The meltup scenario is making a dramatic comeback. It was one of our three scenarios until March 24 when we wrote the following in our Morning Briefing: "We've decided to fold our 1990s meltup/meltdown scenario into our Roaring 2020s scenario. The current correction in the stock market suggests that the former has played out already, as the bull market's highflyers have been hit hardest by the current correction. That leaves us with two scenarios: the Roaring 2020s, to which we assign a 65% subjective probability, and a mostly stagflation scenario, with a 35% probability. The former includes the possibility of a rebound in the former highflyers, while the latter includes the possibility of a recession."

The former highflyers have certainly rebounded. On May 12, we lowered the odds of trouble to 25% raising the odds of the Roaring 2020s to 75%. But it may soon be time to consider adding a third scenario again for a another possible meltup/meltdown in the stock market.

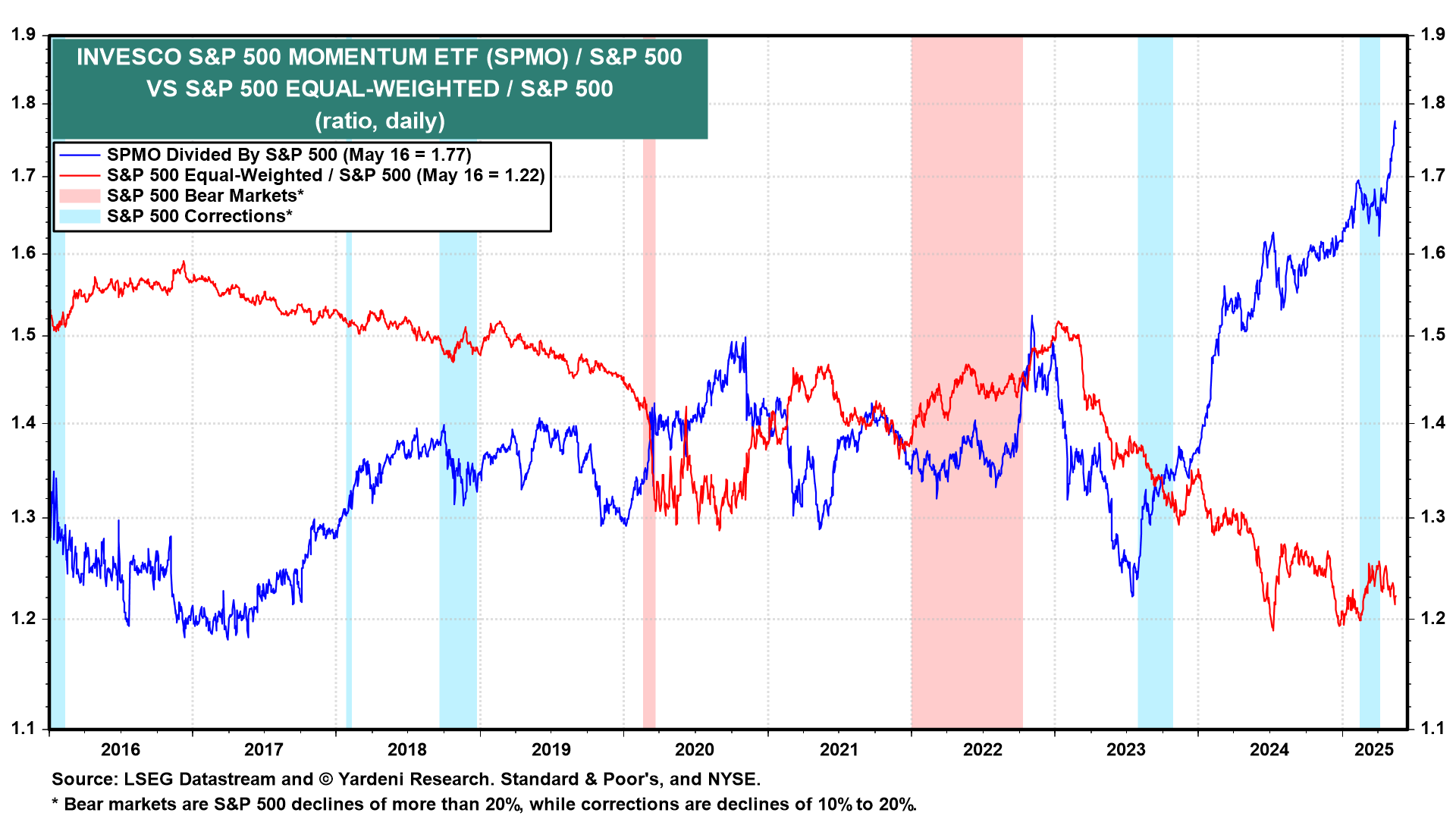

The latest correction in the S&P 500 bottomed on April 8 and it has been a V-shaped recovery in the stock market since then. The momentum stocks have been leading the way (chart).

The 19.6% rebound in the S&P 500 since April 8 has been led by a 29.5% meltup in the Magnificent-7 (chart).