Technological innovations tend to be disruptive and dynamic. That's especially true with AI, which has the potential to disrupt itself, as evidenced by its ability to write software code, including AI code. So it can feed on itself, with the new code eating the old, making it obsolete very quickly. The pace of obsolescence seems to be moving at warp speed for both AI hardware and software, particularly the LLMs. That pace has recently spooked investors who've been selling the stocks of any company that might be negatively disrupted by AI.

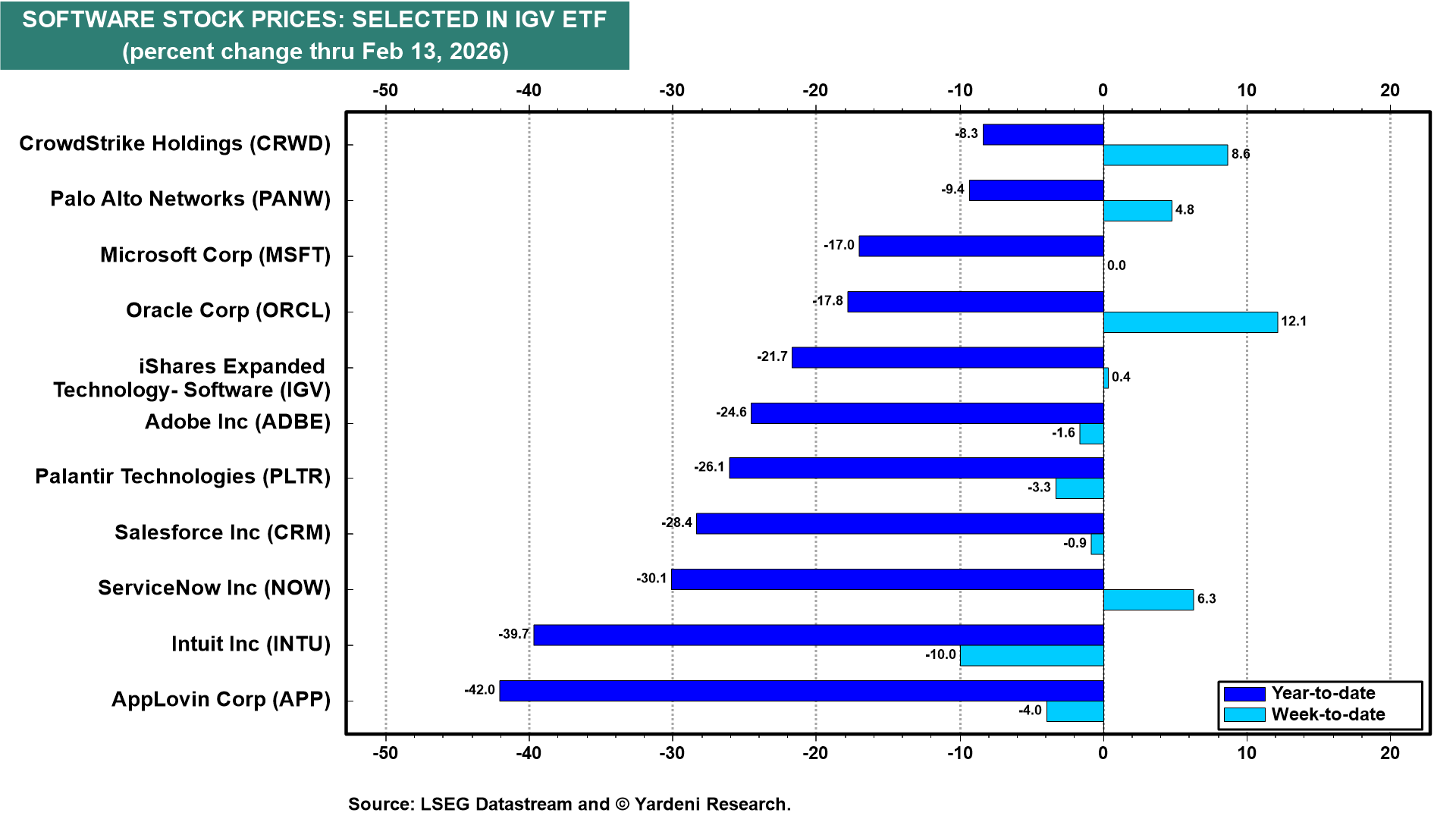

The first casualty so far this year has been the software industry's stocks. The iShares Expanded Technology -Software (IGV) is down 24.6% ytd (chart). Last week, investors started to cherry-pick among some of the beaten-up stocks in search of the companies that might benefit from AI rather than be destroyed by it.

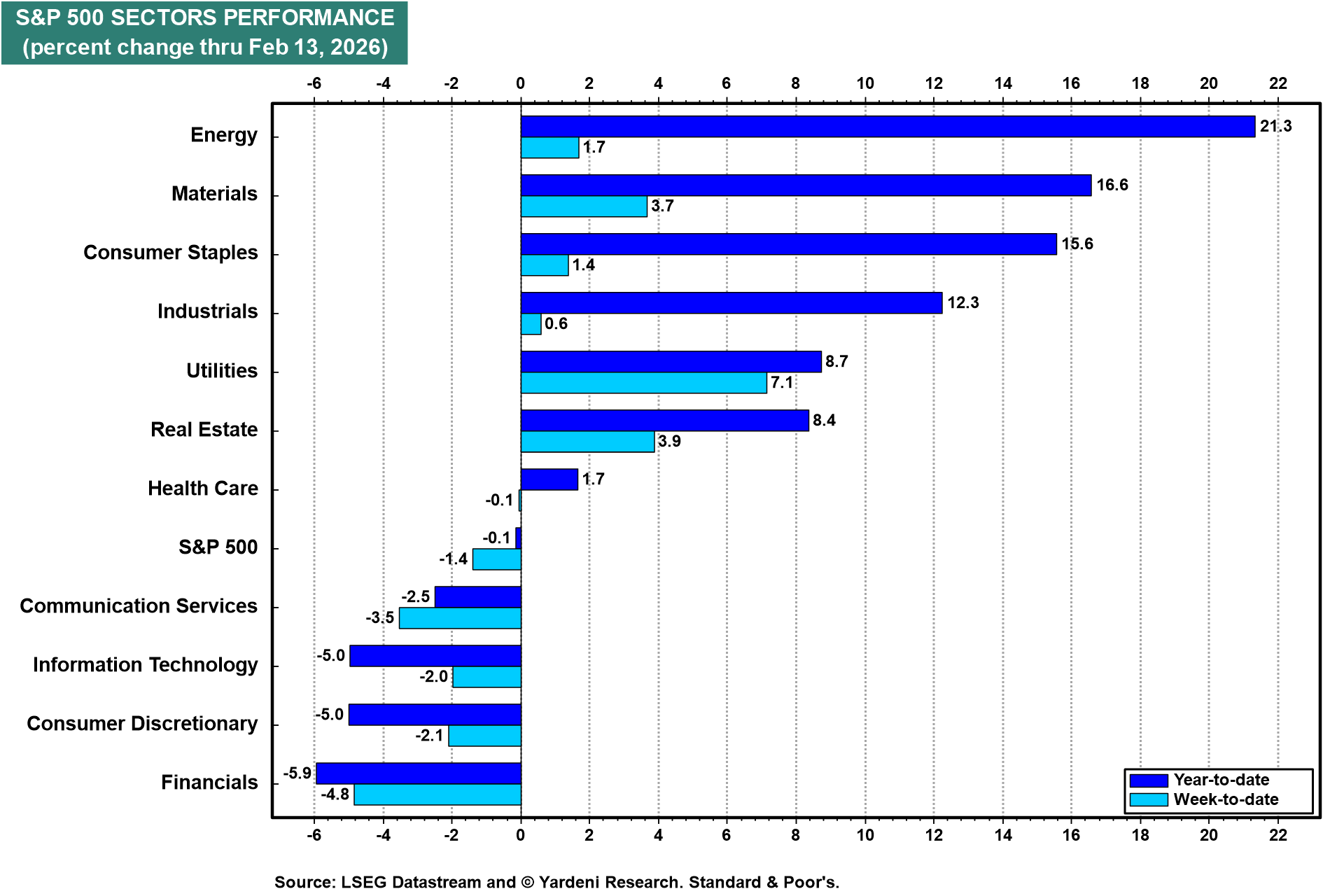

Investors also last week continued to pummel the S&P 500 sectors that might be adversely affected by AI and flock to those that seem most immune to disruptive AI (chart). So there has been a significant rotation in the stock market away from sectors representing less certain bets on the virtual world back to those representing the more predictable physical world, i.e., the S&P 500’s Energy, Materials, Consumer Staples, Industrials, Real Estate, and Health Care sectors.