"Through the roof." That's how Nvidia's CEO Jensen Huang described AI infrastructure spending in his excellent interview with Scott Wapner on CNBC this past Friday, February 6. Huang described the current landscape as a "once-in-a-generation infrastructure buildout," specifically highlighting that demand for Nvidia's Blackwell chips and the upcoming Vera Rubin platform is "sky-high." He emphasized that the shift from experimental AI to AI as a fundamental utility has reached a definitive inflection point for every major industry.

Investors were clearly comforted by Huang's comforting words. Earlier in the week, they trashed the stocks of the four hyperscalers (AMZN, GOOGL, META, and MSFT) after the companies announced plans to increase spending collectively by more than 60% from historic 2025 levels to a whopping $700 billion this year.

In our Friday morning QT, we wrote: "That's freaking out investors, who are worrying that such massive spending might not pay off. However, all that spending in just this year will certainly provide lots of revenues and earnings to the companies that are vendors to the hyperscalers. The economy will also get a big boost from so much capex."

Huang also dismissed concerns about overspending, stating that the capital investments are "appropriate and sustainable" because they lead to "profitable tokens" and rising cash flows. He was interviewed during CNBC's "Closing Bell" on Friday.

The three-part bottom line: The hyperscalers’ cash flow will increase as a result of all their capex, their humongous spending will boost the broad economy, and that’s bullish for a broadening of the Roaring 2020s stock market!

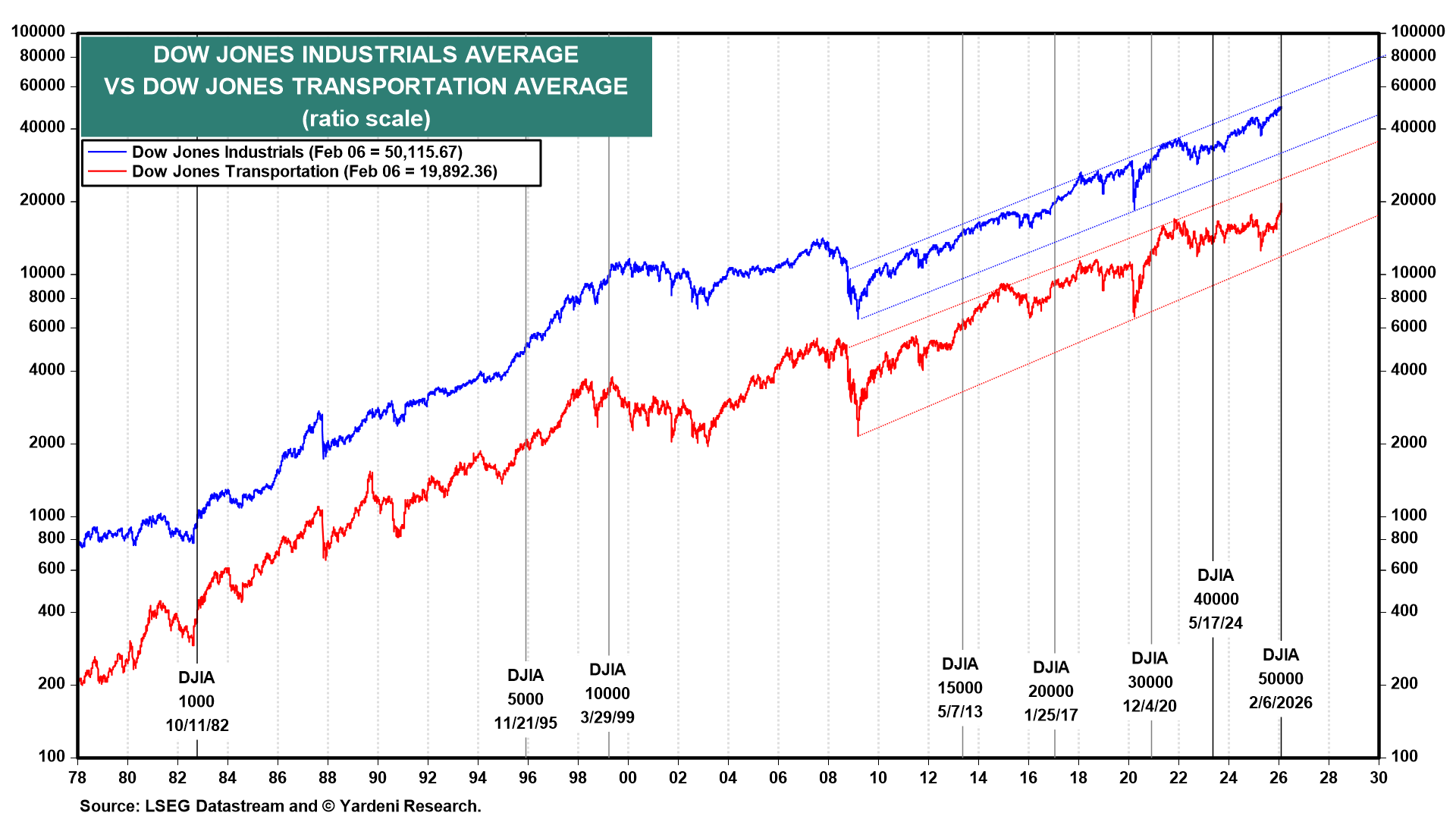

Also "going through the roof" after Huang used that expression was the DJIA, which rose above 50,000 for the first time ever (chart). The DJTA also rose to a new record high. Dow Theory remains bullish. The fact that the "delivery" side of the economy (Transports) is confirming the "production" side (Industrials) suggests that the market currently views the 2026 growth story as fundamentally solid.

We are still forecasting DJIA at 70,000 by the end of the Roaring 2020s.

Over the past few years, the permabears have warned that the bull market was too concentrated in the Magnficent-7 stocks, which include the four hyperscalers. They observed that with more than 30% of the S&P 500's market capitalization in just seven stocks, the stock market was vulnerable to a sharp selloff should any or all of them trip up for any reason.

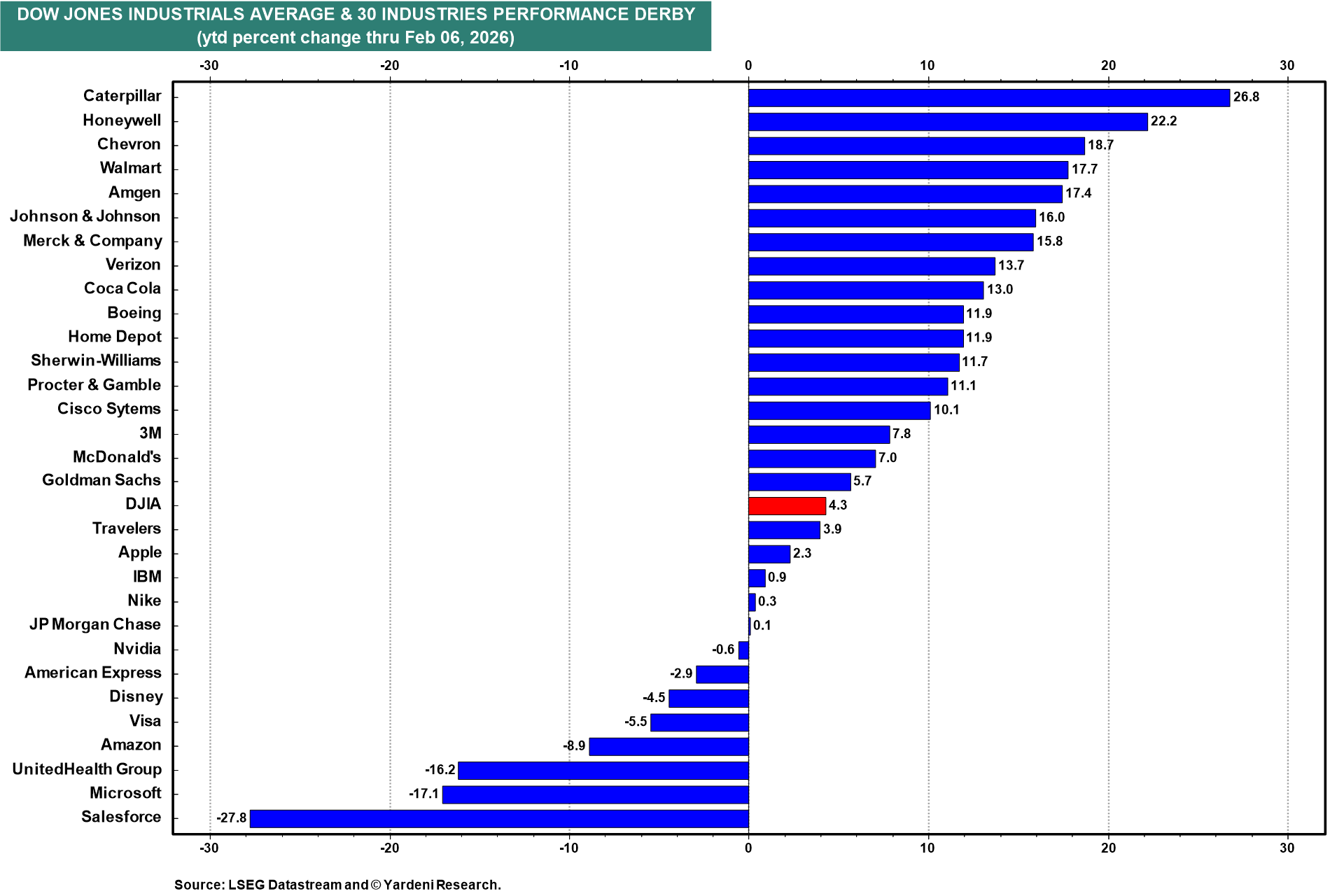

Four of the Mag-7 are in the DJIA (AAPL, AMZN, MSFT, and NVDA). They have underperformed ytd. That didn't stop the DJIA from reaching a new record high on Friday (chart).

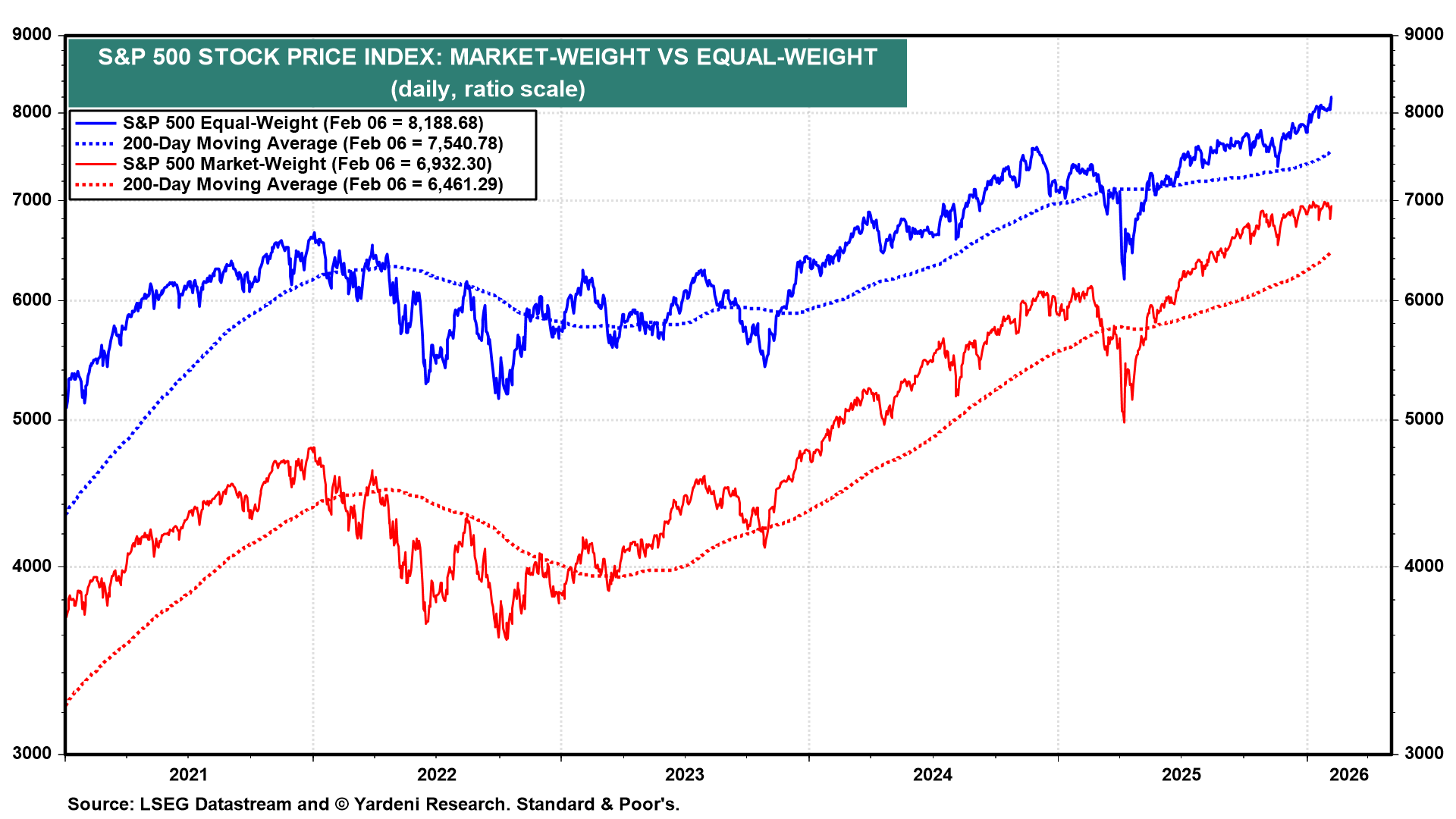

Also rising to a new record high on Friday was the S&P 500 equal-weight stock price index (chart). It is up 5.5% ytd, while the S&P 500 market-weight price index is up 1.3%—which shows the drag of larger-capitalization stocks’ poorer relative performance.

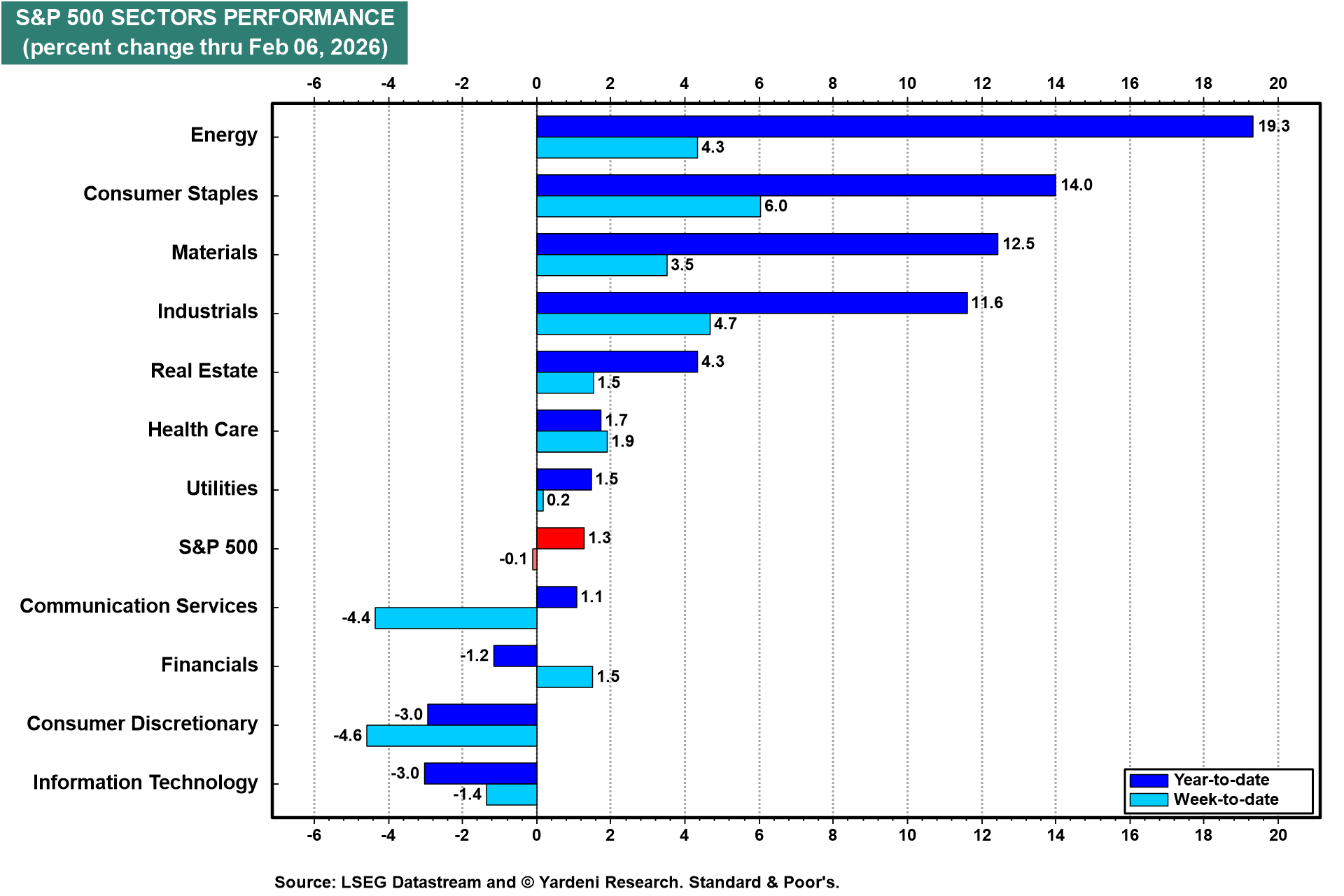

The sectors that mostly underperformed the S&P 500 last year have outperformed so far this year (chart).

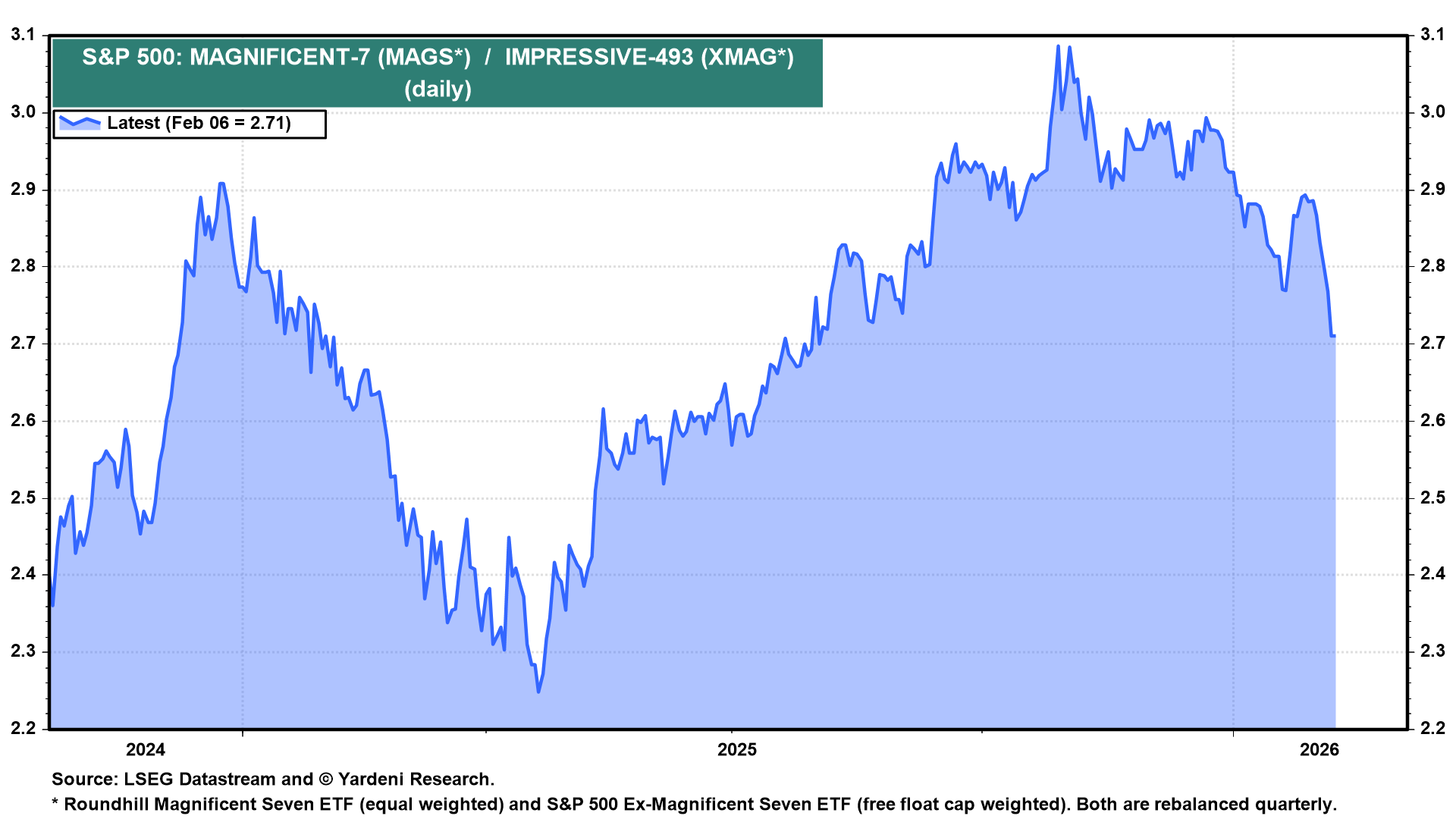

On a relative basis, the MAGS ETF has underperformed the XMAG ETF since November 3, 2025, after Michael Burry publicly announced that he was shorting the AI trade on October 27 (chart). We began to recommend underweighting the Mag-7 on December 7, 2025.

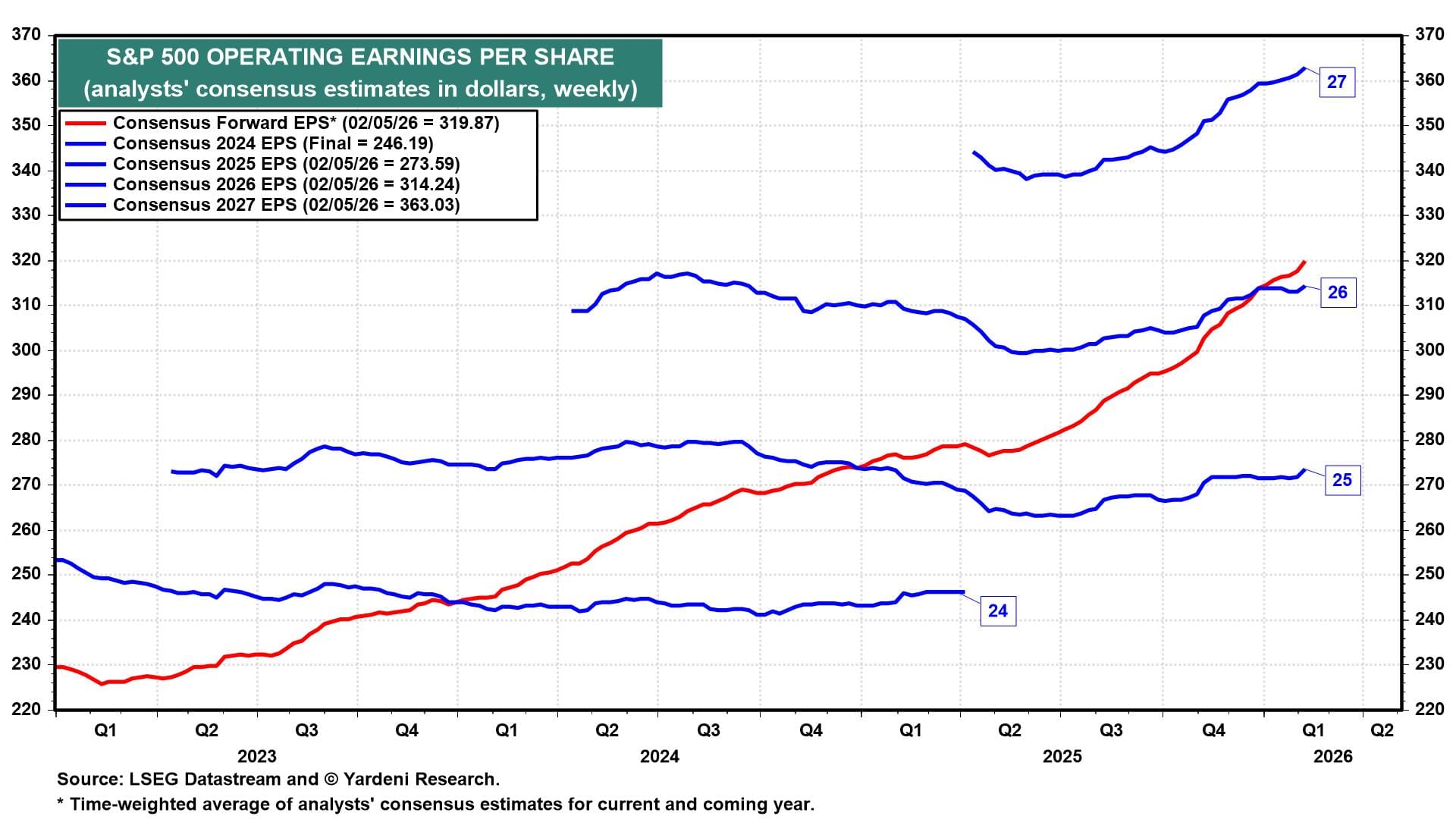

Meanwhile, industry analysts continue to raise their expectations for S&P 500 operating earnings in 2027 (chart). That's important because the forward earnings of the index, which rose to another record high last week, is converging toward the analysts’ 2027 earnings estimate, which is currently at $363.03 per share. We are still forecasting $350.00.

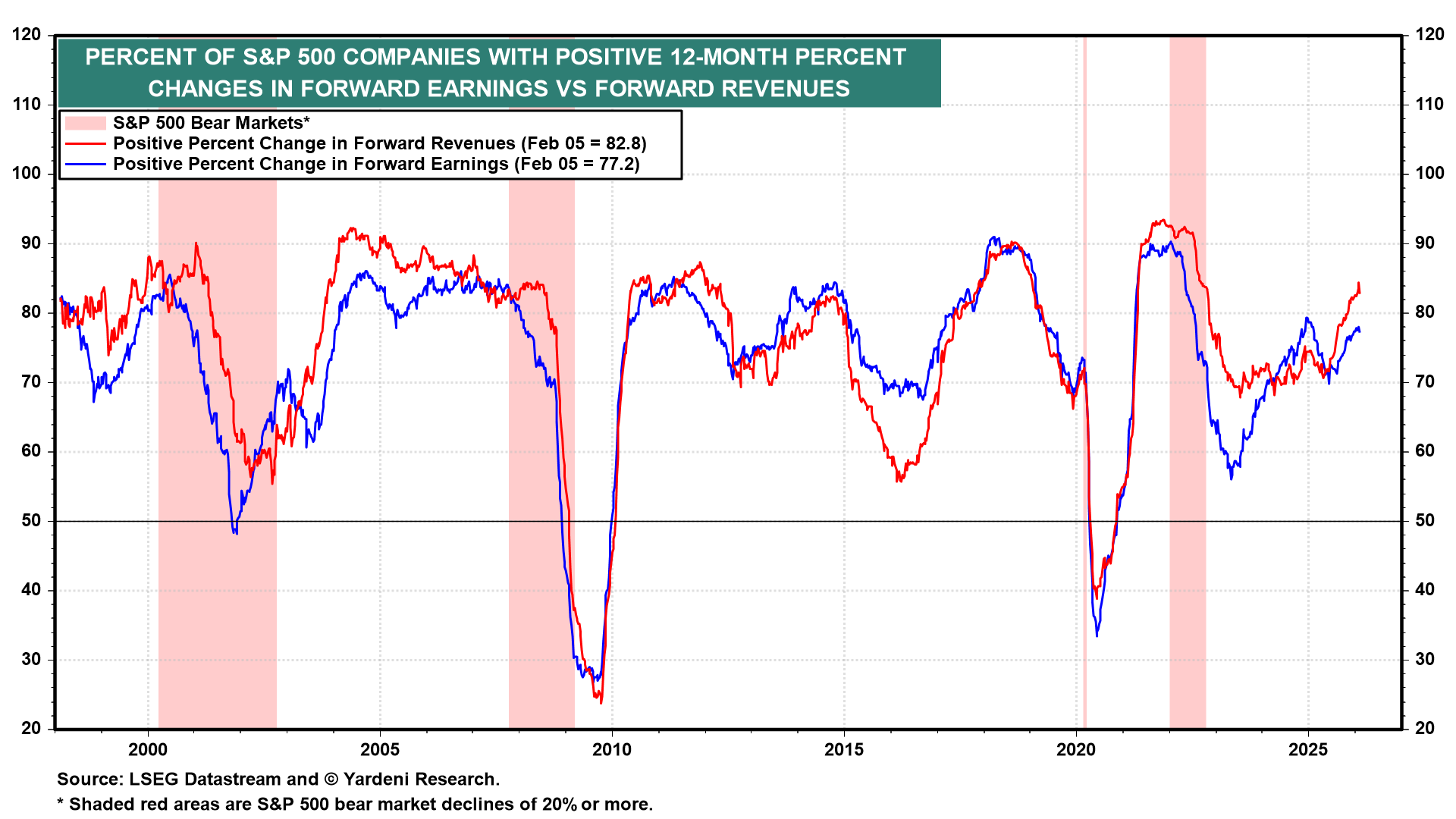

The breadth of positive y/y percent changes in the forward revenues and forward earnings of the S&P 500 continues to improve (chart).

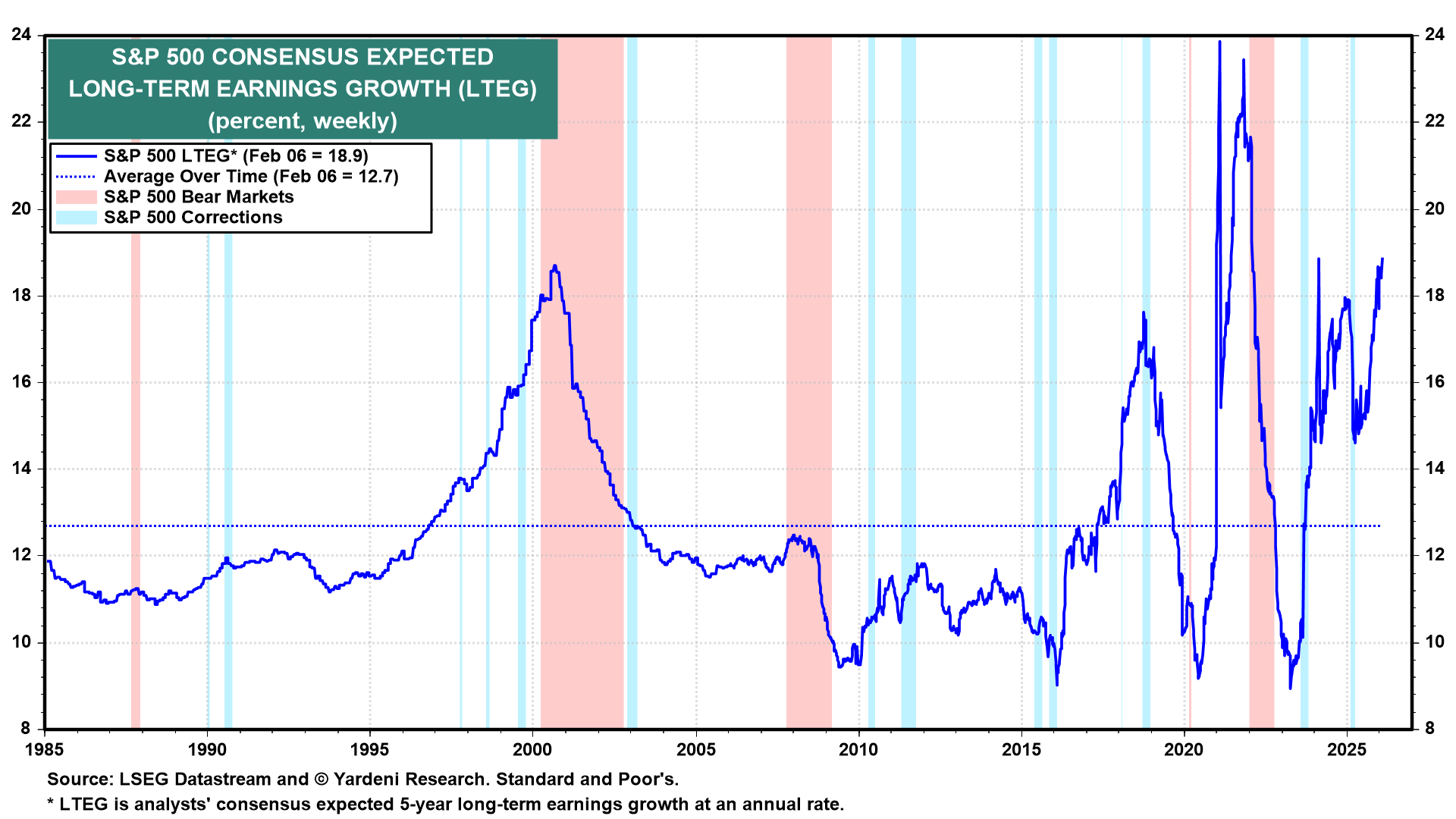

Industry analysts are also turning more upbeat on the outlook for S&P 500 long-term earnings growth (chart).

We asked Michael Brush for an update on insider buying activity: "Insider buying picked up sharply on the weakness last week. That's a bullish statement on the stock market and also the economy because their buying was concentrated in cyclicals. Focusing on the larger, more meaningful buys, actual insiders invested over $15 million across two dozen companies, a sizeable increase from prior weeks’ levels. Their buying was concentrated in industrials, chemicals, electrical components, banks, and consumer-facing companies. Investors considered insiders because of large holdings (10% owners) put over $140 million into their holdings, also a relatively large increase." Michael closely covers insider activity in his investment letter Brush Up on Stocks at uponstocks.com.