We expected the first half of 2026 to be volatile for stocks. It's only January 4, and we can add Venezuela to our list of unsettling developments. Nicolás Maduro, the Venezuelan president captured by the United States on Saturday, is being held in a notorious Brooklyn jail. President Donald Trump said the US will "run" Venezuela. The geopolitical fallout could be troublesome. The Chinese government might increase the heat on Taiwan. Russia might be less inclined to end the war in Ukraine. On Friday morning, Trump said the US is "locked and loaded" as he warned Iran not to kill peaceful protesters in Tehran as nationwide unrest unfolded.

Head-spinning stuff, for sure! However, geopolitical crises tend to create buying opportunities for stock investors. There may be a few such opportunities this year.

Still ahead is a Supreme Court ruling on Trump's tariffs; SCOTUS is likely to rule that they are unconstitutional. Also, Trump will announce his pick for the next Fed chair soon. In the coming weeks, the Treasury may need to borrow more to fund larger refund checks under the One Big Beautiful Bill Act. Any or all of these developments could agitate the Bond Vigilantes.

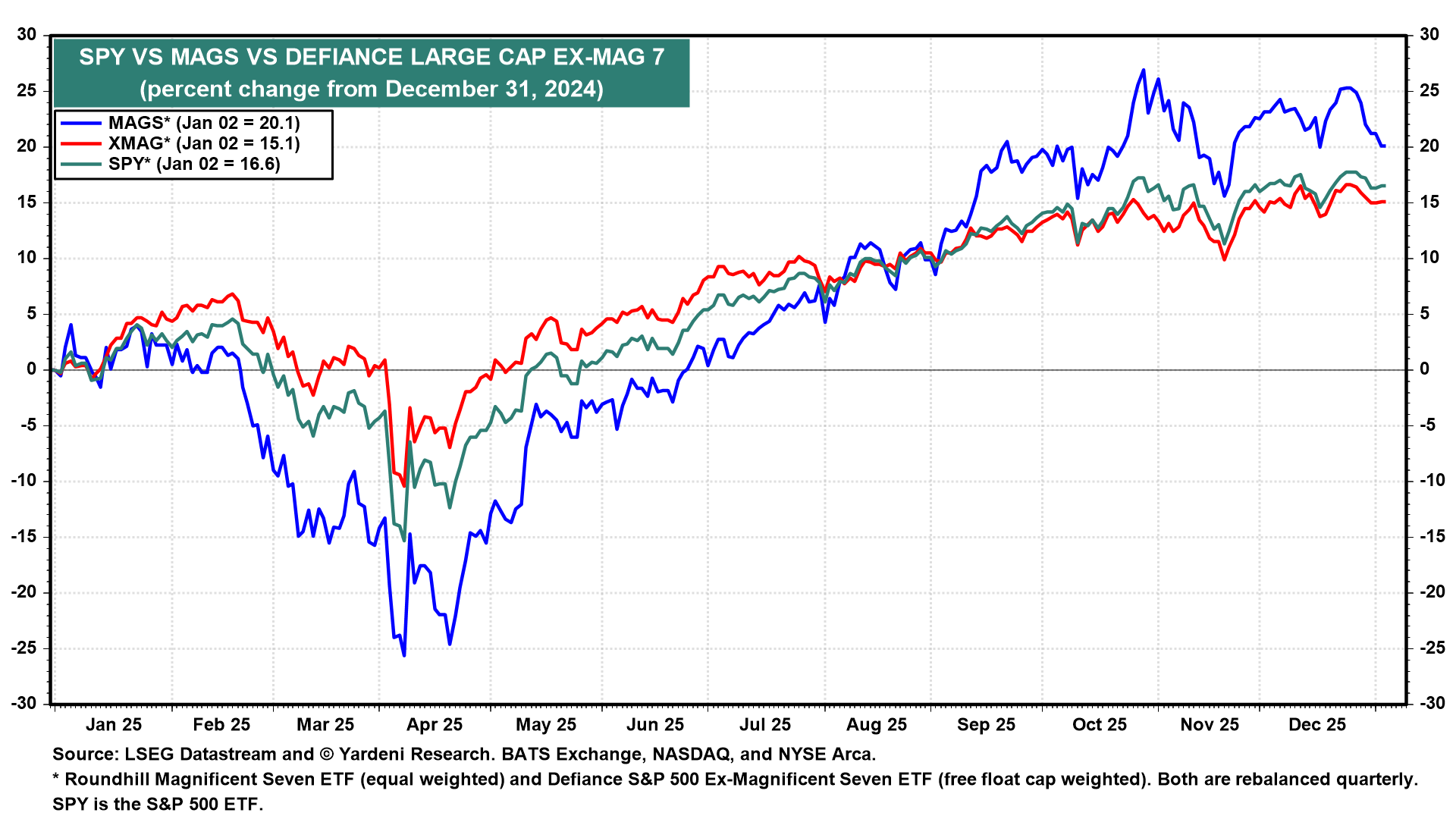

In the stock market, "AI Fatigue" is mounting: The Magnificent-7 haven't been so magnificent since October 30, 2025 (chart). That’s the day Michael Burry posted on X: “Sometimes, we see bubbles. Sometimes, there is something to do about it." He announced that he was shorting AI-related stocks.

The good news is that the outlook for S&P 500 earnings remains solid for the year ahead. Industry analysts who follow companies in the index collectively expect S&P 500 earnings per share to rise 15.6% in 2026 to $313.84 (chart). For next year, they are forecasting $359.44. We are forecasting $310 and $350 for the two years.