The financial markets have become jittery lately due to concerns about high valuation multiples, particularly among AI stocks, and a potential government shutdown. President Donald Trump reportedly will meet with the top four congressional leaders at the White House on Monday as the threat of a government shutdown on October 1 looms.

Meanwhile, investors are once again wondering whether the massive spending on AI infrastructure by the "hyperscalers" will ever pay off. It's a reasonable concern, as AI is an application that generates increased demand for data processing and storage to infinity and beyond. If so, that will require lots of capital spending to infinity and beyond. Alternatively, the novelty of AI might wear off once everyone has had a chance to discover its applications or to abandon its usefulness. That might leave hyperscalers with excessive data center capacity.

Another possibility is that the next generation of GPU chips will be even faster and operate at room temperature, reducing the water and electricity demand of data centers. That means today's state-of-the-art chips could become obsolete before they've generated any profits.

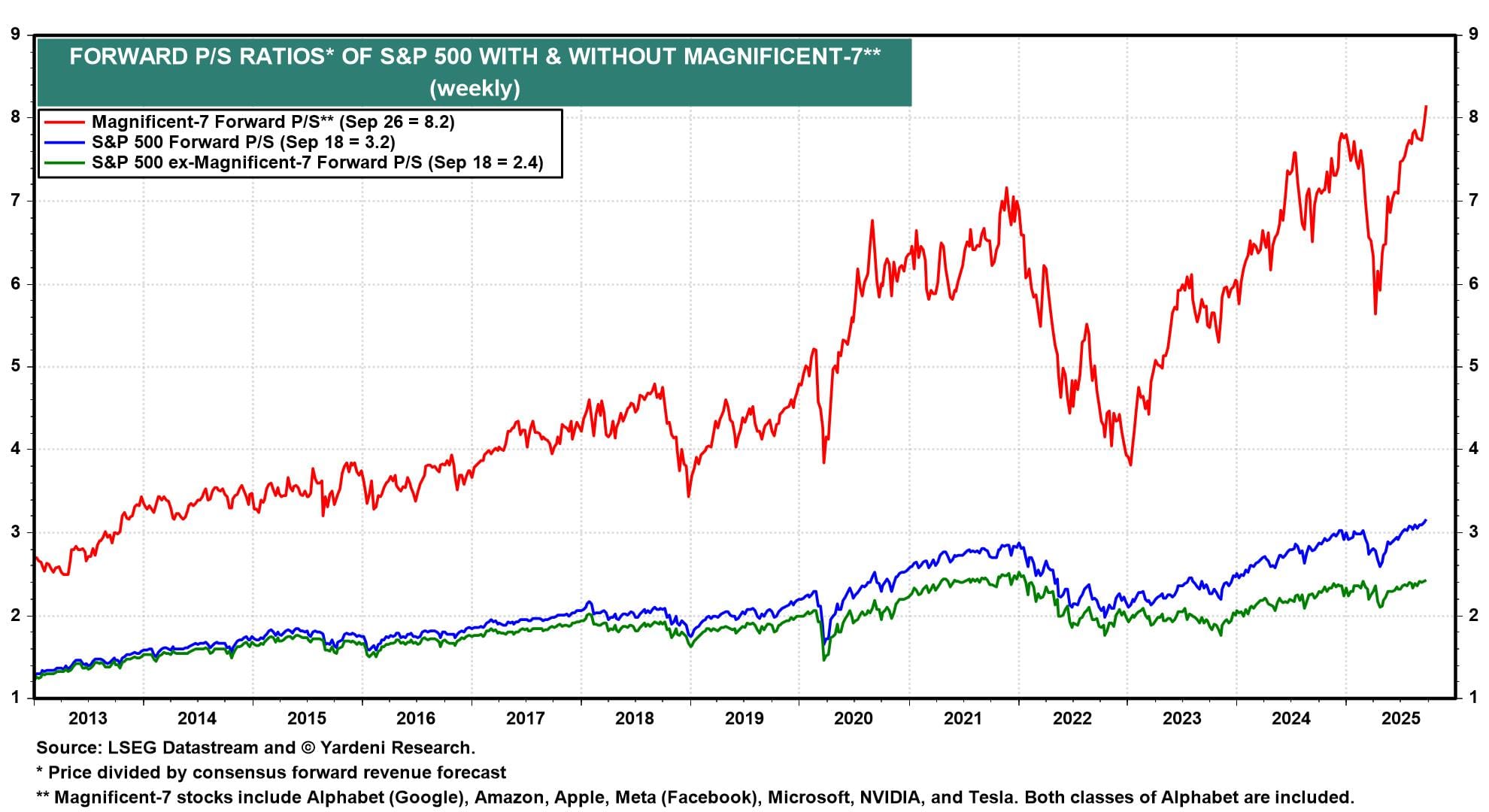

The hyperscalers are included in the Magnificent-7, which collectively sport a weekly Buffett Ratio of a record 8.2 (chart). They've driven the ratio to a record 3.2 for the S&P 500. Excluding them, the ratio for the S&P 493 is 2.4. As a result, we expect to see the bull market broaden, boosting the relative performance of the Impresssive 493.

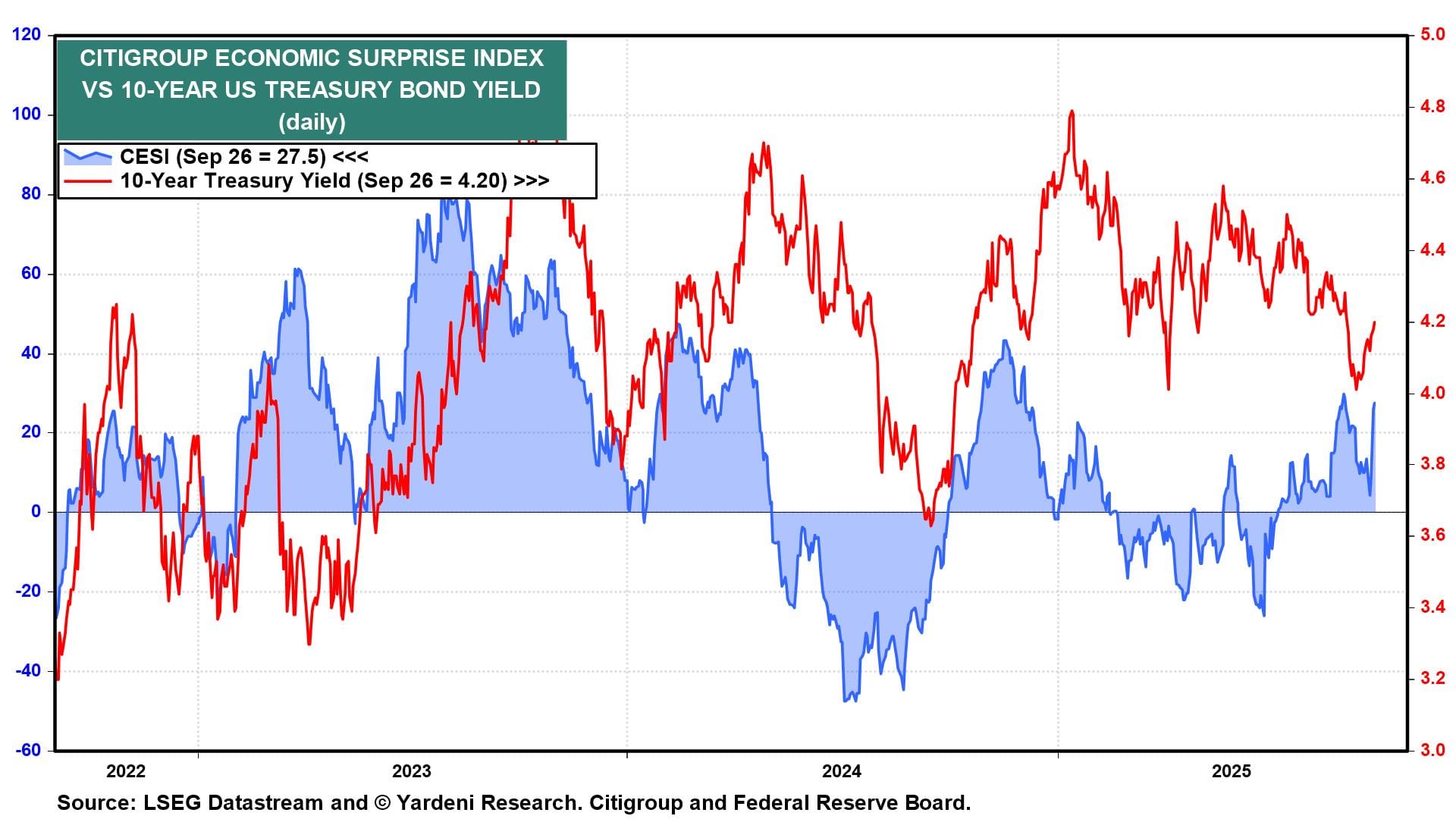

Meanwhile, the 10-year US Treasury bond yield rebounded off 4.00%, just before the Fed cut the federal funds rate on September 17, to 4.20% currently, on better-than-expected economic news this past week (chart). We are sticking with our 4.25%-4.75% range for this yield and extending it through Q1-2026.

In the forex market, the DXY dollar index has been holding support at its uptrend line that starts in 2011 (chart). We expect that better-than-expected US economic growth and falling odds of Fed rate cuts will lift the dollar.

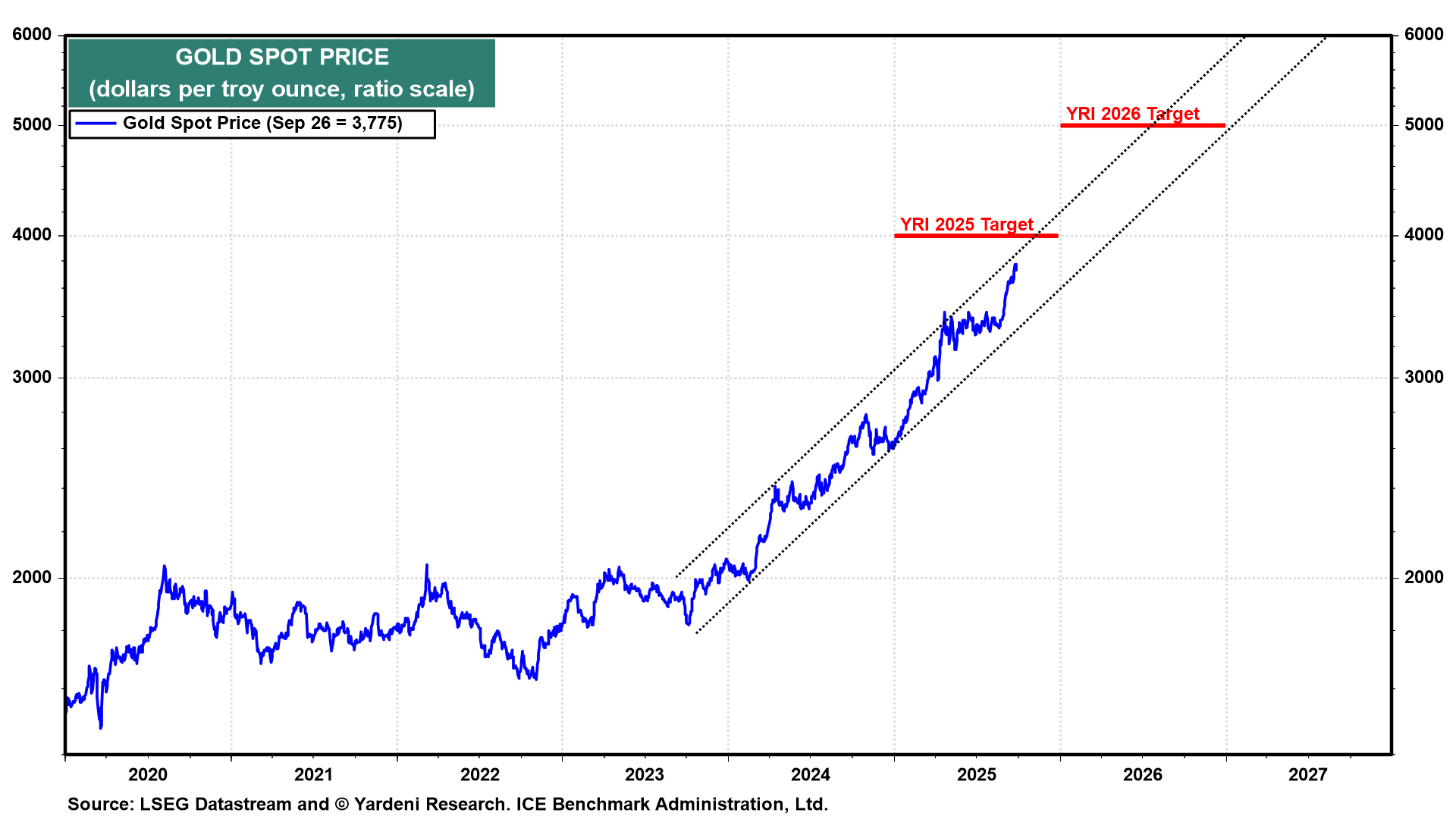

The weak dollar so far this year has boosted the price of gold. There are also numerous other bullish factors, including central bank buying and rising geopolitical risks. When the price rose above $3,000 early this year, we targeted $4,000 per ounce by the end of this year and $5,000 per ounce by the end of next year (chart).

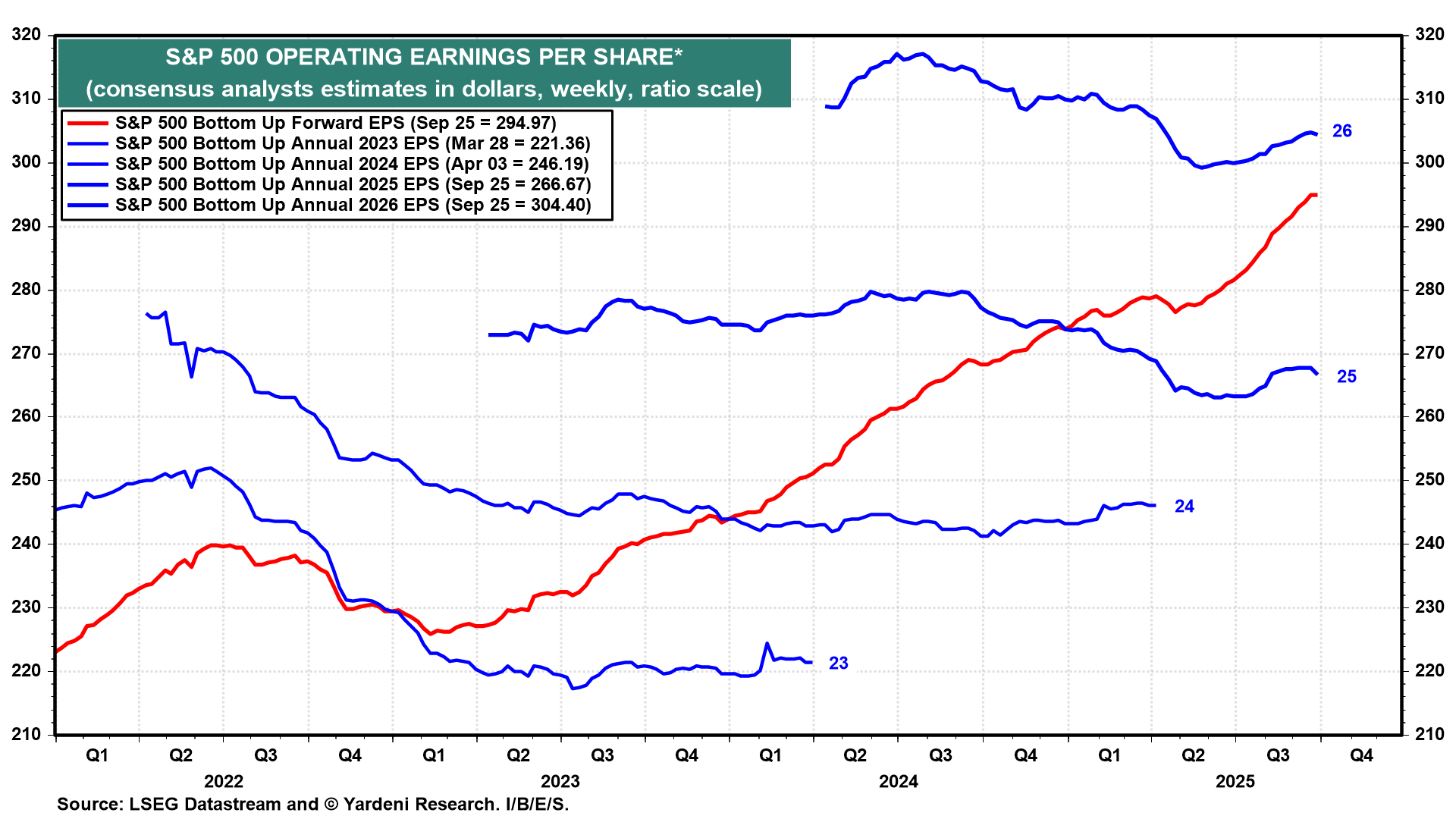

The S&P 500's bull market continues to be supported by S&P 500 forward earnings, which is still rising to record highs. It did so last week, despite small dips in analysts' consensus expectations for earnings in both 2025 and 2026. Our colleague, Joe Abbott, explains that the w/w drops are misleading due to changes in the S&P 500 index resulting from quarterly rebalancing. Here is S&P's press release of the index changes effective with the September 22 market open.

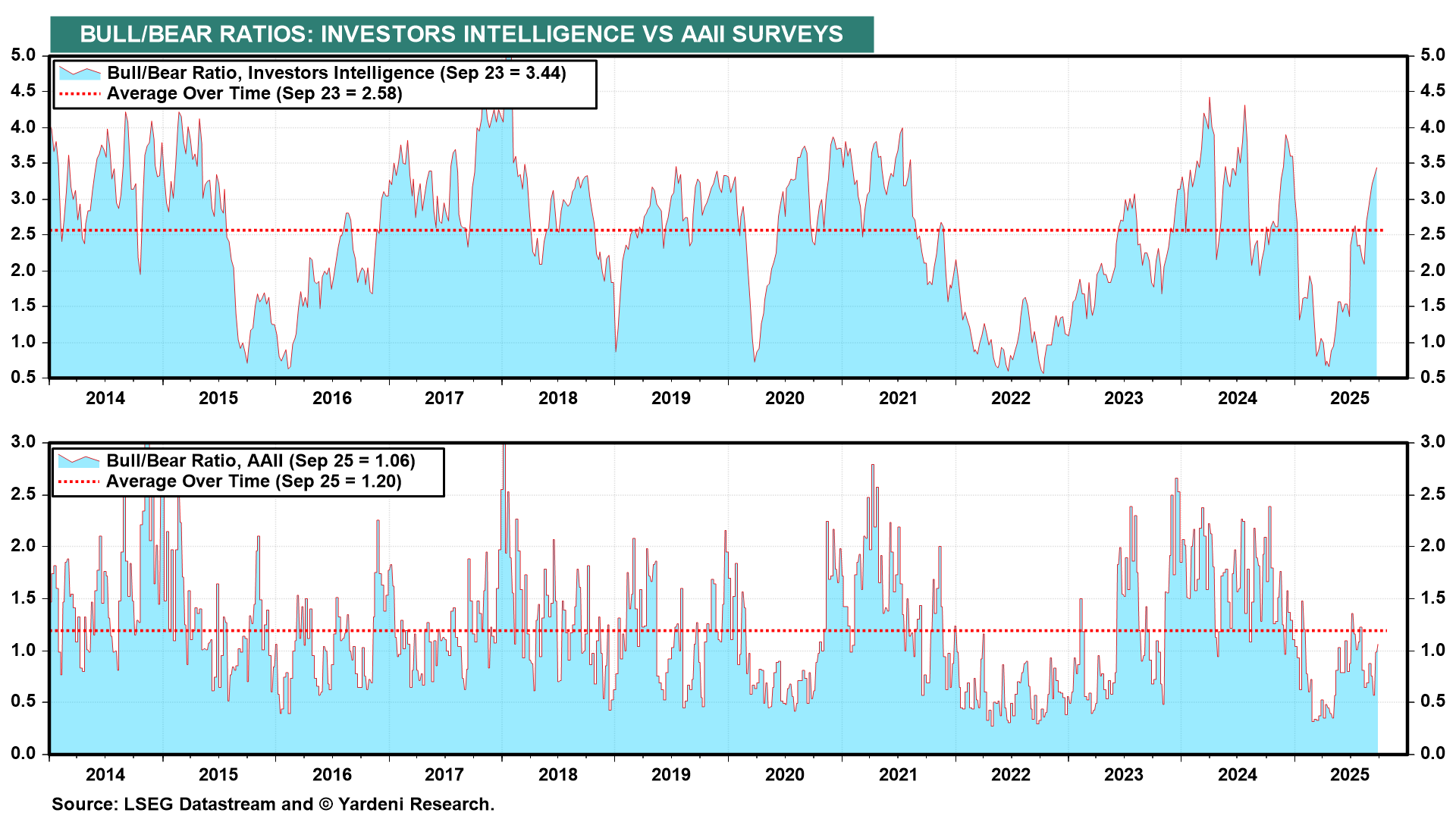

Finally, sentiment has turned quite bullish according to the Investors Intelligence Bull/Bear Ratio (chart). That hasn't been confirmed yet by the AAII Bull/Bear Ratio. However, sentiment is getting a bit frothy.