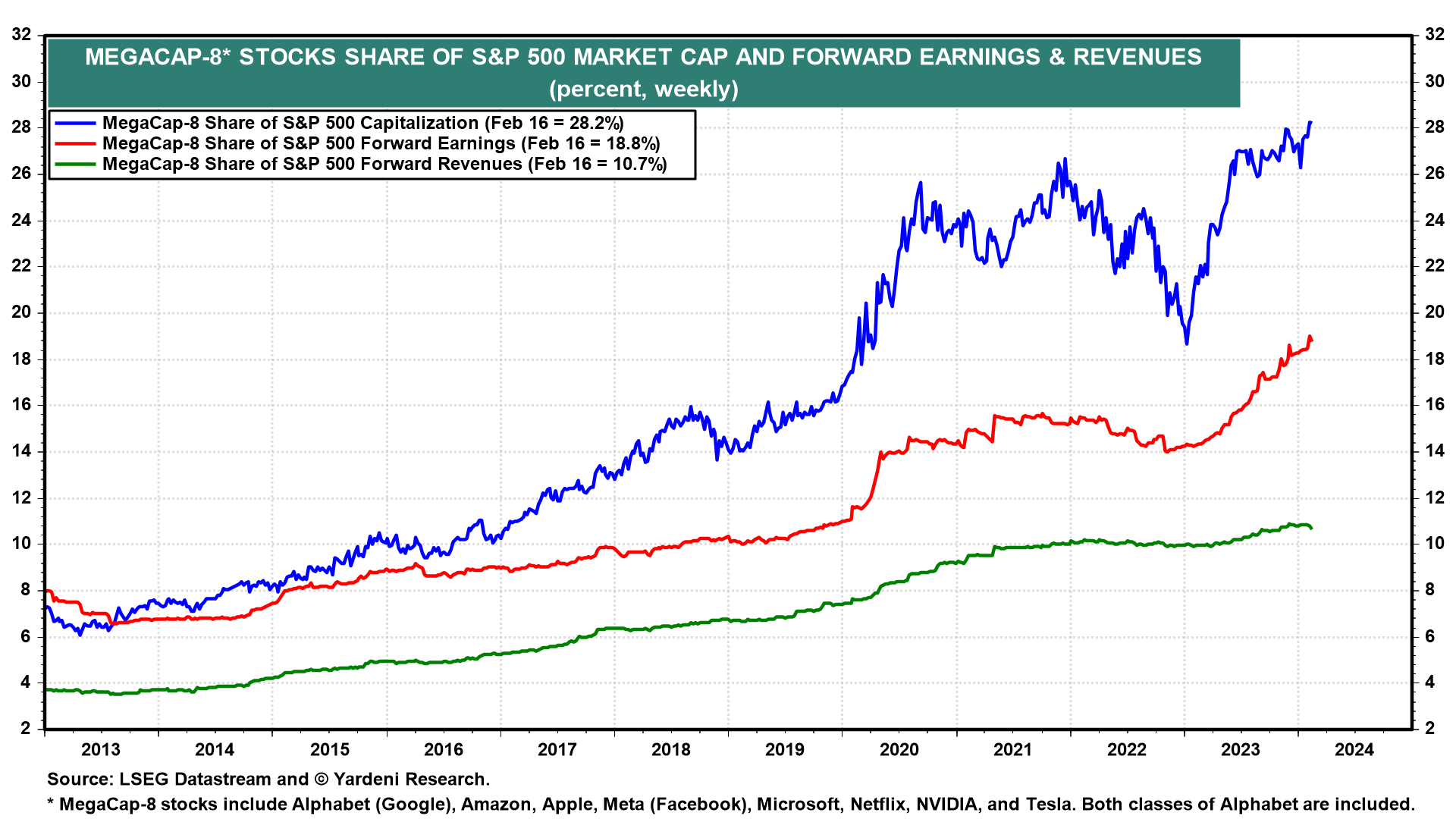

Also still leading the market to new record highs are the MegaCap-8 stocks that now account for a record 28.2% of the S&P 500's market capitalization (chart). They also account for 18.8% and 10.7% of the forward earnings and forward revenues of the S&P 500.

We asked Joe Feshback for his latest assessment of the stock market from a trader's perspective: "Many tech charts have gone parabolic; and with Nvidia reporting this week, this has the earmarks of a buying climax. The put/call ratio is low and confirmed by other bullish sentiment measures. Meanwhile, breadth has been weak. I am of the opinion that the Nasdaq will be vulnerable to a downdraft shortly."

We also asked Michael Brush for his assessment of insider buying: "Buying by insiders continues to pick up as earnings season restrictions wind down, giving us better insight into their thinking. Two developments stand out:

"(1) While regional bank indices remain weak (down 8% this year) because of fears about exposure to commercial real estate loans and deposit flight, insiders at dozens of these banks continue to buy in size. They’re signaling to us that regional bank sector fears are overblown, as they did during last year’s regional bank sector crisis.

"(2) SMidCap biotech insiders are buying in size, especially in IPOs, which are picking up. They’re telling us that the impressive strength in this sector (up 20% in the past six months) has legs."

Thanks, Joe and Michael!