We are surprised that the financial markets were surprised by the hawkish tone of remarks from Fed officials this past week. Collectively, a few participants on the Federal Open Mouth Committee pushed back against market expectations for an imminent rate cut, stressing that inflation is not yet under control and that monetary policy must remain restrictive.

In prepared comments during his October 29 presser, Fed Chair Jerome Powell stated, "A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it. Policy is not on a preset course." He was clearly pushing back against the widespread view (which we didn't share) that another rate cut would occur before the end of this year. On Friday, the odds of that happening dropped to less than 50% (i.e., 44.4%), according to the CME FedWatch Tool.

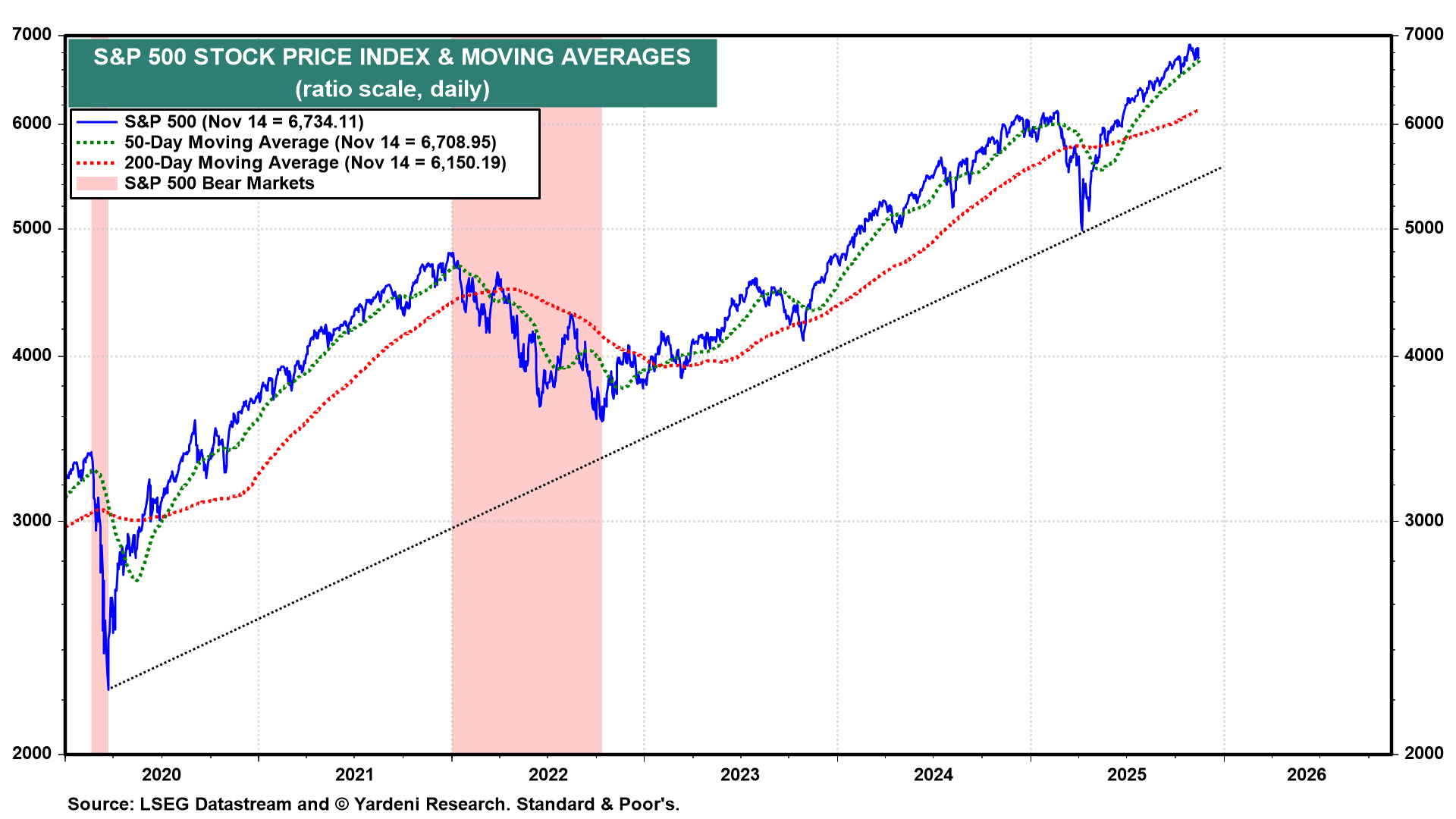

The S&P 500 fell sharply on Thursday, led by AI-related and Financials sector stocks, but didn't breach its 50-day moving average (chart). In addition to second thoughts about Fed easing, investors are having second thoughts about the AI trade, as we've noted in recent QTs.

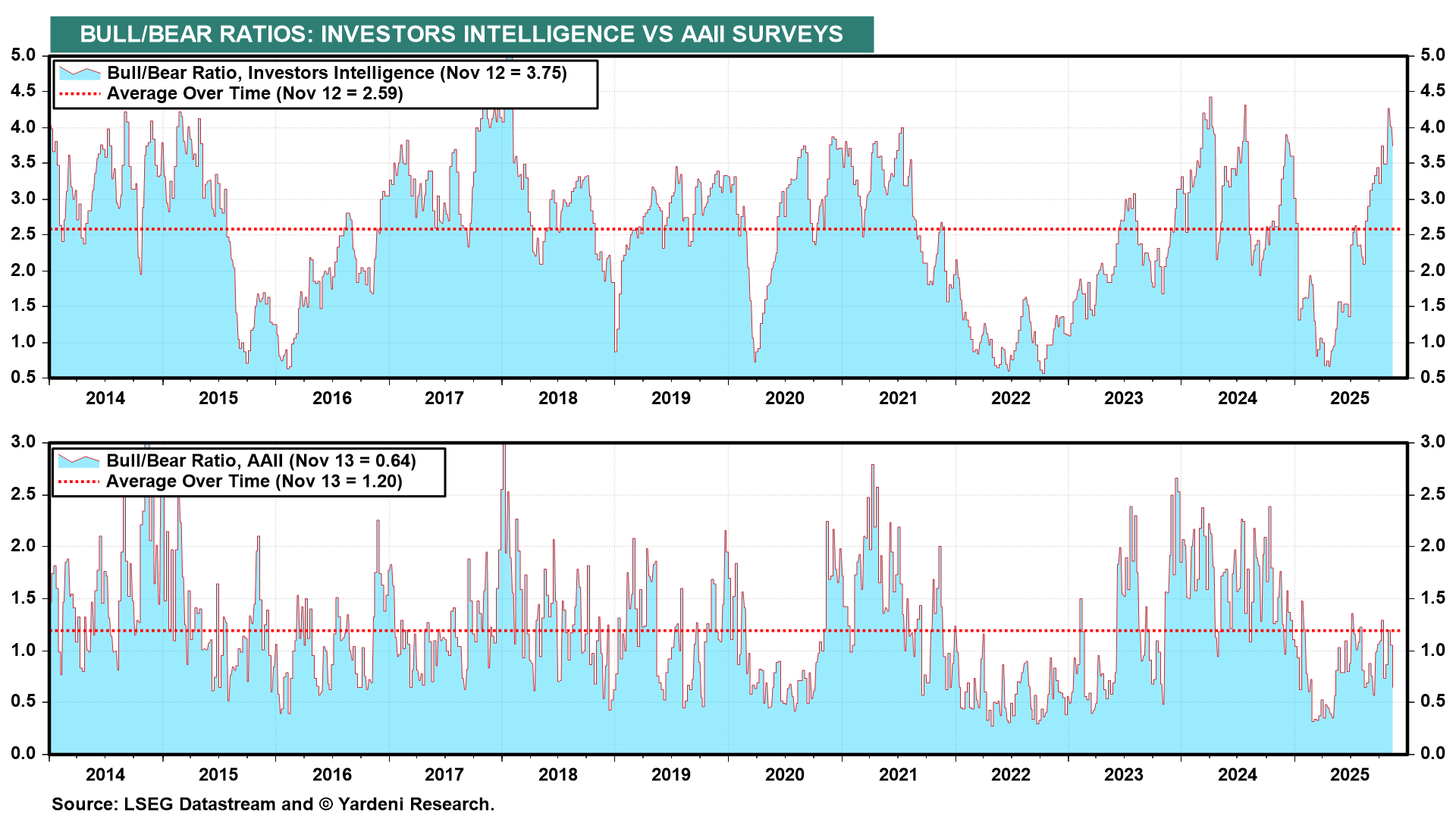

We had been expecting a pullback. On November 1, we observed that "[w]hile earnings are bullish, sentiment is bearish in the very short term. There are too many bulls." Now, we expect to see a significant drop in the bull-bear ratios when this past week's data are released this week (chart).

We are sticking with our 7000 target for the S&P 500 by the end of this year because we expect that investors will soon conclude that the many known unknowns about the AI trade will lead to a happy outcome (i.e., productivity-led growth) rather than an unhappy one (i.e., another Tech Wreck).

As we have observed repeatedly over the past four years, the most widely anticipated recession of all time didn't happen. Now we suspect that the most widely predicted financial market implosion in history might not happen either. In this regard, we are happy to see that the front cover of The Economist this week is very bearish, which is bullish from a contrarian perspective (image).

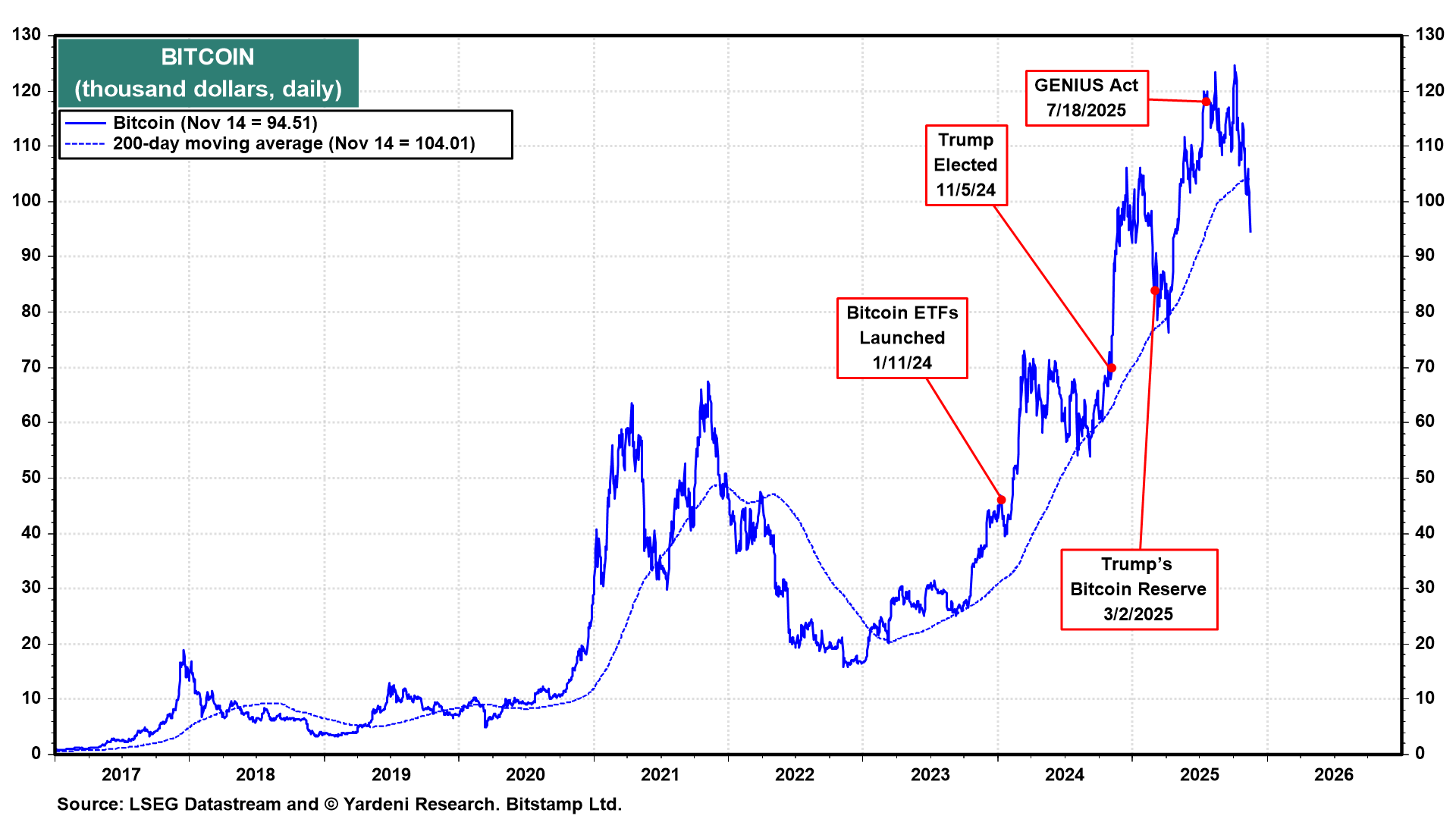

Some of the air did come out of financial markets since the S&P 500 rose to a record high on October 29. That actually reduces the likelihood of a bursting stock market bubble. The Nasdaq has fallen 4.4% since then. The Roundhill Meme Stock ETF lost 41.1% since October 14. The price of gold has retreated 6.3% since October 20. Bitcoin fell below its 200-day moving average last week and is now in a 24.7% bear market since this year's peak on October 6 (chart). On July 18, the GENIUS Act established stablecoin as the cryptocurrency most likely to be used for transactions, thus eliminating this role for bitcoin.

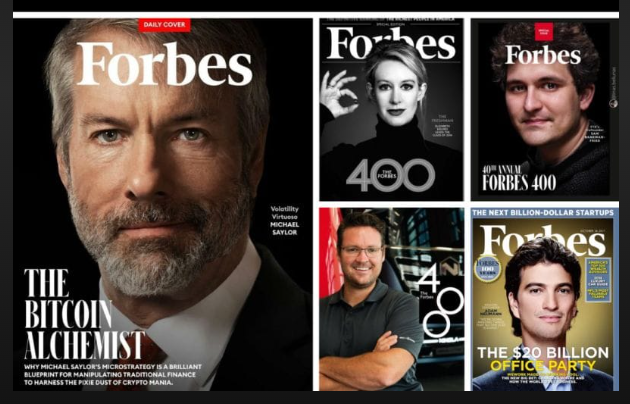

The GENIUS Act might have burst the balloon inflated by financial genius Michael Saylor. He was featured on the front cover of the January 30, 2025 issue of Forbes as "The Bitcoin Alchemist" (chart). That honor has sometimes proved to be a curse (image).

The stock price of Saylor's company, Strategy, has plunged 55.7% from this year's high on July 17 (chart).

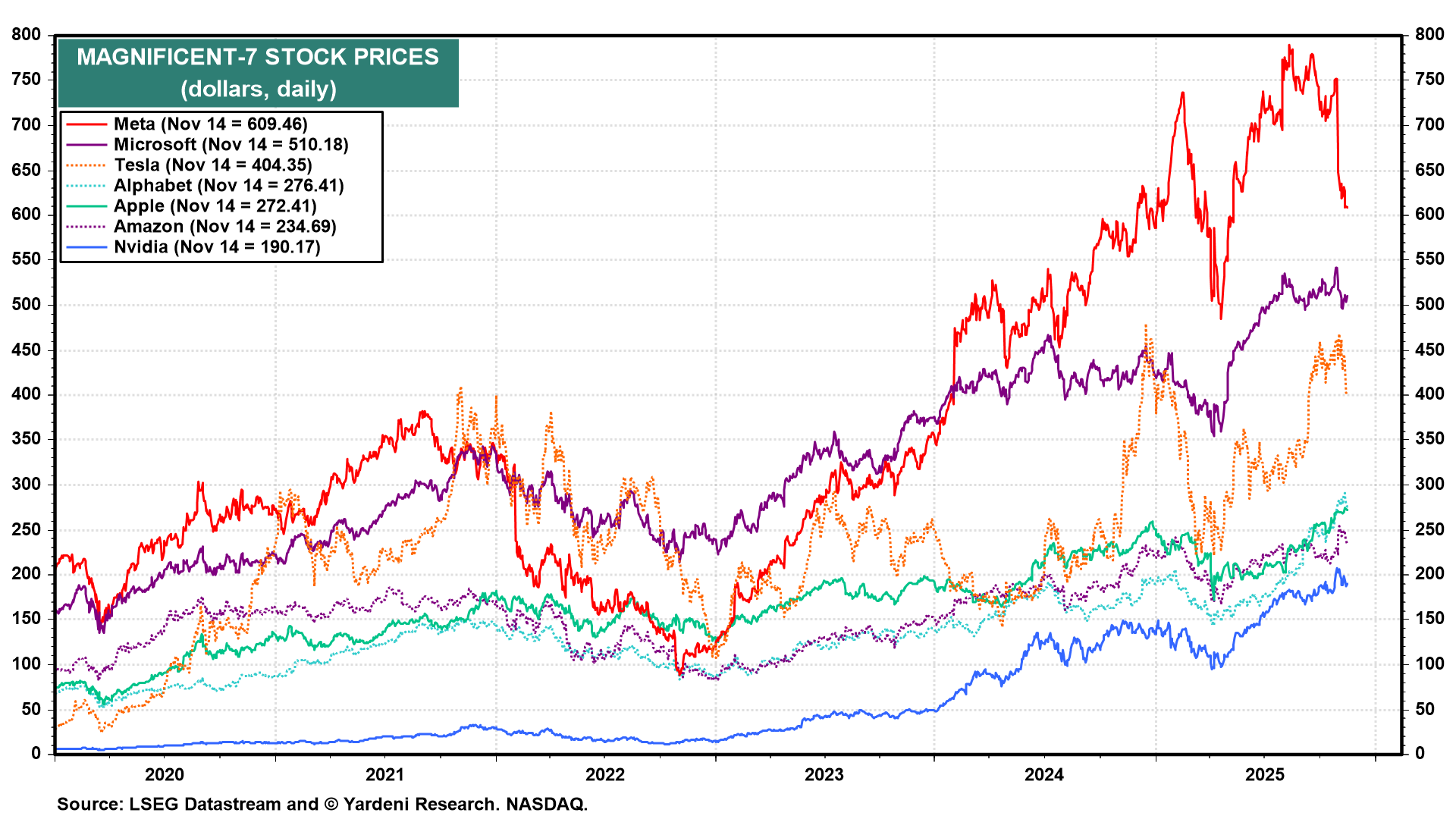

The Magnificent-7’s stock prices have lost some air too, falling 6.0% since October 29 (chart). During the pandemic, these seven stocks were prized for their strong cash flows and asset-light balance sheets. When the Fed tightened monetary policy, they were favored for their low debt burdens. Soon after ChatGPT was introduced in late 2022, they were once again regarded as winners, especially the cloud providers among them.

But in recent months, investors have become concerned that the Magnificent-7 companies are spending too much on AI infrastructure. The concern is that they will have excess capacity. Ironically, some AI-related stocks (like CoreWeave) have been hit recently because building new data centers is taking longer than expected due to electricity shortages and other challenges. Another concern is that the demand for more AI cloud capacity has been driven by the computing power required to train Large Language Models rather than by final demand from consumers and businesses. Michael Burry has also charged that the hyperscalers should be depreciating their GPU chips over 2- to 3-year periods rather than longer ones.

These are all legitimate concerns. However, they don't add up to an AI bubble that is about to burst, in our opinion.