"The Lone Ranger" started as a radio series in 1933. It subsequently ran as a TV series for 21 years until 1954. The premise of the show was that the last surviving Texas Ranger is nursed back to health by Potawatomi tribesman Tonto. The two ride together throughout the West on their horses Silver and Scout, doing good while living off a silver mine that provides them with income and bullets. When they start to chase the bad guys, the announcer shouts, "Hi-Yo Silver Away!" The exciting theme song of the series was written for the movie, "The Lone Ranger and the City of Gold."

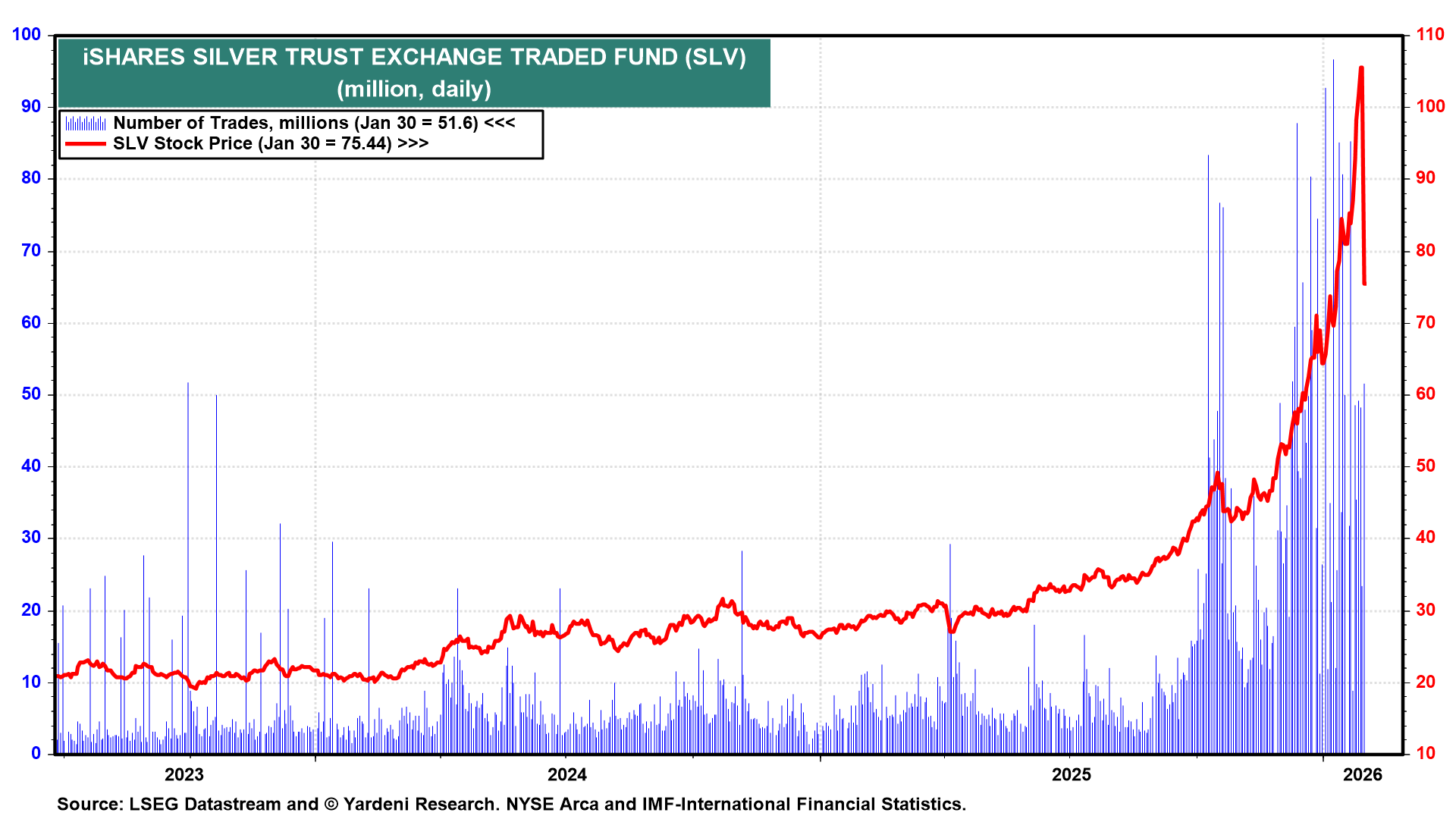

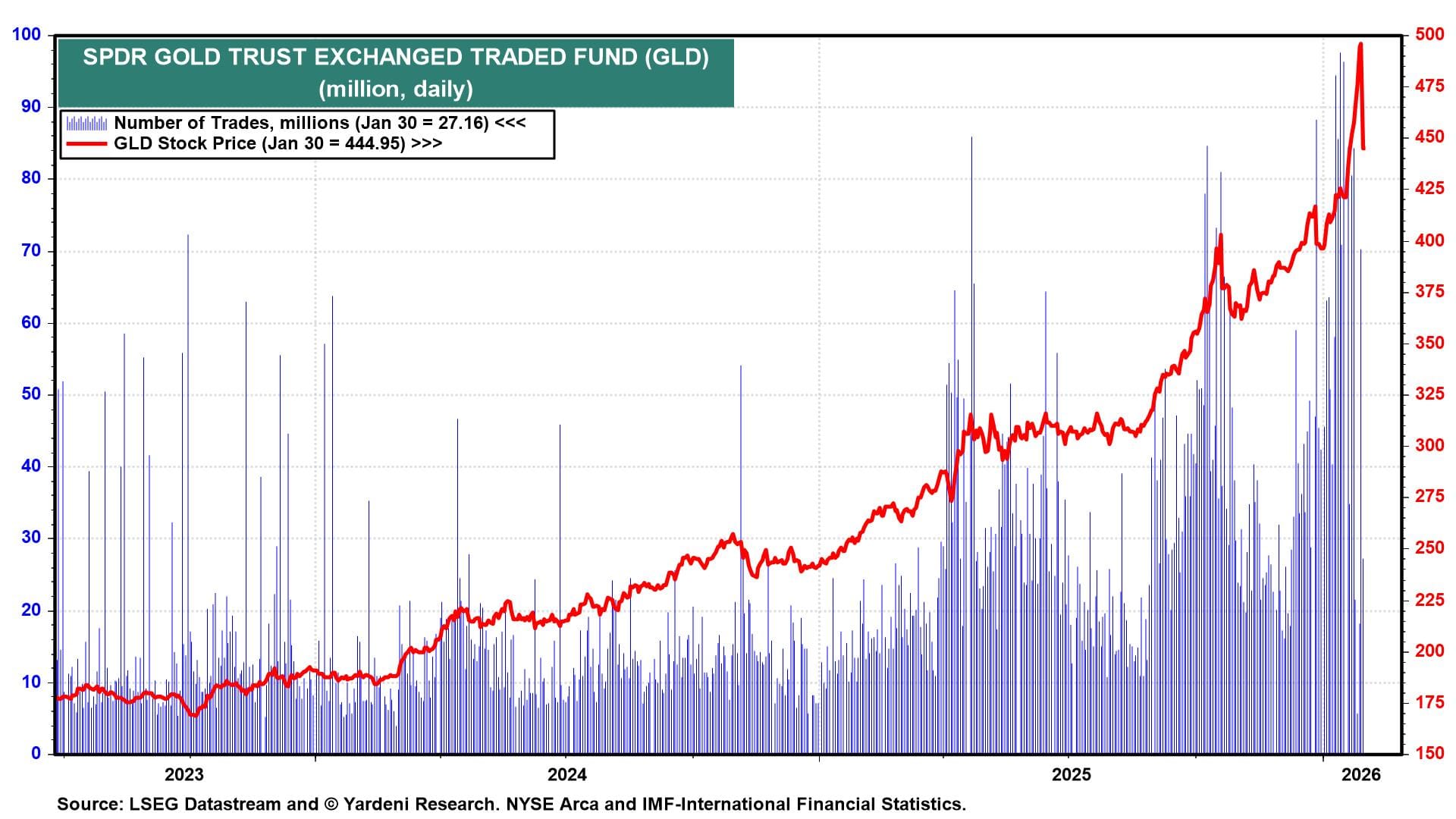

On Friday, commodity traders in the silver pit were shouting "Hi-No Silver Away!" Silver led a rout among the precious metals and their ETFs. SLV dropped 28.5%, and GLD lost 10.3% (charts). But their trading volumes didn't suggest a selling panic in either ETF.

Along with our friend Michael Brush, we spent this morning reading the various explanations for the one-day bear market in silver and the one-day correction in gold. On Friday morning, President Donald Trump's nomination of Kevin Warsh to replace Jerome Powell as Fed chair might have been behind the selloff initially. (On the geopolitical front, Iran reportedly is willing to negotiate with the US, but only on terms unacceptable to the US. So we doubt that was the explanation for the rout.)

Then, at 2:00 pm EST, the CME group raised maintenance margin requirements again, the second increase in three days, effective after the close on Monday, February 2. Gold maintenance goes from 6% to 8%, silver from 11% to 15%, platinum from 12% to 15%, and palladium from 14% to 16%. The margin on copper was raised too.

By announcing the hike before Friday's close, the CME effectively warned traders that any positions held over the weekend would be subject to significantly higher collateral requirements by Monday. This forced many participants to liquidate their positions during the final hours of trading on Friday, which contributed to the late-session acceleration of the price drop.

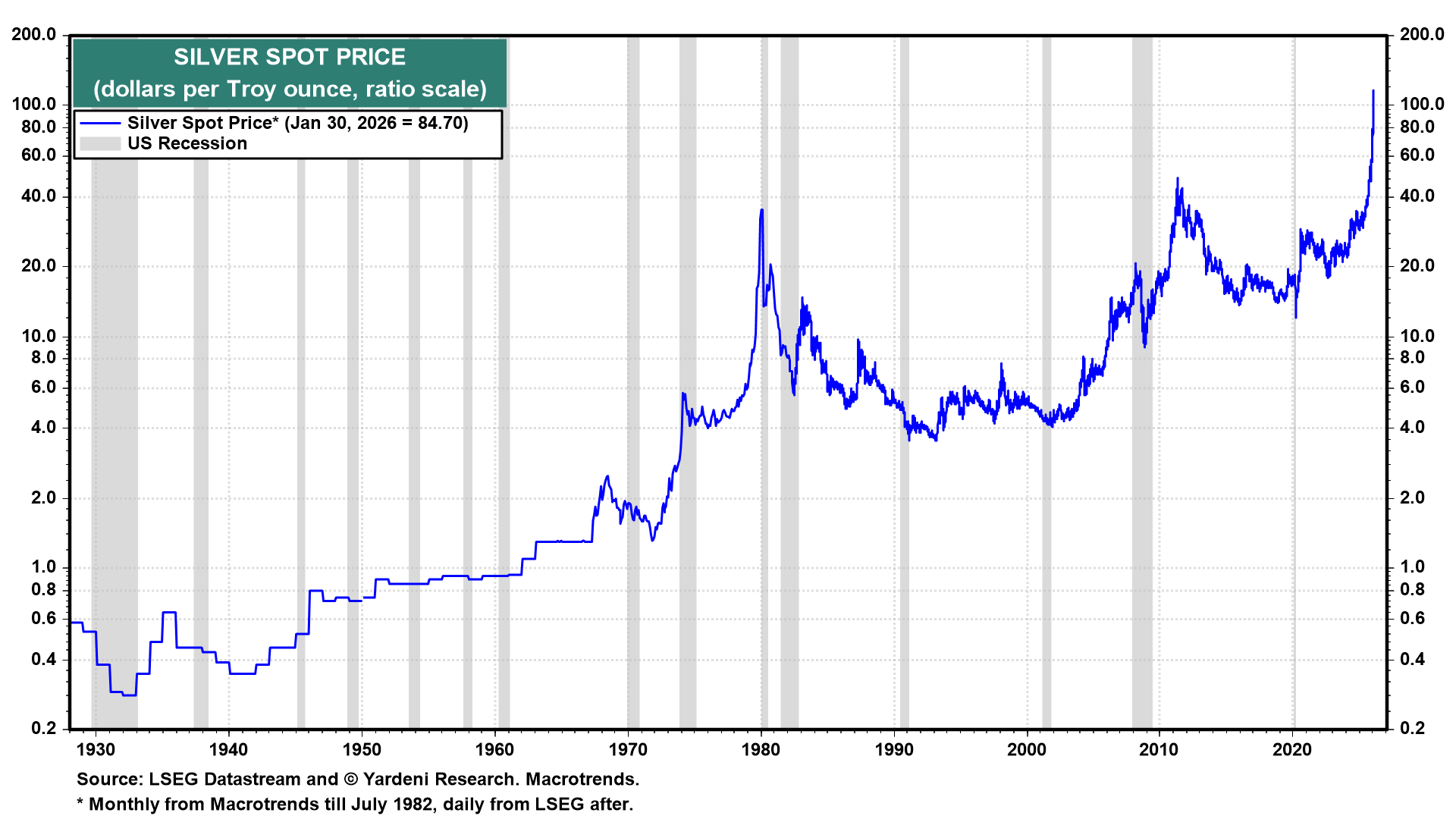

So we doubt all the conspiracy theories, including the possibility that this is the start of another Hunt Silver Crisis of March 27, 1980, when the silver price fell from around $21 to below $11 in a single day (chart).

By the way, the nomination of Warsh should have been bullish for precious metals because he favors stimulating more growth with still lower interest rates. He doesn't believe that the Fed needs to worry about inflation currently.

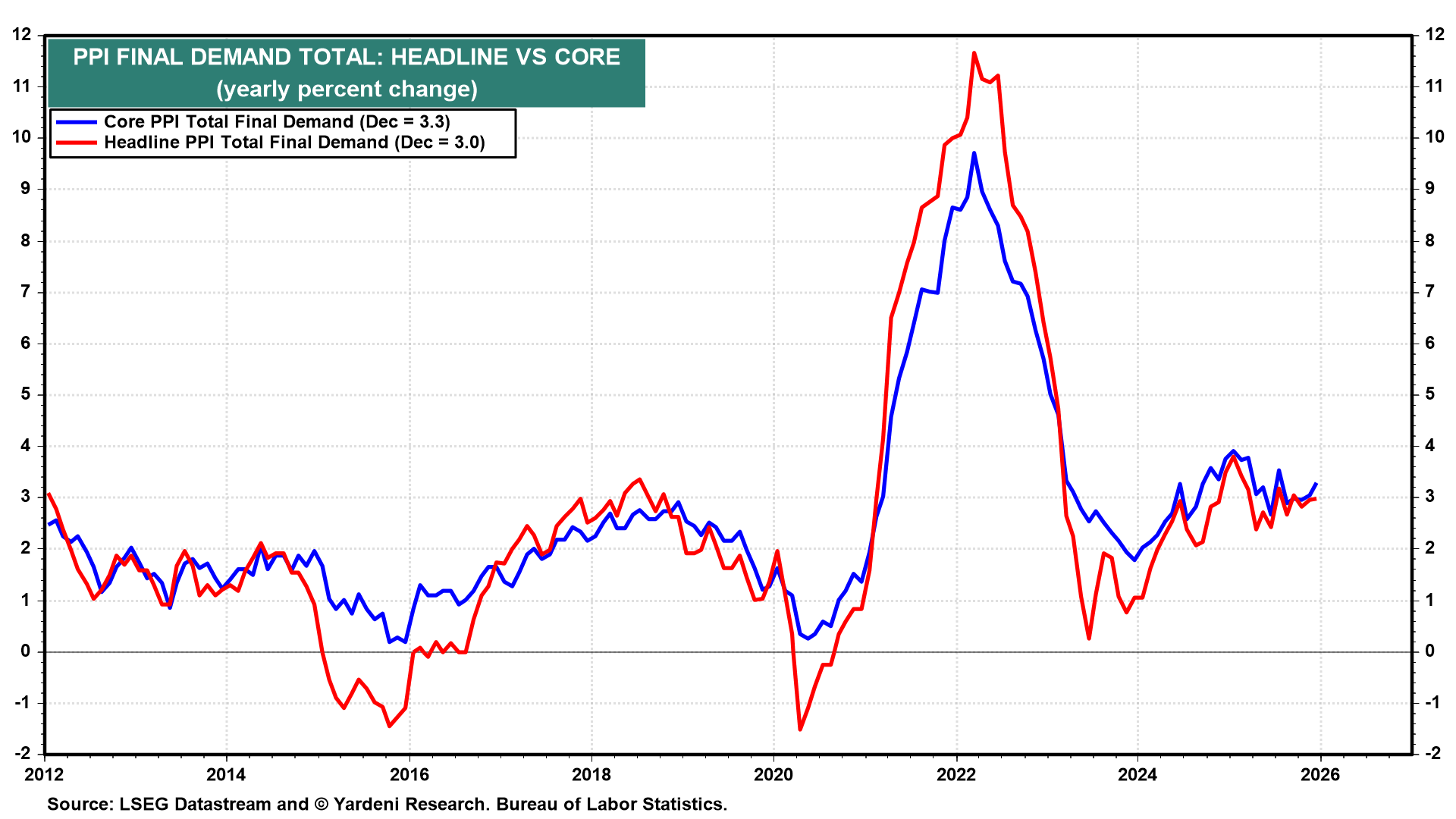

Friday's PPI report for December was hotter than expected and should also have been bullish for precious metals. The headline PPI inflation rate rose 0.5% m/m, while the core rate rose 0.7% m/m. On a y/y basis, the headline and core PPI inflation rates rose to 3.0% and 3.3% (chart). Producers may just be starting to pass higher tariffs and weaker currency costs down the supply chain.

We asked Michael Brush for an update on insider buying activity: "It’s still early, but so far, corporate executives and directors have shown little interest in buying into the market weakness. Their cautious stance continues. Buying by investors considered insiders because of large holdings (10% owners) has picked up slightly. But 10% owner activity is less meaningful as a market signal." (See "Brush Up on Stocks with Michael Brush" at uponstocks.com.)