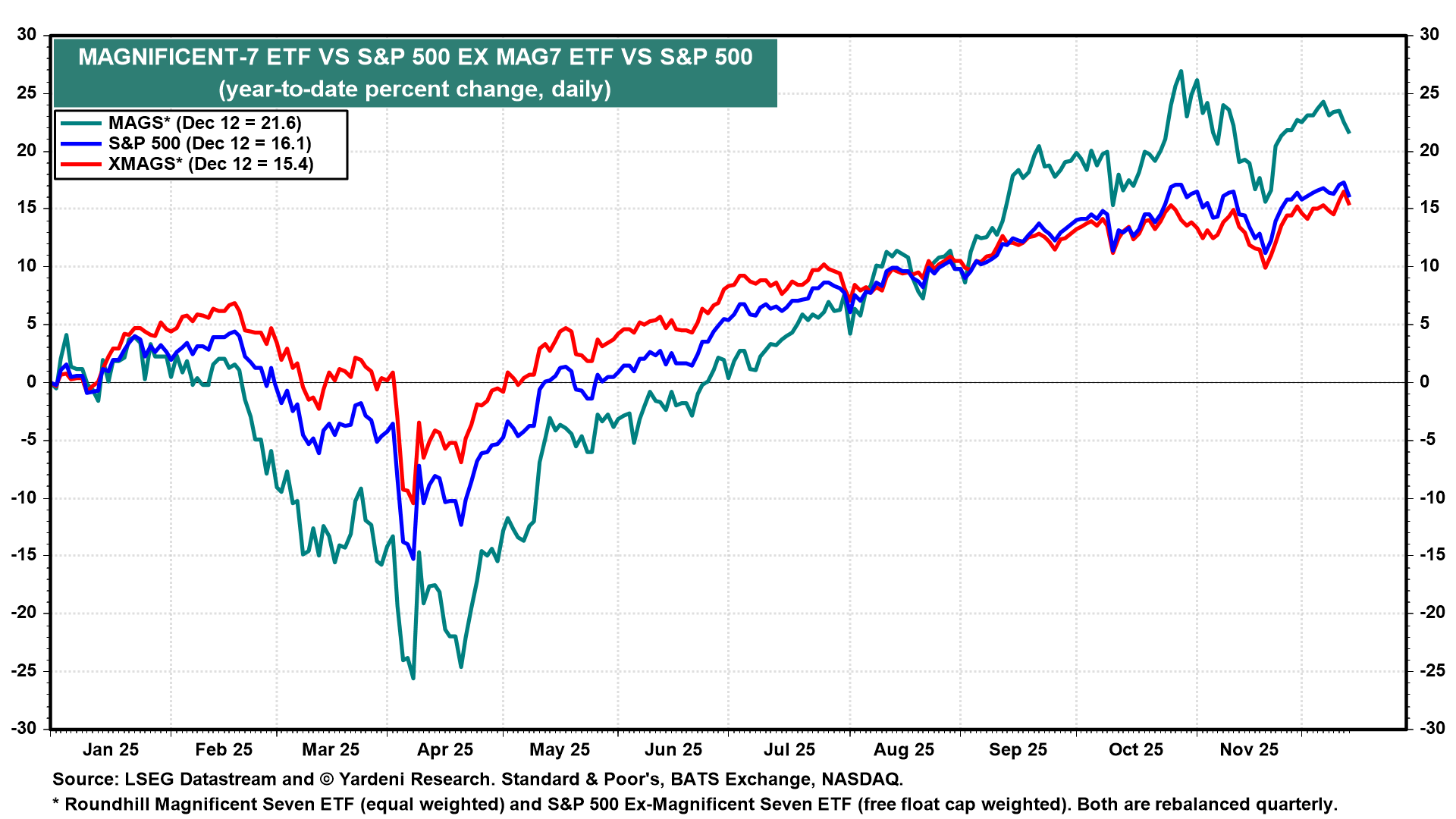

The S&P 500's Magnificent-7 might be less magnificent in 2026 as their fierce competition in the AI race starts to erode the monopolies they have enjoyed in search (Google), software (Microsoft), retailing (Amazon), advertising (Meta), electric vehicles (Tesla), smartphones (Apple), and GPU chips (Nvidia). The beneficiaries of that competition are likely to be the S&P 500's Impressive 493. A week ago, we recommended underweighting the former and overweighting the latter. We may be on the right track: Since October 29, the MAGS ETF is down 4.2%, while the XMAG ETF is up 1.2% (chart).

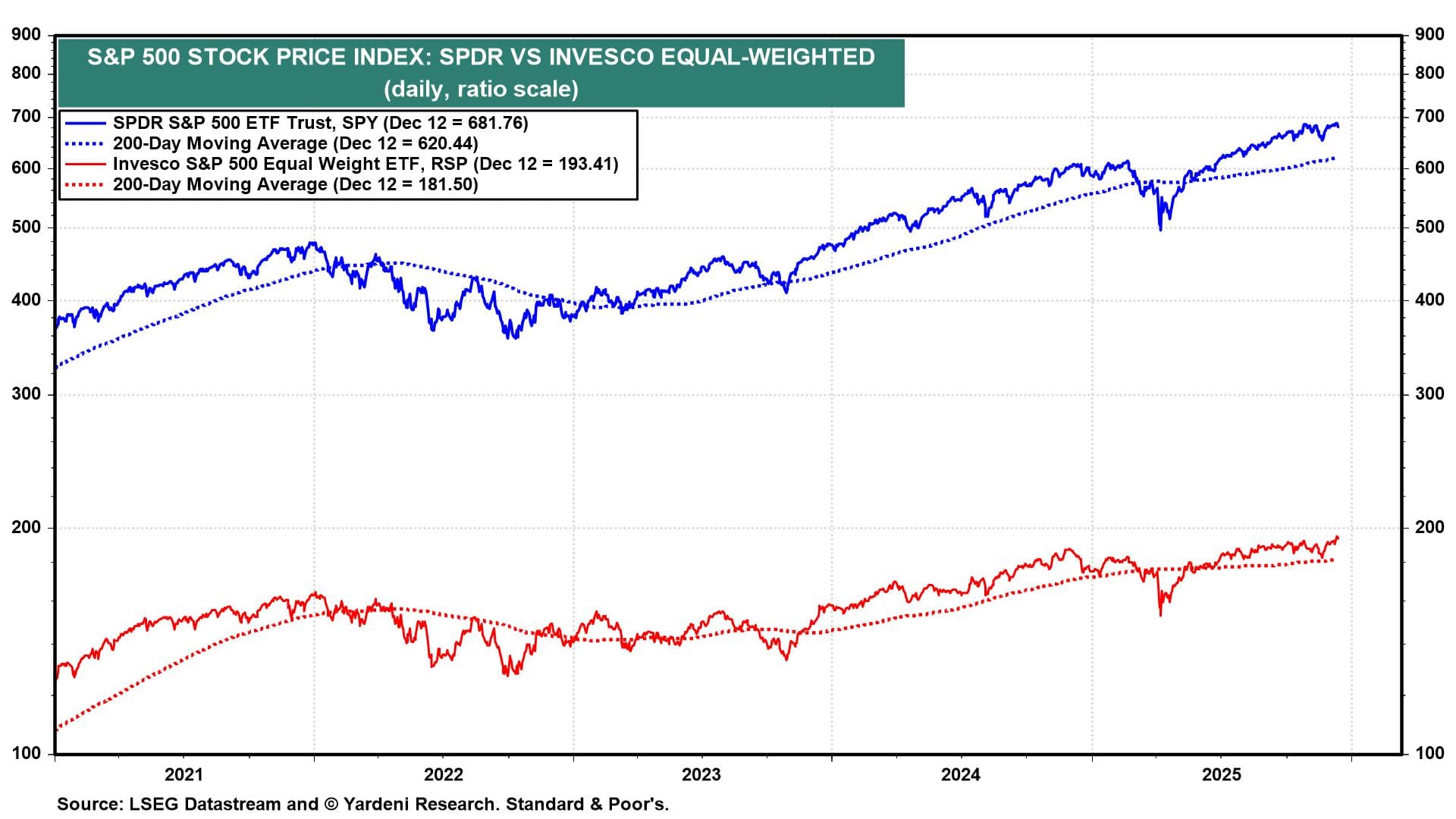

The S&P 500 equal-weight index rose to a new record high at the end of last week, while the S&P 500 market-weight index did the same on Thursday (chart). The former is up 10.1% ytd, while the latter is up 16.1% over the same period. We are expecting a reversal of fortune in 2026.

We downgraded the S&P 500 Information Technology and Communication Services industry index to market-weight last week. We also reiterated our recommendation to overweight the S&P 500 Financials sector, which rose to a record high after the Fed cut the federal funds rate on Wednesday (chart). We remain positive on Diversified Banks, Regional Banks, and Investment Banks.