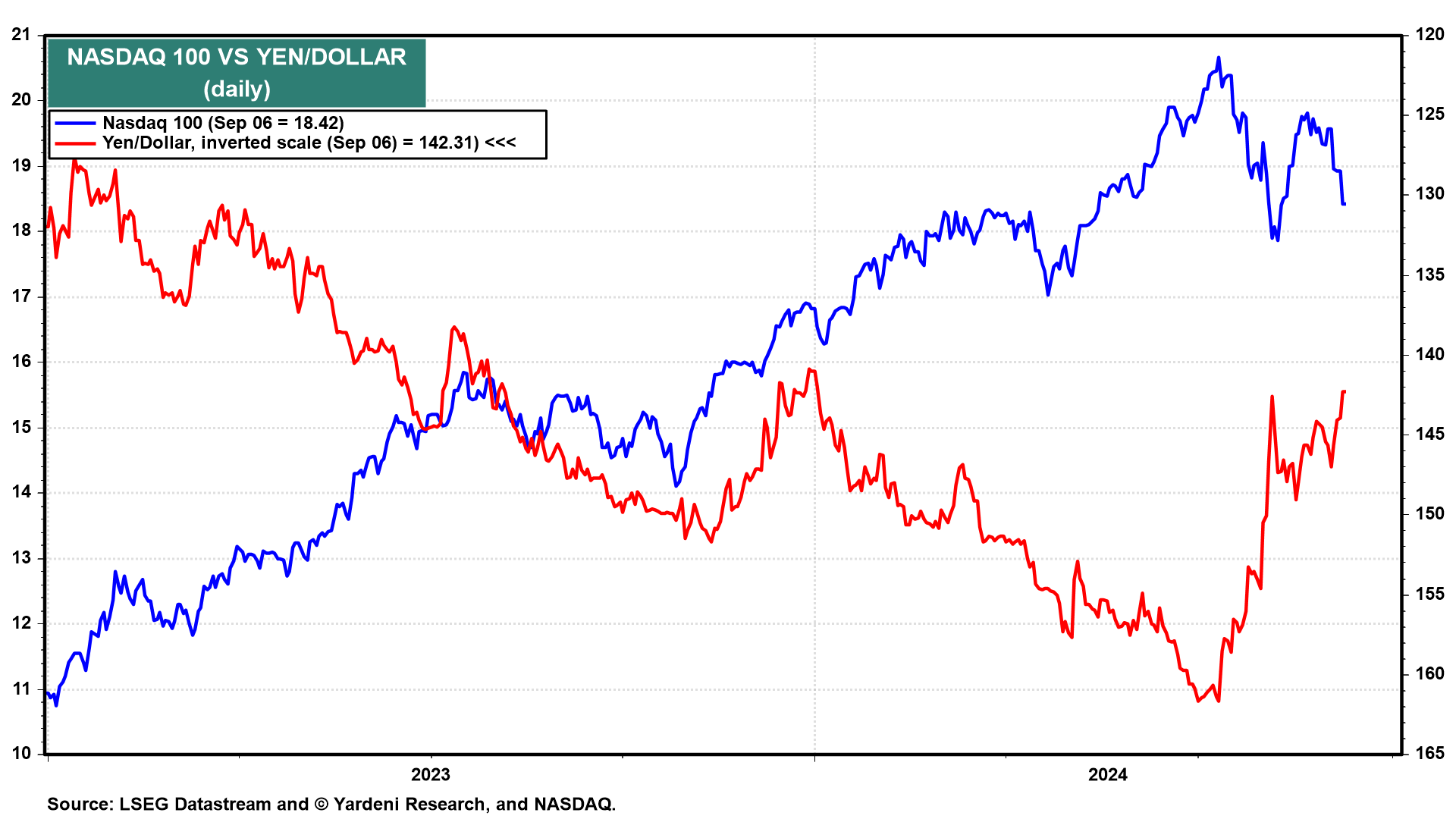

Something doesn't make sense. Why are stock prices falling when the Fed is set to lower interest rates to avert a recession and to stop the unemployment rate from rising by boosting economic growth? We had a glimpse of the answer in early August: The carry trade is still unwinding. Expectations that the Fed will lower our interest rates, while the Bank of Japan raises their interest rates are boosting the yen and forcing traders to unwind their carry trades, which were executed when they borrowed yen at near-zero interest rates to buy assets with higher returns in other currencies, especially the Magnificent 7 and semiconductor stocks in the US. There has been a strong inverse correlation between the yen and the Nasdaq 100 since the start of 2023 (chart).

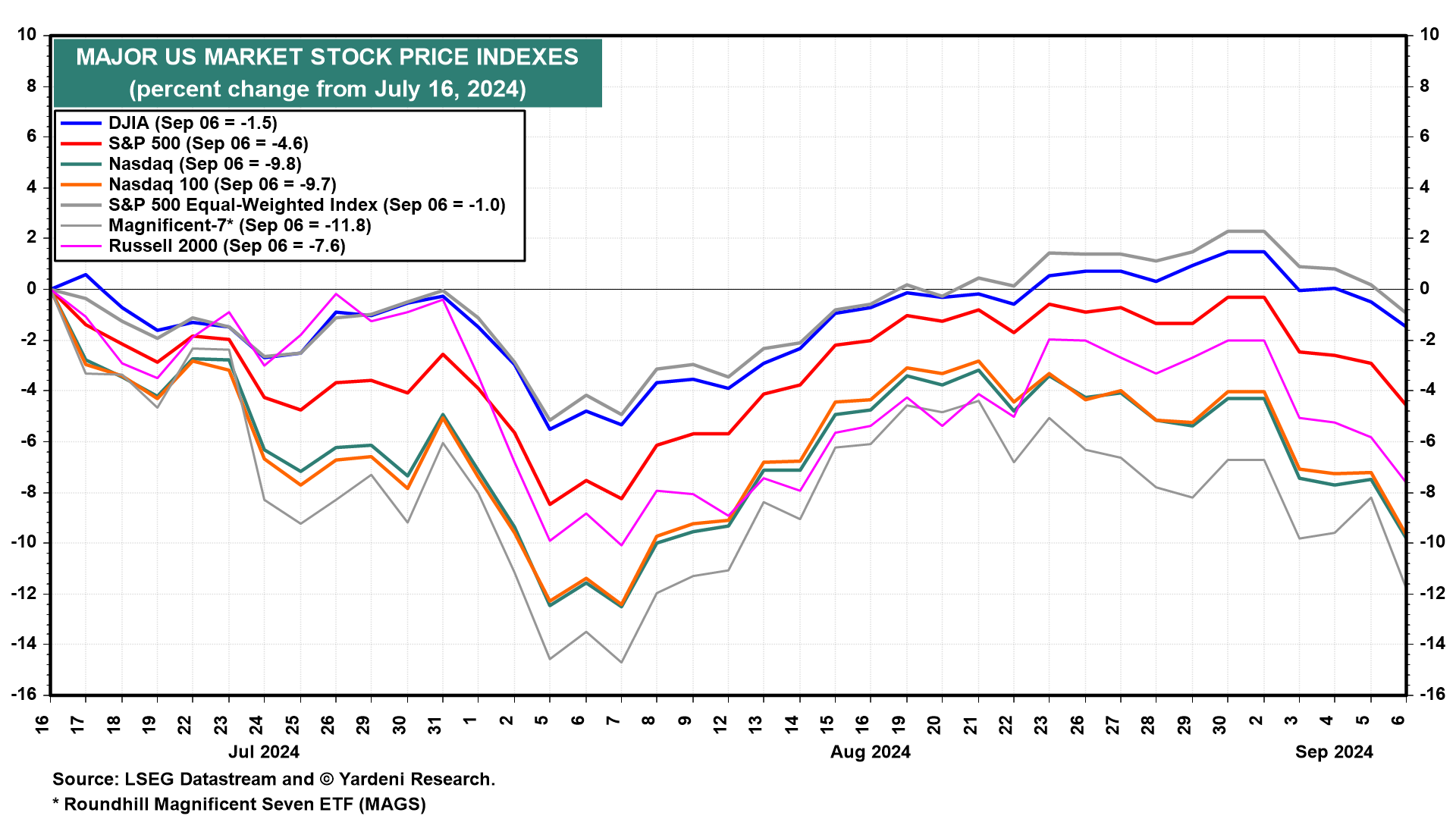

This explains why the stock prices with the most upside momentum have lost the most since the S&P 500 peaked at a record high on July 16 (chart). Friday was a particularly bad day for the Magnificent 7 and the Nasdaq 100. That's because Friday's weak employment report increased the odds the the Fed will cut the federal funds rate by 50bps rather than 25bps on September 18. On Tuesday, BOJ Governor Kazuo Ueda reiterated that the central bank will continue to raise interest rates if the economy and prices perform as expected by the BOJ, a comment that supported further gains in the yen and another round of carry-trade unwinding.