The S&P 500 rose to a new record high on Friday, slightly exceeding its previous peak on February 19 by 0.5%. The bull market that started on October 12, 2022 is alive and well following the 18.9% correction from February 19 through April 8. During that period, the stock market sold off on Trump's Tariff Turmoil (TTT) as well as concerns that China's DeepSeek was bad news for US technology companies, especially the ones spending the most to build AI infrastructure. Both those concerns abated after April 8, and the bull market resumed. Trump started to moderate his stance on tariffs on April 9, and AI companies reiterated their commitment to spend tens of billions of dollars on AI capital investments during April's Q1 earnings season.

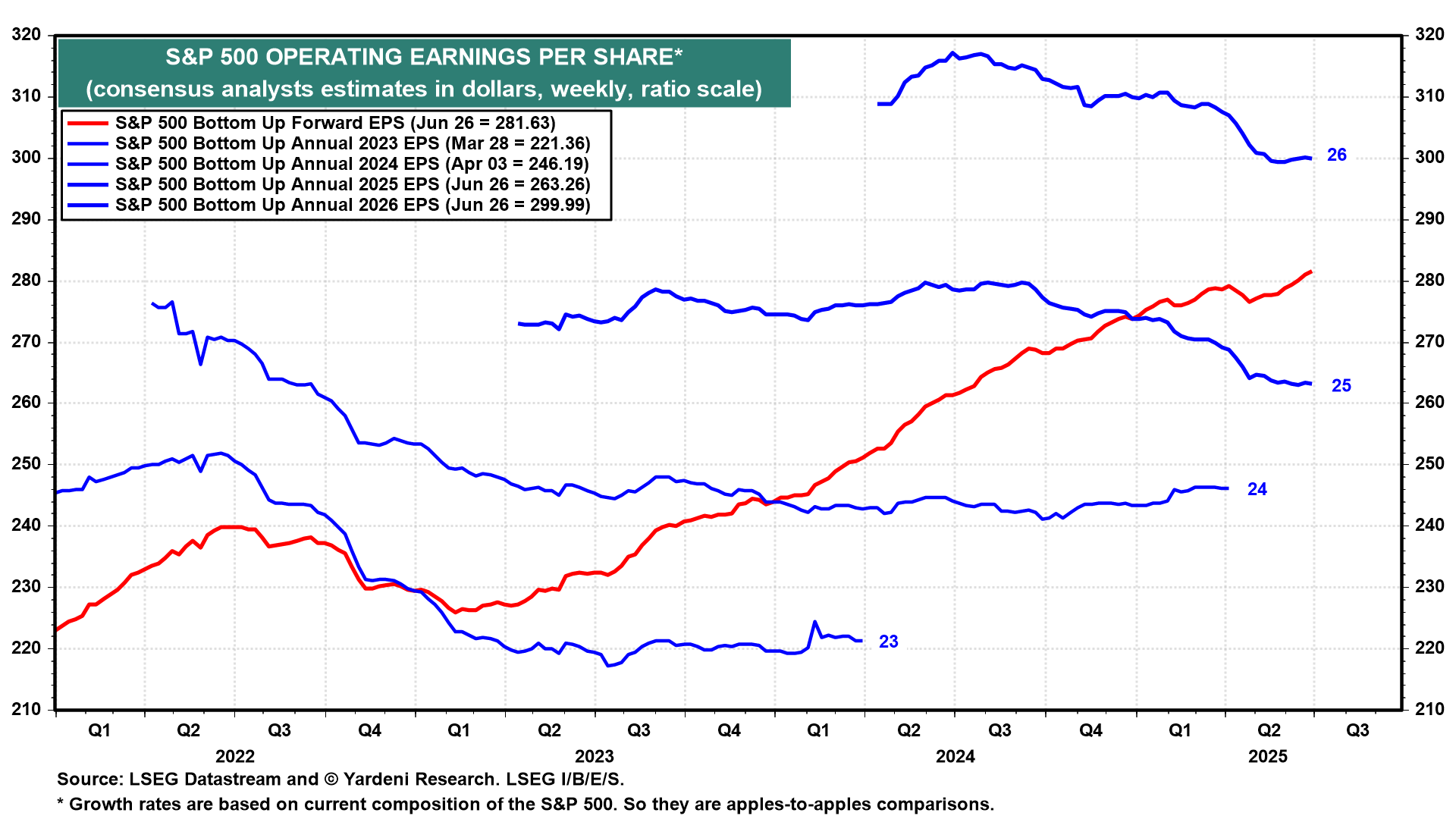

Also boosting the S&P 500 is the record high in S&P 500 forward earnings (chart). It had peaked on April 4, two days after President Donald Trump announced his proposed reciprocal tariffs on America's trading partners. It briefly dipped through April 25 and has rebounded since then.

Almost all of the correction was attributable to a drop in the S&P 500's forward P/E (chart). It peaked at 22.2 at the start of the correction and bottomed at 18.1 at the end of the correction. Now it is back to 21.9! It has been a P/E-led, V-shaped correction lasting 48 days. That's a relatively normal correction.